As a medical provider, it’s important to understand how to read health insurance cards. These cards aren’t just pieces of plastic; they’re packed with vital information that helps you confirm a patient’s coverage, process claims accurately, and avoid costly mistakes.

But here’s the thing, insurance cards can be tricky. Every insurance company has its format and set of details, whether it’s Medicare or any private insurance provider.

Sometimes, the information you need might not be where you expect it, or it could be written in a way that’s hard to understand at first sight.

While reading an insurance card, issues and their consequences that providers providers may face include:

- Missing or incorrect information on the card can delay claim approvals.

- Patients have multiple insurance policies (secondary insurance, for example), which makes verifying coverage more complicated.

- Misreading or overlooking key details like policy numbers, group numbers, or prior authorization requirements leads to billing errors or claim denials.

That’s why healthcare providers must know exactly what to look for on these cards.

Familiarity with the format and key details on cards, you can minimize errors, save time, and ensure everything flows smoothly for you and your patients.

This guide will break down the essential parts of health insurance cards and explain the important parts in detail.

How to Read Health Insurance Cards?

Each insurance payer has unique systems, policies, and cards that healthcare providers must be familiar with to ensure smooth operations, from verifying patient eligibility to submitting claims.

For insurance cards, the information may be different and in different formats.

But, in general what an insurance card may look like and have information, let’s see below.

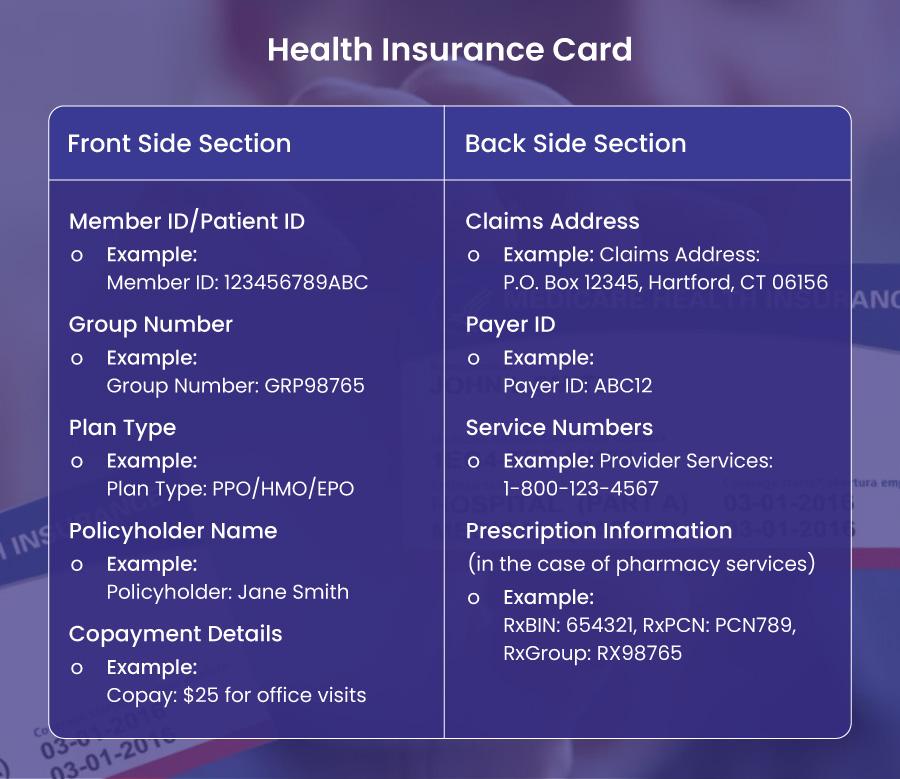

Sections of a Health Insurance Card

Health insurance cards generally have two main sections: the front and the back, each with its purpose.

Both sides may have different information.

➜ Front Section

The front of the card has several essential pieces of information that you’ll need to focus on:

1️⃣ Policyholder Name: This is the person who holds the insurance policy. It helps you determine whether the patient is the primary insured or a dependent. For example, the policyholder might be “Jane Smith.”

2️⃣ Patient/Member ID: This is the unique number assigned to the insured person, and it’s the most critical piece of information you’ll need when verifying coverage or submitting claims. Getting this number right is vital—one wrong digit can delay or deny claims. For example, you might see something like “123456789ABC.”

3️⃣ Group Number: If the patient’s insurance is through their employer, it links their coverage to the employer’s group plan. It’s crucial for processing claims under the correct plan. For example, a group number might be “GRP98765.”

