Getting medical bills can make you feel worried.

The health system is hard to understand. When the doctor bills keep coming, you may want to ignore them.

But don’t be scared!

Not paying medical bills can hurt your credit score and money situation later on.

In this article, we will talk about what happens when you don’t pay medical bills. I will share real stories and tips from people who went through this too. You are not alone!

By the end, you will understand how unpaid medical bills can affect your credit score and money. But more importantly, we will talk about smart ways to deal with it, so you don’t feel too worried. This is not a situation without hope – there are ways to handle it.

Let’s take a deep breath and go through this together, one step at a time. I want you to feel strong, not afraid. We can do this!

What is Medical Debt?

Medical debt means owing money for doctor or hospital bills you haven’t paid yet. It happens when your medical costs are more than you can pay out of your own pocket. Unpaid bills can pile up fast, creating medical debt.

Shocking Medical Debt Numbers

Medical debt is a big problem in America. Studies show 100 million Americans have unpaid medical bills. That’s almost one in three people! Also, 11 million owe over $2,000 for medical care. And 3 million owe a shocking $10,000 or more.

Why People Get Medical Debt

There are a few reasons people get medical debt. Health insurance plans with high deductibles and costs make it hard to pay for care, especially for those with long-term health issues or emergencies. Losing a job or income can also make it tough to pay medical bills. Getting surprise bills from out-of-network doctors or for uncovered services can lead to unexpected debt too.

How Medical Debt Hurts

Medical debt can badly hurt someone’s finances and life. Unpaid bills can hurt credit scores. This can make it harder to get a loan, rent an apartment, or find a job. In extreme cases, it can lead to wage garnishment, property liens, or even bankruptcy. Debt stress can also harm mental and physical health.

Do hospitals in the USA deny medical care to patients who are unable to pay their medical bills or lack insurance?

No, it is not true that hospitals in the United States will let you die if you cannot pay for your medical bills. There is a law that says hospitals must give emergency medical care to everyone who needs it, even if they cannot pay. This law is called the Emergency Medical Treatment and Labor Act (EMTALA).

Under this law, if you go to the emergency room, the hospital must make you stable and treat you, even if you do not have insurance or cannot pay for the treatment. The hospital cannot refuse to care for you or let your condition get worse just because you do not have money. Giving emergency treatment is something the hospital must do by law and is also the right thing to do.

However, if you cannot pay, you may have problems with bills later. The hospital will send you bills that you will need to pay. But many hospitals understand that some people cannot afford to pay all at once. That is why they have special financial assistance programs, like Affordable Care Act (ACA) and Pfizer Patient Assistance Program, to help make the bills easier to pay.

➡️ The most important thing is to talk to the hospital about your situation. Do not just ignore the bills. Speak to them, see if you qualify for any help, and try to make a plan to pay what you can afford. While unpaid bills can hurt your credit score, the hospital cannot legally refuse to treat you in an emergency just because you cannot pay.

The Consequences of Not Paying Your Medical Bills

Not paying medical bills can cause big problems. If you don’t pay your medical bills, you are choosing a path that can lead to money troubles. However, staying on top of your bills and getting help to manage them is very important. Here are some things that can happen if you don’t pay your medical bills:

