In the medical billing field, a “SUPERBILL” is a document that provides a detailed invoice of the services provided by a healthcare provider to their patient. Typically, superbills are created and submitted for each treatment session conducted by an out-of-network provider. Once the doctor has concluded their work with the patient, payment is collected in cash from the patient. In exchange for this payment, the doctor generates a superbill, which the patient can use to get reimbursed by their insurance payer network.

It’s worth noting that some providers even submit superbills on behalf of their patients (for better patient experience), using a portal for electronic submission, also known as an e-superbill. But either way, the patient pays the doctor first. So superbills reimburse the patient, unlike CMS 1500 forms that pay the doctor directly.

Superbills go by other names too, like “encounter forms”, “charge slips”, “fee tickets”, or “Statement for Insurance Reimbursement”. But they all serve to document what treatments were given, for the patient to pursue payment.

Who is responsible for creating and submitting a Superbill?

👉 Created by: the Doctor

👉🏻 Submitted by: the Patient or the Doctor

👉🏻 Who Gets Reimbursed: the Patient

The doctor always generates/creates the superbill. The superbill is then handed over to the patient. The patient then submits the superbill themselves to their insurance company to get paid back.

Nowadays, some doctors like submitting the superbills themselves (on the patient’s behalf) so the patients have an easier time. Other doctors want to save time so they have the patients do it, which is the usual way.

*Note: When you start treating someone and will be writing up the superbills for them, it’s important to be clear about who will submit them to the insurance payors to avoid any awkward situations afterward.

How does a Superbill work in healthcare billing?

Typically, when a patient sees a doctor that doesn’t participate with their health insurance (out-of-network provider), the patient pays the doctor from his/her own pocket for the visit or treatment rendered.

The doctor then gives the patient a superbill, which lists all the services provided and how much each cost. To get reimbursed for at least some of the costs, the patient uses this doctor-generated superbill to file an out-of-network claim with his/her health insurance company.

The insurance company reviews the claim and decides how much, if anything, they will reimburse. If they don’t reimburse all the costs, the patient has the option to revise and re-submit the claim.

Why does the need for Superbill creation arise?

Superbills allow medical specialists to offer their expertise and get paid without being constrained by the limitations of being on an insurance network panel.

How does it work, you ask?

Well, let me enlighten you.

With a superbill, the provider collects the full payment directly from the patient. Later, the patient can seek reimbursement from their insurance provider by submitting the superbill for consideration.

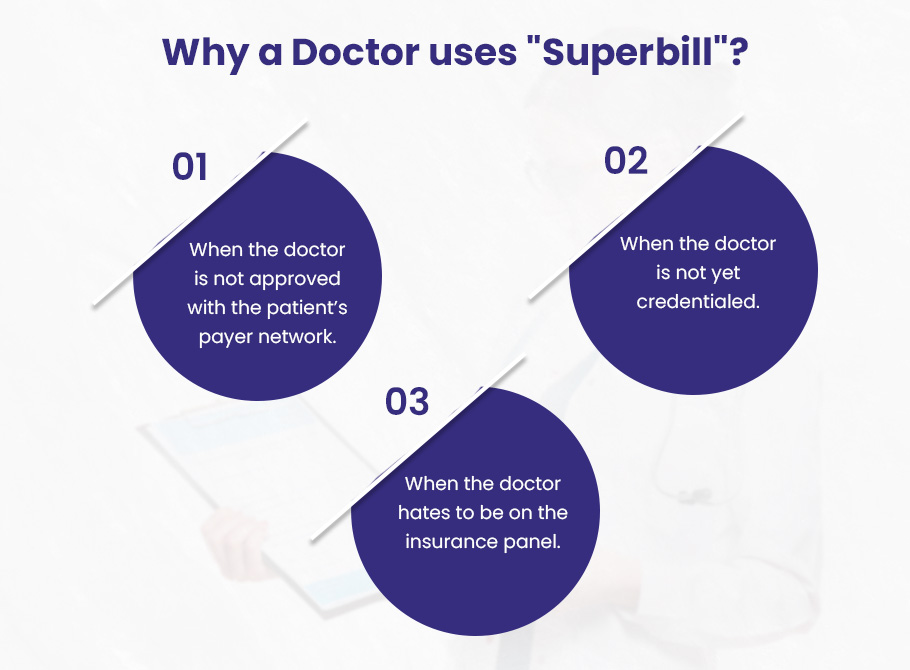

But why would a provider resort to Superbills, you wonder? Here are a couple of reasons, why:

➜ When the doctor is not approved with the patient’s payer network. The need for superbills comes up when a doctor isn’t on the patient’s insurance company’s list of approved providers yet.