4️⃣ Plan Type: This tells you whether the patient’s coverage is an HMO, PPO, EPO, or another type of plan. This can affect the patient’s network options, copayments, and other details. For instance, a “PPO” plan would give the patient more flexibility in choosing healthcare providers.

5️⃣ Copayment Details: The front of the card often lists the patient’s copayments for certain services, like office visits or emergency care. For example, a copayment might be “$25 for office visits.”

➜ Back Section

The back of the card typically contains information related to claims and customer support, such as:

1️⃣ Claims Address: This is where you should send any paper claims. It’s vital to ensure you have the correct address to avoid processing delays. For example, it might say, “P.O. Box 12345, Hartford, CT 06156.”

2️⃣ Payer ID: This alphanumeric code is used when submitting claims electronically. It helps ensure that claims are processed quickly and correctly. For example, you might see something like “ABC12.”

3️⃣ Customer Service Numbers: Customer Service Numbers are for general inquiries, eligibility questions, and billing issues. Some cards may have separate numbers for providers and members. For instance, “Provider Services: 1-800-123-4567.”

4️⃣ Prescription Information: This section provides essential details needed for pharmacy claims, such as the RxBIN, RxPCN, and RxGroup numbers. These are typically found under a “Pharmacy Benefits” section.

Reading Patient’s Health Insurance Cards from Major Payers

There are a number of insurance payers in the US healthcare market. We will cover some major payers and their insurance cards in detail.

These include:

- Medicare

- Aetna

- Cigna

- UnitedHealthcare

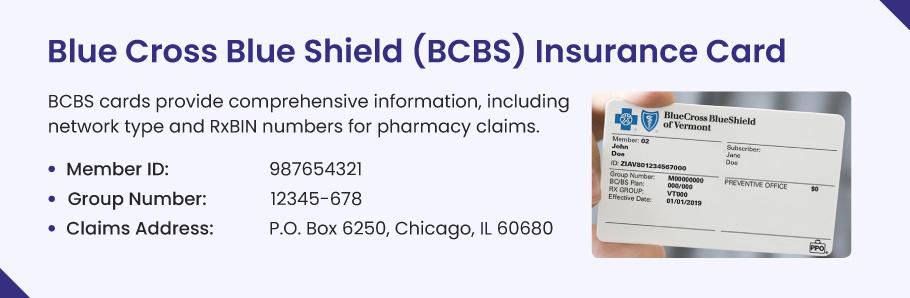

- Blue Cross Blue Shield (BCBS)

Each insurance company has its format and system for issuing cards, so it’s essential to recognize how they present key information.

Let’s break down what to look for on the cards from each of these payers.

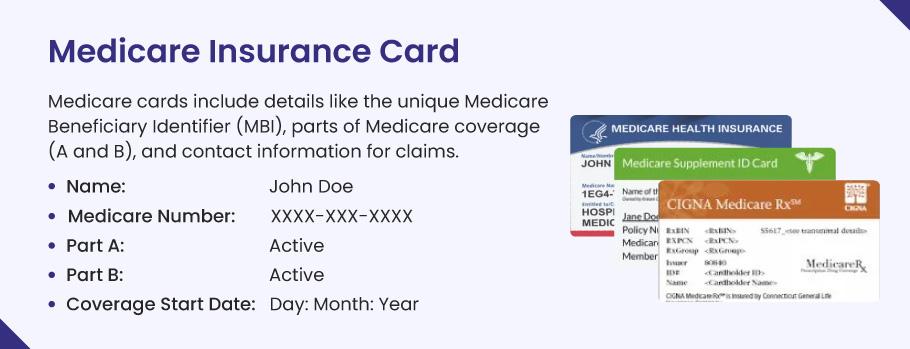

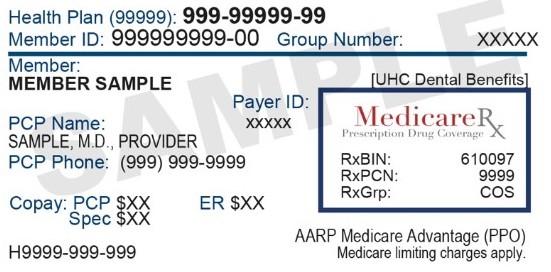

1). Reading the Medicare Insurance Card

Medicare is a federal health insurance program primarily for individuals aged 65 or older and some younger individuals with disabilities. The Medicare insurance card has some distinct features that differentiate it from private insurance cards. Medicare is divided into different parts:

- Part A covers hospital insurance (inpatient care, skilled nursing facilities, hospice, and some home health services).

