When Medicare sneezes, healthcare providers catch a cold!

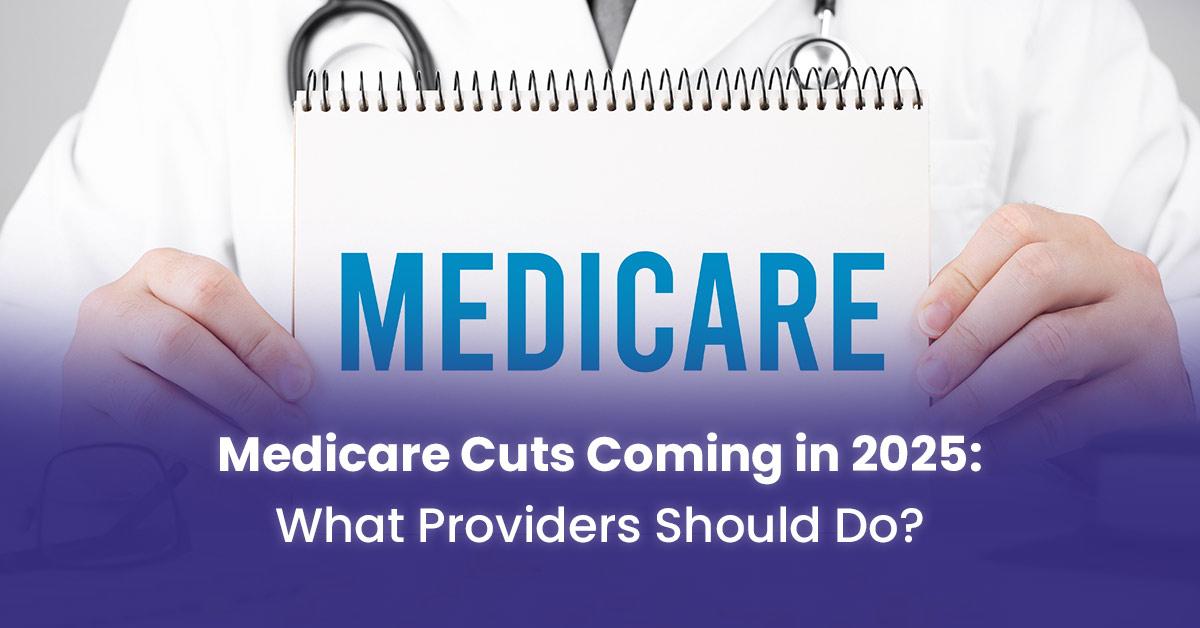

First came the sequester. Then came MACRA. Now, healthcare providers are getting ready for what could be the biggest round of cuts to Medicare yet; these cuts are likely to happen in 2025. Since the Medicare trust fund is supposed to run out by 2036, big changes are likely to happen.

As providers get ready for what 2025 will bring, this coming change makes them uncomfortable and excited at the same time.

This blog will talk in depth about the Medicare cuts that are coming in 2025, based on the best and most correct predictions.

Medicare Reimbursement Cuts Coming In 2025

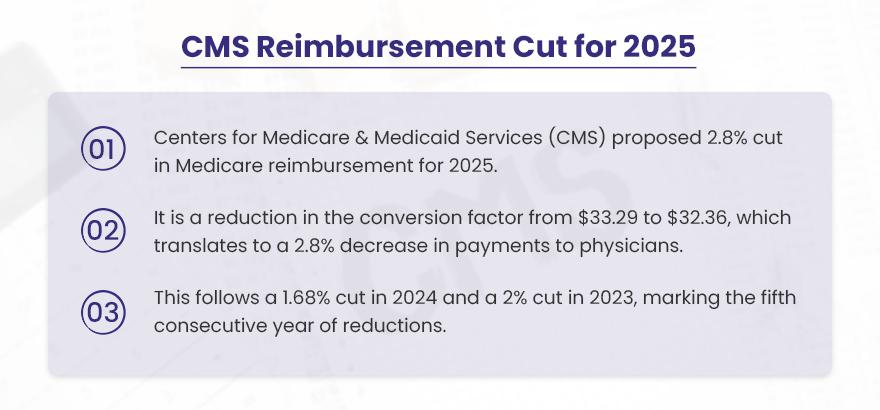

The Centers for Medicare & Medicaid Services (CMS) has suggested a new decrease in the Medicare Physician Fee Schedule (MPFS) conversion factor for 2025. If this is put into action, the conversion factor will go down from $33.29 to $32.36, leading to a 2.8% reduction in payments to doctors. This new cut comes after a 1.68% decrease in 2024 and a 2% decrease in 2023. This is the fifth year in a row that healthcare providers who serve Medicare patients have seen their payment rates go down.

