The golden years are meant to be enjoyed, not fretted over finances.

But for elderly folks living hand to mouth on meager pensions or social security, healthcare expenses can be an unbearable burden.

Medicaid aims to lift that burden!

This federal program provides medical insurance to those who can’t otherwise afford it.

For millions of senior citizens, Medicaid is a source of relief that allows them to seek treatment without fear of financial ruin.

Is Medicaid’s Spenddown Right for Americans? 💭

For Americans struggling to afford healthcare, Medicaid can be a lifeline. Medicaid provides health coverage for those with limited income and resources.

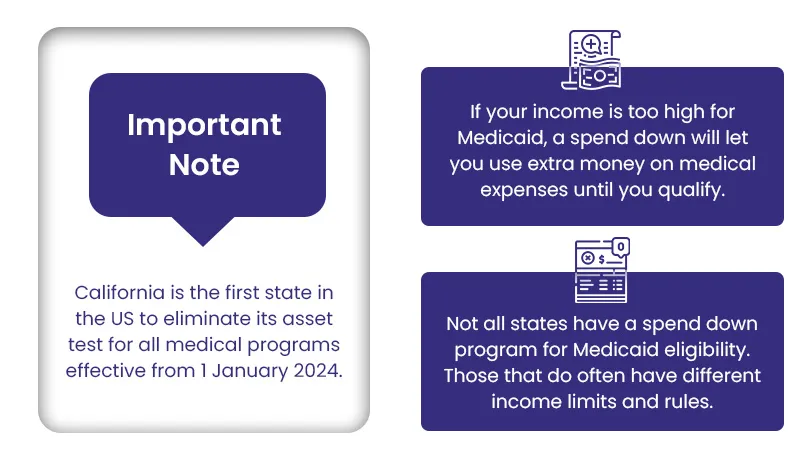

However, many hardworking Americans find themselves in a cruel catch-22, making too much money to qualify for Medicaid but not enough to pay for expensive medical care and insurance premiums.

Fortunately, some states offer Medicaid spenddown programs. These programs allow individuals to deduct certain medical expenses from their income, potentially making them eligible for Medicaid. By paying for things like prescription drugs, doctor visits, and hospital stays out of pocket, individuals can essentially “spend down” their excess income to Medicaid-qualifying levels.

What is meant by “Medicaid Spenddown”?

The government aid program Medicaid has certain eligibility criteria based on an individual’s income and assets. For those whose income exceeds the threshold set by Medicaid, there exists a mechanism called the “Medicaid spenddown” which provides a path to qualify for coverage.

As the name suggests, the Medicaid spenddown requires an individual to spend down their income on medical expenses to reach the Medicaid eligibility limit. For example, an elderly diabetic person earning $1,400 a month faces a Medicaid income limit of $1,200. By spending $200 per month on insulin, test strips and other such necessities to manage the condition, the person’s income reduces to the $1,200 limit, making them eligible for Medicaid.

💡 Things to know about the Medicaid Spenddown policy

A person’s monthly income often ends up exceeding the maximum limit set by the state to qualify for Medicaid benefits. To become eligible, individuals have to find ways to spend the excess amount. This process is known as “spending down” and it works as follows:

▶ Each month, a person can reduce the amount of income counted towards Medicaid eligibility by paying out of pocket for necessary medical expenses.

▶ Things like doctors’ visits, hospital bills, prescriptions, and treatment can all count towards spending down the excess income.

▶ Keeping detailed records of all medical expenses is critical, so individuals should save every receipt and bill to provide as proof to the state Medicaid office that the excess income has been spent.

▶ Spending down one’s income to meet the Medicaid limit can be challenging to keep track of, but with diligent record-keeping and persistence, it is possible to become eligible for Medicaid coverage.

▶ Once a person’s excess income has been spent down to reach the Medicaid threshold, they will qualify for benefits. However, if their income continues to surpass the limit in subsequent months, the spending down process will need to be repeated to maintain eligibility.

In short, by using out of pocket medical costs to offset income that exceeds Medicaid limits, people who otherwise earn too much to qualify can become eligible for benefits. With organization and patience, spending down provides a pathway for those stuck between affordable healthcare and making too much to receive government assistance.

Do you know? California has taken great and significant initiative in expanding Medicaid access by eliminating the asset test for all of its healthcare supporting programs. This means Californians are more likely to qualify for Medicaid regardless of their income and asset limit.

What are the types of Medicaid Spenddown?