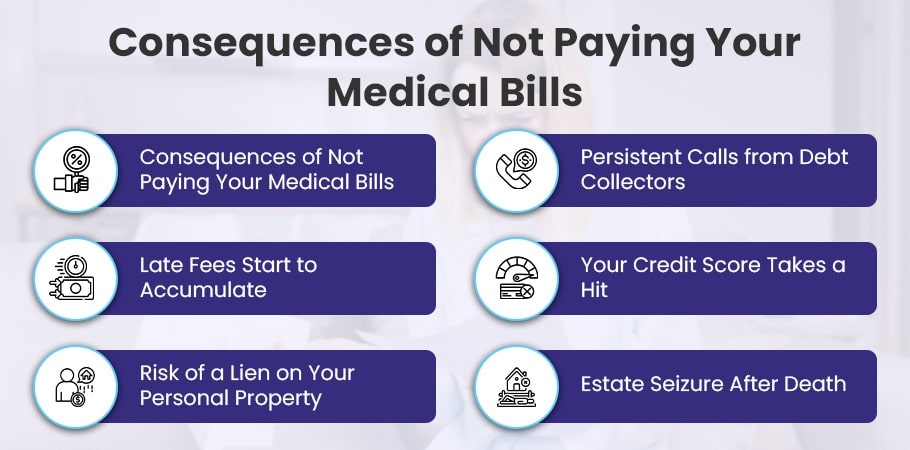

1). Higher Interest Rates Can Hit You Badly

Not paying your medical bills can cause big money problems. If you don’t pay, the amount you owe keeps growing bigger and bigger. The hospital or doctor will send your unpaid bills to a collections company. These companies add extra fees and interest charges, making your debt much larger.

For example, some collections companies charge 25% yearly interest on unpaid medical bills. That means if you originally owed $1,000 but didn’t pay for one year, you would then owe $1,250! The extra $250 is just from the 25% interest they added. A bill that was manageable can quickly become too much to handle.

Many hospitals now work with credit card companies for medical bills too. If you miss payments on one of those cards, they charge over 20% interest on the full amount you owe. That makes your debt grow out of control very fast.

So it’s very important to pay your medical bills on time. The interest and fees can make a small debt become a huge debt that’s hard to pay back. Paying bills right away helps avoid those extra costs.

2). Persistent Calls from Debt Collectors

If you don’t pay your hospital bills, you will get many calls from debt collectors. These are companies that want to get the money you owe. They will keep calling and calling, which can make you feel stressed and worried.

The debt collectors will call you, send you messages, emails, and letters. They will try to reach you in every way they can. There are rules under the Fair Debt Collection Practices Act about how they can talk to you, but they will still keep trying hard to get the money.

If you ignore their calls and messages, things will get worse. You may have to pay even more money, and they could take you to court. Some debt collectors, like Convergent Healthcare and Medical Data Systems, are known for never giving up easily.

The main thing to remember is that if you don’t pay your medical bills, the debt collectors will keep bothering you until you pay. It’s best to talk to them and make a plan to pay what you owe, even a little bit at a time. That way, you won’t have to worry about them calling all the time or taking you to court.

3). Late Fees Start to Accumulate

Not paying your medical bills on time can quickly make the amount you owe get really big. Doctors and collection agencies will start adding late fees every time you miss a payment. This makes the total amount you owe grow very fast.

These late fees don’t just add stress about money – they can also hurt your relationship with your doctor. Doctors may not want to see you anymore if you don’t pay your bills. This could put your health in danger later on.

The best way to avoid this is to pay all medical bills right when you get them. If you can’t pay in full, call the billing office right away to set up smaller payments you can handle. Keeping the conversation going is key to stopping late fees from making your debt too big.

Ignoring medical bills leads to more fees, more debt, and more problems. By making those payments a priority, you’ll save money and keep access to good healthcare. A little effort ahead of time goes a long way.

4). Your Credit Score Takes a Hit

If you don’t pay medical bills, the hospital may send it to collections. When it goes to collections, that unpaid bill shows up on your credit report. This makes your credit score go down a lot.

A low credit score makes life more expensive. You may have to pay higher interest rates on loans, credit cards, and mortgages. Landlords may charge you more money when you rent. Some jobs even check your credit score before hiring you.

Unpaid medical bills can really hurt your score. Just one unpaid bill in collections can make your score drop by 100 points or more! For example, if your score was a great 780 before, it could drop all the way down to 680 or lower.

Not paying medical bills has big money problems beyond just owing the hospital. Keeping your credit score good by paying those bills is very important. If you can’t pay all at once, call the hospital and make a payment plan you can afford. Paying the bills will help your credit score.

