Applying correct revenue codes is like fueling your practice’s revenue cycle. A few additional valid codes can help your reimbursements increase significantly. Remember, if you miss adding a specific revenue code, it can mean lost revenue for your facility. Payers may also deny claims if the revenue codes don’t align properly with the procedure codes. That’s why careful attention to coding is essential for physicians, clinicians, and healthcare teams.

In this blog, we will discuss Revenue Code 0510, its uses, and how it can impact your reimbursement outcomes.

What is Revenue Code 0510 in Medical Billing?

Revenue Code 0510 tells the insurance company that a patient came to a hospital clinic for a regular visit. It shows the cost of using the clinic itself, like the room, the nurse’s help, and the clinic staff. It does not describe what the doctor or clinician did during the visit. That part is billed separately with CPT or HCPCS codes. So, Revenue Code 0510 = clinic costs, and CPT or HCPCS = provider’s work.

| ✔️ When to use it | ❌ When not to use it |

| Use 0510 for simple, routine outpatient visits in a hospital clinic. These are visits where the patient is coming in for basic care, not an emergency or a special test. | Do not use 0510 for emergency visits, surgeries, imaging, lab only visits, or other clearly specialized services. Those have different revenue codes. |

For example, let’s assume a patient visits the hospital for a cold or flu. They book an appointment at the hospital clinic. The nurse takes their vitals, the patient waits in an exam room, and the doctor checks them and gives advice or maybe a prescription.

So here, the clinic will use Revenue Code 0510 to bill for the space, the nurse’s time, and the clinic resources. Whereas, the doctor’s exam and medical decisions will be billed separately with a CPT code.

Therefore, Revenue Code 0510 shows the clinic resources used during a routine outpatient visit in a hospital owned clinic. At the same time, make sure the professional service is billed with the correct CPT or HCPCS code. Together, these codes give payers the full picture of the visit and help ensure fuller reimbursements for the healthcare provider.

Make Revenue Code 0510 Work for Your Clinic

Unsure if the facility side is billed right? We are here to help. Get clear steps, clean claims, and fuller reimbursements with BellMedEx’s medical billing service.

When to use the 0510 Revenue Code?

There are several situations where Revenue Code 0510 will be applied, such as:

➜ Routine clinic visits

Here, the 0510 code will be applied because the patient is coming for a regular appointment like a check up, consultation, or follow up. For example, a patient comes in with a sore throat, the nurse checks vitals, the doctor gives advice, and the patient leaves.

➜ General care, not specialty care

Here, RC 0510 is used because the service does not fall into a specialty like cardiology, orthopedics, or surgery. For example, a patient stops by for a quick blood pressure check and a refill of routine medication.

➜ Hospital owned outpatient clinics

This code is chosen when the visit takes place in a clinic that is part of or owned by a hospital. For instance, a patient is seen at the hospital’s family medicine clinic on campus.

➜ Facility portion of the bill

The 0510 code captures the clinic’s contribution to the visit, including the exam room, nursing staff, and supplies. For example, the nurse checks vitals and the patient uses an exam room, while the provider bills separately for their professional service with CPT codes.

Purpose of the 0510 Revenue Code and How It Differs From CPT Codes

The main role of the 0510 code is to separate facility fees from professional services. When a patient visits a hospital owned clinic, two parts of the bill are usually created:

1). Facility charge

This reflects what the clinic provides, such as the exam room, nursing support, equipment, utilities, and administrative staff. Revenue code 0510 captures this part.

2). Professional charge

This part shows the actual care given by the physician or clinician. It is billed with CPT (Current Procedural Terminology) codes.

In simple terms, RC 0510 explains the cost of running the clinic for that visit, while CPT codes explain the medical work done by the provider. Both are needed, and both play different roles.

How it works in practice?

For example, imagine a new patient comes in with several health concerns. The provider spends extra time, making the visit moderately complex. The provider might bill CPT 99204 for their work. At the same time, the clinic adds the 0510 code to show the resources used for the visit, like space and staff. Together, the two codes give payers a clear picture: what was done (CPT) and where it happened (0510).

Revenue Code 0510 Billing and Reimbursement

Think of a clinic visit as two parts. One part is the provider’s work. The other part is the clinic resources that make the visit possible. The 0510 code tells the payer about that clinic side. When you pair RC 0510 with the right CPT code and clear documentation, the payer can see both parts and pay both.

Without Revenue Code 0510, the facility side of the visit may go unbilled or underpaid, leading to missed revenue opportunities.

Do you know → How Medicare Looks at the 0510 Code?

Medicare closely monitors how the 0510 code is used in outpatient billing. While not all details are published, internal claims data often show that:

- The 0510 code is frequently used on UB‑04 forms for outpatient clinic services.

- Errors like missing or mismatched procedure codes (e.g., CPT or HCPCS) can trigger claim denials or payment delays.

- Clinics that consistently pair the correct facility codes with proper documentation tend to see smoother approvals and fewer appeals.