To qualify for Medicaid, a person’s income and assets are taken into account. Depending on each individual’s particular circumstances, you may have to reduce either your income, your assets, or both to meet the eligibility criteria. Medicaid spenddown refers to the process of lowering your income and assets to qualify.

Here are the main types of spend downs in Medicaid:

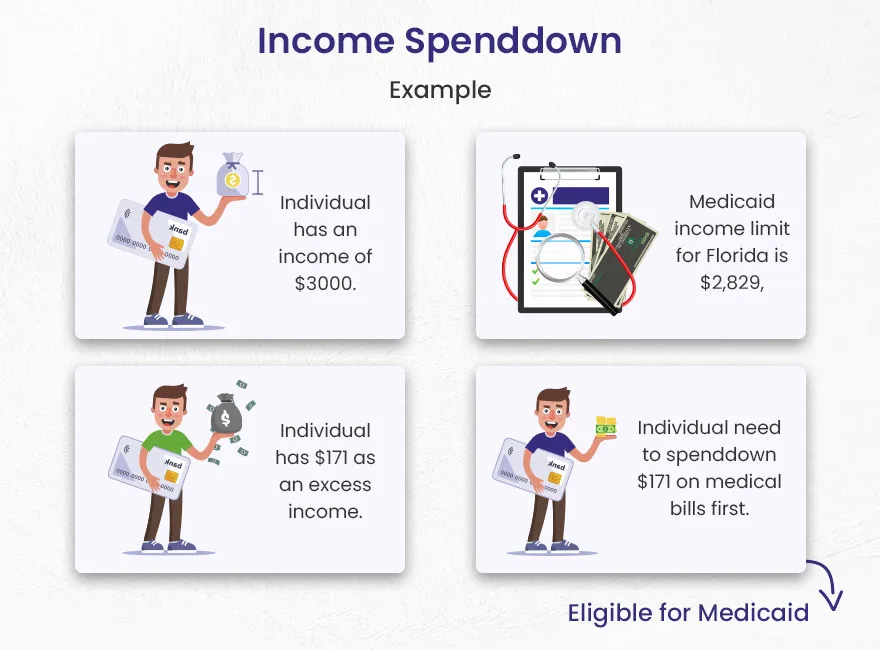

1). Income Spenddown

Income spenddown is a means for seniors whose monthly income exceeds their state’s Medicaid limits to become eligible for benefits. Though their income is too high under normal circumstances, by spending a portion of it on medical expenses they can “spend down” to Medicaid’s required level.

They can spenddown their income on medical bills, like:

- Physicians visits

- Unpaid medical bills

- Prescribed drugs

- Health insurance premiums

For example, take an elderly man in Florida with a monthly income of $3,000 in 2024. Florida’s Medicaid income limit that year is $2,829. That means the man has earned $171 over the limit. To qualify for Medicaid, he must first spend that $171 on medical bills and prescriptions. Once he does, he meets the income requirements.

Do you know? Some states permit applicants to place excess income into a Qualified Income Trust, also called a Miller Trust. The money above Medicaid’s cap goes directly into the account monthly. It covers the senior’s medical costs and long-term care expenses.