➜ When the doctor is not yet credentialed. While the doctor is waiting to get approved, called “credentialing”, he’s got to get paid somehow. In that case, a provider might rely on Superbills as a payment method while awaiting credentialing from an insurance company. This allows them to continue offering their services and ensures that they can receive payment for their expertise until they are officially recognized by the insurance provider.

➜ When the doctor hates to be on the insurance panel. Lots of head doctors and therapists don’t even bother joining insurance networks. This is because the application process takes forever, with piles of paperwork and interviews. Therefore, it’s easier for the doctor just to charge the patient directly, and let the patient get reimbursed on their own time.

Having trouble getting credentialed with insurance companies? BellMedEx’s provider enrollment service can help you get credentialed with all the top commercial payers and government programs in the state.

What are the types of Superbills?

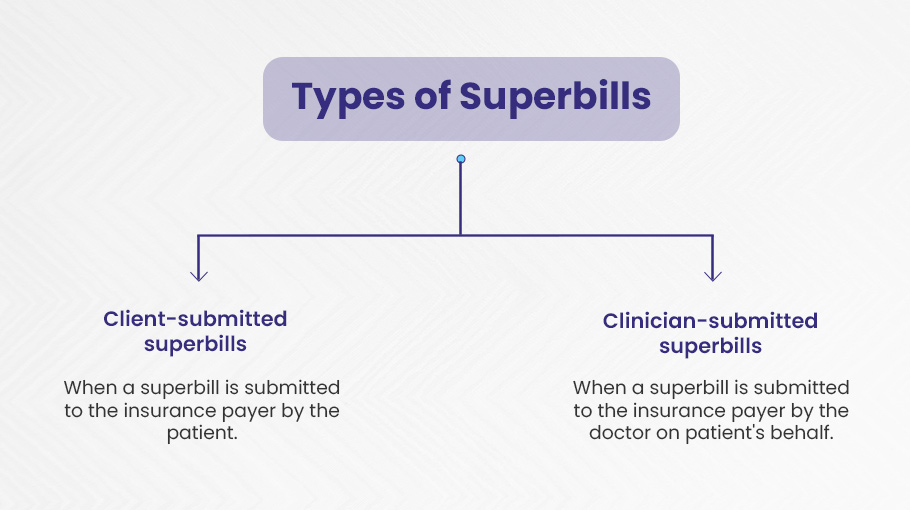

Medical superbills come in two types. The making of them is the same each time – the provider puts them together for every case. But when it comes time to hand them in to the payer for reimbursement, that’s where it changes.

1). Client-submitted superbills

Firstly, we have the client-submitted superbills. Here the healthcare provider hands over a copy of the superbill to the patient. The patient then takes the initiative to contact their insurance plan and proceed with submitting the claim and getting reimbursed for the out-of-pocket costs earlier.

2). Clinician-submitted superbills

On the other hand, we have clinician-submitted superbills. Here, the healthcare provider takes charge and submits the superbill to the insurance on behalf of the patient. The therapist acts as the intermediary, streamlining the reimbursement process for the patient.