5). Risk of a Lien on Your Personal Property

When you go to the doctor or hospital, you must pay the bills. If you don’t pay, the doctor or hospital can take you to court.

One bad thing that can happen is they can put a “lien” on your things.

A lien means they have a legal right to take your stuff if you don’t pay them the money you owe.

If they put a lien on your house, car, or other valuable things, they can force you to sell those things to pay back the money you owe for the medical bills.

Even if the medical bills are small, they can grow into a big problem. Collection companies are very tough about getting their money back. They will take you to court to get permission to take your stuff.

In the United States, companies like Credence Resource Management often take people to court and put liens on their property when they don’t pay their medical bills.

Once there is a lien, it is very hard to borrow money or do other money things until you pay off the debt.

6). Estate Seizure After Death

If you don’t pay your medical bills, it can cause big problems even after you die. When you pass away, any unpaid medical bills don’t just go away. The people you owe money to (called creditors) have the right to get paid from the things you leave behind (your estate).

In the United States, creditors can ask for money from your estate to cover any medical bills you didn’t pay. The people in charge of giving away your things after you die (called executors) have to use those things to pay off your medical bills first. This means there might be less left over to give to your family and loved ones.

Also, paying off those old medical bills can take a long time. The executors can’t give away what’s left of your things until they’ve paid off all the bills people are asking for. This can make your family wait longer to get their share, which can be hard when they’re already sad about losing you.

Some companies, like Nationwide Recovery Systems and ARS National Services, are really good at asking for money from people’s estates to cover medical bills. This shows how important it is to take care of your medical bills while you’re still alive. If you don’t, a big part of the things you wanted to leave for your loved ones might have to be used to pay off those old bills instead.

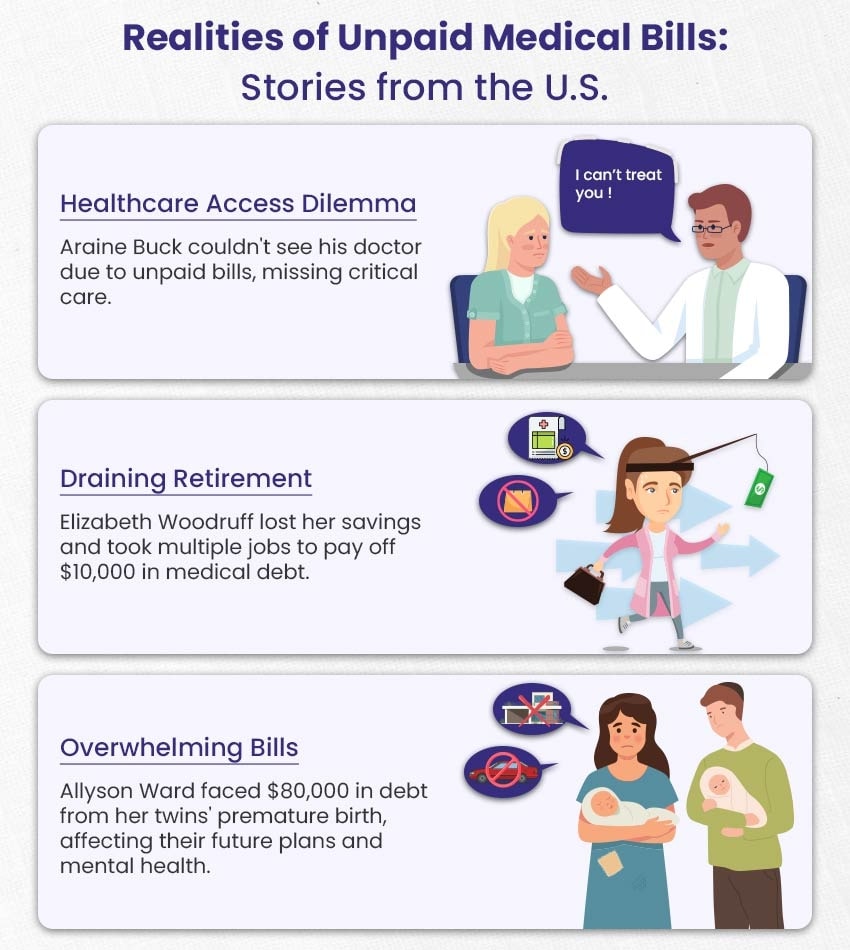

The Realities of Unpaid Medical Bills: Stories You Need to Hear

We’ve gathered real-life stories from Americans to shed light on the challenges patients face when dealing with medical bills. These experiences reveal the struggles and tough decisions many encounter when trying to manage healthcare costs.

