Medicare billing affects millions of healthcare providers across the United States. As a healthcare provider, you serve over 60 million enrolled Medicare beneficiaries who depend on your services. Understanding Medicare’s billing process protects your revenue and ensures patients receive proper coverage.

The Medicare system can be daunting at first. However, once you master the enrollment process and billing requirements, you’ll find it manageable. This step-by-step guide helps you learn how to bill Medicare as a provider, from Medicare claim submission to getting paid.

Many new providers struggle with Medicare’s documentation requirements and coding standards. Others face delays because they miss enrollment deadlines or submit incomplete applications. Let us share practical steps to avoid these common pitfalls while maximizing your reimbursements.

How to Bill Medicare as a Provider (Complete Guide)

Medicare billing process for providers requires three essentials:

- Proper enrollment to Medicare

- Accurate claim submission

- And ongoing compliance.

To bill Medicare as a provider, you must obtain an NPI number and enroll through the Provider Enrollment, Chain, and Ownership System (PECOS). Next, you’ll verify patient eligibility and gather required documentation before submitting claims to your Medicare Administrative Contractor (MAC). Finally, you must maintain accurate records and update your enrollment information as needed.

The entire process follows a structured workflow designed to protect both providers and beneficiaries. Medicare uses standardized systems like the resource-based relative value scale (RBRVS) to determine payments. Your MAC processes claims and handles communications throughout the billing cycle. Success depends on understanding each step and following established guidelines consistently.

What is Medicare? And What Does Medicare Billing Mean for Providers?

Medicare serves as America’s federal health insurance program for adults aged 65 and older. The program also covers younger individuals with specific disabilities or permanent kidney failure. The Centers for Medicare and Medicaid Services (CMS) manages this vast system that processes billions of claims annually.

Medicare program divides into three main parts that affect your Medical billing strategy.

| Medicare Part A | Hospital stays, skilled nursing facility care, hospice services, and some home health options |

| Medicare Part B | outpatient care, doctor visits, medical supplies, and preventive services |

| Medicare Part D | prescription drug coverage through separate plans |

For providers, Medicare billing means following federal regulations while serving eligible beneficiaries. You must determine which Medicare part covers each service you provide. Some patients only qualify for certain coverage types, which affects your billing strategy.

Medicare may act as a secondary payer when patients have other insurance coverage.

Understanding Medicare’s structure helps you navigate billing requirements more effectively. Each part has different rules, payment schedules, and documentation needs. Your billing staff must recognize these differences to submit accurate claims and avoid denials.

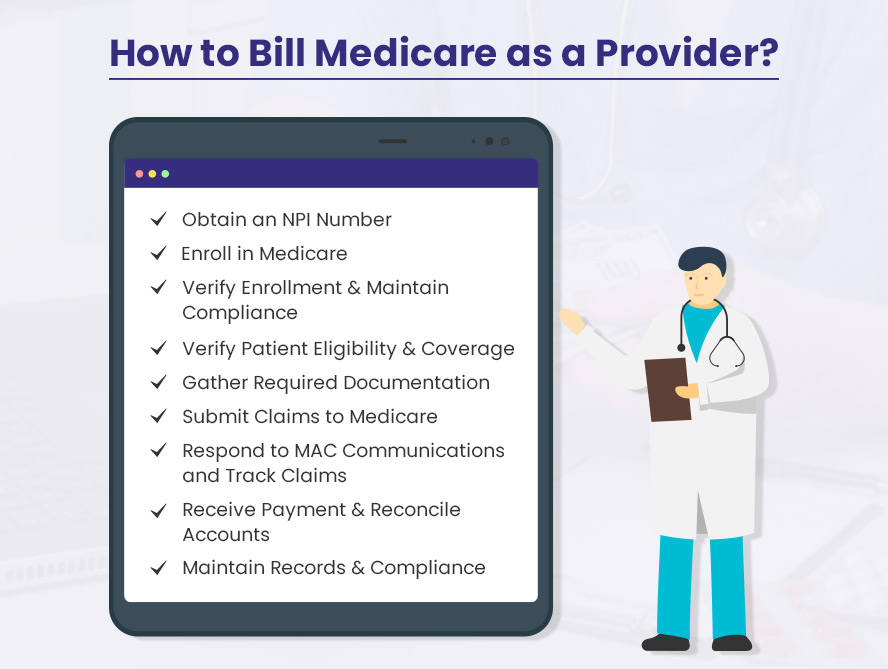

How to Bill Medicare as a Provider (Step-by-Step)

Successfully billing Medicare requires following a systematic approach from enrollment through payment reconciliation. The process involves multiple steps that build upon each other to ensure compliance and maximize Medicare reimbursement.