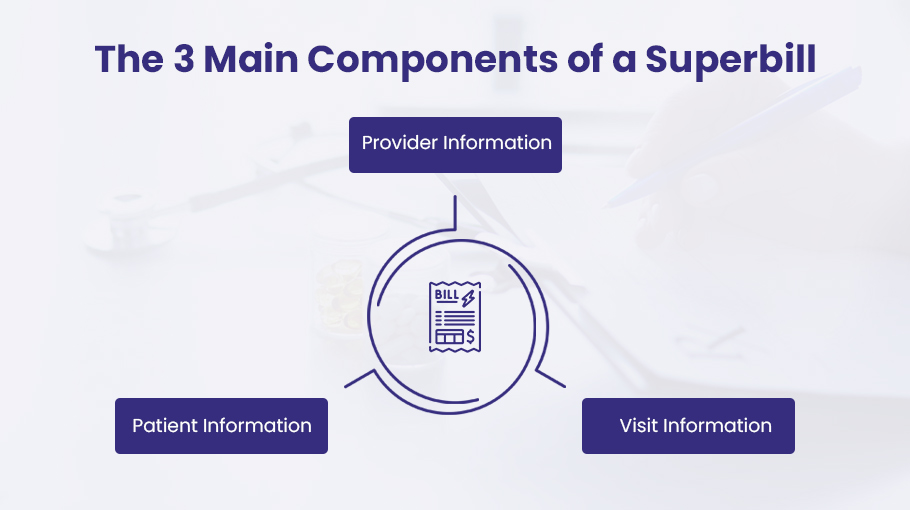

The Components of A Superbill

A superbill has all the details of the patient-provider encounter such as date(s) of service, fee for each service date, diagnostic code (DX), etc. Being the crucial piece of billing information, a superbill showcases the important components as given below:

Component #1: Provider Information

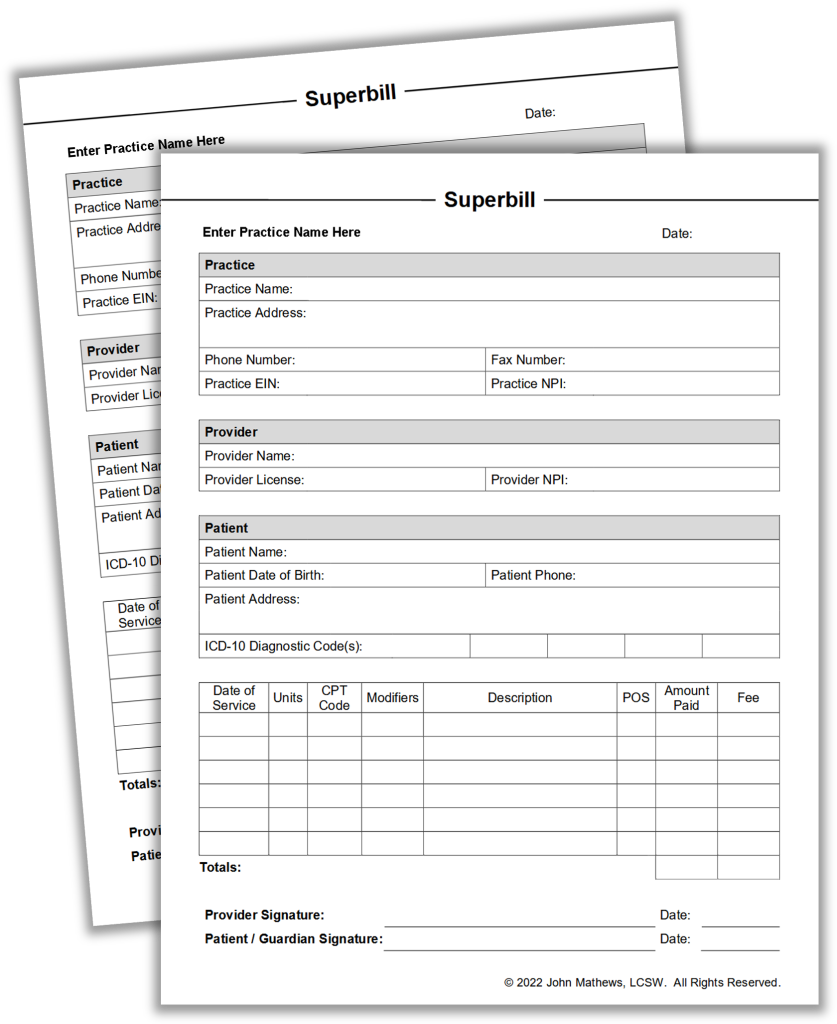

The provider information section holds all the relevant information to the practice involved in providing the service or treatment. The information contains:

- Provider’s first and last name

- Provider NPI number (a 10-digit identification number issued to the provider by the U.S.)