😷 Facing Barriers to Healthcare Access (Araine Buck’s Experience)

John was a young dad who lived in Arizona. He got very sick after eating some bad food. The doctor said he had an infection in his stomach. The doctor told John to come back for more check-ups.

But when John tried to make those appointments, the doctor’s office would not let him in. Why? Because John had not paid his bill from the first visit.

This happens a lot to people who cannot pay for their medical care. If you don’t pay the bill, many doctors will not see you again until you pay. So even if you really need help, unpaid bills can stop you from seeing the doctor. For John, it meant he could not get important care for his bad infection. And as he got sicker, more bills kept coming.

John’s story shows how unpaid medical bills make it hard to get healthcare. It’s not just about money – unpaid bills can stop sick people from seeing their doctor when they need it most. No one should be denied care just because of an unpaid bill. But as long as medical costs are high and there are billing problems, many patients will not get the treatment they need. John was lucky his infection did not become deadly before he could finally see the doctor again. Others may not be so lucky.

😷 Draining Savings to Pay Medical Debt (Woodruff’s Struggle)

Elizabeth Woodruff and her husband faced a nightmare when he had to get his leg amputated due to an infection.

They had insurance, but still had to pay $10,000 to the hospital. They did not pay, so the hospital sued them. This turned their lives upside down.

To pay the debt, Elizabeth took all the money from her retirement savings. But that was still not enough. She had to get three jobs to keep paying the big hospital bill. All the money they earned went to pay the bill.

The money problems were very hard on them. Elizabeth and her husband could not go out to eat or have fun anymore. It was even hard to pay for rent, utilities, and food. Elizabeth felt very stressed working three jobs while also taking care of her husband after his leg amputation.

No matter how hard they worked or what they gave up, they could not get ahead of the debt. The money problems made it very difficult for them to get better and move on with life. Their story shows what can happen when people cannot pay their medical bills, even with insurance.

Elizabeth and her husband did everything they could. They spent all their retirement savings and worked all the time. But they still might have to declare bankruptcy because of the one medical problem.

😷 Managing Overwhelming Medical Bills (Ward’s Story)

Allyson Ward and her husband Marcus were so happy when their twins Milo and Theo were born. But then they got a huge $80,000 hospital bill due to the premature birth of their babies. Even though Allyson worked extra hours as a nurse, they could not pay the bill.

To pay for things, they had to use credit cards, borrow money from family, and delay paying other bills. It was very hard for them to pay for their home and other needs. They could not save money for their children’s school or to buy a house.

Having so much debt made Allyson and Marcus very worried and stressed all the time. They felt anxious because they did not know how they would pay the big hospital bill. They wanted to pay, but the bill was too expensive for them.