Here are the nine essential steps every provider must master:

- Obtain an NPI Number

- Enroll in Medicare

- Verify Enrollment and Maintain Compliance

- Verify Patient Eligibility and Coverage

- Gather Required Documentation

- Submit Claims to Medicare

- Respond to MAC Communications and Track Claims

- Receive Payment and Reconcile Accounts

- Maintain Records and Compliance

Let us dive a little deeper into these steps to billing Medicare as a healthcare provider.

1. Obtain an NPI Number

Your National Provider Identifier (NPI) serves as your unique healthcare identifier across all transactions. This 10-digit number links all your Medicare billing activities to your practice or facility. Without an NPI, you cannot submit claims or receive payments from Medicare.

Apply for your NPI through the National Plan and Provider Enumeration System (NPPES) website. The application process requires basic information about your practice, including your name, address, and taxonomy code.

Note: Individual providers and healthcare organizations each need separate NPI numbers.

The NPPES system typically processes applications within 10 business days. You’ll receive your NPI via email once approved. Keep this number confidential and use it consistently across all Medicare transactions. Never share your NPI with unauthorized individuals or organizations.

Some providers already have NPI numbers from other insurance billing. You can use the same NPI for Medicare if it’s still active and accurate. Verify your existing NPI information through the NPPES registry before proceeding to Medicare enrollment.

2. Enroll in Medicare

Medicare enrollment establishes your eligibility to bill the program for covered services. The process varies depending on whether you’re an individual provider or institutional facility. Individual physicians typically complete the CMS-855I form, while groups use CMS-855B forms.

Access the enrollment system through PECOS, Medicare’s online platform for provider registration. Create your account using your NPI number and basic practice information. The system guides you through each section of the enrollment application.

Institutional providers face additional requirements during enrollment. Hospitals, skilled nursing facilities, and similar organizations must pay application fees. These fees vary by provider type and are updated annually on the PECOS website.

Prepare supporting documentation before starting your application. You’ll need copies of your professional license, malpractice insurance, and curriculum vitae. Some provider types require additional certifications or accreditations. Having these documents ready speeds up the enrollment process.

3. Verify Enrollment and Maintain Compliance

Your Medicare Administrative Contractor (MAC) reviews your enrollment application and may request additional information. Respond promptly to any MAC communications to avoid processing delays. The review process can take several weeks depending on your provider type and application completeness.

Once enrolled, you must keep your information current in the PECOS system. Report ownership changes, legal actions, or address updates within 30 days. Other enrollment changes must be reported within 90 days. Failure to maintain current information can result in payment delays or enrollment termination.

Institutional providers may undergo site visits or surveys during the enrollment process. Your CMS Location and State Agency coordinates these evaluations. Prepare your facility for inspection and ensure all required documentation is readily available.

Monitor your enrollment status regularly through PECOS. The system shows your current status and any pending actions. Address any issues immediately to maintain uninterrupted billing privileges. Set calendar reminders for important deadlines and renewal dates.

4. Verify Patient Eligibility and Coverage

Patient eligibility verification prevents claim denials and ensures proper billing. Check each patient’s Medicare status before providing services. Use your MAC’s portal or eligibility verification tools to confirm coverage details.

Determine whether Medicare serves as the primary or secondary payer for each patient. Other insurance coverage may take precedence over Medicare in certain situations. Workers’ compensation, employer group health plans, and auto insurance often pay before Medicare.

Collect comprehensive insurance information from every patient. Use the CMS Questionnaire or similar forms to gather employment and coverage details. Ask about spouse’s insurance, recent accidents, and work-related injuries. This information helps identify other potential payers.

Document your eligibility verification efforts in the patient’s record. Note the date, method, and results of your verification. This documentation supports your billing decisions and helps during audits or appeals. Update eligibility information if the patient’s circumstances change.

5. Gather Required Documentation

Accurate documentation forms the foundation of successful Medicare billing. Collect all necessary information before submitting claims to avoid delays or rejections. Your documentation must support the medical necessity of services provided.

Start with basic patient demographics including name, date of birth, and Medicare Beneficiary Identifier (MBI). Verify the patient’s address and contact information. Ensure the MBI matches exactly with Medicare’s records to prevent processing errors.

Select appropriate diagnosis codes using the current ICD-10 system. Choose codes that accurately reflect the patient’s condition and support the services provided. Use the most specific code available and include secondary diagnoses when relevant.