- Office location where the visit took place

- Provider phone number

- Provider email address

- Provider signature

- Referring provider name (if applicable)

- Referring provider NPI number (if applicable)

Component #2: Patient Information

This section contains complete patient-relevant information required to successfully generate claims and call reimbursement for the patient. This includes:

- Patient first and last name

- Patient address

- Patient phone number

- Patient date of birth (DOB)

- Patient insurance information

Component #3: Visit Information

The visit information is comparatively tricky and therefore requires utmost accuracy to generate correct bills. The visit information on a superbill needs codes generated from medical diagnoses and procedures performed with thorough accuracy to avoid denials.

Since superbills contain detailed information on procedures and diagnoses performed, therefore the service should be outsourced to a medical coding company compliant with ICD-10 and CPT coding guidelines. This ensures accurate code generation that leads to reduced coding errors as well as denials.

Visit information contains:

- Date of visit

- Procedure Codes and Description (CPT) (codes that describe procedures performed on the patient)

- Diagnosis Codes and Description (ICD-10) (codes that describe the medical diagnoses)

- Modifiers (a code that tells that the procedure performed has been changed but not in its code)

- Units or Minutes

- Fees Charged

The Pros & Cons of Superbills

| PROS ✔️ More patient traffic ✔️ Cost-effective for patients ✔️ Provider gets reimbursed without middleman ✔️ Lowers provider’s overhead costs | CONS ❌ Generating superbills compliant with each insurance network type requires expertise. ❌ Patients don’t know how much they will be reimbursed. |

Superbills occupy an odd space in medical billing, facilitating direct payments from patients that are then reimbursed by insurance. This approach allows providers to easily collect fees without battling insurers. It also puts the onus on patients to front costs and trust they’ll be repaid later. Insurers take on some risk but skip the headache of first-line payments.

So who benefits most from this system? Likely providers and insurers. Patients shoulder more work and uncertainty. Still, superbills inject flexibility into an otherwise rigid billing process. For some, the pros outweigh the cons.

What are the Benefits of Superbills?

1). The provider receives more patient traffic.

Providing patients with a superbill allows them the chance to get money back from their insurance companies. This can bring more new customers into your practice.

Take old Mrs. Jenkins, with her arthritis giving her fits. Her insurance covers the cost of doctor’s appointments. She comes to you limping, looking for relief from the pain. You give her a superbill along with a remedy for what ails her. A few days later, Mrs. Jenkins is out and about again, telling all her friends at the church social how you’re the only doc worth seeing, on account of you taking insurance and charging honest prices. Pretty soon you’ve got more business than you can handle from all the ladies at the social whose joints are creaking and acting up.

2). Healthcare services become affordable for patients.

The upside of superbills is that more people can use the healthcare services. Some patients can’t afford the provider’s fees without getting their insurance companies to pay back some. When the doctor provides the paperwork for patients to get paid back (I mean the superbill), more people can go to the doctor and get the help they’re needing.

3). Patients pay the provider directly – No middlemen!

As an independent physician, using a superbill keeps life blissfully simple. You can forget about jumping through the insurance companies’ hoops to get “credentialed”—approved to see their members. No more filling out application after application, and then doing it all over again every couple of years to stay credentialed.

Without dealing with the insurance companies, you also don’t need an army of staff spending their days arguing the bills. You don’t have to pay staff just to hound the insurance companies to actually pay what they owe for services already rendered. And you sidestep the messy accounting nightmare that comes with submitting claims, tracking what the insurance companies say they’ll pay versus what they actually deliver.

With a superbill, your patients pay you directly. No middleman. Meaning, more time spent practicing medicine, less time wrestling with paperwork. For a doctor, it’s a beautiful thing. Freedom to focus on your patients, not on forms and bookkeeping.

4). Minimizes overhead costs for the provider.

As a doctor, using superbills in your practice means you get to keep more of your hard-earned pay. When you opt out of dealing with insurance companies, you opt out of paying for 3rd party medical billing services too. Those companies are expensive, charging monthly fees and a percentage of your earnings to process insurance claims.

With superbills, it’s simple. The patient pays you in full after their visit, you provide them a receipt for services, and you keep what you earn. No middlemen taking a cut. No administrative hassle. Just you, the patient, and a straightforward cash transaction. The money stays where it should: in your pocket. Superbills equal simplicity and the ability to keep what you earn.

