In medical billing, even a small mistake can slow down your payments. When an insurance company doesn’t pay a claim on time, that claim becomes delinquent.

This can happen for many reasons. You might miss some patient information. A code might be wrong. Or no one followed up with the payer. No matter the cause, delayed claims create problems. They hurt your cash flow, frustrate your patients, and add stress to your team.

Here’s the good news: most delinquent medical claims are easy to prevent. With the right systems and a few simple habits, you can keep your billing on track.

In this blog, you’ll learn how to avoid claim delays, get paid faster, and keep your practice running smoothly.

What Is a “Delinquent” Claim?

Before we talk about prevention, it’s important to understand what a delinquent claim actually is.

A delinquent claim is a health insurance claim that hasn’t been paid by the insurance payer to the healthcare provider within the expected timeframe. For most payers:

- Electronic claims are expected to be paid within 30 days

- Paper claims usually have up to 45 days

These timelines apply across most commercial insurers, as well as Medicare and Medicaid.

To meet these deadlines, healthcare providers must move quickly and accurately—from patient registration, through coding, to final claim submission. But if anything in this process is missed or delayed, the claim may not get paid on time.

If a payer doesn’t send payment within their expected window, the claim becomes delinquent. At this point, either the provider’s in-house billing staff or their outsourced medical billing company must take action. This could involve:

- Reviewing the claim for missing modifiers or CPT/ICD-10 coding errors

- Confirming the claim was received by the payer or clearinghouse

- Resubmitting the claim, if necessary

It’s important to note: a delinquent claim is not the same as a denied claim. The claim may still be “processing,” placed “on hold,” or delayed due to something as simple as an incorrect payer address or a missing document.

Here’s an example:

A physician at a small internal medicine clinic sees a patient on April 1st who has a commercial insurance plan. The provider submits the claim electronically on April 3rd.

By May 15th, the payment still hasn’t arrived.

The billing team checks the clearinghouse and sees that the payer accepted the claim on April 4th. So what happened?

A modifier was missing from a CPT code, so the claim stalled in the payer’s system. If someone had followed up sooner, the team could have corrected the issue and avoided missing the timely filing deadline—and the claim wouldn’t have turned delinquent.

Ever wish denial letters came with a “solve” button?

Here it is. Click us in, and we’ll clear the logjam, appeal what’s worth fighting, and code‑proof tomorrow’s claims so the mess doesn’t repeat.

When a Claim Becomes Delinquent?

A claim becomes delinquent when it:

- Is at risk of being denied, written off, or sent to collections

- Has been unpaid beyond 30 days (for electronic claims) or 45 days (for paper claims), depending on the payer

- May be held up due to missing information, errors, or payer issues

Impact of Delinquent Claims

When a claim drags past its due date, three parties feel the impact — your medical practice, the payer, and the patient. Here’s the clear, step‑by‑step chain of events.

Stage 1 – Claim Sits in A/R (Day 0 – 30)

| 🔽 | Details |

|---|---|

| Trigger — Why it happens | Claim is submitted but pends or denies for data, coding, or eligibility errors. |

| What your team does | Biller edits the claim, rebills, and calls the payer for status. |

| What actually happens | Cash that should arrive in 14 days now sits in Accounts Receivable (A/R). |

| Who feels it | Practice leadership — KPIs such as “days in A/R” climb, squeezing cash flow. |

Stage 2 – Patient Becomes the Payer (Day 31 – 60)

| 🔽 | Details |

|---|---|

| Trigger — Why it happens | Payer downcodes or denies the service. Your policy shifts the balance to “patient responsibility.” |

| What the patient sees | A surprise bill (e.g., $300) appears in the mailbox or portal. |

| What actually happens | Confused patients delay payment, waiting for “another insurance adjustment.” After 60 days a $25 late fee applies. |

| Who feels it | Patient – shock and frustration. Practice – still no cash, clerical load rises. |

