Here’s a simple checklist to follow every time a patient visits you holding BCBS insurance card:

✅ Confirm the Member ID number and Group Number

✅ Check the effective date to confirm coverage is active

✅ Identify the plan type (PPO, HMO, etc.)

✅ Confirm co-pay or coinsurance amounts

✅ Review pharmacy info (if prescriptions are involved)

✅ Check if you are an in-network provider

✅ Look for contact numbers in case you need to call BCBS

✅ Always verify benefits before non-emergency procedures

Reading the BCBS insurance card is easy and simple. But sometimes healthcare providers misinterpret a simple detail that could lead to claim rejection. Therefore, it is super important for you as a healthcare provider to read the patient’s BCBS insurance card carefully. The card contains important information i.e. member name, member ID number, group number, etc.

Do you know? According to the American Medical Association (AMA), about 10-20% of insurance claims are rejected due to administrative or billing errors. These errors often include issues related to incorrect or incomplete patient information, which could involve misunderstandings of insurance details on the BCBS card.

This guide will help you understand how to use the information on the BCBS insurance card efficiently for billing, claims, and verifying patient eligibility.

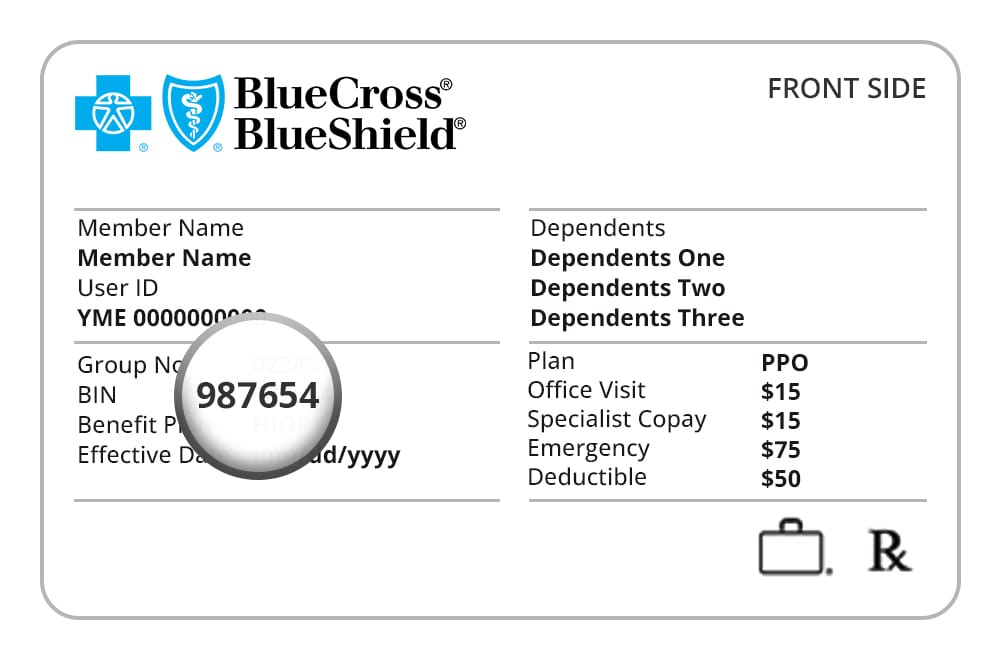

When reading a BCBS card, you’ll often see abbreviations or codes that may not be immediately clear. Here are a few common ones and what they mean:

| Term/Code | Meaning |

| PCP | Primary Care Provider – the doctor a patient must see first under some plans (like HMO). |

| RX | Prescription drug coverage – related to pharmacy benefits. |

| BIN | Bank Identification Number – used to route pharmacy claims. |

| PCN | Processor Control Number – helps process pharmacy claims. |

| Grp | Group Number – usually related to the employer or group sponsoring the plan. |

| ID | Member ID – the patient’s unique ID number with BCBS. |

Key Elements of the Blue Cross Blue Shield Insurance Card

Understanding the following key elements of the BCBS (Blue Cross Blue Shield) insurance card is essential for accurate medical billing, claims submission, and verifying patient coverage:

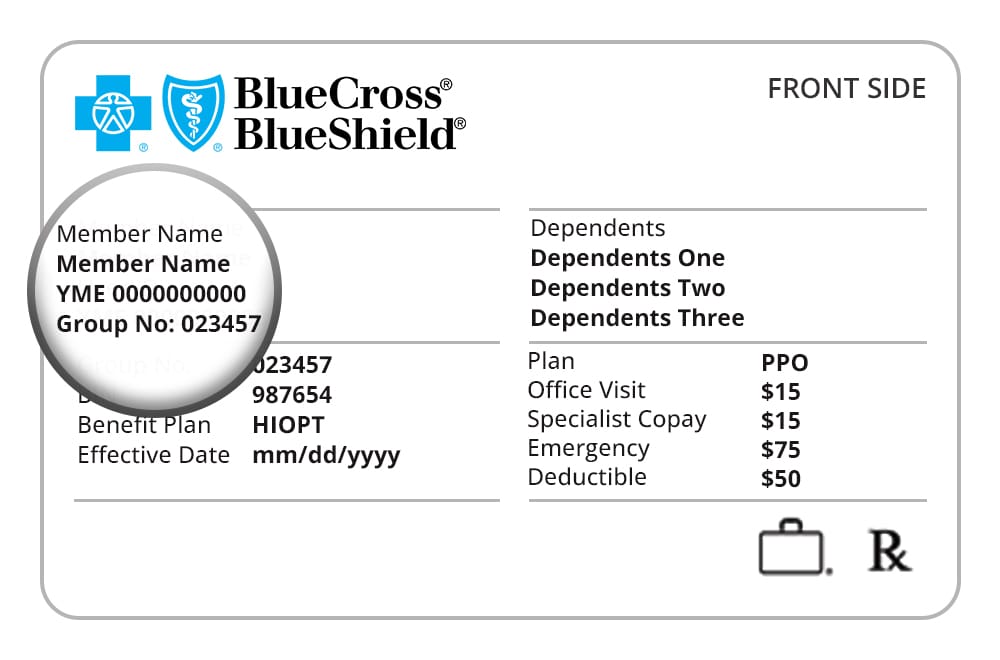

1). Member Identification Information

➡️ Member ID Number

This is the unique identifier for the patient’s insurance coverage. It’s used by BCBS to track the patient’s plan, claims, and eligibility status. You must include this ID number in all claims before submitting.

What to do: Always verify the patient’s Member ID number against the card and your records. Double-checking this number reduces the risk of claim denials or confusion.

➡️ Group Number

The group number identifies the employer or organization that sponsors the insurance plan. If the patient is covered under a group policy (e.g., through their employer), this number helps identify the terms of the patient’s benefits.

What to do: Use the group number when submitting claims, especially for employer-sponsored plans, to ensure the correct billing rates and coverage details are applied.

➡️ Member Name

The insured individual’s name appears here. If the patient is covered under a family plan, the primary policyholder’s name will be listed.

What to do: Confirm the patient’s identity with a government-issued ID and cross-check the name on the insurance card to prevent mix-ups.

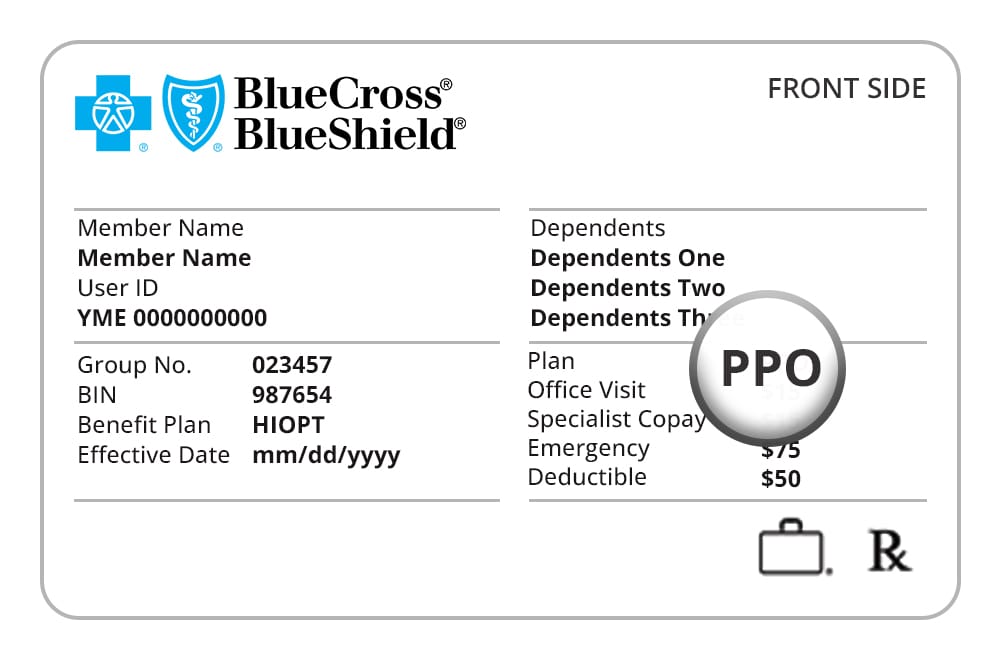

2). Plan Type (HMO, PPO, POS, etc.)

