Medical billing is full of codes that may seem confusing but have a big impact on your revenue. One of the most common is the CO-45 denial code. It’s a reason code you might see on your remittance advice that can reduce payment for your services.

If you’ve ever opened an Explanation of Benefits (EOB) or an Electronic Remittance Advice (ERA) and found CO-45 next to a line item, you wonder; What exactly does it mean, why did it happen, and how can I prevent it next time?

This guide explains CO-45 and its common causes to help protect your revenue and prevent write-offs. We’ll also show how it works as an adjustment code and the exact steps you can take to fix or appeal it.

CO-45 in Medical Billing

In medical billing, the CO-45 denial code means the amount charged is more than what the insurance company agreed to pay. The insurer won’t pay the full charge because the billed amount is higher than their set limit. This usually happens because of their contract or fee schedule. Let us break it down a bit more.

Expanded CO-45 Denial Code Description

In insurance and medical billing terms:

- CO stands for Contractual Obligation, meaning the amount cannot be billed to the patient because it’s part of your agreement with the payer.

- 45 means Charges exceed fee schedule/maximum allowable or contracted amount.

The reason for CO-45 denial code is that you billed more than what the payer allows under your contract. This is why they reduced the payment to match the contracted rate. The difference between your charge and the allowed amount is written off as a contractual adjustment.

CO-45 Denial Code Example:

If your charge for a chest X-ray is $120, but your payer’s contract allows $100, the EOB will show CO-45 for $20. That $20 is not billable to the patient; you must write it off.

Key Note: CO-45 is not a coding for “experimental” or “investigational” services. It is strictly about payment adjustment based on contractual limits.

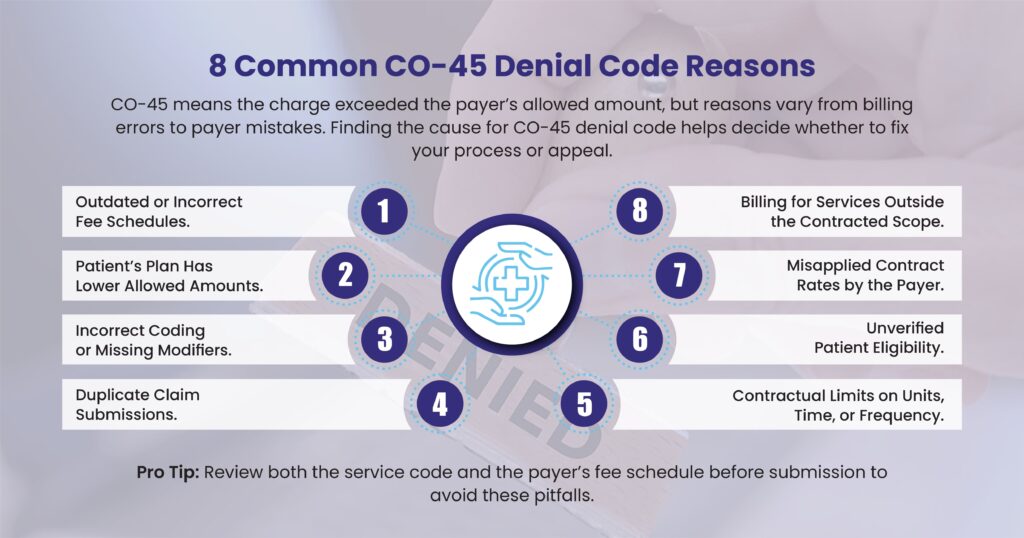

Common CO-45 Denial Code Reasons

The CO-45 denial code appears when the billed charge for a service is higher than the amount allowed by the payer’s contract or fee schedule. While that’s the core reason, several specific scenarios can trigger this adjustment. Understanding these will help prevent revenue loss.

1. Outdated or Incorrect Fee Schedules

Payers regularly update their allowable amounts for services. If your internal billing system uses an outdated fee schedule:

- You may unknowingly bill above the current contracted rate.