- Part B covers medical insurance (doctor visits, outpatient care, and some preventive services).

- Part C (Medicare Advantage) combines Parts A and B into one plan, often with additional benefits, and is offered through private insurance companies.

- Part D covers prescription drug plans.

Medicare beneficiaries are issued a Medicare card that provides essential information such as a unique Medicare Payer ID number/EDI number on the insurance card, plan coverage, and provider services contact details.

General information on a Medicare Insurance Card is as follows:

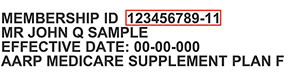

➜ Medicare ID Number: Medicare cards no longer display the beneficiary’s Social Security Number (SSN) for privacy reasons. Instead, they feature a unique Medicare number, a Medicare Beneficiary Identifier (MBI). This 11-character identifier is used to process claims and confirm eligibility.

➜ Part A and Part B Coverage: The card will indicate which parts of Medicare the beneficiary is enrolled in (Part A, Part B, or both).

➜ Supplemental Insurance: If the patient is covered by a Medicare Advantage plan (Part C) or a Medigap policy (a supplemental plan), this may be indicated on the card or included as additional coverage information.

➜ Claims Address: Typically, Medicare will have a centralized claims address that providers should use to submit paper claims. The provider will use the payer ID on the insurance card associated with Medicare for electronic claims.

➜ Expiration Date: Medicare coverage does not expire in the traditional sense as long as the beneficiary remains eligible. However, specific dates might indicate when certain parts of the coverage, like a supplemental policy, will be renewed.

| Example of a Medicare Card Layout | |

| Medicare Number: | 1EG4-TE5-MK72 |

| Name: | John Doe |

| Part A: | Active |

| Part B: | Active |

| Claims Address: | P.O. Box 1234, Baltimore, MD 21201 |

| Medicare Beneficiary ID: | The identifier will be in place of the SSN. |

Since Medicare is a federal program, the cards are standardized. Still, eligibility and coverage details can vary depending on the beneficiary’s enrollment in additional programs like Medicare Advantage or Medigap plans.

Additional Medicare Cards that the patient might have:

These cards also work alongside the main Medicare card of a patient. Therefore, you (as a healthcare provider) must also confirm these cards during patient intake to prevent billing errors and coverage gaps.

Medicare Supplement (Medigap) Card

Issued by:

- Private insurers (e.g., Aetna, Cigna, Mutual of Omaha).

Key Features:

- States “Medicare Supplement” or “Medigap” + plan type (e.g., Plan G).

- Includes the insurer’s name and policy effective date.

Why Verify?

- Medigap covers copays, coinsurance, or deductibles not paid by Original Medicare.

- Missing this card = Risk of unpaid balances (patient may be billed).

Provider Action:

“Ask for both the Original Medicare card and the Medigap card to confirm secondary coverage.”

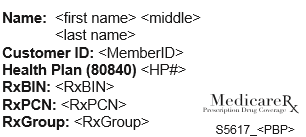

Medicare Part D (Prescription Drug Plan) Card

Issued by:

- Stand-alone Part D insurers (e.g., CVS Caremark, Humana, Wellcare).

Key Features:

- Lists Rx-specific details: RxBIN, RxPCN, RxGrp numbers.

- May include the plan’s formulary tiers.

Why Verify?

- Pharmacies require this card to process claims under Part D.

Exception: If the patient has a Medicare Advantage Plan with drug coverage (MAPD), they may not have a separate Part D card.

Provider Action:

- “Check for a Part D card unless the patient has a Medicare Advantage Plan that includes drug coverage.”

Medicare Advantage (Part C) Plan Card

Issued by:

- Private insurers (e.g., UnitedHealthcare, Kaiser Permanente, Blue Cross Blue Shield).

Key Features:

- Replaces Original Medicare (covers Part A + Part B, sometimes Part D).

- Lists plan ID, network restrictions, and customer service numbers.

Why Verify?

- Patients must use their Medicare Advantage card (not Original Medicare) for services.

- Original Medicare claims will be denied if the patient is enrolled in Part C.

Provider Action:

- “Always check the Medicare Advantage card for network rules and prior authorization requirements.”