BCBS cards will typically indicate the type of health plan the patient has. Common plan types include:

HMO (Health Maintenance Organization)

Requires patients to select a primary care physician (PCP) and obtain referrals to see specialists.

PPO (Preferred Provider Organization)

Allows patients to see any doctor or specialist, but with lower costs if they stay within the in-network provider list.

POS (Point of Service)

A hybrid of HMO and PPO, requiring a PCP but offering some out-of-network benefits with higher out-of-pocket costs.

What to Do: Determine if the patient needs a referral for specialist visits or if out-of-network care will result in higher costs. This helps you provide appropriate care and avoid patient confusion at billing time.

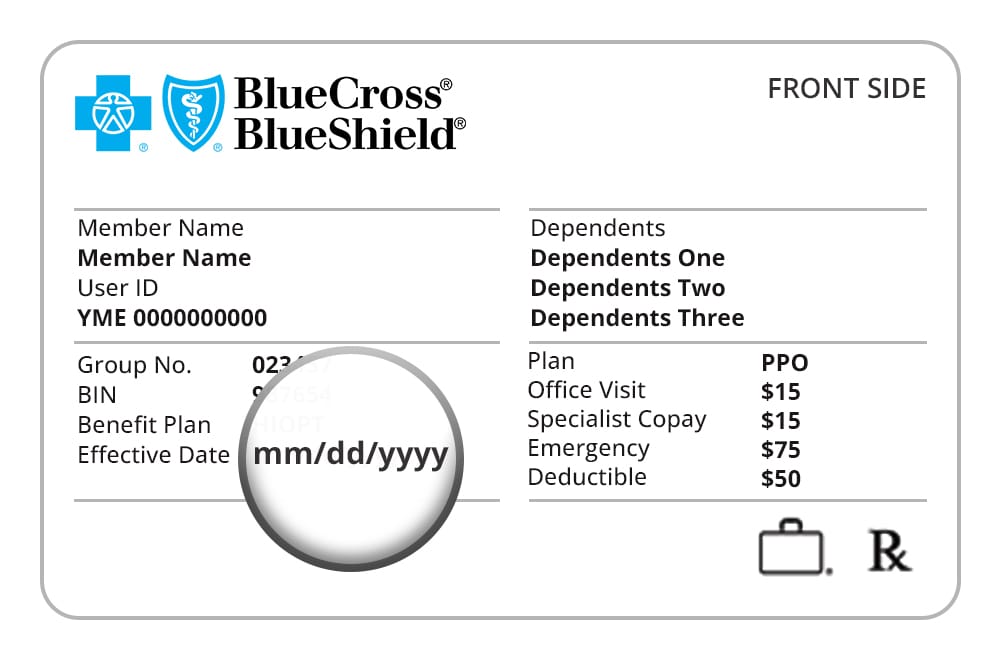

3). Effective Date of Coverage

The effective date is the start date of the patient’s insurance coverage. This is particularly important if a patient has recently enrolled or is switching between plans.

What to do: Ensure that the insurance coverage is active as of the date of service. If the patient’s insurance has not yet started, you may need to collect payment upfront or explore other options.