- This automatically results in CO-45 adjustments for the difference.

Example: You charge $150 for a lab test, but the new contract reduced the allowed amount to $140. You haven’t updated your system, so every claim for that test now shows a $10 CO-45 adjustment.

2. Patient’s Plan Has Lower Allowed Amounts

Even within the same insurance company, different plan types can have different allowable amounts. If you base your billing on a standard plan rate but the patient’s plan pays less, CO-45 will appear.

Example: Your contract allows $200 for a procedure under most plans, but the patient has a high-deductible plan with a $180 allowable. You bill $200, the extra $20 becomes a CO-45 adjustment.

3. Incorrect Coding or Missing Modifiers

The way you code a service directly affects the allowable amount. Incorrect CPT/HCPCS codes or missing modifiers can lower the allowable rate and trigger CO-45.

- Using an outdated CPT code

- Leaving off a modifier for bilateral procedures

- Incorrect place-of-service coding

Example: A bilateral procedure without the proper modifier may get reimbursed as a single procedure at a lower rate, making the rest an “exceeds allowable” adjustment.

4. Duplicate Claim Submissions

If you submit the same claim more than once without checking the status:

- The payer’s system may process the duplicate with a CO-45 adjustment.

- This often happens when billing staff resubmit because they think the first claim was lost.

Example: The original claim is still processing. A second submission for the same date of service gets flagged as duplicate, and the extra amount is adjusted with CO-45.

5. Contractual Limits on Units, Time, or Frequency

Many payer contracts specify:

- The maximum units allowed per service

- The maximum billable time for a therapy

- The number of times a procedure is covered within a set period

If you bill beyond these limits, the excess is written off as CO-45.

Example: Your contract covers 10 physical therapy sessions per year. You bill for a patient’s 12th session, the charge for the extra two sessions will be adjusted under CO-45.

6. Unverified Patient Eligibility

If eligibility and benefits aren’t verified before treatment, you might:

- Provide services not covered under the patient’s current plan

- Bill using a fee schedule for a different payer or network

When the payer processes the claim, any excess above the allowable is adjusted off with CO-45.

7. Misapplied Contract Rates by the Payer

Sometimes CO-45 isn’t your billing error, it’s the payer applying the wrong allowable rate.

- The system may apply an out-of-network rate when you are in-network.

- A recent contract update may not yet be loaded in their system.

Example: Your updated contract increases the allowable for a service to $250, but the payer still applies the old $230 rate, adjusting $20 as CO-45.

8. Billing for Services Outside the Contracted Scope

Your contract may not cover certain add-on codes, supplies, or equipment at your billed rate. When billed, these extra charges can be reduced to the contract’s allowed amount, leading to CO-45 adjustments.

Bottom line:

While CO-45 always means the charge exceeded the payer’s allowed amount, the underlying reason can range from billing process errors to payer-side mistakes. Identifying the exact cause is key to deciding whether to correct your process or file an appeal.

Tip: Review both the service code and the payer’s fee schedule before submission to avoid these pitfalls.

CO-45 Adjustment Code vs. Denial Code: What’s the Difference?

Many healthcare providers use the terms “denial code” and “adjustment code” interchangeably. But in payer processing they serve slightly different purposes.

- Denial Code: Indicates the claim (or part of it) was not paid as billed.

- Adjustment Code: Shows a payment reduction applied to an otherwise payable claim.

CO-45 is technically a Claim Adjustment Reason Code (CARC). This means it’s used to explain why a payment was adjusted, not necessarily that the claim was fully denied. However, for some providers, the effect feels like a denial because the difference is written off and not recoverable from the patient.