Stage 3 – Collections Take Over (Day 61 – 120)

| 🔽 | Details |

|---|---|

| Trigger — Why it happens | Patient ignored at least two statements and a final notice. Your financial policy—signed at intake—sends ≥ 60‑day accounts to collections. |

| What the agency does | Calls or texts the patient up to three times a week; adds a 15–20 % fee (e.g., $325 → ≈ $390); offers payment plans. |

| Who feels it | Patient – stress grows with every call. Practice – online reviews blame your clinic, not the agency, eroding trust. |

Stage 4 – Credit Report Damage (Day 180 +)

| 🔽 | Details |

|---|---|

| Trigger — Why it happens | Unpaid balance > $500 remains in collections for 180 days. Agency reports it to Experian, Equifax, and TransUnion. |

| What actually happens | Credit score may drop 50–100 points. |

| Who feels it | Patient – faces higher loan rates and may skip follow‑ups. Practice – loses revenue from missed care. |

Stage 5 – Lawsuit & Public Record (Month 6 – 18)

| 🔽 | Details |

|---|---|

| Trigger — Why it happens | Large balances (often >$2,000) remain unpaid; hospitals or debt buyers sue in states like New York, Texas, or California. |

| What the court does | Adds filing fees, attorney costs, and may approve wage garnishment. Case becomes public record. |

| Who feels it | Patient – faces legal risk and long‑term credit damage. Practice – name appears in court documents, signaling harsh collections—even if the root cause was a preventable claim error. |

How to Prevent Delinquent Medical Claims?

Delinquent medical claims aren’t just an inconvenience — they directly threaten your revenue flow.

When claims aren’t paid on time, it creates a domino effect of rework, patient confusion, lost revenue, and wasted hours chasing down answers.

The good news? Most of it’s preventable.

Here’s how healthcare practices can prevent claims from going delinquent, improve cash flow, and reduce stress.

1). Get It Right at the Front Desk

The front desk may not stamp invoices, yet it controls every data element a payer will judge. One mistyped policy number or an expired plan on file can trigger a denial that costs weeks of rework.

- Verify insurance at every visit. Run a real‑time eligibility (RTE) check before the patient sits down.

- Scan IDs and cards. Store both sides in the EHR for instant reference.

- Confirm spelling aloud. Catch name or date‑of‑birth errors while the patient can still correct them.

2). Scrub Every Claim Before Submission

Claim scrubbing is a second set of eyes—only faster. By auto‑flagging code mismatches in seconds, you stop denials before they enter the payer’s system.

- Pass every encounter through a clearinghouse. Let software spot CPT/ICD‑10 conflicts, missing modifiers, and NPI errors.

- Fix alerts on the spot. Aim for a 97 percent or better clean‑claim rate.

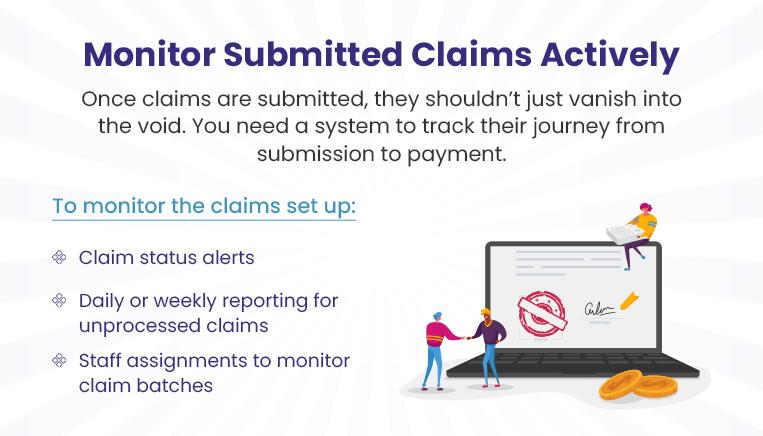

3). Monitor Submitted Claims Actively

A claim can disappear into a payer queue, gathering dust while the filing clock keeps ticking. Real‑time monitoring surfaces silent claims early, so you can nudge them before they stall out.

- Set status alerts. Flag any claim that shows no movement after 14 days.