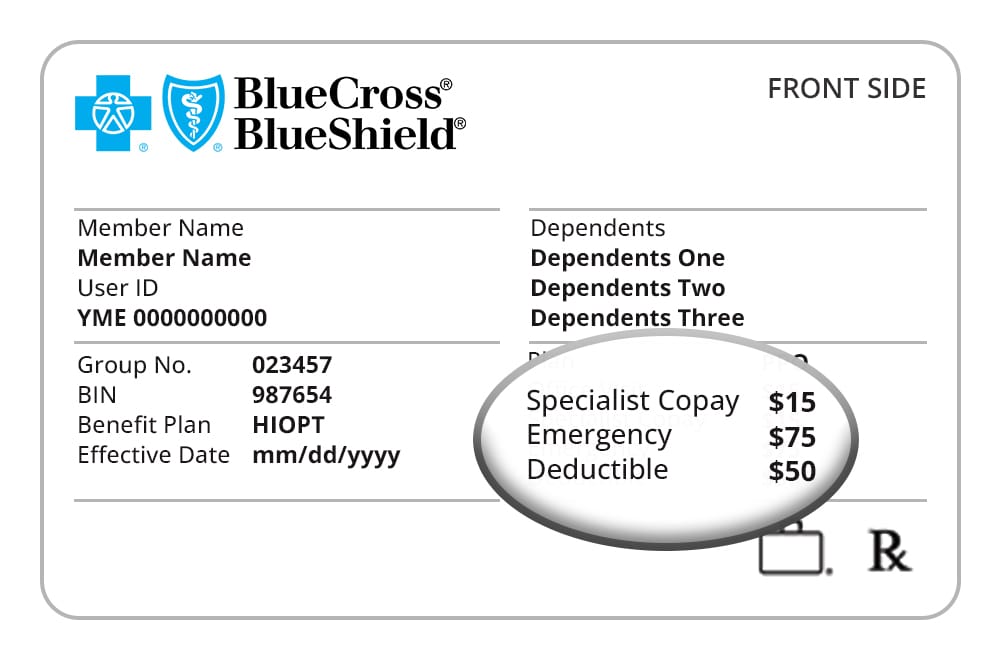

4). Co-pays, Deductibles, and Coinsurance

Most BCBS insurance cards will show the patient’s co-pays, coinsurance percentages, and sometimes the deductible amounts. These are the costs the patient is responsible for paying out-of-pocket for services rendered.

Co-pay

A fixed amount the patient pays for certain services (e.g., office visits, specialist visits, ER visits).

Coinsurance

The percentage of the cost the patient must pay after meeting their deductible. For example, if a service costs $500 and the coinsurance is 20%, the patient will owe $100.

Deductible

The amount the patient must pay before insurance starts covering costs. For example, if the deductible is $1,000, the patient will pay for services up to that amount before the insurance plan kicks in.

What to do: Always check the co-pay and deductible amounts to ensure that you are collecting the right patient payment at the time of service. Understanding these amounts will also help you explain any patient responsibility when it comes to larger procedures or specialty services.

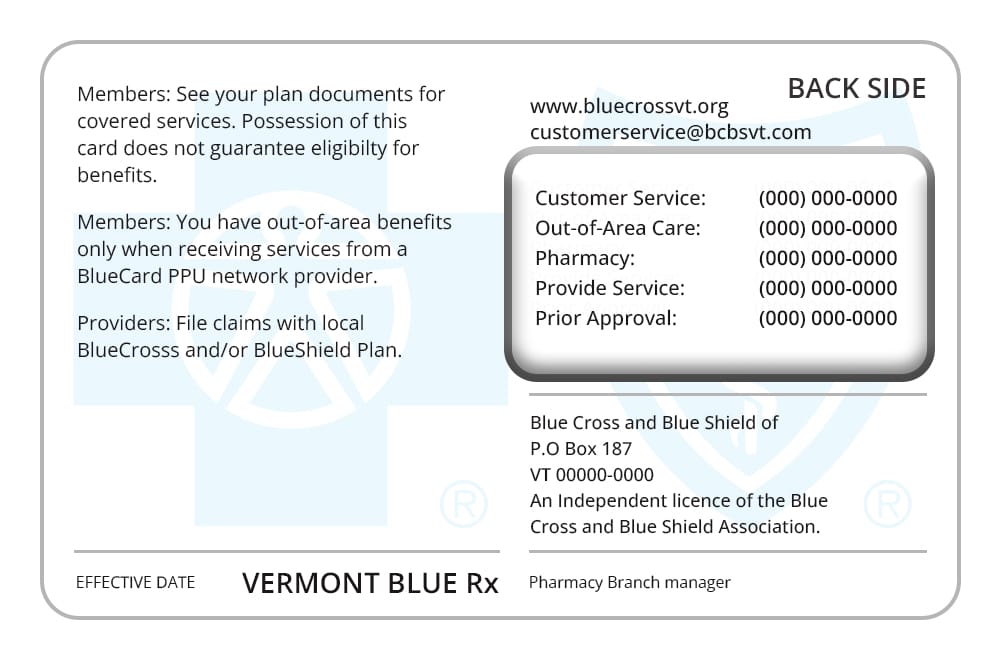

5). Pharmacy Benefits (RX BIN, RX PCN)

The back side of the BCBS card will typically include pharmacy-related information such as the RX BIN and RX PCN. These numbers are used to process prescriptions and verify the patient’s drug coverage.