Identify correct procedure codes using CPT or HCPCS Level II codes. Match procedures to appropriate diagnosis codes to demonstrate medical necessity. Apply modifiers when required to clarify services or indicate special circumstances. Review coding guidelines regularly!

6. Submit Claims to Medicare

Electronic claim submission offers the fastest and most reliable method for Medicare billing. Use HIPAA-compliant systems that meet federal privacy requirements. Most practice management systems include Medicare billing capabilities.

Submit claims through your MAC using approved Electronic Data Interchange (EDI) formats. The standard format for professional claims is the 837P transaction. Institutional claims use the 837I format. Ensure your medical billing system supports these formats.

Paper claims serve as a backup option when electronic submission isn’t possible. Use the CMS-1500 form for professional services or the UB-04 form for institutional services. Complete all required fields and include supporting documentation when necessary.

Medicare Advantage patients require different claim submission procedures. Send these claims directly to the patient’s specific plan administrator, not to traditional Medicare. Each Medicare Advantage plan has its own submission requirements and contact information.

7. Respond to MAC Communications and Track Claims

Your MAC processes all Medicare claims and manages communications throughout the billing cycle. Monitor your submissions regularly and respond promptly to any requests for additional information. Delays in responding can result in claim denials.

Track claim status through your MAC’s provider portal or electronic systems. Claims typically process within 14-30 days depending on complexity. Follow up on any claims that exceed normal processing times.

Address claim rejections immediately by reviewing error messages and correcting problems. Common rejection reasons include invalid patient information, coding errors, or missing documentation. Resubmit corrected claims as soon as possible.

Appeal denied claims when you believe Medicare’s decision is incorrect. Submit additional documentation or clarification to support your position. Follow the appeals process outlined by your MAC and meet all required deadlines.

8. Receive Payment and Reconcile Accounts

Medicare payments arrive via electronic funds transfer to your designated bank account. Payment amounts reflect the Medicare fee schedule minus any applicable deductibles or coinsurance. Reconcile payments against your submitted claims to identify any discrepancies.

Review your Medicare Summary Notice (MSN) or Electronic Remittance Advice (ERA) for payment details. These documents explain what Medicare paid, what the patient owes, and any claim adjustments. Use this information to bill patients for their portion of costs.

Handle patient billing carefully to comply with Medicare regulations. You cannot bill patients for services that Medicare doesn’t cover unless you provide proper advance notice. Use Advance Beneficiary Notices (ABNs) when services may not be covered.

Track your accounts receivable to ensure timely payment collection. Follow up on unpaid claims and patient balances according to your practice’s policies. Maintain detailed records of all collection efforts for audit purposes.

Tip: Some visits can be billed incident-to and pay the full doctor rate even if a nurse practitioner saw the patient. Learn the rules here → [Medicare incident-to billing guide]

9. Maintain Records and Compliance

Medicare requires providers to maintain comprehensive records for audit and compliance purposes. Keep all billing documentation, patient records, and correspondence for at least five years. Some states have longer retention requirements.

Update your PECOS enrollment information whenever changes occur. Report new locations, ownership changes, or changes in services provided. Keep your contact information current to ensure you receive important Medicare communications.

Participate in Medicare audit requests promptly and thoroughly. Provide requested documentation within specified timeframes. Maintain organized records that allow quick retrieval of information during audits.

Stay informed about Medicare policy changes and updates. Subscribe to your MAC’s newsletters and attend provider education sessions. Changes in coverage, coding, or billing requirements can affect your reimbursement if not implemented properly.