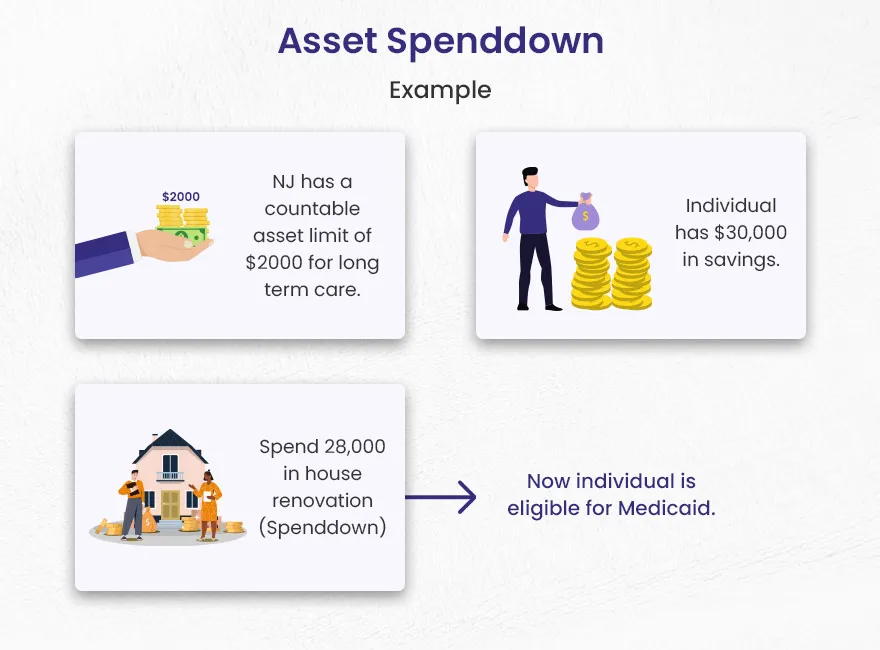

2). Asset Spenddown

Asset Spenddown means that if an elderly person or a married couple owns assets above the Medicaid limits, they are not outside the circle of people who can receive Medicaid benefits. Though not all assets are counted in determining Medicaid eligibility, for instance, a single vehicle for everyday use is totally exempt. To qualify for Medicaid, individuals must meet income and countable asset spenddown criteria.

It is important to remember that careful planning plays an essential role in avoiding penalties since Medicaid reviews asset spending over a lookback period.

For example, there was an elderly woman living alone in New Jersey. The Garden State had a limit of $2,000 in countable assets for long-term care Medicaid. This woman, a Ms. Jones, had $30,000 tucked away in her savings account.

The money was earmarked for her golden years, but Ms. Jones took ill and required in-home care.

She spent $28,000 of her savings on renovating her home to be wheelchair accessible – installing ramps, widening doorways, adding a first-floor bathroom. This brought Ms. Jones below the $2,000 asset limit, thereby making her eligible for Medicaid coverage for her long-term care needs.

Here is a complete table for US assets limits that can vary on the basis of state.

