One in seven of all claims are denied amounting to 200 million rejections each day.

And out of these, 27% of denials are due to issues with patient registration and eligibility for the medical claim.

Now, the average denial management costs a minimum of $25 per claim denial. Thereby, creating cash flow issues for practices’ RCM!

Eligibility coverage issues not only increase the overall billing costs but further delay the revenue collection process disrupting the whole revenue cycle.

Using a reliable insurance verification method saves you from the trouble of getting denied while streamlining the medical billing practices and raising your overall bottom line.

This document provides you with a detailed guide on how to check a patient’s Medicare insurance eligibility using different methods.

What is Medicare Coverage?

Medicare coverage is a Federal health insurance program created in 1965. It covers the cost of healthcare for people aged 65 and above, irrespective of their work and medical history, income, and health condition. Medicare pays for numerous medical services such as; physician visits, hospitalization, laboratory tests, prescription drugs, home health care, and hospice care. However, it doesn’t cover all the expenses or medical costs of most long-term healthcare issues.

Why Do Providers Need to Verify Medicare Coverage?

Medicare coverage verification is important for you as a provider because it optimizes your revenue cycle and streamlines the collection process. According to CompuGroup Medical, manual verification makes you lose the average visit cost of two patients per day which on average costs you $6000 a year. Therefore staying electronic saves you time, money and effort.

You need to verify Medicare eligibility coverage because:

➜ Up front eligibility verification improves your first-pass rate while reducing A/R days, which means you will get paid sooner without any delays.

➜ Checking eligibility prior to providing services gives you a better understanding of your patients’ co-pay amounts, co-insurance, deductibles, and out-of-pockets allowing you to collect payments timely.

➜ Prior eligibility verification allows you to educate your patients ahead of time on the billing process with their insurance plan, co-pay, and deductibles. This results in enhanced patient satisfaction and fewer contested bills.

➜ Lastly, it improves cash flow as your revenue collection is upfront without any delays.

List of Things You Need to Verify Medicare Coverage of a Patient

- National Provider Identifier (NPI)

- Provider Transaction Access Number (PTAN)

- Tax Identification Number (TIN)

- Beneficiary Medicare ID

- Beneficiary name

- Beneficiary date of birth

- Date of service (if applicable)

How to Check Your Patient’s Medicare Eligibility Status?

Method #1: BellMedEx Medicare Coverage Verification

BellMedEx is a medical billing company that has its own comprehensive Medicare verification system. The company takes over a provider’s non-clinical burdens and eases the process of verification. This enables a provider to focus on their core tasks such as delivering care.

To verify Medicare insurance eligibility via BellMedEx, follow these simple steps:

1). Visit BellMedEx.com

2). Fill in the form – enter your name, email, and phone number – and click on “Book a Free Consultation”.

3). BellMedEx’s support representative will immediately contact you and help you with confirming your patient’s Medicare coverage.

4). Likewise, you can also contact BellMedEx at 888-987-6250 and receive Medicare coverage verification support.

Method #2: Using Secure Provider Online Tool (SPOT)

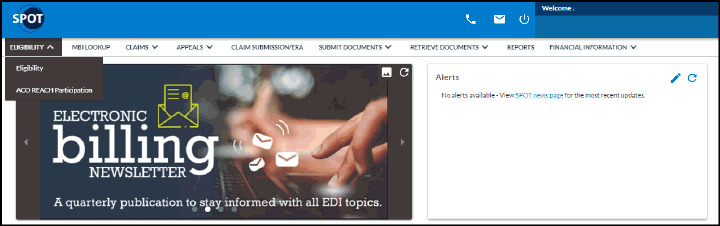

SPOT, as known as Secure Provider Online Tool, gives you the ability to view claims status and patient eligibility information online. SPOT also offers the opportunity to search for a Medicare Beneficiary Identifier (MBI) through the MBI lookup.

The Eligibility information through SPOT is accessible 24/7 and the providers can avail Part A and Part B eligibility status as well benefit eligibility for preventive services, deductibles, therapy caps, inpatient, hospice and home health, Medicare secondary payer (MSP), plan coverage data categories and claim status up to twelve months from the date of the inquiry.

Here’s how you can verify the eligibility of your patients via SPOT:

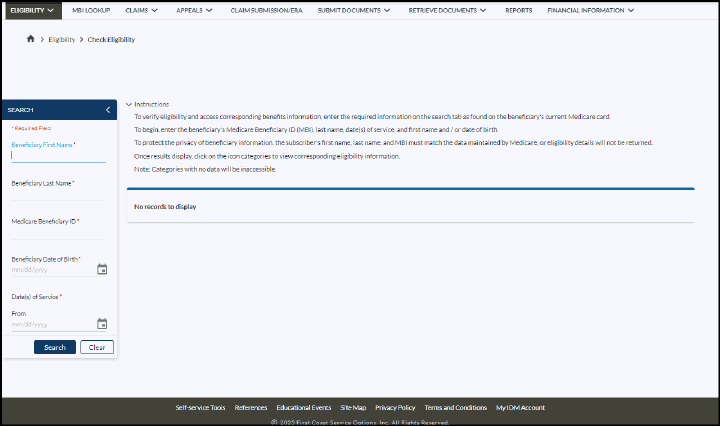

1). Select Eligibility from the top drop down menu.