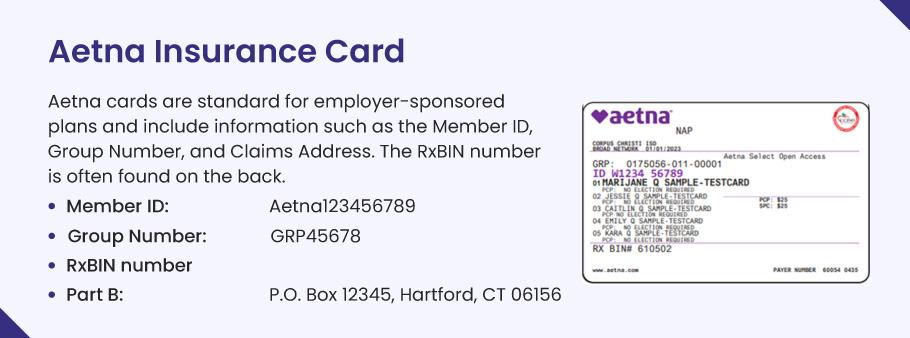

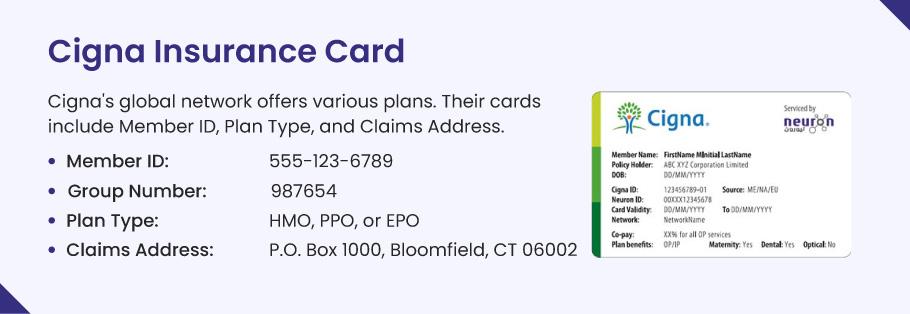

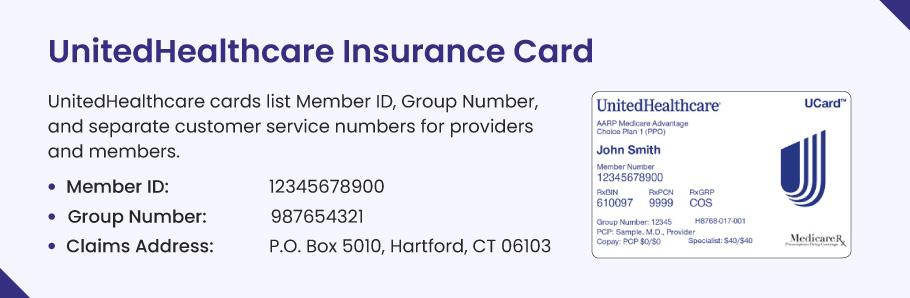

2). Reading Patient Health Insurance Cards Issued by Aetna, Cigna, UnitedHealthcare, BCBS and others

Health insurance cards, regardless of the payor, follow a standardized format to help healthcare providers quickly access critical information for billing, claims, and patient care.

While designs and labels may vary slightly between companies like Aetna, Cigna, UnitedHealthcare, or Blue Cross Blue Shield (BCBS), the core details remain consistent.

Let’s tell you how to interpret these cards efficiently, with notes on subtle differences between major payors.

Universal Elements on the Healthcare Payor Insurance Cards

Every payor insurance card includes essential details that providers need to verify coverage, submit claims, and process prescriptions.

1). Member ID (or Policy Number)

The Member ID is a unique identifier for the patient and is always prominently displayed on the front of the card. This number is required for verifying eligibility, submitting claims, and coordinating referrals. Labels like “Member ID,” “Subscriber ID,” or “Policy Number” are commonly used.

2). Group Number

The Group Number identifies the employer or organization sponsoring the insurance plan (if applicable). It is typically located near the Member ID on the front of the card. This number helps match the patient to their specific group plan, which is especially important for employer-sponsored coverage.

3). Plan Type

The Plan Type (e.g., HMO, PPO, EPO) is usually listed on the front or back of the card and indicates network rules. For example, HMO plans often require referrals, while PPOs allow out-of-network care at higher costs. This information is critical for avoiding claim denials related to authorization or network restrictions.

