Investigating issues like claim denial and the slow payment process is necessary to ensure your practice operates effectively. Your billing procedure is one of the elements of your practice that needs to run smoothly.

Medical billing reports are crucial for tracking and fixing billing process issues. They can provide essential details regarding payments, claims, and many other facets of your practice. Although you should review various reports for your practice, some should be prioritized above others.

This blog will discuss accounts receivable (A/R) reports, their significance in medical billing, and key elements that practices must consider.

Accounts Receivable Aging Report

The Accounts Receivable Aging Report shows the percentage of outstanding patient balances and insurance claims that have been unpaid for more than 120 days. The better, the lower the proportion. It is shown as a percentage as well as a monetary value.

This report measures the practice’s health and shows how well the billing department performs its duties. Even though it is possible to construct this report manually, doing so would take too much time, making manually producing accounts receivable aging reports unworkable. Software is required to produce this report at a clinic with 15 to 20 patients daily. The practice is losing money if it doesn’t use the software.

Use a practice management system and effective billing software to analyze your procedure. You may verify the state of billing processes, such as denied claims and their status, and effectively address them using precise data analytics and accounts receivable A/R reports.

Does Your Practice Face Claim Denials? BellMedEx’s Medical Billing Software can resolve your issues.

An experienced medical doctor can determine whether or not a practice’s billing department is performing correctly by looking at the 150 days plus column on this report.

AR Report Track

The A/R Report monitors claims according to how long they have been in receivables, meaning how long they have gone unpaid. Typically, it takes around a month for most claims to be paid. This report enables you to detect possible problems from a broad perspective, while subsequent reports provide a more in-depth examination of where these problems may originate.

Red Flags

Unresolved technical issues with insurance can be a red flag in medical billing. Claims may take two, three, or even four months to process if a practice has problems with a specific insurance provider that hasn’t paid for whatever reason. This is because there may be a technical problem that hasn’t been fixed yet. Payment delays may result from this, which could negatively affect the business’s bottom line. It is essential for practices to address any technical issues with insurance companies as soon as possible to ensure timely payment of claims.

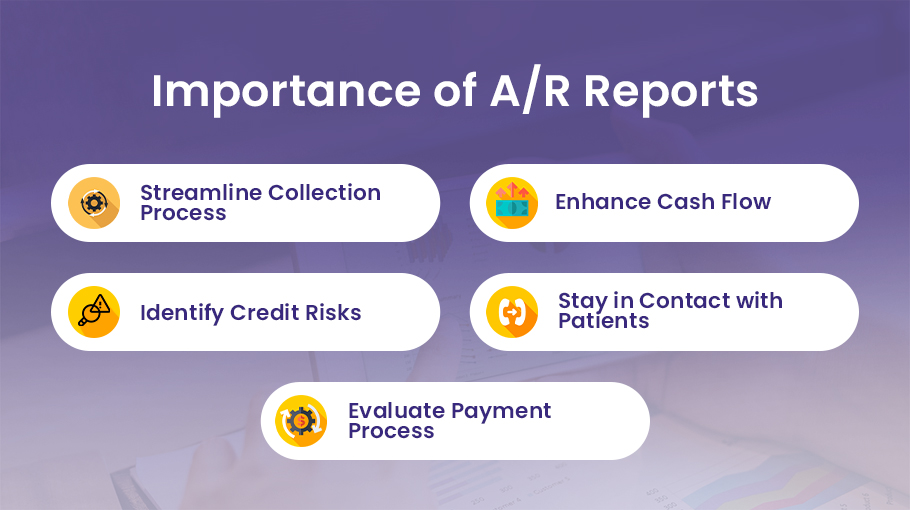

Importance of A/R Reports

A/R reports play a crucial role in medical billing claims management by providing valuable insights into the financial situation of medical practice. By streamlining the collection process, enhancing cash flow, identifying credit risks, staying in contact with patients, and evaluating the payment process, practices can improve their A/R management and maximize their profits.

Streamline Collection Process

Accounts receivable aging reports can assist practices in enhancing the collection efforts of your AR team. For instance, a considerable portion of your outstanding payments being more than 60 to 90 days past due may hint that your collections procedure needs to be improved.

Enhance Cash Flow

To maintain the health of your cash flow, AR aging reports help you remain on top of your receivables and track who owes you money and who might threaten your credit.

Identify Credit Risks

The AR aging report approach can assist you in estimating your uncollectible debts, including an estimate of the amount of receivables you might not be able to collect for various reasons. This can then be used as the final balance of your uncertain account limit.

Stay in Contact with Patients

Staying in contact with patients is also essential in A/R management. Good communication with patients can help resolve the denied claims issues.

Evaluate Payment Process

A/R reports help practices to build a successful payment system. Practices can gain control of their cash flow by implementing new policies such as offering discounts to customers. Read tips for help with quick A/R recovery.