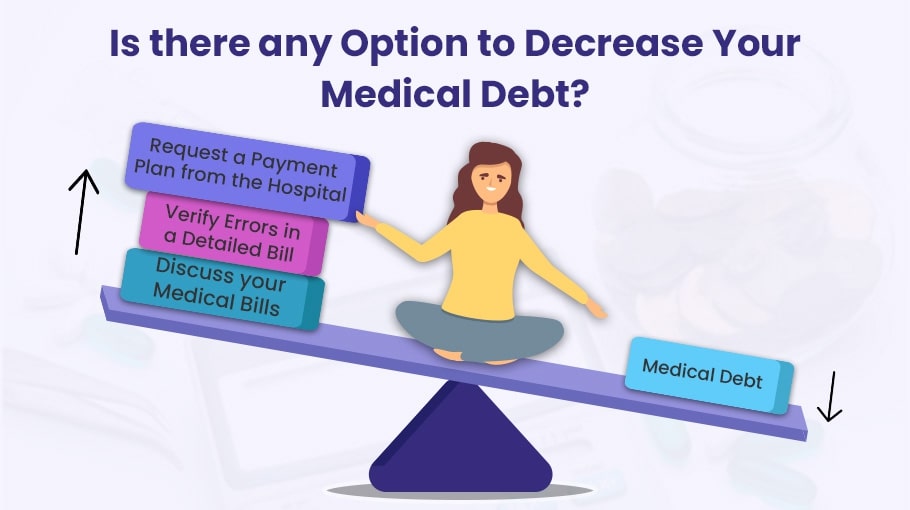

Reliable Options To Decrease Your Medical Debt

After understanding the problems caused by not paying medical bills, you may wonder: Can I lower my medical debt? Yes, you can lower your medical debt. Here are some simple ways to do it:

➜ Discuss your Medical Bills with the Healthcare Facility

First, call the hospital’s billing office. Tell them you don’t have enough money to pay the full amount. Ask if they can give you a lower price or let you pay over time in smaller amounts. Many places will work with you if you explain your situation. Don’t be afraid to ask.

Also, check if the hospital has programs to help people who can’t afford their bills. Groups like the PAN Foundation, American Cancer Society, and Healthcare Hospitality Network can sometimes help pay medical costs for people in need.

There are nonprofit groups that teach you how to negotiate lower medical bills. The Healthcare Financial Management Association (HFMA) gives advice on how to talk to billing offices.

Negotiating medical bills takes some work, but it’s worth it if you can get the total amount lowered. Don’t hesitate to call the billing offices and ask about assistance programs. If you keep trying and explain your finances honestly, you may be able to reduce what you owe.

➜ Request a Payment Plan from the Hospital

Many hospitals let you pay your medical bill in smaller monthly payments. This helps patients pay their big medical bills without stress.

The key is to call the hospital’s billing office. Ask them what payment plan options they have. Make sure you understand everything – like interest rates and how long the plan lasts.

By setting up a payment plan, you avoid having the hospital send your unpaid bill to collections. That’s bad for your credit score.

Hospitals want to help patients pay their bills. Good payment plans make both sides happy.

So call the hospital billing office. With some talk and a payment plan, you can relax knowing you’re fixing your medical bill in a manageable way.

➜ Review Your Medical Bills

Reviewing your medical bills carefully can help you pay less money. First, ask your doctor or hospital for a list of all the charges. The list should show every test, medicine, and service they charged you for.

Next, compare the prices on your bill to the average prices in your area. You can use websites like Fair Health Consumer to find the average prices.

Look closely at your bill. Check if they charged you twice for the same thing, or if they charged you for something you didn’t get. If you see any mistakes, call the billing office right away and tell them about it.

It’s good to have someone on your side who knows about medical bills. You can hire medical billing audit experts from BellMedEx to help you. Their job is to find mistakes on bills and negotiate to lower the costs, so you don’t pay too much.

With BellMedEx working on fixing mistakes and getting you lower costs, you can pay less money overall for your medical care.

Smart Ways to Avoid Unpaid Medical Bills

It’s good to look at your money situation closely. Ask a finance expert for help when you need it. This can help you make smart choices. Here are some tips to help you manage and lower your medical bills:

✅ Monetize Your Life Insurance Policy to Handle Medical Expenses

Are medical bills too big for you? There is a smart way to get money from your life insurance. It is called a “life settlement”.

With a life settlement, you can sell your life insurance policy to another company. They will give you a big amount of cash money right away. You can use this cash to pay off your medical bills or pay for treatments.

Here’s how it works:

If you cannot pay the premiums (regular payments) for your life insurance anymore, or if you don’t need the insurance now, you can sell the policy.