4). Claims Submission Details

Insurance cards include a claims address for paper submissions and a 5-digit Payer ID for electronic claims via EDI (Electronic Data Interchange). The Payer ID may not always be printed on the card but can be found on the insurer’s website. For example, Aetna’s Payer ID is 87654, while UnitedHealthcare uses 87726.

5). Policyholder Name

If the patient is a dependent (e.g., a child or spouse), the primary policyholder’s name will appear on the card, often labeled “Policyholder” or “Subscriber.” Verify this name against the patient’s records to ensure coverage validity.

6). Pharmacy Benefits (RxBIN, RxPCN, RxGroup)

These numbers, essential for processing prescriptions, are typically found under a “Pharmacy Benefits” section on the back of the card. The RxBIN (Bank Identification Number) is the most critical, as it identifies the pharmacy benefits manager.

7). Customer Service Contact

A customer service phone number for providers is usually listed on the front or back of the card. Use this for eligibility checks, billing questions, or claims support.

🔵 Payor-Specific Notes

While the core elements are universal, subtle differences exist between insurers:

Aetna: Look for the plan name (e.g., “Aetna HMO”) near the Member ID. Their electronic claims Payer ID is 87654, and some cards include a dedicated “RxBIN” label in the pharmacy section.

Cigna: The term “Cigna ID” may replace “Member ID.” Their Payer ID for electronic claims is 62308, and pharmacy identifiers are often grouped under “Prescription Benefits.”

UnitedHealthcare (UHC): Member IDs may include prefixes like “UHC” or “UHG.” Use Payer ID 87726 for electronic claims. Check the card’s back for regional claims addresses if the patient has a Medicare Advantage plan.

Blue Cross Blue Shield (BCBS): BCBS operates through 36 regional companies (e.g., BCBS of Texas, Anthem BCBS). The regional logo will appear on the card, and Payer IDs vary by location. Always confirm the correct Payer ID on the BCBS portal or card.

💬 How to Locate the Rx BIN Number on an Insurance Card?

The Rx BIN number is a 6-digit code used to process pharmacy claims electronically. Here’s how to find it quickly:

➜ Check the Front of the Card: Look near the “Pharmacy Benefits” section or close to the Rx PCN and Rx Group numbers (often labeled as “RxBIN”).

➜ Check the Back of the Card: Some cards list pharmacy details like the Rx BIN on the back.

➜ Call the Insurance Company: If you can’t find it, call the customer service number on the card for help.

💬 Why It Matters?

The Rx BIN number, along with the PCN and Group number, helps pharmacies confirm a patient’s insurance coverage immediately—even if their details haven’t fully loaded into the pharmacy’s system yet. This is especially important during common insurance changes, such as:

- Starting a new job with different health coverage.

- Switching to a Medicare or Medicaid plan.

- Upgrading to a new plan during open enrollment.

For example, if a patient’s insurance recently changed (like after getting a new job), their pharmacy might not see their updated coverage in the system for 1–2 days. Without the Rx BIN, PCN, and Group number, the pharmacy can’t bill their insurance right away, which could delay the patient’s medication.