Manual A/R Reports Vs. Automated A/R Reports: Comparison Table

| Features | Manual A/R Reports | Automated A/R Reports |

| Speed of Processing | Typically slower due to manual data entry | Much faster as processes are automated |

| Accuracy | More chances of human error due to a lot of manual work and human input | Reduced errors due to automation, but depends on the software’s reliability |

| Scalability | Difficult to scale up for a larger volume of claims | Easily scalable, can handle large volumes efficiently |

| Workforce | High; requires more manual effort and workforce | Low; most processes are handled by software |

| Consistency | Can vary depending on the person doing the work | Consistent output as it’s based on a set algorithm |

| Cost | Lower initial cost but higher long-term due to labor | Higher initial investment but can reduce costs in the long run |

| Customizability | Flexible as it depends on human input | Depends on the software; may require developer changes |

| Integration with Other Systems | Limited unless manually integrated | Often designed to integrate with other billing systems |

| Audit & Tracking | Harder to track changes and edits | Easily tracked and logged for transparency |

| Storage & Retrieval | Physical space or manual digital filing required | Digital and cloud storage makes retrieval efficient |

| Security | Depends on physical security and manual digital safeguards | Often has built-in security features; depends on software |

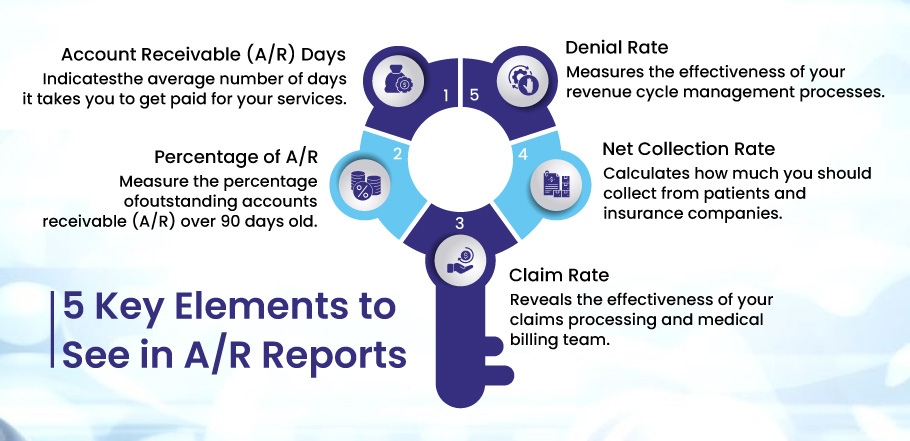

5 Key Elements to See in A/R Reports

Accounts Receivable reports play a vital role in making able practices and providers make informed decisions to tackle the denied claims. There are some significant elements they must know in A/R reports. These are:

- Account Receivable (A/R) Days

- Percentage of A/R

- Claim Rate

- Net Collection Rate

- Denial Rate

Let’s discuss each element in detail:

1. Account Receivable (A/R) Days

A/R days or accounts receivable days are the days a medical billing office/hospital takes to collect the outstanding amount from an insurance carrier for all the services it provides to insured patients.

Why Should You Consider?

Considering A/R days in Accounts Receivable assists in identifying potential problems with the revenue cycle and the effectiveness of your billing team.

It shows how long it typically takes you to receive payment for your services. High A/R are warning signs and might harm your bottom line. Fast-track claims reimbursement and routine claim follow-up can reduce your medical AR days.

- Identifies potential revenue cycle issues.

- Assesses the efficiency of the billing team.

- Indicates the average number of days taken to receive payments.

Calculation: A/R days are calculated for 3 months, 6 months, and 12 months.

Formula: A/R Days=Accounts receivable×Number of days in the year

Example: For a pediatric clinic, accounts receivable for a pediatric clinic is $100,000, and its (Account receivable/total charges) X 365 days is $600,000. Then the A/R days for this clinic will be:

A/R Days = ($100,000 accounts receivable ÷ $600,000) x 365 days = 60.8 Accounts Receivable Days

2. Percentage of A/R

The percentage of accounts receivable (A/R) over 90 days old is one of the primary metrics used in healthcare revenue cycle management. This indicator is crucial because it shows how well the company’s billing and collections procedures work.

Why Should You Consider?

A high percentage of accounts receivable (A/R) exceeding 90 days suggests that the company is having trouble timely collecting payments, which can cause cash flow problems and have a negative effect on the bottom line. On the other hand, a low percentage of accounts receivable (A/R) over 90 days shows that the company is successfully managing its revenue cycle by promptly recovering payments.

- It provides a comprehensive view of the financial health of any organization.

- Reflects effectiveness of billing and collections processes.

- Monitors financial health.

Calculation: The percentage of A/R over 90 days is calculated by dividing the total amount of accounts receivable (A/R) over 90 days old by the total amount of A/R outstanding and then multiplying the result by 100 to get a percentage.

