The Medicare Coverage Verification is a crucial part of the claim submission process in medical billing that prevents claim denials.

One in seven medical claims are denied, leading to approximately 200 million rejections daily. Of these, a significant 27% are due to issues with patient registration and Verify Medicare Coverage thing for the medical claim.

On average, denial management costs at least $25 per claim denial, resulting in cash flow issues for healthcare practices’ Revenue Cycle Management (RCM).

When the Verify Medicare Coverage part is not done correctly, it not only drives up billing costs but also delays revenue collection, causing disruptions throughout the revenue cycle.

Implementing a reliable insurance verification process helps mitigate claim denials, streamlining medical billing and ultimately improving the practice’s financial health.

This document offers a detailed guide on how to Verify Medicare Coverage, eligibility, and benefits for providers using various methods.

What is Medicare Coverage Verification for Providers?

Medicare coverage verification is the process of checking that a healthcare service or item will be paid for by Medicare before it is provided.

Medicare is a federal health insurance program that covers certain medical costs for people aged 65 and over. While Medicare pays for things like doctor visits, hospital stays, lab tests, and prescriptions, it does not cover all health expenses. Medicare coverage verification allows healthcare providers and patients to confirm in advance that a proposed treatment or service will be covered and reimbursed by Medicare.

For example, before scheduling an MRI, a doctor’s office may contact Medicare to verify that the scan will be covered for that patient. This prevents unexpected costs and ensures the patient and provider are aware of any potential out-of-pocket expenses ahead of time.

“Medicare coverage verification refers to checking in advance whether something will be covered under Medicare for a particular patient. This prevents the patient or healthcare provider from assuming something is covered, only to find out later that Medicare denied the claim.”

Wyatt Butler, Medical Biller & RCM Expert

Why Do Providers Need to Verify Medicare Coverage?

Medicare Coverage Verification is essential for providers as it optimizes the revenue cycle and streamlines the collection process.

According to CompuGroup Medical, manual verification causes providers to lose the average visit cost of two patients per day, which amounts to $6000 annually. Therefore, staying electronic with verification saves you time, money, and effort.

Healthcare providers must verify their patient’s Medicare eligibility coverage due to the following reasons:

➜ Upfront eligibility verification improves your first-pass rate while reducing A/R days, meaning you’ll get paid faster without any delays.

➜ Checking Medicare eligibility before providing services gives you a better understanding of your patients’ co-pay amounts, co-insurance, deductibles, and out-of-pocket costs, allowing you to collect Medicare payments in a timely manner.

➜ Prior eligibility verification allows you to educate your patients ahead of time about the billing process with their insurance plan, co-pays, and deductibles. This leads to enhanced patient satisfaction and fewer contested bills.

➜ Lastly, it improves cash flow, as you collect your revenue upfront without any delays.

List of Things You Need to Verify Medicare Coverage of a Patient

- National Provider Identifier (NPI)

- Provider Transaction Access Number (PTAN)

- Tax Identification Number (TIN)

- Beneficiary Medicare ID

- Beneficiary name

- Beneficiary date of birth

- Date of service (if applicable)

How to Check Your Patient’s Medicare Eligibility Status?

Checking your patient’s Medicare eligibility is key to avoiding billing problems and getting paid on time. There are different ways to verify Medicare coverage, from online tools to phone calls. Here are the most common methods to help you confirm your patient’s Medicare eligibility.

Method #1 – BellMedEx Medicare Coverage Verification Tool

BellMedEx is a medical billing company that has its own comprehensive Medicare verification system. The company takes over a provider’s non-clinical burdens and simplifies the Medicare coverage verification process. This enables providers to focus on their core tasks, such as delivering care.

To verify Medicare insurance eligibility via BellMedEx, follow these simple steps:

1). Visit BellMedEx’s Medicare Coverage & Patient Eligibility Checker Tool online.

2). Fill in the form – enter your name, email, and phone number – and click on “Book a Free Consultation”.

3). BellMedEx’s support representative will immediately contact you and help you with confirming your patient’s Medicare coverage.

4). Likewise, you can also contact BellMedEx at 888-987-6250 to receive Medicare coverage verification support and verify if a patient qualifies for Medicare or not.

Method #2 – Confirm Medicare Coverage Online via Secure Provider Online Tool (SPOT)

SPOT, as known as Secure Provider Online Tool, gives you the ability to view claims status and confirm patient’s Medicare eligibility status online. SPOT also offers the opportunity to search for a Medicare Beneficiary Identifier (MBI) through the Medicare MBI lookup tool.

The eligibility information through SPOT is accessible 24/7, and the providers can check Part A and Part B eligibility status, as well benefit eligibility for preventive services, deductibles, therapy caps, inpatient care, hospice, home health, Medicare secondary payer (MSP), plan coverage data categories, and claim status up to twelve months from the date of the inquiry.