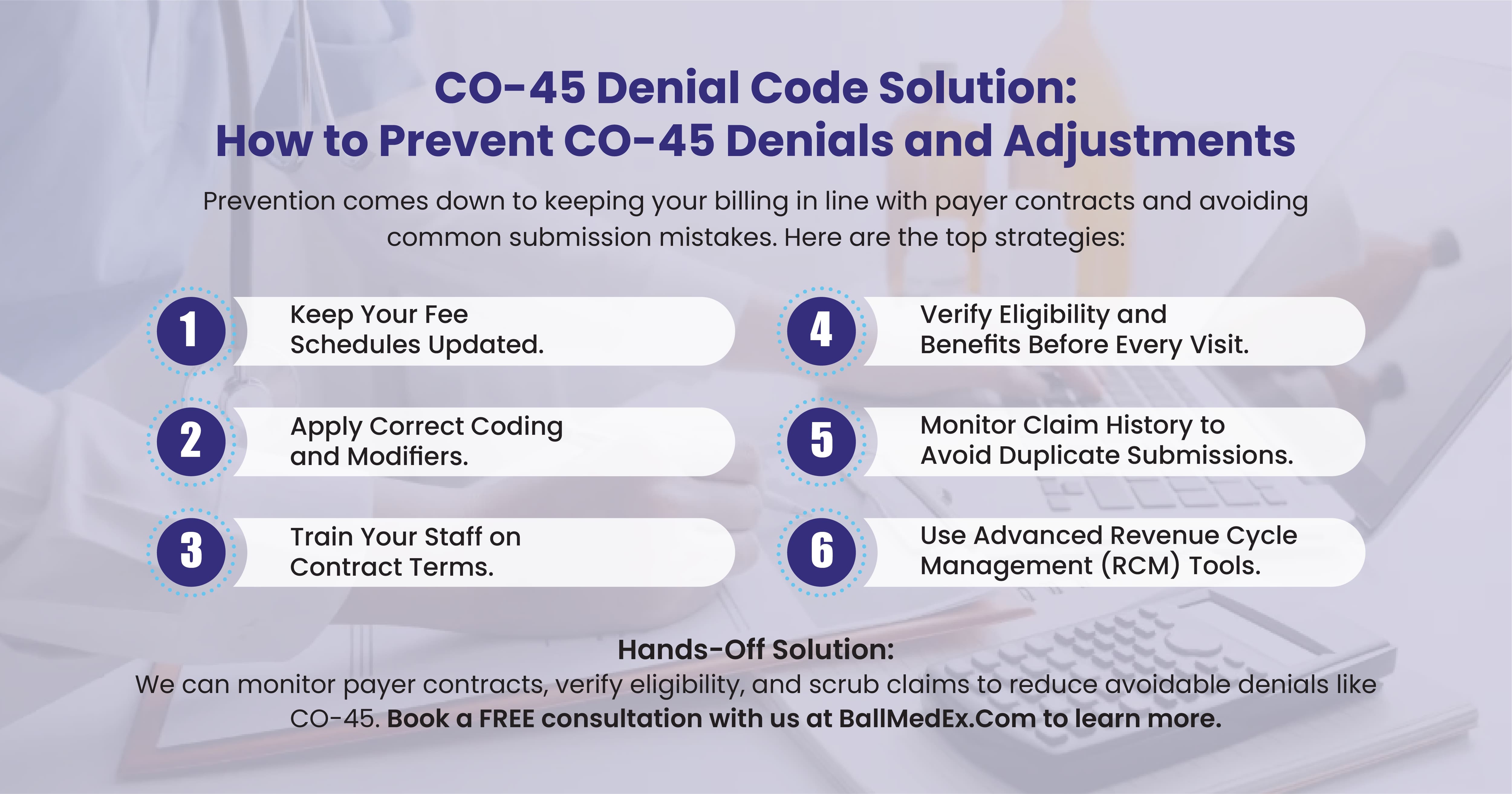

CO-45 Denial Code Solution: How to Prevent CO-45 Denials and Adjustments

Prevention comes down to keeping your billing in line with payer contracts and avoiding common submission mistakes. Here are the top strategies:

1. Keep Your Fee Schedules Updated

Payers update their fee schedules regularly, and even a small change can cause repeated CO-45 adjustments if you don’t keep your system current.