Budget cuts are not liked by many people, but there are good reasons for both sides of this topic.

Reducing Medicare spending might help lower the national debt and make the program more financially stable in the future. But, these cuts also make it harder for doctors to manage the increasing costs of running a medical office.

✅ PROS

✔ Cost savings for the Medicare program, which could help extend its solvency.

✔ Incentivizes physicians to operate more efficiently and reduce unnecessary services.

❌ CONS

✘ Reduced payments could lead to physicians limiting the number of Medicare patients they see or opting out of the program altogether.

✘ Potential negative impact on the quality of care as physicians may have to see more patients in less time to maintain revenue levels.

✘ Could exacerbate existing physician shortages, particularly in rural and underserved areas.

Want to stay profitable despite Medicare cuts?

BellMedEx has a custom strategy for your specialty.

“We must protect Medicare for future generations, but not at the expense of those it serves today.”

On one hand, Medicare does need to reduce spending to remain financially viable. As more Baby Boomers age into the program, costs continue to rise. Some cuts are reasonable to keep Medicare sustainable.

However, continual cuts also jeopardize seniors’ access to care. Many doctors now refuse new Medicare patients due to low reimbursements. Others have been forced to join large health systems and limit visit time to make up for losses. Quality of care suffers.

Perhaps the answer lies in a balanced approach. Instead of blanket cuts, reforms could target inefficiencies and waste while protecting access. For instance, paying doctors for providing coordinated, high-value care instead of fee-for-service. Or allowing Medicare to negotiate drug costs. We need bipartisan solutions that address cost drivers while maintaining quality.

Comparison of Medicare Cuts from 2020 to 2025

In recent years, Medicare reimbursement rates have gone down, which has caused a lot of worry among healthcare providers. To see how these cuts will affect things, let’s look at how things changed from 2020 to 2025.

Medicare Conversion Factor Reductions (2020-2025)

The Medicare conversion factor is an important number that helps decide how much money doctors and healthcare providers get paid. This is a yearly list of the Medicare conversion factor and the percentage cuts for each year:

| Year | Conversion Factor | Percentage Cut | Notes |

| 2020 | $36.09 | -0.0% (Baseline) | No reduction in 2020. |

| 2021 | $34.89 | -3.36% | Reduction due to the expiration of a temporary increase from the COVID-19 pandemic relief measures. |

| 2022 | $34.61 | -0.80% | Minor reduction; part of ongoing adjustments. |

| 2023 | $33.89 | -2.09% | Reduction driven by broader budgetary constraints. |

| 2024 | $33.29 | -1.68% | Continued reduction amidst rising operational costs. |

| 2025 | $32.36 | -2.80% | Proposed cut exacerbating financial challenges for providers. |

➡️ 2020 Conversion Factor — $36.09

Example Calculation: If a provider was reimbursed $100 for a service in 2020:

100⁄36.09 × 36.09 = $100 earned

➡️ 2021 Conversion Factor — $34.89

Example Calculation: If the same service was reimbursed in 2021:

100⁄36.09 × 34.89 = $96.9 earned

This means a $3.1 or 3.1% decrease from 2020.

➡️ 2022 Conversion Factor — $34.61

Example Calculation: If the same service was reimbursed in 2022:

100⁄36.09 × 34.61 = $95.9 earned

This means a $4.1 or 4.1% decrease from 2020.

➡️ 2023 Conversion Factor — $33.89

Example Calculation: If the same service was reimbursed in 2023:

100⁄36.09 × 33.89 = $93.9 earned

This means a $6.1 or 6.1% decrease from 2020.

➡️ 2024 Conversion Factor — $33.29

Example Calculation: If the same service was reimbursed in 2024:

100⁄36.09 × 33.29 = $92.1 earned

This means a $7.9 or 7.9% decrease from 2020.

➡️ 2025 Conversion Factor — $32.36 (Proposed)

Example Calculation: If a provider is reimbursed $100 for a service in 2025:

100⁄36.09 × 32.36 = $89.7 earned

This means a $10.3 or 10.3% decrease from 2020.

Summary of Impact

Between 2020 and 2025, the conversion factor is expected to go down from $36.09 to $32.36. This means a total decrease of about 10.3%. This decrease shows a continuing pattern of lower payment rates even though the costs of providing healthcare are going up.

➜ In 2020, a service paid at $100 would receive $100.

➜ By 2025, the same service would be reimbursed at approximately $89.70, representing a 10.3% reduction over five years.