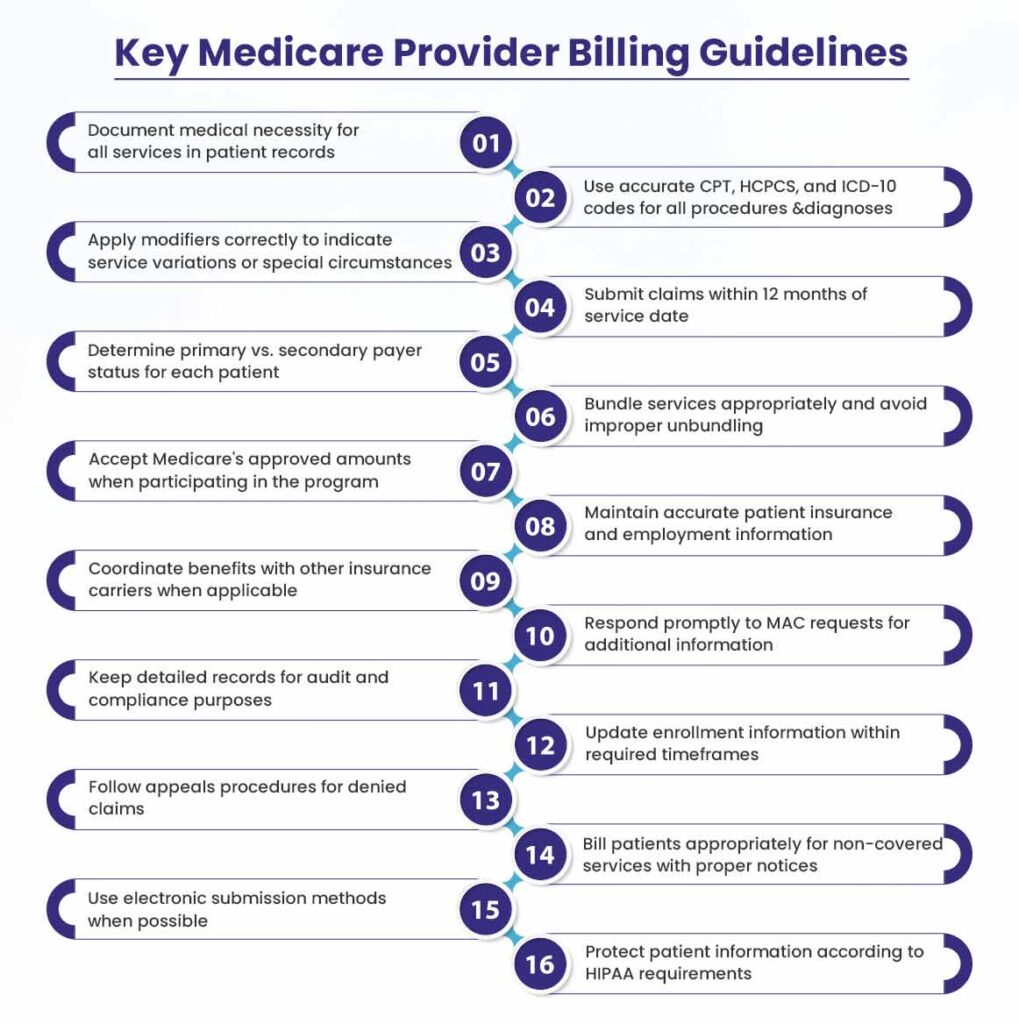

Medicare Provider Billing Guidelines

Medicare billing guidelines are a set of rules that providers must follow when submitting claims for reimbursement. Following these guidelines helps providers submit claims accurately. This also protects healthcare providers and beneficiaries.

Key Medicare provider billing guidelines include:

- Document medical necessity for all services in patient records

- Use accurate CPT, HCPCS, and ICD-10 codes for all procedures and diagnoses

- Apply modifiers correctly to indicate service variations or special circumstances

- Submit claims within 12 months of service date

- Determine primary vs. secondary payer status for each patient

- Bundle services appropriately and avoid improper unbundling

- Accept Medicare’s approved amounts when participating in the program

- Maintain accurate patient insurance and employment information

- Coordinate benefits with other insurance carriers when applicable

- Respond promptly to MAC requests for additional information

- Keep detailed records for audit and compliance purposes

- Update enrollment information within required timeframes

- Follow appeals procedures for denied claims

- Bill patients appropriately for non-covered services with proper notices

- Use electronic submission methods when possible

- Protect patient information according to HIPAA requirements

Common Medicare Medical Billing Questions

Let us answer some of the most common Medicare billing questions for providers.

1. What is the Medicare billing process?

The Medicare billing process involves submitting claims electronically to your assigned Medicare Administrative Contractor (MAC) for covered services. You must first enroll in Medicare, obtain an NPI number, and verify patient eligibility before providing services.

After treatment, you code the services using appropriate CPT and ICD-10 codes and submit the claim within one year. Your MAC reviews the claim for accuracy and compliance with Medicare guidelines. They may request additional documentation or clarification before processing payment. Once approved, Medicare pays 80% of the approved amount for Part B services. Patients remain responsible for deductibles and coinsurance.