RX BIN

It is a unique number used to process prescription drug claims.

RX PCN

It is a Processor Control Number used in conjunction with the RX BIN for more accurate claims processing.

What to do: If prescribing medications, confirm that the RX BIN and PCN are correctly listed. This ensures that the patient’s pharmacy benefits are applied when filling prescriptions and prevents delays in medication dispensing.

6). In-Network vs. Out-of-Network Coverage

The card may include network information that indicates whether the patient’s plan covers services in-network or out-of-network, or if there are different benefits for each.

What to do: Always verify if the patient is using in-network or out-of-network providers. In-network providers typically receive higher reimbursement rates, and the patient will have lower co-pays. Out-of-network services often come with higher costs and reduced coverage.

7). Contact Information and Customer Service

The back of the BCBS patient insurance card typically contains customer service numbers and claims submission addresses. This is where you can reach out if you need help with eligibility verification, claims status, or any billing issues.

What to do: Have the customer service number on hand for any questions or issues regarding the patient’s benefits. You can also refer to the claims address for mailing documents if necessary.

What to do if the BCBS card is missing or outdated

Patients often show up without their insurance card, or they may bring an old one after switching plans.

Here’s how to handle it:

- Ask for the member ID number and the insurance company name (e.g., Blue Cross Blue Shield).

- Call the BCBS provider services number (usually found online by searching “[State] BCBS provider contact”).

- Use your provider portal (if your clinic has one) to check eligibility.

- If necessary, ask the patient to access their digital insurance card through the BCBS mobile app or website.

Important: Don’t treat based only on what the patient “thinks” is covered. Always verify before performing any non-emergency service.

Red flags to watch out for when reading BCBS Insurance Card

Sometimes, insurance cards look valid but there are issues behind the scenes. Watch out for these signs:

🚩 Coverage expired: Always check the effective date. Insurance may have ended due to job loss or non-payment.

🚩 Duplicate ID numbers: Sometimes, different patients may show up with similar ID numbers (especially in families). Confirm the date of birth and name carefully.

🚩 Handwritten changes: Never trust hand-written edits on a card (like changed co-pay amounts or plan types). These are not official and can lead to rejected claims.

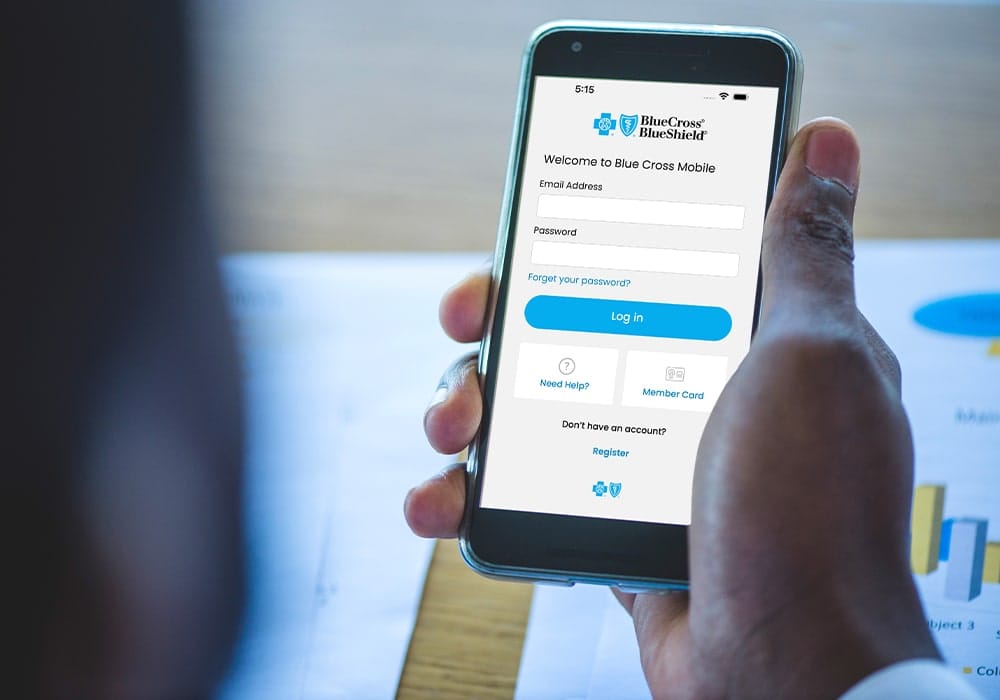

Digital and Mobile Insurance Cards

Many BCBS plans now support digital insurance cards. Patients can access their insurance card through the BCBS mobile app or their member portal online.