These cuts have a big impact on healthcare providers, especially those working in expensive or rural areas. The ongoing drop in payment rates, while practice costs keep going up, adds to the money problems many medical practices are experiencing.

Reactions from the Healthcare Community

Medicare payments have gone down by about 29% since 2001 when we consider inflation. This is a big problem for many medical practices.

🔊 Dr. Bruce A. Scott, the president of the AMA, said that the Medicare Economic Index (MEI), which looks at the cost of running a practice, is expected to go up by 3.6% in 2025. This will make the difference bigger between what doctors are paid and the real cost of giving care.

🔊 Doctors in rural areas and those helping low-income communities are especially at risk. They usually work with less money and deal with more difficulties in their operations.

🔊 Groups like the American Medical Association (AMA), Premier, Medical Group Management Association (MGMA), American Academy of Family Physicians (AAFP), National Association of Accountable Care Organizations (NAACOS), and Society for Cardiovascular Angiography & Interventions (SCAI) spoke out against the rule soon after CMS announced it.

🔊 The American Medical Association (AMA) is very worried about these budget cuts. They say these cuts could make it harder for older people to get good medical care, especially in areas that do not have enough services, like rural places.

🔊 The Medicare Payment Advisory Commission (MedPAC) has warned that these cuts might reduce access to care for people on Medicare, making current healthcare access problems worse.

🔊 This year, the Medicare Economic Index (MEI), which measures the increase in practice costs, is 3.6%. The AMA and the Medical Group Management Association (MGMA) have spoken out against the proposal, noting that this is the fifth consecutive year that Medicare payments have been lowered. The cut is now even more “short-sighted.” These organizations are working in the US House of Representatives for a bipartisan bill. This bill would connect the MEI to a yearly pay update based on inflation.

🔊 Also, when healthcare workers have to deal with high costs while doing their jobs, their situation becomes very difficult. In 2024, the costs to operate have increased compared to 2023. They will feel even more frustrated about the upcoming Medicare payment cuts in 2025.

Changes in the Medicare Fee Schedule from 2020 to 2025

| Year | Conversion Factor | Percentage Change from Previous Year |

| 2020 | $36.09 | Baseline |

| 2021 | $34.89 | -3.36% |

| 2022 | $34.61 | -0.80% |

| 2023 | $33.89 | -2.09% |

| 2024 | $33.29 | -1.68% |

| 2025 | $32.36 (Proposed) | -2.8% (Proposed) |

The Medicare Fee Schedule (MFS) helps decide how much money is paid for services given to people who have Medicare. It is a system with several important parts:

Relative Value Units (RVUs) – RVUs are important in the MFS. They show how valuable each service is compared to others. RVUs take into account the physician work required, practice expenses, and malpractice costs associated with a service. Services that are more complicated and take more time have higher RVU values.

Geographic Practice Cost Indices (GPCIs) – GPCIs are adjustments made based on location to consider differences in costs in different areas. There are separate GPCIs for the work component, practice expense component, and malpractice component of RVUs. Places where it costs more to run a medical practice have higher GPCI numbers.

Conversion Factor – The conversion factor is a dollar amount. It is multiplied by the RVU to find out the final Medicare payment amount. It changes the relative values into real payment amounts. The conversion factor is changed every year by CMS.

The following are the changes in the Medicare Fee Schedule from 2020 to 2025:

⏩ 2020 Fee Schedule

Conversion Factor: $36.09

Example Payment: For a service with 2.0 RVUs, the payment was 2.0 RVUs x 36.09 CF = $72.18

⏩ 2021 Fee Schedule

Conversion Factor: $34.89

Example Payment: For a service with 2.0 RVUs, the payment was 2.0 RVUs x 34.89 CF = $69.78

Impact: A decrease of $2.40 per service from 2020 levels, or 3.3%.

⏩ 2022 Fee Schedule

Conversion Factor: $34.61

Example Payment: For a service with 2.0 RVUs, the payment was 2.0 RVUs x 34.61 CF = $69.22

Impact: A decrease of $3.96 per service from 2020 levels, or 5.5%.

⏩ 2023 Fee Schedule

Conversion Factor: $33.89

Example Payment: For a service with 2.0 RVUs, the payment was 2.0 RVUs x 33.89 CF = $67.78

Impact: A decrease of $6.40 per service from 2020 levels, or 8.9%.

⏩ 2024 Fee Schedule

Conversion Factor: $33.29

Example Payment: For a service with 2.0 RVUs, the payment was 2.0 RVUs x 33.29 CF = $66.58

Impact: A decrease of $8.60 per service from 2020 levels, or 11.9%.