The company that buys your policy will pay you more money than what the insurance company would give you if you canceled the policy. But they will pay you less than the full death benefit amount.

This way of getting money from your life insurance can really help when medical bills are piling up. It lets you get the value from your policy right when you need money the most, instead of canceling the policy for a small amount.

To learn more, you can talk to the Life Insurance Settlement Association (LISA). They can explain the process and help you decide if a life settlement is a good choice for you.

✅ Seek Medical Debt Relief Through Bankruptcy

If medical bills are too much, you can look into medical debt relief through bankruptcy. But first try other options, because bankruptcy hurts your credit score and finances for a long time.

One way to handle medical costs is to negotiate your medical bills. Many doctors will work with you, especially if you explain your money situation honestly. Don’t be scared to ask for discounts or payment plans that work for you.

If negotiating doesn’t work, and bankruptcy seems like the only choice, there are two main types:

Chapter 7 Bankruptcy: This means selling some things to pay medical debt. Some of your stuff may be sold, and the money goes to who you owe. The good part is once it’s done, most other medical debt can go away, and you don’t have to pay it.

Chapter 13 Bankruptcy: With this, you don’t sell anything. Instead, you make a plan to pay back all medical debt over 3-5 years with affordable monthly payments. This lets you keep your home, car, and other necessities.

Before filing for bankruptcy, it’s important to talk to a bankruptcy lawyer. They can help you understand the pros and cons of each option and pick the best one for your finances.

Remember, only use bankruptcy as a last resort after trying other options, like negotiating with doctors, setting up payment plans, or getting financial help from nonprofits or government programs.

✅ Utilize Personal Loans to Cover Costs

One of the best ways to pay for big medical bills and avoid medical debt is to use personal loans. Personal loans give you a simple way to pay off all those big medical bills at one time.

Personal loans usually have a fixed interest rate. That means your monthly payment stays the same for the whole loan. This makes it easier to budget and plan your finances compared to medical bills that change all the time. By putting all your debt into one personal loan payment, you can feel less stressed and stay on top of your money situation.

However, it’s really important to shop around and pick the right lender with good rates and terms for you. Good online lenders like SoFi and LendingClub are worth looking at since they often have good interest rates and flexible repayment options.

Before getting a personal loan, it’s also a good idea to try negotiating your medical bills or doing a debt reduction program. Many healthcare providers are willing to lower your medical bills, especially if you’re having money troubles. By negotiating, you may be able to reduce the total debt which makes it easier to pay off without a loan.

Remember, while personal loans can help, be careful about how they impact your credit score. Make sure to review the terms carefully, and only borrow what you can comfortably pay back.

By looking at all your options, like personal loans, negotiating bills, and debt reduction programs, you can take control of your medical expenses and avoid being overwhelmed by debt.

Conclusion

Not paying your medical bills can make your money situation very bad. It can also hurt your credit score, which is important for getting loans or credit cards in the future. Even though it may seem easy to ignore the bills now, you should not do that. The bills will not go away on their own. Here are some key takeaways:

- Talk to your doctor or hospital. Ask if you can pay a little bit each month. Many will let you do this. This way, the bills won’t get sent to a debt collector.

- Look for help from hospitals or charities. If you don’t make a lot of money, they might forgive some or all of your bill.

- Pay your medical bills first, before other debts. If you don’t, it can really hurt your credit score.

- If you feel overwhelmed, ask a credit counselor for help. They can talk to the places you owe money and make a plan for you to pay it back slowly.

- You can also get a debt consolidation loan. This combines all your debts into one monthly payment, which can be easier to manage.

- Bankruptcy is the last option if you really can’t pay back the money you owe. It will hurt your credit, but it stops debt collectors from calling and suing you.

The most important thing is to not ignore the medical bills. That will only make the problem worse. If you make a plan to pay what you can, it shows you are trying. Over time, if you keep paying, you can get out of debt and improve your money situation. Paying something, even a little, is better than not paying at all.