- Review every payer’s updates as soon as they are released.

- Update your practice management system and billing software promptly.

- Maintain a master document with all current allowable amounts for quick reference.

Tip: Set calendar reminders to review fee schedules quarterly, even if the payer hasn’t sent a formal notice.

2. Verify Eligibility and Benefits Before Every Visit

Many CO-45 adjustments happen because the service was covered — but at a lower allowable rate than expected.

- Use electronic eligibility verification tools to confirm coverage in real-time.

- Check for any service caps, unit limits, or plan-specific restrictions.

- Confirm whether the patient’s plan is PPO, HMO, or another type — each can have different allowed amounts.

Example: A PPO plan may allow $150 for a procedure, while the HMO version allows $140. Knowing this upfront avoids surprise adjustments.

3. Apply Correct Coding and Modifiers

Incorrect coding is one of the top preventable causes of CO-45 adjustments.

- Always use current CPT/HCPCS codes.

- Apply appropriate modifiers to reflect the service performed.

- Verify compliance with National Correct Coding Initiative (NCCI) edits and payer-specific rules.

Tip: Use claim scrubbing software to detect missing modifiers or mismatched codes before submission.

4. Monitor Claim History to Avoid Duplicate Submissions

Duplicate claims can trigger CO-45 adjustments even when the first claim was valid.

- Before resubmitting, check the claim status in your clearinghouse or payer portal.

- If a claim appears delayed, follow up with the payer instead of automatically resending.

5. Train Your Staff on Contract Terms

Front-office and billing staff should understand:

- What “allowable amount” means.

- That CO-45 write-offs cannot be billed to the patient.

- The importance of verifying plan-specific rates before billing.

Tip: Hold quarterly refresher training sessions to review contract changes and common denial codes.

6. Use Advanced Revenue Cycle Management (RCM) Tools

Modern RCM software can:

- Compare your billed amount to the payer’s allowable in real-time.

- Flag discrepancies before the claim leaves your system.

- Provide reports showing patterns in CO-45 adjustments so you can address root causes.

How to Fix and Appeal a CO-45 Denial Code?

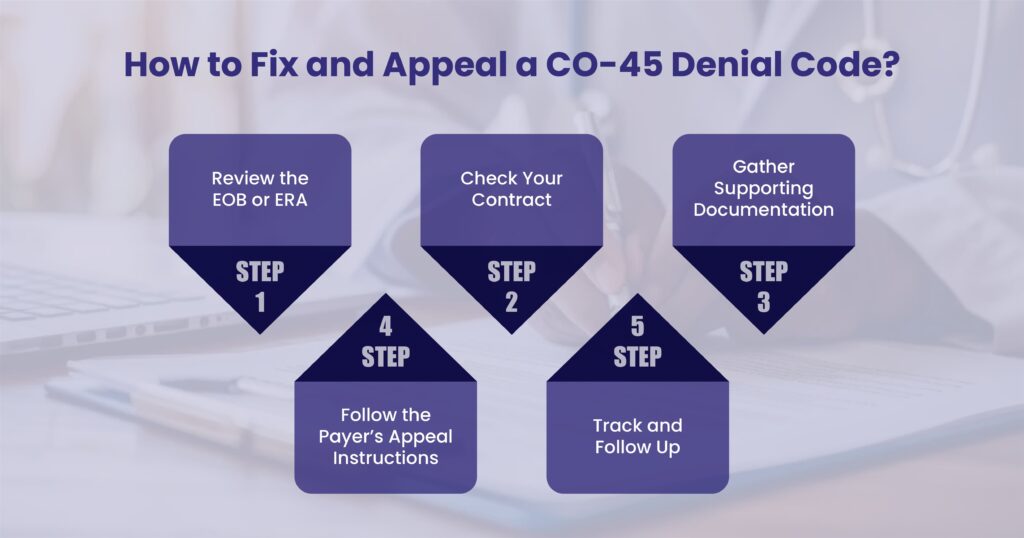

If you receive a CO-45 adjustment and believe it’s incorrect, you have the right to appeal. Follow these steps:

Step 1: Review the EOB or ERA

- Confirm that CO-45 was applied and note the amount adjusted.