Why this matters:

- Patients may not carry a physical card.

- Information is often up to date.

- Pharmacies and clinics can accept the digital version.

What providers should do:

- Accept screenshots or digital cards as long as they show the member ID and plan details.

- Educate staff to treat digital cards just like physical ones, unless your policy says otherwise.

When to Contact BCBS Directly

There are times when the card doesn’t tell the whole story. Don’t hesitate to contact BCBS directly if:

- The card looks unusual or outdated.

- The patient has urgent care needs, and you must confirm active coverage.

- You’re billing for a complex or high-cost procedure.

- You’re unsure whether a service is covered under the plan.

- You can usually find the correct provider phone number for BCBS on the back of the card or through your provider portal.

Main Categories of BCBS Insurance Cards

Blue Cross Blue Shield (BCBS) issues several types of insurance cards depending on the plan, coverage, and whether the patient is an individual or a dependent. The number and type of cards can vary, but here are the main categories of BCBS cards that are typically used:

- Primary Member Card: For the main policyholder.

- Dependent Cards: For family members (spouses, children, etc.).

- Temporary Insurance Cards: Issued for new enrollees or during a policy switch.

- Pharmacy Cards: For prescription benefits (sometimes separate from the health card).

- Medicaid/Medicare Advantage Cards: For those enrolled in these government programs.

- Specialty Cards: For dental, vision, and supplemental insurance.

FAQs

Can two people in the same family have different BCBS cards?

Yes. Each covered member (such as a spouse or child) may receive their own card. These cards usually have the same group number but different names and sometimes different ID numbers.

What if a patient brings an expired BCBS card?

Always verify active coverage. The card alone does not guarantee that the patient is still insured. Use the provider portal or call BCBS to confirm eligibility.

Do all BCBS cards look the same?

No. BCBS cards vary by state and plan. The design may look different depending on the local BCBS company or whether it is a Medicare, Marketplace, or employer-sponsored plan.

How can I tell if a plan is PPO or HMO?

The plan type is usually printed on the front of the card. Look for terms such as “PPO,” “HMO,” or “POS.”

What do RX BIN and RX PCN mean?

These are codes used by pharmacies to process prescriptions. Providers generally do not need them unless they are dealing with pharmacy benefits or sending prescriptions.

What should I do if the card is damaged or unreadable?

Ask the patient to use their digital card or call BCBS to request a replacement. Coverage can also be verified using the patient’s name and date of birth.

Are dental and vision benefits included on the main BCBS card?

Not always. Some patients have separate cards for dental and vision coverage. If you’re unsure, verify benefits directly with BCBS.

Does BCBS offer Medicare coverage?

Yes. BCBS offers Medicare Advantage plans (Part C) and Medigap (Medicare Supplement) plans. Patients eligible for Medicare may receive a separate BCBS card for these plans.

How is BCBS Medigap different from regular BCBS insurance?

Medigap is a supplemental plan for patients already enrolled in Original Medicare. It helps cover costs such as deductibles and coinsurance that Medicare does not pay. It is not a full insurance plan by itself.

What’s the difference between BCBS Medicare Advantage and regular Medicare?

With Medicare Advantage, BCBS administers the patient’s full Medicare benefits under one plan. The patient typically only needs to show their BCBS card—not the red, white, and blue Medicare card—for services.

How do I know if BCBS is the primary or secondary insurance?

Check the Coordination of Benefits (COB) section on the back of the card, or call BCBS. Always confirm with the patient if they have other insurance coverage.

Can I bill BCBS without a copy of the card?

It’s not recommended. If the card isn’t available, collect the patient’s full name, date of birth, and Member ID if possible. Always verify active coverage before billing.

What is the prefix on the BCBS card and why does it matter?

The prefix is the first three letters of the Member ID (for example, ABC1234567). It identifies which state or regional BCBS plan to contact. This is essential for proper eligibility and claims processing.