2). A pop up will appear, asking for the following details:

- Beneficiary Last Name

- Medicare Beneficiary ID

- Beneficiary First Name

- Beneficiary Date of Birth

- Date(s) of Service

Note: (You may limit your query to the date(s) the service will be furnished to the patient, or you may specify any time up to four months in the future and 24 months in the past).

3). Click Search to view Eligibility status.

4). The Eligibility results will include complete eligibility information of the beneficiary, including part A and part B eligibility statuses with effective and termination dates.

Method #3: Medicare Part A & Part B Eligibility Verification via IVR

Interactive Voice Response (IVR) system allows a provider to verify patient’s Medicare eligibility. You can find the patient’s primary insurance info and primary care doctor name. You can also confirm if pre-authorization is approved and confirm the status of a claim.

Contact the following numbers for Medicare Part A verification:

- 1-888-664-4112 (Toll-free telephone number)

- 1-877-660-1759 (For speech and hearing impaired)

Contact the following numbers for Medicare Part B verification:

- 1-866-454-9007 (Toll-free telephone number)

- 1-877-660-1759 (speech and hearing impaired)

Providers can access Medicare’s Part A and Part B eligibility information via IVR during the following times, with the exception of Holidays:

- Monday-Friday 7am to 7pm, ET

- Saturday 6am to 3pm, ET

IVR’s CSR service is also available in case a complexity arises about insurance plans, coverage, and benefits that you need to navigate through. Customer service representatives are available during the following times, excluding holiday closings:

- 8am to 4pm Monday through Friday, ET and CT for providers in Florida.

- 8am to 4pm Monday through Friday, ET for providers in the U.S. Virgin Islands.

Method #4: Confirming Medicare Eligibility Status via MAC Online Provider Portal

Medicare Administrative Contractors (MACs) are agents that process claims and verification for Medicare-covered services to providers and suppliers for fee-for-service (FFS). These contractors provide their own online provider portal to the Medicare providers and suppliers.

Not registered with MAC?

A supplier can register with its MAC’s provider portal by contacting its MAC or by finding its MAC provider portal online. Once registered, the supplier can use the portal to search a Medicare beneficiary’s eligibility.

The supplier can access its MAC’s provider portal at any time and look up a beneficiary’s verification. Here’s how you can verify Medicare coverage of your patient with MAC provider portal:

- Enter the beneficiary’s Health Insurance Claim Number (HICN) or Medicare Beneficiary Identifier (MBI)

- Beneficiary’s first and last name

- Beneficiary’s date of birth

- Upon entering the above information you can check the status.

The process however, is self-service meaning thereby, you have to enter the information to check the status.

Method #5: Using Medicare Administrative Contractor (MAC) Phone Verification

Medicare Administrative Contractors offer a phone verification system as well that Medicare suppliers can contact to access beneficiary eligibility information. The appropriate phone number of a MAC can be found from its website by state.

To perform the eligibility verification the authentication should be done through the phone system by entering;

- National Provider Identifier (NPI),

- Provider Transaction Access Number (PTAN), and

- Tax Identification Number

This information is needed by the provider to accurately perform the eligibility query and provider authentication.

Once the provider has confirmed its authentication he provider can now enter the following details to confirm the patient’s Medicare eligibility.

- The beneficiary’s HICN or MBI,

- The beneficiary’s first and last name, and

- The beneficiary’s date of birth

This option is self service and is available 24/7.

Method #6: HIPAA Eligibility Transaction System (HETS)

HETS (HIPAA Eligibility Transaction System) allows providers and suppliers to verify and check eligibility status using a HIPAA compliant transaction. You can get eligibility information by submitting a HETS 270 request. To check eligibility status in HETS you must have the following information:

- MBI

- First and last name

- Date of birth (MM/DD/YYYY)

If a patient is eligible, you will get a 271 response with information like Part A entitlement, Part B entitlement, Part D, Hospital lifetime reserve days remaining, skilled nursing facility remaining benefit days, and more.

Note: To verify your patients’ Medicare eligibility via Health Eligibility Transaction System, your medical billing software must connect with it. This integration permits creating, sending, and getting the transactions. HETS benefits large healthcare facilities with the resources to build their own programs. It is a good choice if you want to avoid third parties and keep things quick and secure.

Conclusion

When treating Medicare patients, verifying their coverage is crucial for providers. Before scheduling appointments, check the patient’s eligibility. This confirms which services Medicare will cover for that individual. It also shows the patient’s cost-sharing responsibility. Doing this eligibility check ahead of time helps providers manage the revenue cycle smoothly. Also, early verification leads to fewer payment surprises down the road.