| State | Individual Asset Limit | Couple Asset Limit |

| Alabama | $2,000 | $3,000 |

| Alaska | $2,000 | $3,000 |

| Arizona | $2,000 | $3,000 |

| Arkansas | $2,000 | $3,000 |

| California | No limit | No limit |

| Colorado | $2,000 | $3,000 |

| Connecticut | $1,600 | $2,400 |

| Delaware | $2,000 | $3,000 |

| District of Columbia | $4,000 | $6,000 |

| Florida | $2,000 | $3,000 |

| Georgia | $2,000 | $4,000 |

| Hawaii | $2,000 | $3,000 |

| Idaho | $2,000 | $3,000 |

| Illinois | $2,000 | $3,000 |

| Indiana | $2,000 | $3,000 |

| Iowa | $2,000 | $3,000 |

| Kansas | $2,000 | $3,000 |

| Kentucky | $2,000 | $4,000 |

| Louisiana | $2,000 | $3,000 |

| Maine | $10,000 | $15,000 |

| Maryland | $2,500 | $3,000 |

| Massachusetts | $2,000 | $3,000 |

| Michigan | $2,000 | $3,000 |

| Minnesota | $3,000 | $6,000 |

| Mississippi | $2,000 | $3,000 |

| Missouri | $2,000 | $3,000 |

| Montana | $2,000 | $3,000 |

| Nebraska | $4,000 | $6,000 |

| Nevada | $2,000 | $3,000 |

| New Hampshire | $2,500 | $4,000 |

| New Jersey | $2,000 | $3,000 |

| New Mexico | $2,000 | $3,000 |

| New York | $30,182 | $40,821 |

| North Carolina | $2,000 | $3,000 |

| North Dakota | $3,000 | $6,000 |

| Ohio | $2,000 | $3,000 |

| Oklahoma | $2,000 | $3,000 |

| Oregon | $2,000 | $3,000 |

| Pennsylvania | $2,000 | $3,000 |

| Rhode Island | $4,000 | $6,000 |

| South Carolina | $9,090 | $13,630 |

| South Dakota | $2,000 | $3,000 |

| Tennessee | $2,000 | $3,000 |

| Texas | $2,000 | $3,000 |

| Utah | $2,000 | $3,000 |

| Vermont | $2,000 | $3,000 |

| Virginia | $2,000 | $3,000 |

| Washington | $2,000 | $3,000 |

| West Virginia | $2,000 | $3,000 |

| Wisconsin | $2,000 | $3,000 |

| Wyoming | $2,000 | $3,000 |

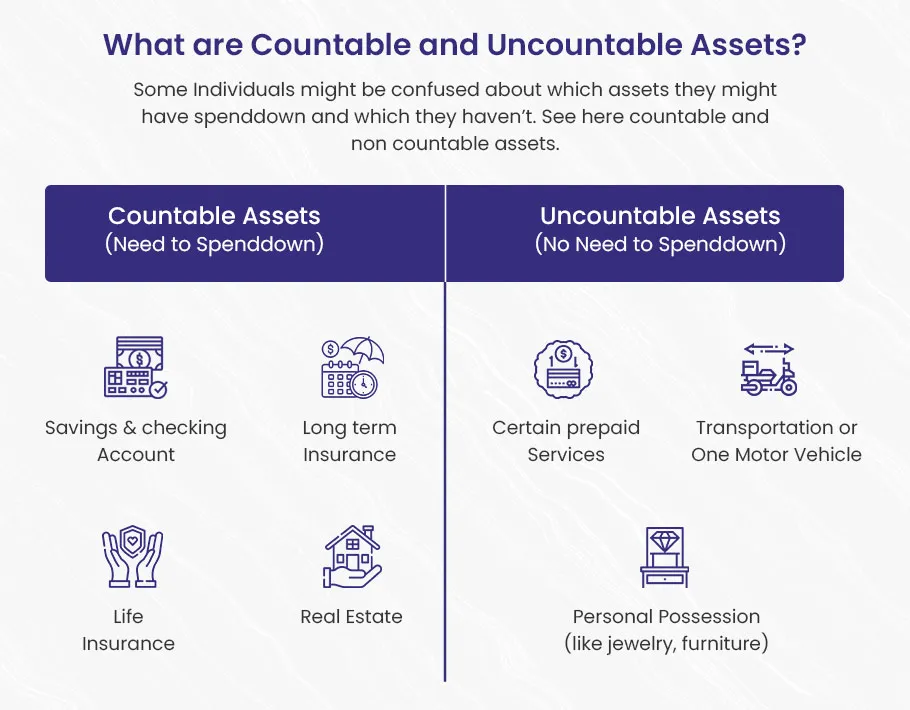

Countable and Uncountable Assets in Medicaid Spend Down

🔵 Countable assets are the resources a person has that can be used to pay for their own medical care. These are the assets that are counted when determining if someone meets the income limits to qualify for Medicaid. For example, a savings account with $5,000 would be considered a countable asset.

🔵 Uncountable assets, also called exempt assets, are not counted when determining Medicaid eligibility. These are assets that are excluded from the calculations. A person’s primary home, for instance, would be considered an uncountable asset. Even if the home is worth $500,000, it would not impact the Medicaid eligibility determination.

Medicaid Eligibility Income Chart (Updated May 2024)

The table mentioned below shows Medicaid’s income limit for seniors. Income is not a single factor for Medicaid eligibility, asset limits also have a role in determining eligibility.

Here we have mentioned three states which have complete Medicaid eligibility criteria.

Click here to get eligibility criteria of any other state.

For Alabama

| Type of Medicaid | Single | Married (both spouse applying) | Married (one spouse applying) |

| Institutional/ Nursing home Medicaid | $2,829 / month | $5,658 / month( $2,829 / month per spouse | $2,829 / month for applicant |

| Medicaid waivers/home and community based services | $2,829 / month | $5,658 / month($2,829 / month per spouse) | $2,829 / for applicant |

| Regular Medicaid/ Medicaid for elderly and disabled | $963 / month | $1,435 / month | $1,435 / month |

For California

| Type of Medicaid | Single | Married (both spouse applying) | Married (one spouse applying) |

| Institutional/ Nursing home Medicaid | No income limit, but residents are only permitted to keep $35 / month. | No income limit, but residents are only permitted to keep $35 / month. | No income limit, but residents are only permitted to keep $35 / month. |

| Medicaid waivers/home and community based services | $1,732 / month (eff. 4/24 – 3/25) | $2,352 / month (eff. 4/24 – 3/25) | $2,352 / month (eff. 4/24 – 3/25) |

| Regular Medicaid/ Medicaid for elderly and disabled | $1,732 / month (eff. 4/24 – 3/25) | $2,352 / month (eff. 4/24 – 3/25) | $2,352 / month (eff. 4/24 – 3/25) |

For Florida

| Type of Medicaid | Single | Married (both spouse applying) | Married (one spouse applying) |

| Institutional/ Nursing home Medicaid | $2,829 / month | $5,658 / month ($2,829 / month per spouse) | $2,829 / month for applicant |

| Medicaid waivers/home and community based services | $2,829 / month | $5,658 / month ($2,829 / month per spouse) | $2,829 / month for applicant |

| Regular Medicaid/ Medicaid for elderly and disabled | $1,104 / month (eff. 4/24 – 3/25) | $1,492 / month (eff. 4/24 – 3/25) | $1,492 / month (eff. 4/24 – 3/25) |

What’s the Medicaid Spend Down Period?

