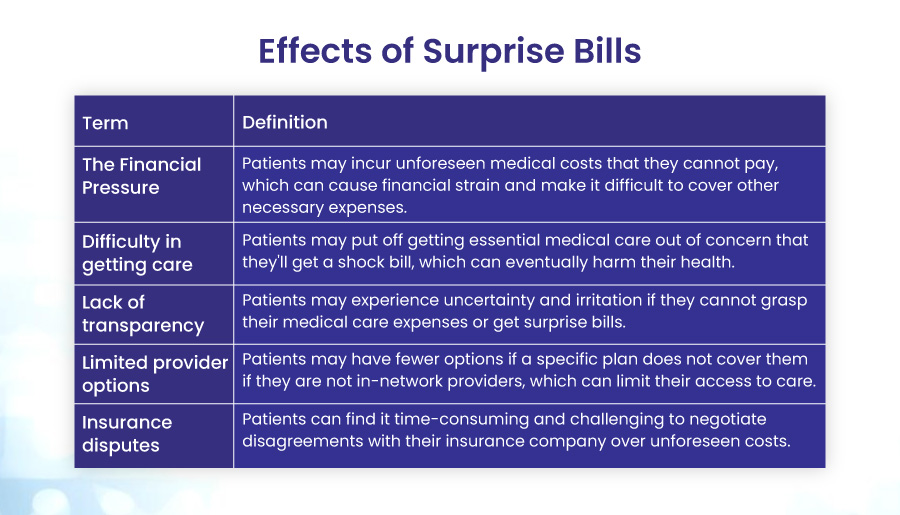

If you’ve ever received a medical bill that was much higher than you expected, you may have been a victim of surprise billing. This common and frustrating problem affects millions of Americans every year. In this blog post, we’ll explain what surprise billing is, how it can affect you, and how to avoid it with 10 pro tips.

What are Surprise Medical Bills?

A surprise medical bill is an unexpected bill, often for services received from a health care provider or facility that you did not know was out-of-network until you were billed. Your health insurance may not cover the entire out-of-network cost, leaving you owing the difference between the billed cost and the amount your health insurance paid. This is known as “balance billing.” This bill could be for a service like anesthesiology or laboratory tests. You may not know the provider or facility is out-of-network until you are billed.

10 Pro Tips to Avoid Surprise Bills

The easiest way to avoid surprise medical bills is to take the following precautions before receiving medical treatments. As a result, these measures appear to be more appropriate for scheduled operations rather than emergency care. You can also read about the No Surprise Act.

1. Determine the Coverage of Your Plan

Before you seek any medical service, check your health insurance plan’s details and benefits. Find out what services are covered and your deductibles, copays, coinsurance, and out-of-pocket maximums. Also, check for prior authorization or referral requirements for particular services or providers.

After the No Surprises Act is enacted on January 1, 2022, you will also have federal external appeal rights. If your insurance plan rejects your appeal regarding a surprise medical bill, you have the right to appeal to an independent decision-maker. You can do this through your state’s designated external review process or one of two federally approved organizations.

2. Recheck in Network Providers

The provider network changes frequently, so it is advisable to check with the insurer before the procedure to be sure the doctor you plan to see is still in the network. Keep a record of who you spoke with and what you said. Keep this knowledge close because it will be helpful if you get a surprise bill. You can do this by calling your provider’s office, checking your plan’s website or app, or contacting your plan’s customer service.

3. Forecasting costs

Many insurers offer a cost estimator to give you an estimate of the price of any individual procedure. Along with this, numerous third-party tools on the internet may assist you in obtaining price quotes for any treatment. Once you have the expected cost, request an estimate from the healthcare provider. Check whether there is a significant gap between the fees and the values you have independently studied. Your healthcare provider’s anticipated costs will prevent you from receiving a surprise bill.

4. Request State Assistance

Although no federal restrictions protect patients from unexpected invoicing, certain states have laws that do. For instance, in some states, patients are exempt from paying for trips to the emergency room made by network providers. Checking with the state government for legal requirements is a good idea to avoid receiving surprising bills.

5. Check the Bills Properly

The billing departments of hospitals deal with a lot of data every day, and unexpected billing errors are relatively frequent. They could have utilized the incorrect insurance information, billed you for services you didn’t receive, or had the dates wrong. Always carefully review your medical invoices to look for any differences.

6. Filing an Appeal

Instructions on medical bills are also included if you think they are inaccurate. If you believe your insurance company overcharges you, making a formal complaint is a good idea. Inform your healthcare provider of your intent to dispute a medical bill with your insurer and request they hold off on sending it to collections. Even though they are not obligated to comply, making this request will give you additional time to talk to your insurance and resolve the issue.

7. Consult Payment Schedule

It is better to contact for financial aid or a payment plan if all other options fail, and it is evident that the bill is actual and you must make the payments. Many billing offices offer low- or no-interest payment options that might help you pay your medical expenses fast.

8. Be Aware of Emergency Care Options

Patients and their families often endure stress due to medical treatments, and unforeseen medical expenditures can make things much more difficult. Surprise bills can be prevented with the fundamental checks outlined above, even though there is no timeframe for the government to implement regulations that would abolish them.

9. Contact Your Healthcare Provider

This will enable you to review each service billed and look for mistakes. Contact your healthcare provider. According to Medical Billing Advocates of America, approximately 75% of medical invoices have some inaccuracy. Ask your provider for more information about each service and to have any faults fixed.

10. Complain To the State Insurance Regulator

If you still aren’t satisfied with the outcome, find out who your state’s insurance regulator is. The Department of Insurance supervises health insurance complaints in various forms. You might be able to discover a link to the state agency that can help you if you search for “help with surprise medical bills” and your state’s name. The U.S. Public Interest Research Group advises contacting the state’s health department or consumer affairs office if the issue is a hospital bill. Depending on your state regulator, you might be able to lodge a complaint or obtain additional assistance with your surprise bill.

Final Remarks

Surprise medical bills are a common and costly problem affecting anyone receiving medical care. However, by following these 10 pro tips, you can avoid or reduce the impact of surprise billing on your finances and health. You can also use Bell MedEx to help you negotiate and lower your medical bills quickly and confidently.