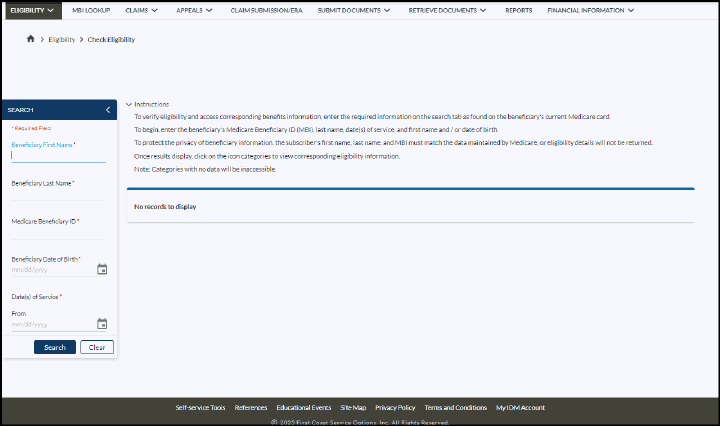

Here’s how you can verify Medicare eligibility for your patients via SPOT:

1). Select Eligibility from the top drop down menu.

2). A pop up will appear, asking for the following details:

- Beneficiary Last Name

- Medicare Beneficiary ID

- Beneficiary First Name

- Beneficiary Date of Birth

- Date(s) of Service

Note: (You may limit your query to the date(s) the service will be furnished to the patient, or you may specify any time up to four months in the future and 24 months in the past).

3). Click Search to view Eligibility status.

4). The Eligibility results will include complete eligibility information of the beneficiary, including part A and part B eligibility statuses, with effective and termination dates.

Method #3 – Using IVR to Verify Medicare Part A and Part B Eligibility

The Interactive Voice Response (IVR) system allows a provider to verify Medicare eligibility for free by phone. You can access primary insurance info, confirm pre-authorization, and check claim status.

Contact the following numbers for Medicare Part A verification:

- 1-888-664-4112 (Toll-free telephone number)

- 1-877-660-1759 (For speech and hearing impaired)

Contact the following numbers for Medicare Part B verification:

- 1-866-454-9007 (Toll-free telephone number)

- 1-877-660-1759 (speech and hearing impaired)

Providers can access Medicare Part A and Part B eligibility information via IVR during the following times (excluding holidays):

- Monday-Friday 7am to 7pm, ET

- Saturday 6am to 3pm, ET

IVR’s CSR service is also available in case a complexity arises about insurance plans, coverage, and benefits that you need to navigate through. Customer service representatives are available during the following times, excluding holiday closings:

- 8am to 4pm Monday through Friday, ET and CT for providers in Florida.

- 8am to 4pm Monday through Friday, ET for providers in the U.S. Virgin Islands.

Method #4 – Confirming Medicare Benefits via MAC Online Provider Portal

Medicare Administrative Contractors (MACs) process claims and Medicare eligibility verification for fee-for-service (FFS). These contractors offer an online provider portal for registered providers.

Not registered with MAC?

A supplier can register with its MAC’s provider portal by contacting its MAC or by finding its MAC provider portal online. Once registered, the supplier can use the portal to search a Medicare beneficiary’s eligibility. The supplier can access its MAC’s provider portal at any time and look up a beneficiary’s verification.

Here’s how you can verify Medicare coverage of your patient with MAC provider portal:

- Enter the beneficiary’s Health Insurance Claim Number (HICN) or Medicare Beneficiary Identifier (MBI)

- Beneficiary’s first and last name

- Beneficiary’s date of birth

- Upon entering the above information you can check the status.

However, the process is self-service, meaning you are responsible for entering the information to check the status.

Method #5 – Phone Number to Verify Medicare Eligibility and Benefits

Using Medicare Administrative Contractor (MAC) Phone Verification

Medicare Administrative Contractors offer a phone verification system as well that Medicare suppliers can contact to access beneficiary eligibility information. The appropriate phone number of a MAC can be found from its website by state. Or you can simply dial 1-800-MEDICARE (800-633-4227) to get your state’s phone number.

To perform the eligibility verification, the authentication should be done through the phone system by entering:

- National Provider Identifier (NPI),

- Provider Transaction Access Number (PTAN), and

- Tax Identification Number

This information is needed by Medicare to accurately perform the eligibility query and provider authentication. Once the provider has confirmed its authentication, the provider can now enter the following details to confirm the patient’s Medicare eligibility.

- The beneficiary’s HICN or MBI,

- The beneficiary’s first and last name, and

- The beneficiary’s date of birth

This option is self-service and available around the clock, 24/7.

Method #6 – Validate Medicare Coverage via HIPAA Eligibility Transaction System (HETS)

HETS (HIPAA Eligibility Transaction System) allows providers and suppliers to verify and check Medicare eligibility status using a HIPAA compliant transaction. You can get eligibility information by submitting a HETS 270 request. To check eligibility status in HETS, you must have the following information:

- MBI

- First and last name

- Date of birth (MM/DD/YYYY)

If a patient is eligible, you will get a 271 response with information like Part A entitlement, Part B entitlement, Part D, Hospital lifetime reserve days remaining, skilled nursing facility remaining benefit days, and more.

Note: To verify your patients’ Medicare eligibility via Health Eligibility Transaction System, your medical billing software must connect with it. This integration permits creating, sending, and getting the transactions. HETS benefits large healthcare facilities with the resources to build their own programs. This makes it a good choice if you want to avoid third parties and keep things quick and secure.

Conclusion

Now that you know how to verify Medicare eligibility and verify Medicare benefits across multiple methods—whether through IVR, MACs, or online platforms like SPOT—you can streamline your verification process. This will help reduce denials, improve patient billing accuracy, and increase your cash flow. Efficient Medicare verification for providers is key to ensuring your practice operates smoothly, so make sure to verify Medicare eligibility as soon as possible to avoid delays in claims processing.