5). The provider gets reimbursed on the spot.

The superbill allows the physician to get paid right away. Instead of filling out forms and waiting weeks for the insurance companies to finally send a check, the physician can leave the office with cash in hand at the end of the day.

For a small practice, that steady flow of payments means the doctor can pay the rent and staff on time without worrying where the money will come from. The insurance companies make you jump through hoops before they’ll pay up. Lots of paperwork, phone calls, and headaches. The superbill skips all that complexities. The patient pays in full, the doctor provides the care, end of story.

The Drawbacks of Superbills

1). The provider must know how to create superbills compliant with each type of health insurance network.

For a doctor, superbills pose a problem as they permit the insurance outfits to audit your patient records. The minute a patient presents a superbill to request payment for your services, the insurance company is free to review your notes, documents, the whole kit and caboodle to establish whether your treatment was “medically necessary”.

Accordingly, if you employ superbills, you must become fluent in the documentation requirements. Your notes, treatment protocols, and assessments must satisfy the insurance company’s criteria; if not, your client won’t receive a penny in compensation. It’s a nuisance, but that’s the trade-off if you wish your patient to get reimbursed.

This makes superbills a bit of irritation for both patients (if they don’t get reimbursed) and for the provider (as the patient may blame the provider for not creating a superbill compliant with their insurance network).

2). The problem with superbills is patients don’t always understand the reimbursement they’ll receive.

The trouble with superbills is patients don’t always grasp what they’ll get back from insurance. When a fellow doesn’t understand what his plan covers for out-of-network care, he might think the company will pay more than they really will. Expecting a big reimbursement but receiving peanuts instead – or not a dime – well, that’s a nasty surprise that bites hard where it hurts most: the bank account. When these medical bills aren’t spelled out plain and simple, a patient’s budget really takes the punch.

How to create a Superbill: A step-by-step guide

To create superbills for your patients, the first thing you’ll want to do is find yourself a good software to help generate them. There are many third-party companies that offer platforms to quickly and easily create superbills. While the process may differ slightly between different software, the general steps remain the same.

1). To get started, you’ll enter the diagnosis code, known as the DX code, for your patient. The DX code indicates the primary diagnosis for the services provided. Entering the correct DX code is crucial, as an incorrect code can lead to a denied insurance claim.

2). You’ll also add the Place of Service or POS code, which specifies where the service took place. For example, in the office, in the patient’s home, etc.

3). Next, you’ll fill in the required fields in the superbill. For new patients, you’ll manually enter this information. But for returning patients, most superbill software will pre-fill these fields based on the patient’s profile. This includes basic information like the patient’s name, date of birth, address, phone number, and insurance details.

4). You’ll also enter details about your own practice, such as your name, email, NPI number, organization name, tax ID number, and office address.

5). To continue, you’ll enter your NPI number, a 10-digit ID issued to all healthcare providers under HIPAA, and your tax ID number. If another provider referred the patient to you, include their information as well.

6). You’ll then add the ICD-10 diagnosis code(s) to indicate the health issues you treated the patient for.

7). You’ll also add the CPT code(s) for the services provided, the number of units – as per the Medicare’s 8-minute rule, the fee per unit, and the total amount paid by the patient. For example, if you saw a patient for 60 minutes and charge $100 per hour, you would enter 4 units at $25 per unit, for a total of $100 paid.

8). In the billing section, enter the amount paid by the patient. Often they pay upfront and then get reimbursed by insurance later.

9). The superbill software will then automatically calculate the billing details, including any amount still owed by the patient.

10). Finally, you can add modifier codes to provide additional details about the services rendered.

Using Old Paper Superbills? Here’s A Better Way – Go Electric ⚡

Are you still using paper superbills?

Well, creating manual bills gives in to making more billing and coding errors while delaying the claim generation process.

The solution? E-superbills.

Creating e-superbills helps you save time and money, while reducing administrative burdens as lesser time is spent on creating bills electronically and more time is spent on providing quality patient care.

Shifting to e-superbills is easy with BellMedEx as our medical billing company has done it all. We are certified and trained experts who use integrated EHR software to speed up the superbill creation, submission, and collection process on the patient’s behalf.