- Run daily aging reports. Assign each silent claim to a staff owner for follow‑up.

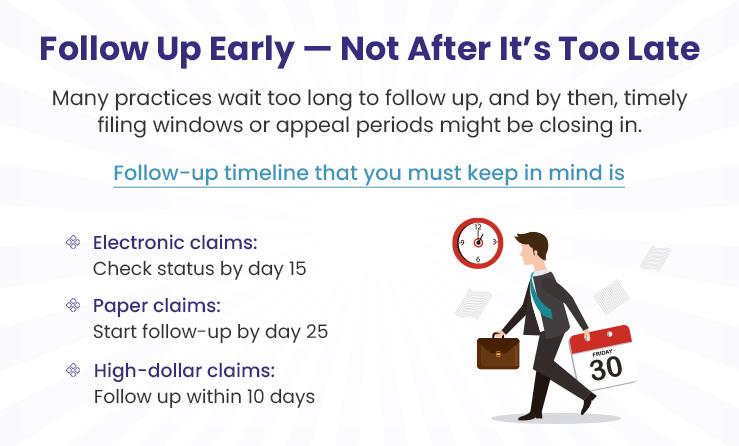

4). Follow Up Early — Not After It’s Too Late

Denials aren’t death sentences; they’re calls to action. A tight, seven‑day appeal cycle converts many of them into full reimbursements—long before they qualify as delinquent.

- Route denials by reason code. Coding, medical necessity, eligibility, and prior auth each get a separate queue.

- Appeal within seven calendar days. Include corrected codes, notes, and supporting records in one packet.

5). Patient Financial Engagement

Patients pay faster when they know exactly what they owe and have friction‑free ways to settle up. Transparent, tech‑friendly billing keeps their balances from aging into collections.

- Send e‑statements the day a balance posts and follow up with a text reminder.

- Offer no‑interest payment plans for balances over $200.

- Publish estimates and financial‑assistance options online and at check‑in.

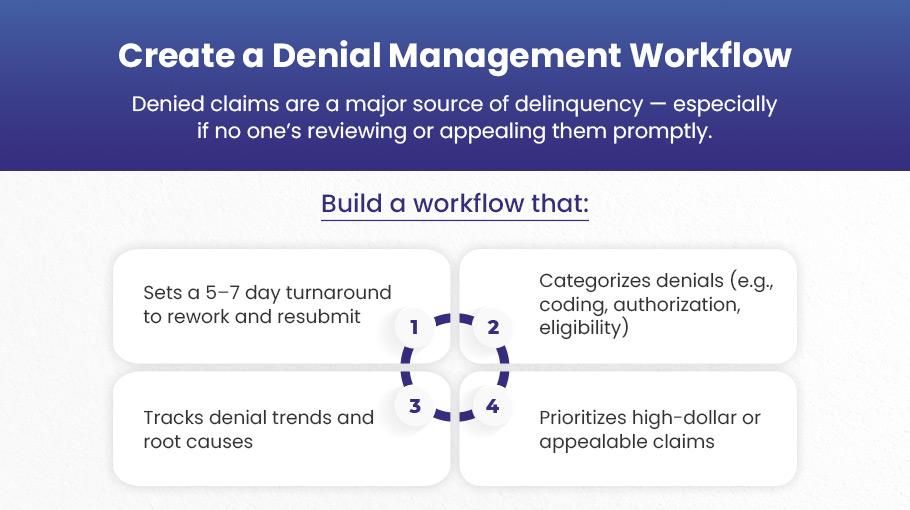

6). Create a Denial Management Workflow

Denied claims are the biggest gateway to delinquency—unless you treat them with factory‑grade precision. A clear playbook turns firefighting into an orderly, repeatable process.

- Categorize denials (coding error, prior auth, eligibility, medical necessity).

- Prioritize high‑dollar, appealable claims.

- Rework and resubmit within five to seven days.

- Track root causes so one fix can eliminate dozens of future denials.

7). Use a Centralized Claims Dashboard

Spreadsheets hide patterns; dashboards reveal them. A single, color‑coded view of every claim lets your team tackle the oldest and riskiest accounts first—before they slip past timely‑filing limits.

