Understanding allowable expenses for Medicaid spend down helps you become eligible for Medicaid. For example, medical bills, prescriptions, and home changes can help you qualify for Medicaid by reducing your assets. Other expenses like funeral planning, dental work, and rides to medical services might also count, depending on your state.

Since each state has its own rules, it’s best to call your local Medicaid office to find out what expenses they accept. Or you can also book a FREE consultation with us at BellMedEx to understand Medicaid spend down rules in your state and get help checking if your patients qualify.

| ➜ But what is a Medicaid spend-down? A Medicaid spend down lets you qualify for Medicaid even if your income or assets exceed the program’s limits. You do this by paying for medical bills until you reach your state’s limit. This helps you with high medical costs get the care you need, even if you start out making more money than usual Medicaid rules allow. For example, if your state allows up to $2,500 monthly income and you make $2,800, you would need to spend $300 on healthcare costs first. After that, Medicaid can help pay for your other medical needs. |

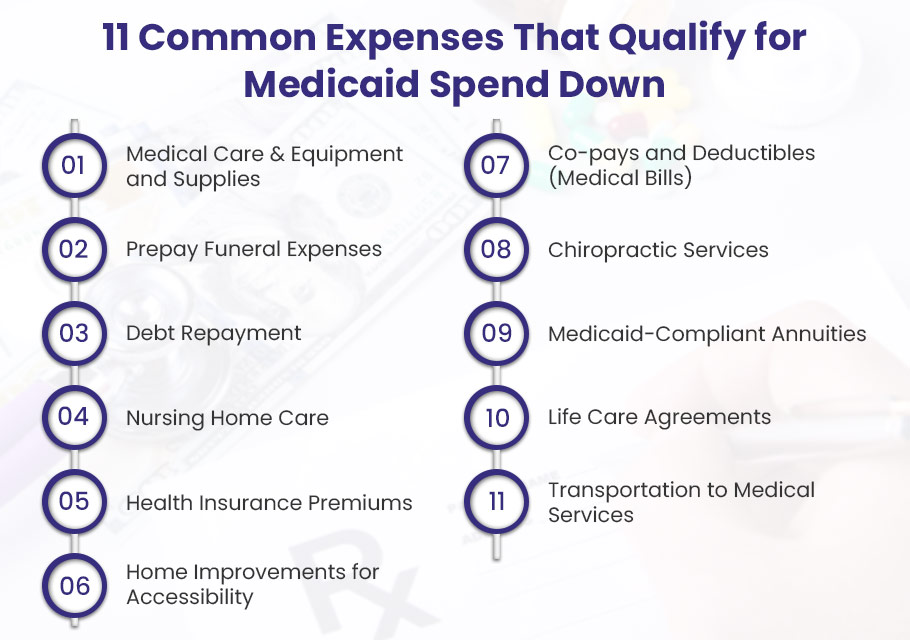

What Expenses Qualify for Medicaid Spend Down?

When applying for Medicaid, you must spend down your assets to meet eligibility requirements. You can do this by paying for medical bills and other allowed expenses that Medicaid covers. How Medicaid spend down works depends on each state.

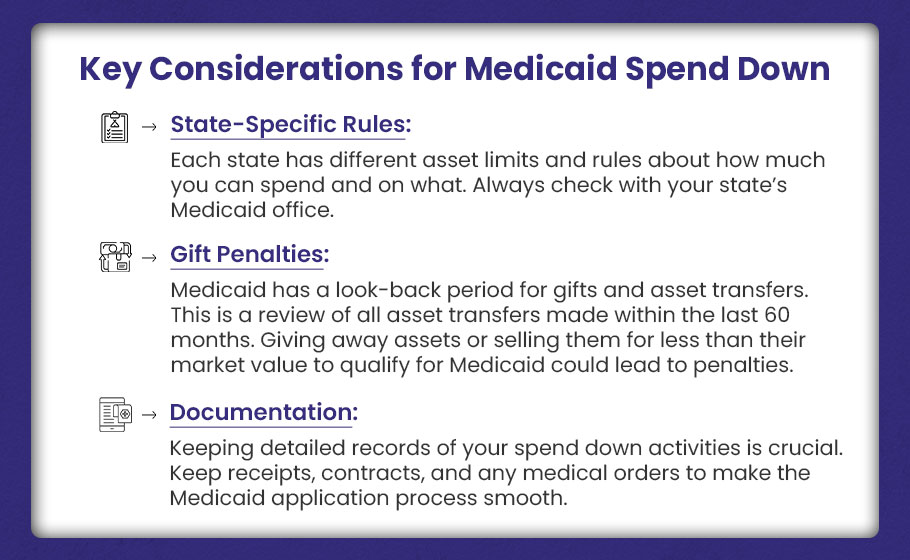

Keep these things in mind to ensure compliance and avoid issues during the Medicaid application process:

➜ State-Specific Rules:

Each state has different asset limits and Medicaid eligibility rules about how much you can spend and on what. Always check with your state’s Medicaid office.