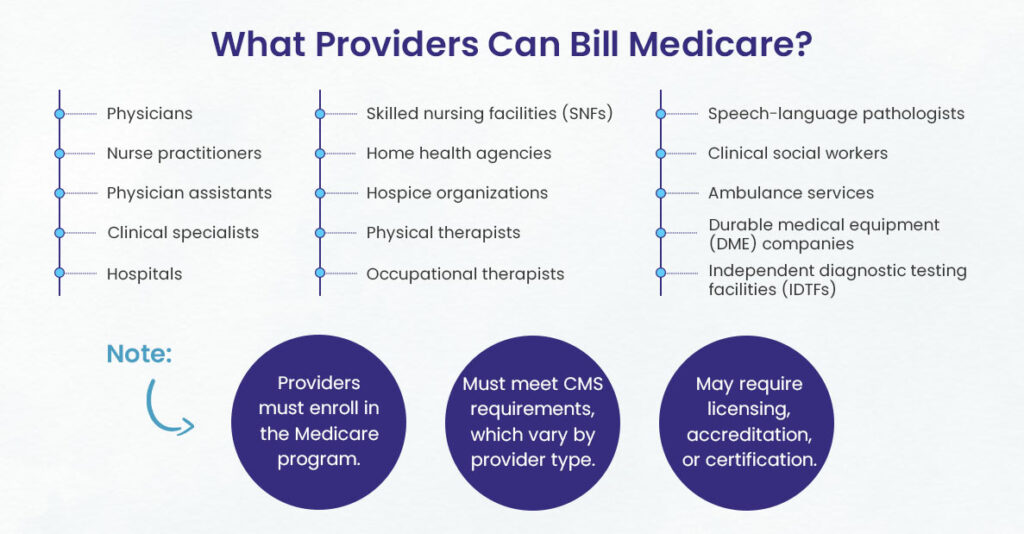

2. What providers can bill Medicare?

Medicare accepts claims from a wide range of healthcare providers including physicians, nurse practitioners, physician assistants, and clinical specialists. Hospitals, skilled nursing facilities, home health agencies, and hospice organizations also qualify for Medicare billing.

Other eligible providers include physical therapists, occupational therapists, speech-language pathologists, and clinical social workers.

Suppliers such as ambulance services, durable medical equipment companies, and independent diagnostic testing facilities can also bill Medicare. Healthcare providers must enroll in the Medicare program and meet requirements established by CMS. Enrollment requirements vary by provider type and may include licensing, accreditation, or certification standards.

3. Is provider based billing only for Medicare?

Provider-based billing extends beyond Medicare to include Medicaid and some Medicare Advantage plans. This billing method separates professional and facility charges for services provided in hospital-based outpatient clinics or departments. CMS requires this approach for government programs. But some insurance companies also use provider-based billing models.

The requirement affects facilities that have relationships with hospitals and bills under the hospital’s NPI number. Private insurance plans may combine professional and facility charges into single bills, but Medicare and Medicaid maintain separate billing requirements.

4. Are providers required to bill Medicare?

Most providers must submit claims to Medicare for covered services provided to Medicare beneficiaries, regardless of their participation status. Participating providers agree to accept Medicare’s approved amounts and must file claims for all covered services. Non-participating providers can accept assignments on a case-by-case basis but must still submit claims.

Providers can opt out of Medicare entirely by entering into private contracts with patients. In this arrangement, providers cannot bill Medicare and patients pay entirely out-of-pocket. Certain exceptions exist for small providers, roster billing, and demonstration projects. But the general rule requires claim submission for covered services.

5. How to Bill Medicare Electronically?

Electronic Medicare billing uses HIPAA-compliant systems to submit claims through Electronic Data Interchange (EDI) transactions. Providers transmit claims to their MAC using direct data entry screens or practice management software. The system automatically checks claims for errors and returns rejected submissions for correction before final processing.

Most healthcare facilities use clearinghouses or billing services that handle electronic transmission. These intermediaries convert claims into proper EDI formats and manage the submission process. Electronic billing reduces processing time, minimizes errors, and provides faster payment compared to paper submissions.

6. What Payment Will I Receive From Medicare?

Medicare payments follow the resource-based relative value scale (RBRVS) system that calculates reimbursement based on resources required for specific services. Payment amounts vary by geographic location, provider specialty, and service complexity. The Medicare Physician Fee Schedule provides specific payment rates updated annually.

Medicare pays 80% of approved amounts for Part B services, with patients responsible for remaining costs. Part A payments vary by service type and may include deductibles or coinsurance. Providers who accept assignments agree to Medicare’s approved amounts as full payment. Non-participating providers can charge limited additional amounts above Medicare’s rates.

Want higher first-pass acceptance rates?

BellMedEx is a medical billing services company averaging 98% clean claim submissions to Medicare. Ask us for the case study, and then let’s talk results for you!