⏩ 2025 Fee Schedule (Proposed)

Conversion Factor: $32.36

Example Payment: For a service with 2.0 RVUs, the payment was 2.0 RVUs x 32.36 CF = $64.72

Impact: A decrease of $11.46 per service from 2020 levels, or 15.9%.

BellMedEx medical billing company gets you the private payer rates you deserve, so Medicare cuts don’t hurt as much. Accurate coding. No claim denials. Rapid reimbursement. Schedule a free analysis and stop stressing over Medicare cuts now!

💸get

paid

higher

Impact of Medicare Cuts on Patient Care

Medicare cuts affect patients in many ways, some obvious and some not so obvious. Even if budget cuts look small on paper, they can have serious effects on people who depend on Medicare services.

As one older patient said,

“These Medicare cuts have made it more difficult for me to get the care I need. I have had to miss doctor appointments and reduce my medicine because of high prices.”

This part will look at how Medicare cuts affect people and what it means for patient care:

Minimized Access to Services

Medicare payment cuts can make it much harder for patients to get medical care. Many providers, especially those in rural or underserved areas, may limit the number of Medicare patients they take on as payment rates go down. This drop in services can make Medicare recipients have to wait longer and have less access to care.

Poor Quality of Care

Medicare reimbursement rates are still declining, which may force providers to make cost-cutting decisions that could lower the standard of care provided. Due to lack of money, staff may be cut, patient care resources may be limited, or investments in new technologies may be lowered. These changes could affect how patients feel and how well they get care generally.

Increased Out-of-Pocket Costs

With Medicare payments decreasing, some providers might shift the burden of costs to patients, resulting in increased out-of-pocket expenses. This shift can affect Medicare beneficiaries’ ability to afford necessary treatments, potentially leading to delayed or foregone care.

For example, a primary care provider who is getting paid less might charge Medicare patients higher co-pays or deductibles, which would make it harder for those patients to pay for their medical bills.

Financial Tips for Providers after Medicare Payment Cuts

Medicare payment cuts are a constant worry for healthcare providers everywhere in the country. But succumbing to panic or despair won’t solve anything. Instead, take action to improve your practice’s finances. In this section, we’ll look at practical ways to lessen the impact of Medicare payment cuts. There are several ways to increase your bottom line, from cutting back on wasteful spending to thinking about different payment choices.

Medicare cuts will be difficult, but they don’t have to be a disaster. With smart money planning, you can keep providing great care and protect your practice from financial problems.

Let’s explore simple solutions to be prepared and succeed despite lower Medicare payments.

Applying Money-Saving Techniques

Healthcare providers can reduce the effects of Medicare cuts by using money-saving strategies. Ways to improve include negotiating payer contracts, making office work easier, and cutting down on extra costs. Taking these steps can help reduce the financial stress from lower payments.

Finding Different Ways to Make Money

Finding additional ways to make money is another plan for providers. This could mean providing extra services that Medicare does not cover or moving into markets that do not use Medicare. Diversification can make revenue more stable and lessen reliance on Medicare payments.

Integrating Technology

Technology investments can increase operational effectiveness and lower expenses. For example, using electronic health records (EHRs) or telemedicine platforms can make work easier and reduce costs for administration. These technologies can help make patient care and practice management better.

For example, a medical practice can use a telemedicine platform. This helps reduce the need for patients to visit in person. It can lower costs for the facility and make it easier for more patients to get care.

Collaborating with Provider Support Groups

Professional groups are very important in pushing for changes to Medicare rules. Groups like the American Medical Association (AMA) and the Medical Group Management Association (MGMA) aim to affect policy choices and deal with provider issues. Providers should connect with these groups to get updates and join in advocacy activities.

Participating in Advocacy

Many laws are being worked on to fix problems with Medicare payments. New bills and negotiations are trying to change how payments work and make it easier for providers financially. Knowing about these efforts can help providers see possible changes and get involved in advocacy. Doing these activities helps make the voices of healthcare providers stronger and can result in better policy results.

For example, providers can join advocacy groups to support laws that connect Medicare payments to inflation. This helps make reimbursement rates more stable and fair.

BellMedEx Can Keep Your Practice Profitable Despite Medicare Cuts 💯

Medicare cuts got you down? Take back control with our medical billing services. We’ll boost your private payer rates so Medicare cuts hurt less. Expert coders get you max, denial-free reimbursements fast. Schedule a free analysis and stop worrying about Medicare cuts today!

Thanks to BellMedEx, our billing reimbursement is at its highest!

Dr. Esther

Counselor, Mental Health Clinic

Top Features

✓ Medical Billing

✓ High Rate Negotiation

✓ Revenue Cycle Management