- See if the amount was applied toward the patient’s deductible or coinsurance (sometimes misapplied codes can happen).

Step 2: Check Your Contract

- Compare the allowed amount in the EOB to your payer contract.

- If your billed amount matches the contracted rate but still got CO-45, you have grounds for appeal.

Step 3: Gather Supporting Documentation

Include:

- Original claim copy

- Payer contract or fee schedule excerpt

- Medical records if relevant (to show coding accuracy)

- Any prior authorization or referral documentation

Step 4: Follow the Payer’s Appeal Instructions

- Each payer has a set appeal process and timeline (often 90–120 days from the denial date).

- Submit your appeal via the payer’s portal, secure email, fax, or mail.

- Keep a record of your submission.

Step 5: Track and Follow Up

- Set reminders to check appeal status.

- If no response within the stated time frame, contact the payer directly with your reference number.

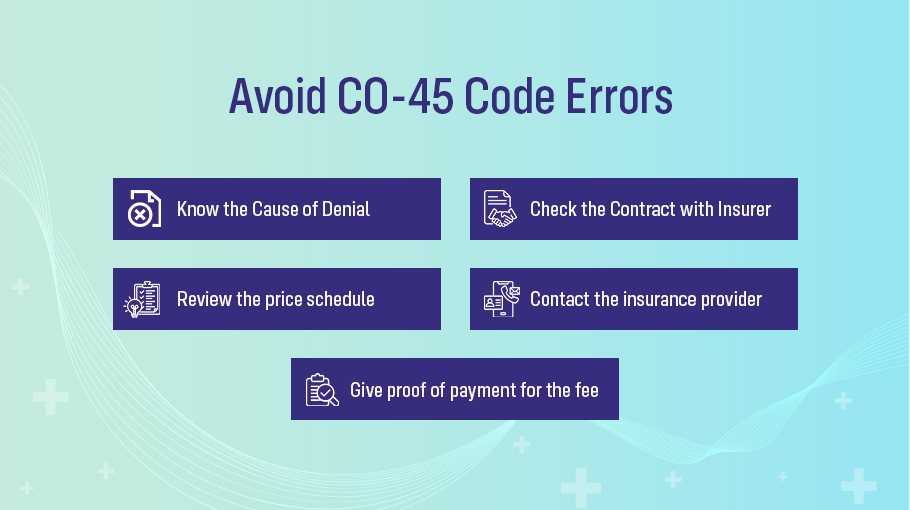

How to Avoid CO-45 Code Errors

Healthcare providers should follow the measures below to prevent CO-45 denial and reduce errors:

- To determine the cause of the denial and the extent of the write-off, review the insurance company’s Explanation of Benefits (EOB) statement.

- Check your contract with the insurance provider to confirm that the invoiced amount is within the permitted amount.

- Review the price schedule for the specific treatment in the area to ensure the fee charged is reasonable and typical if the invoiced amount exceeds the allowable amount.

- Contact the insurance provider to discuss the denial and ask for a reconsideration of the claim if the fee is within the reasonable and typical range.

- Give proof of payment for the fee, such as a fee schedule, an invoice, or medical records.

Healthcare providers may challenge the insurance company’s decision or pursue a dispute resolution if the claim is still denied.

Hands-Off Solution for CO-45 Denials

At BellMedEx, our medical billing experts monitor payer contracts, verify eligibility, and scrub claims to reduce avoidable denials like CO-45. Our goal is to help providers get paid accurately and on time, without losing revenue to contractual write-offs.