Formula: (Total A/R over 90 days / Total A/R outstanding) x 100

Example: If a healthcare organization has $500,000 in A/R and $100,000 of that is over 90 days old, the calculation would be:

($100,000 / $500,000) x 100 = 20%

3. Claim Rate

The percentage of claims that receive reimbursement immediately after they get submitted to the insurance provider for review and payment is known as CRR. It is a crucial medical billing performance measure. Lower A/R and faster payments result from an increase in FPRR. Mistakes, oversights, and ineffective billing procedures frequently cause lower FPRR. Therefore, for a more effective Revenue Cycle Management (RCM), you should immediately concentrate on insurance verification, invoicing, and coding for a low rate of FPRR.

Why Should You Consider?

It reveals problems and inefficiencies in claim submission and processing. Thus, indicating the effectiveness of your claims processing and medical billing team.

- Reveals inefficiencies in claim submission and processing.

- Measures efficiency of claims processing and billing team.

Calculation: Number of claims paid on a first pass/ Total Number of claims submitted in a time frame.

Benchmark: The industry standard is 98%. For an efficient, well-run physician, a practice should be more than 90%.

4. Net Collection Rate

The metric measures how much you should collect from patients and their insurance companies. A high NCR reflects timely billing, adjudicated claims, and patient balances are all collected.

Why Should You Consider?

The KPI is a good indicator of how well your practice is doing overall.

- Assesses the overall performance of the practice.

- Reflects timely billing and collection of adjudicated claims and patient balances.

Calculation: (Payments/ (Charges- Contractual Adjustments) x 100%

Benchmark: An NCR, lower than 95 – 100% after write-offs, indicates poor performance.

5. Denial Rate

It is the percentage of claims that payers have rejected. A low denial rate reveals sound cash flow and how quickly your claims are handled. Other KPIs will suffer if the denial rate is not addressed promptly.

Why Should You Consider?

- Assesses the efficiency of revenue cycle management processes.

- Indicates the health of cash flow.

Calculation: Total denied claims/ Total submitted claims (for a specific period)

Benchmark: 5% – 10% denial rate is the industry average.

BellMedEx Helps Maximize Your Medical Billing Potential

Suffering claim denials or payment delays

Is your practice facing claim denial and payment delays? Every missed or delayed payment can hinder your practice’s growth and patient satisfaction.

BellMedEx Medical Billing Company is here to assist you.

Let BellMedEx Optimize Your Billing Process:

We don’t just provide insights; we offer solutions. With our state-of-the-art practice management system and expert guidance, we ensure your billing process is streamlined, transparent, and efficient.

BellMedEx A/R Services:

Detailed Analysis: Get a clear picture of your outstanding balances, payer-wise breakdowns, and aging data.

Issue Resolution: Identify discrepancies, manage denied claims, and mitigate potential challenges.

Insightful Recommendations: Proactive suggestions to improve billing efficiency and prevent future issues.

Dedicated Support: Our team is always ready to assist, guide, and ensure your billing processes are on track.

Take Action Now!

Don’t let billing issues slow you down. Explore A/R reports and resolve problems before they become roadblocks. Partner with BellMedEx today and turn your billing challenges into triumphs. Schedule Your FREE Demo Today!

Final Thoughts

Understanding your A/R reports is more critical than ever. By tracking the key elements highlighted in this article, medical practices can ensure they remain financially stable and continue offering essential services to their patients. Effective monitoring of these metrics can identify issues early on and pave the way for corrective actions. With technology integration and automation, tracking and managing these metrics efficiently has become more accessible, but understanding them is the first step.

Frequently Asked Questions (FAQs)

What are A/R Reports?

Accounts Receivable (A/R) reports provide essential insights into the financial health of medical practices by tracking and reporting on outstanding patient balances and insurance claims. They help assess billing processes, streamline collections, enhance cash flow, and identify potential credit risks.

Why is the Accounts Receivable Aging Report vital?

The Accounts Receivable Aging Report displays the percentage of unpaid outstanding patient balances and insurance claims over a period such as 120 days. It gives insights into the practice’s health, showing how efficiently the billing department operates. A high percentage indicates potential issues in the collection process.

How does the A/R Report track claims?

The A/R Report categorizes claims based on how long they’ve remained unpaid or in receivables. Typically, most claims are settled within a month. Monitoring this timeline helps practices identify potential billing problems and address them early.

What’s the difference between Manual A/R Reports and Automated A/R Reports?

Manual A/R Reports rely on human input, often leading to slower processing speeds and potential errors. They may also be challenging to scale up. In contrast, Automated A/R Reports use software, resulting in faster processing, fewer errors, easy scalability, and consistent output. However, the effectiveness of automated reports depends on the reliability of the software used.

Why should practices monitor the 5 key elements highlighted in the article?

Monitoring these essential elements, such as A/R Days and Denial Rate, provides insights into potential revenue cycle problems, billing team efficiency, cash flow health, and the practice’s overall financial stability. By monitoring these metrics, practices can take corrective actions early and optimize their financial health.