- Show total outstanding claims with aging buckets (0–30, 30–60, 60–90, 90+).

- Highlight payer bottlenecks and denials awaiting action in real time.

8). Keep the Whole Team Informed

Your coders, clinicians, and front‑desk staff all leave fingerprints on a claim. Regular knowledge‑sharing keeps small mistakes from snowballing into systemic cash delays.

- Hold a monthly revenue‑cycle huddle. Bring front desk, coders, billers, and providers together.

- Share payer rule changes and new denial trends.

- Coach clinicians on documentation gaps that trigger “medical necessity” denials.

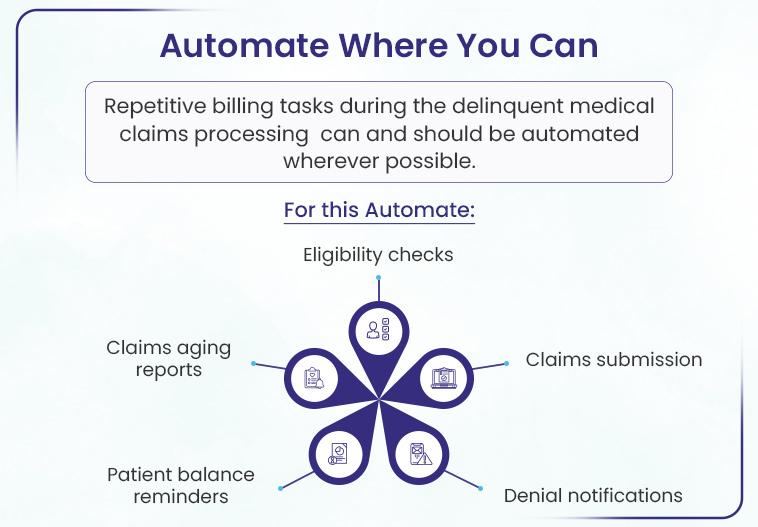

9). Automate Where You Can

Manual keystrokes breed errors and burnout. Automating routine tasks frees your staff to focus on higher‑value work like appeals and patient calls.

- Automate eligibility checks, claims submission, denial alerts, aging reports, and balance reminders.

- Integrate RCM and EHR systems to eliminate double entry.

10). Build a Claims Quality Checklist

A simple checklist is a tiny time investment that prevents month‑long payment delays. Think of it as your claim’s boarding pass—no errors, no hold‑ups.

- Insurance verified ✔️

- CPT and ICD‑10 codes match ✔️

- Modifiers and prior‑auth included ✔️

- Claim passed scrubber ✔️

- Correct payer ID ✔️

11). Don’t Miss Timely Filing Deadlines

Payers don’t negotiate filing deadlines. Miss one and the revenue is gone—appeals included. Rigorous deadline tracking keeps every claim alive until it pays.

- Catalog each payer’s limits (e.g., 90 days, 180 days).

- Flag claims 30 days before expiration for urgent follow‑up.

- Apply the same countdown to denials; resubmit well before cutoff.

Wondering where your revenue went this quarter?

Check the denial bin. Then hand it off. We’ll dig out every missed dollar and show you, line by line, how we pulled it back.

Conclusion

Take last month’s aging report, grab a marker, and swipe every claim older than 30 days. Jot a quick note beside each one (missing code, no authorization, wrong ID) whatever tripped it. When the same problem shows up twice, that’s your fix for the week. Give it five days; if the payer still hasn’t moved, get a live rep on the phone. Do this every week and slow‑pay surprises lose their punch before they drain your cash or your team’s patience.

Tired of insurers holding your paycheck hostage?

When that routine starts eating hours you’d rather spend with patients, hand the list to BellMedEx. We’ll dig into each stalled claim, explain in plain words what’s blocking payment, and seal up the pattern so it won’t return. Our medical coders flag errors in your healthcare practice, and a live dashboard shows how much money is at risk right now. One quick chat and you’ll feel the load lift.