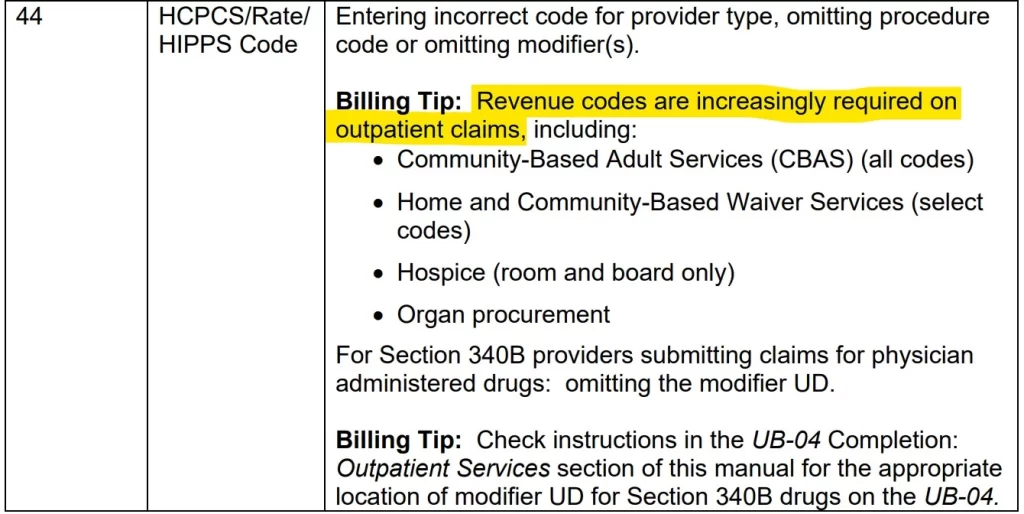

Even though Medicare’s exact audit metrics aren’t publicly available, but payer policies such as UnitedHealthcare’s clearly state that outpatient UB-04 claims must include both a revenue code and a matching CPT or HCPCS code. If the procedure code is missing, the claim is at risk of denial.

Also, according to Field 44 of the UB-04 tips for outpatient services, revenue codes are now more and more required on outpatient claims. The reason is simple: they show payers exactly what type of service or setting was involved.

Medical Billing Reimbursement Rates for the 0510 Revenue Code

These figures show what payers may reimburse for the facility side of clinic visits billed with the 0510 code. They are national averages based on fee schedule data from mid 2025, so your actual numbers can differ.

- Blue Cross Blue Shield: about $3,002.58

- UnitedHealthcare: about $145.57

- Aetna: about $212.48

- Cigna: about $161.93

So what does this mean for 0510 billing? The same clinic visit can pay very differently under the 0510 code, depending on the payer. BCBS often shows higher amounts, which can reflect negotiated contracts or bundled arrangements with large hospital systems. Meanwhile, other payers may use more fixed or standardized rates for routine outpatient services.

Your medical bill reimbursement for 0510 can shift based on a few practical factors.

- Where you are located. Urban and rural markets often pay differently.

- Who owns the clinic. Hospital owned settings may see different fee structures than independent clinics.

- What your contract says. Each payer agreement can set its own amounts, edits, and packaging rules for 0510 claims.

Compliance and Regulatory Considerations While Applying Revenue Code 0510

Use the revenue code 0510 the right way to keep medical claims clean and lower audit risk.