The Medicaid Spend Down Period is the time frame some states provide for folks whose income is too high to qualify for Medicaid coverage, so they can lower that income by paying for medical bills. During those months, usually one to six, a person spends their money on doctor visits, prescriptions, and other healthcare costs until their income reaches the Medicaid eligibility level.

For instance, say a state gives two months to spend down – a man with high medical bills could pay those off in that time and qualify for Medicaid.

To qualify for Medicaid throughout the spend down tenure, people must consistently meet the spend down necessities each month. A single mother living in Connecticut working part-time earns $2000 per month. Her state’s Medicaid income limit is $1600. She must spend down $400 on co-pays, prescriptions, medical bills, and other medical care within 6 months to qualify for Medicaid.

What if people don’t spend down enough income?

Individuals who fail to effectively spend down their income within the nominated timeframe may face a challenge of temporary loss of Medicaid coverage. This can create noteworthy monetary hardship and gaps in healthcare access.

To resolve this complex situation, individuals can seek assistance from their local State Insurance Assistance Program (SHIP). SHIP offers Medicaid counseling services, helping people recognize and manage their healthcare coverage opportunities.

However, keeping a record of the expenses and ensuring compliance with Medicaid’s spenddown requirements can be overwhelming for many people. The monetary backlash due to errors or misinterpretations can be severe, highlighting the need for cautious planning and professional guidance.

Healthcare expenses that qualify for Medicaid Spenddown

To determine Medicaid eligibility, it’s critical to recognize which healthcare expenses qualify for spenddown. These typically include:

- Personal medical bills that encompass a varied range of healthcare costs experienced by the individual seeking Medicaid, such as doctor visits, prescriptions, hospital stays, medical tools and others.

- Spouse’s medical bills can be counted towards the spenddown amount, helping the couple meet Medicaid eligibility.

- Healthcare expenses for dependent children, whether living with or apart from the parent, can often be included in the spenddown calculation.

- Unpaid medical bills (past medical bills), sometimes dating back several years, can be considered on the road to spenddown if they encounter specific standards.

- Healthcare expenses that are not covered by other insurance, such as Medicare or private health insurance, can also be eligible for Medicaid to be applied towards the spenddown amount.

Who can get Medicaid Spenddown?

Not everyone can get Medicaid spend down. People must be positioned in the category of following groups:

- Child under 21 years of age

- Adult over 65 years

- Disabled or Blind

How to calculate the Spenddown amount?

[Individual Income – Medicaid Eligibility Limit] = Medicaid Spenddown amount

The Medicaid spend-down amount is calculated by taking the difference between an individual’s income and the Medicaid eligibility limit set by their state over a precise time frame, which can range from one to six months. This process involves a few steps:

- First, individuals need to identify their monthly income and compare it to the Medicaid eligibility limit for your state.

- The difference between income and this Medicaid limit is the amount an individual needs to spend down.

- The spend-down period can fluctuate from one to six months, reliant on state regulations and guidelines.

- Throughout this period, people can reduce their countable income by the specified amount to become eligible for Medicaid.

Say a fellow’s monthly income adds up to $2,500. The Medicaid limit in his state is $2,000 per month. So to figure his spenddown amount, you take that $2,500 income and subtract the $2,000 limit. In this case, that leaves $500 as his spenddown amount for the month. The government will make him pay that $500 out of his own pocket for medical expenses before they’ll start picking up the tab.

What is Extra Help and how does it impact a person who qualifies for Medicaid through Spenddown?

An individual who’s eligible for Medicaid due to high medical expenses (higher than their income or might be spent down) can get help with the cost of Medicare drug coverage. So “extra help” is a program that lowers out of pocket Medicare drug costs. Individuals having Medicare and Medicaid can qualify for Extra Help and they have to pay a small copayment for Medicare-covered drugs.

Once an individual qualifies for Medicaid through spenddown, they are meant for Extra Help. This program is designed to meet individuals healthcare needs for at least the rest of all months in the calendar (1 year).

Individuals who are eligible for Medicaid through Spenddown in the last 6 months, are automatically eligible for Extra help (rest of the current year).

The Bottom Line

It’s possible for people to qualify for Medicaid long term care by spending down their income and assets. All people should be able to understand the guidelines and rules of their state. Planning spenddown in advance is a great practice to wisely use income or assets by avoiding penalties.