For example, Ohio lets you count medical bills, prescriptions, and home changes like wheelchair ramps. In Illinois, eligible expenses include medical services, dental care, and over-the-counter medications prescribed by a doctor. Michigan includes medical bills, prescriptions, and the cost of getting to medical appointments. And California covers medical and dental care, along with medical supplies for Medicaid spend down.

➜ Gift Penalties:

Medicaid has a look-back period for gifts and asset transfers. This is a review of all asset transfers made within the last 60 months. Giving away assets or selling them for less than their market value to qualify for Medicaid could lead to penalties. So, avoid transferring assets before applying for Medicaid without understanding the relevant rules.

➜ Documentation:

Keeping detailed records of your spend down activities is crucial. Keep receipts, contracts, and any medical orders to make the Medicaid application process smooth.

Here are the most common and allowable expenses for Medicaid spend down.

1. Medical Care & Equipment and Supplies

Medicaid spend-down can cover medical care and equipment not usually included by other insurance. This covers items like eyeglasses, dentures, hearing aids, and prosthetics, as well as medical supplies such as bandages and medications. These items must be medically necessary and prescribed by a healthcare provider.

2. Prepay Funeral Expenses

Medicaid helps individuals prepay funeral expenses through a funeral contract or burial trust. This can cover irrevocable and non-refundable burial costs, cremation services, and other funeral-related expenses. But, states may limit how much you can spend, and any leftover funds will revert to the state if not used.

3. Debt Repayment

Paying off legitimate debts, like mortgages, credit card balances, or car loans, counts as a Medicaid spend down expense. You can make both full and partial payments for debt repayment. Prepaying future debts is also allowed if you are obligated to repay them.

4. Nursing Home Care

One of the most common expenses for Medicaid spend down is nursing home care. This includes paying for short-term or long-term stays in nursing homes or other qualified personal care attendants and home health aids.

5. Health Insurance Premiums

Paying for health insurance premiums counts toward your Medicaid spend down. This can include premiums for private health plans, long-term care insurance, or other medically necessary coverage. Medicaid will allow these payments to be deducted from your total assets.

6. Home Improvements for Accessibility

Home improvements may qualify for Medicaid spend down if you need to modify your home for medical reasons. This includes installing wheelchair ramps, widening doorways for wheelchair access, or adding grab bars.

Repairs for home safety and accessibility are also covered in most states. These include fixing plumbing, repairing roofs, and dealing with safety hazards. However, general home renovations are not covered.

7. Co-pays and Deductibles (Medical Bills)

You can use Medicaid spend down to pay medical bills, whether paid or unpaid. This includes co-pays, deductibles, and outstanding balances for medical services already received. These are out-of-pocket expenses you must pay under your health insurance plan before Medicaid starts covering the remaining costs.

8. Chiropractic Services

Medicaid covers chiropractic services if they are medically necessary and prescribed by a doctor. This includes treatments for conditions like back pain or other musculoskeletal issues that require chiropractic care.

9. Medicaid-Compliant Annuities

Buying a Medicaid-compliant annuity can convert assets (including lump sum of money) into a steady income stream. This strategy works well for married couples. But, the annuity must meet state and federal requirements. For example, the annuity must be non-transferable, and the state must be named as a beneficiary.

10. Life Care Agreements

A Life Care Agreement helps you to hire a family member or trusted person for providing long-term care. The contract must be legally drafted, and payments must be reasonable. Avoid prepaying for healthcare services that haven’t been provided yet, as this could result in Medicaid ineligibility.

11. Transportation to Medical Services

Medicaid spend down funds can fix or replace an old car needed for medical visits. Expenses for rides to doctor’s appointments or medical treatments also qualify for Medicaid spend down.

FAQs About Allowable Expenses for Medicaid Spend Down

⬇️⬇️⬇️

How do I qualify for a Medicaid spend down?

You may qualify for a Medicaid spend down if you have high medical expenses or if your income exceeds the Medicaid limit for your state. For example, Medically Needy Pathway restricts the eligibility to people aged 65 or older, those with disabilities, or the blind. States also consider the number of people in your household and local cost of living when determining eligibility.

What counts as income for Medicaid spend down?

Income includes any money you receive regularly, such as Social Security payments, pensions, disability benefits, and earnings from a job. In addition, Medicaid may consider interest from savings accounts, dividends from investments, and other financial resources in determining your eligibility.

What happens if I don’t spend enough income during my spend-down period?

If you don’t spend enough to meet your state’s income limit, you could temporarily lose Medicaid coverage until the next period. Work collaboratively with a Medicaid caseworker to track expenses and avoid gaps in coverage.

Can I use Medicaid spend down to pay for regular household expenses?

No, Medicaid spend down funds must be spent on qualified medical expenses or necessary services. Regular household expenses like rent, utilities, and groceries do not qualify. Spending down must focus on medical-related costs.

How long do I have to spend down my income?

The time frame for meeting your spend-down goal varies by state, but it generally lasts between one and six months. During this period, you must spend the excess income on medical expenses. Once you meet the required amount, Medicaid can begin covering your healthcare costs.

Book Your FREE Consultation Today!

Take the first step towards understanding Medicaid spend down rules in your state and book a free meeting with us. Our team will explain how Medicaid works and help you check if your patients qualify.