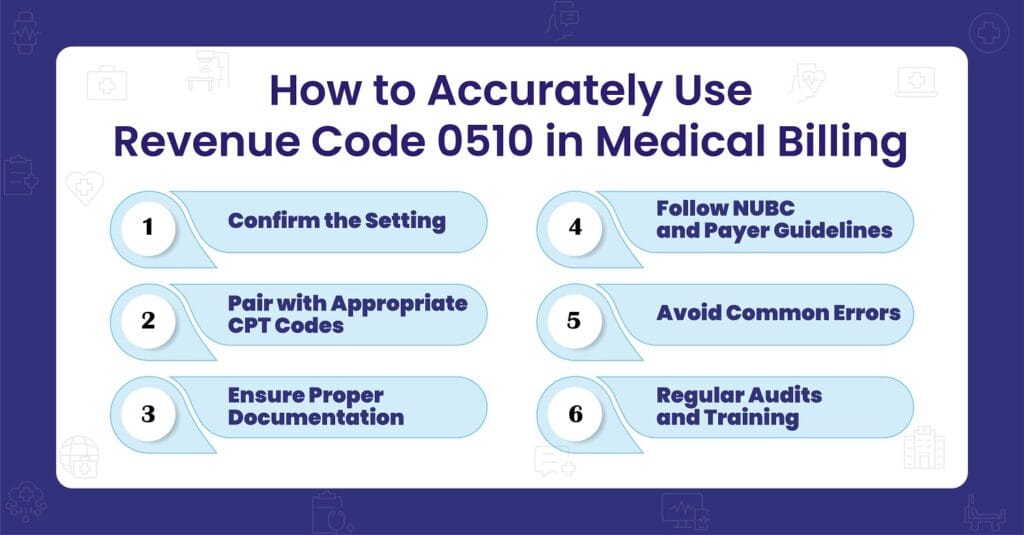

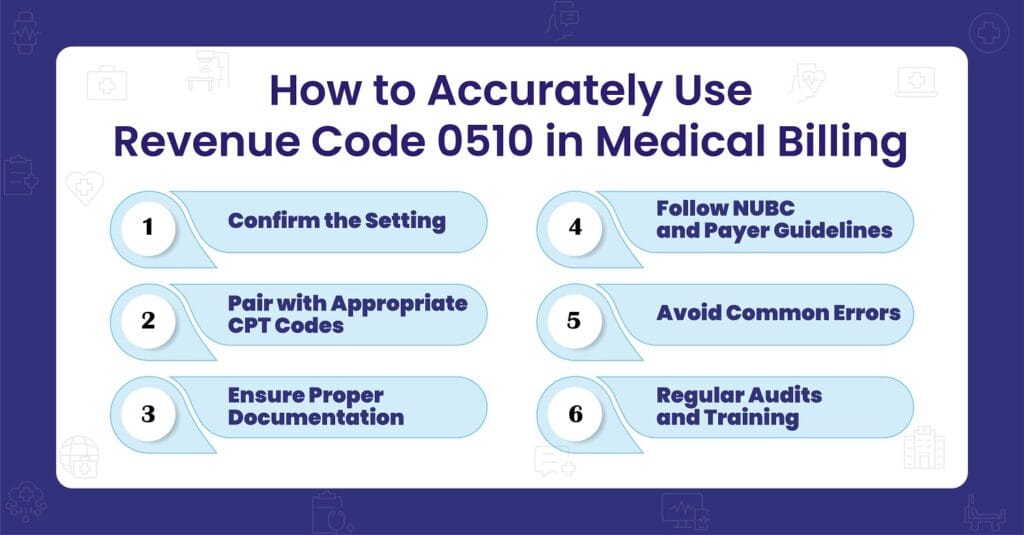

✅ NUBC guidelines

Follow the NUBC definition for revenue codes.

- Use RC 0510 only for general outpatient clinic services in hospital owned or provider based settings.

- Do not use it for emergency care, surgery, imaging, or other specialty services.

- Make sure the UB-04 form is completed correctly and any required procedure codes are included per payer rules.

✅ Documentation requirements

Your note should clearly support the 0510 line.

- Show medical necessity for the visit.

- Support the evaluation and management level selected, for example 99214.

- Describe the clinic resources used, such as the exam room, nursing support, equipment, and registration.

- Document why the facility portion was needed for this encounter.

Related Revenue Codes in the 051X Series

The 051X series covers different types of outpatient clinic services. Knowing how each code works helps you bill the right setting and keep claims accurate.

| Revenue Code | Description | When It’s Used |

|---|---|---|

| 0450 | Emergency Room Services | For urgent or emergency care visits in the ER. Different from 0510, which is for routine outpatient clinic visits. |

| 0520 | Clinic – Specialty Services | For specialty clinic visits, such as cardiology or dermatology. Unlike 0510, which is for general outpatient visits. |

| 0761 | Preventive Services | For preventive care like wellness exams and immunizations. Complements 0510 by focusing on prevention rather than problem-based visits. |

| 0511 | Clinic – Mental Health | For outpatient mental health clinic services. Related to 0510 but focused specifically on behavioral health. |

Know What 0510 Is Worth for You!

You may not see how much you are losing on the facility side. We map your payer rules, fix 0510 setup, and show the dollars you can capture.

FAQs

Can the 0510 code be used for telehealth visits?

No. The 0510 code is only for in-person outpatient clinic services. For telehealth, use telehealth revenue codes (such as 0780 for telemedicine) along with the proper CPT and modifier codes.

What are outpatient services?

Outpatient services are medical visits where the patient comes in but does not stay overnight. These include check ups, follow ups, minor procedures, and consultations that are finished the same day. The 0510 code is commonly used for these clinic visits in hospital settings.

Can we use the 0510 code in an independent or freestanding clinic?

No. The 0510 code applies only to hospital-owned or provider-based outpatient clinics. Independent practices and freestanding clinics cannot use it.

Do we need to add modifiers with the 0510 code?

Not directly. Modifiers are placed on CPT codes, not revenue codes. For example, you might add modifier 25 to your E/M code when a separate, identifiable service is done on the same day.

What if we see a patient during a global surgical period?

You may use the 0510 code if the visit is unrelated to the surgery. In that case, add modifier 24 to the CPT code and clearly document why the visit is separate. If it is related to the surgery, the claim may be denied.

Do all payers handle the 0510 code the same way?

No. Medicare and Medicaid follow set rules, but private insurers like BCBS, Aetna, or Cigna may pay differently. Always check each payer’s policy before billing.

Can we bill revenue code 0510 on the CMS-1500 form?

No. The 0510 code is only reported on the UB-04 institutional claim form. The CMS-1500 is for professional billing and does not include revenue codes.