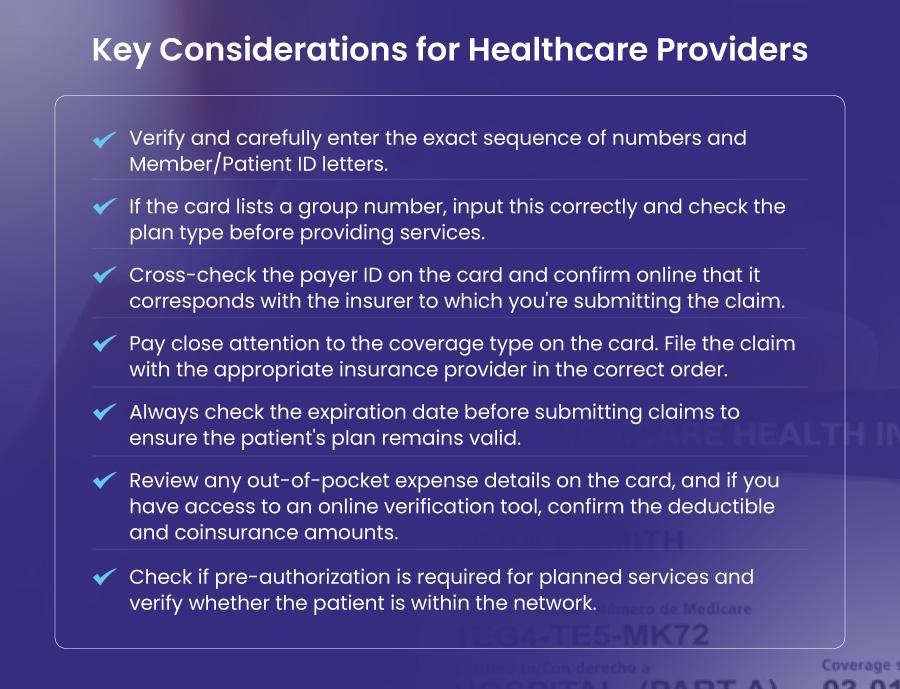

Key considerations for Healthcare Providers when interpreting a patient’s insurance card

Interpreting a patient’s insurance card accurately is crucial for seamless billing and patient satisfaction. Below, we break down the process into actionable steps to guide your workflow:

1. Verify the Member ID Number

The Member ID is the patient’s unique identifier and the linchpin of claims processing. Even minor errors (e.g., mistyping “W1234X” as “1234”) can lead to denials. Always double-check the alphanumeric sequence, including prefixes or suffixes. If the ID is unclear, ask the patient to confirm or contact the insurer directly.

2. Confirm Payer Information

- Payer ID: This 5-digit code (e.g., 87726 for Aetna) ensures electronic claims route to the correct insurer. Never guess—verify it through your billing software or the payer’s portal.

- Claims Address: While rarely used for paper claims today, ensure it matches the insurer’s current submission guidelines.

💡 Tip: Similar plan names (e.g., “Blue Cross Blue Shield of Texas” vs. “Illinois”) often have different payer IDs. Cross-reference carefully.

3. Understand Plan Type and Network Restrictions

- HMO: Requires referrals for specialists and limits coverage to in-network care.

- PPO/EPO: Offers flexibility but may charge higher out-of-network fees (PPO) or restrict non-emergency care to the network (EPO).

💡 Why it matters: A patient’s card may say “PPO,” but your practice might still be out-of-network. Always confirm your status with the insurer.

4. Check the Group Number (When Applicable)

Common in employer-sponsored plans, the group number links the patient to their company’s policy. If absent (e.g., Medicare Advantage plans), contact the payer for clarification. This avoids misrouting claims, especially during policy renewals (e.g., 2023 vs. 2024 plans).

5. Review Coverage Dates

Look for effective dates (start of coverage) and expiration dates (if listed). Services outside active dates will be denied. If a plan is nearing expiration, verify eligibility electronically—patients may assume auto-renewal, but gaps (e.g., unpaid premiums) can occur.

6. Coordinate Benefits for Secondary Insurance

If the card lists “Secondary” or “Coordination of Benefits,” ask the patient for details (e.g., a spouse’s plan or Medicaid ID). Billing the wrong insurer first delays reimbursement and frustrates patients.

7. Anticipate Plan-Specific Requirements

- Pre-authorizations: Assume high-cost services (e.g., surgeries, MRIs) require prior approval, even if the card doesn’t specify it.

- Cost-sharing: Cards rarely list deductibles or copays. Use real-time eligibility tools to confirm patient responsibility.

8. Resolve Red Flags Immediately

Address missing data, expired plans, or unclear payer details before providing care. For example:

- A Medicaid card without a valid ID? Contact the state for eligibility.

- An employer plan with no group number? Call the payer to confirm.

Pro Tip: Leverage Technology

Insurance cards can be outdated. Use electronic eligibility verification tools for real-time coverage details. When in doubt, call the payer’s provider line—it’s faster than appealing a denial later.

Frequently Asked Questions (FAQs)

What should healthcare providers do if a patient loses their Medicare card?

If a patient loses their Medicare card, healthcare providers can help by sharing two simple ways to replace it.

- First, the patient can visit Medicare.gov to print a temporary card or order a new one to be mailed.

- Second, they can call 1-800-MEDICARE (1-800-633-4227) for help.

In the meantime, providers can still check the patient’s coverage using their Medicare number (called an MBI), which is usually saved in past records. Remind the patient to share their new number once they get it, so future claims go smoothly.

What does the “issuer” mean on an insurance card?

The issuer is the company or program that provides the insurance. For example, it could be a private company like Blue Cross Blue Shield, or a government program like Medicare or Medicaid. Knowing the issuer helps healthcare providers send bills to the right place. For instance, Medicare bills go to the government, while Aetna bills go to Aetna. Always double-check the issuer name on the card to avoid billing mistakes.

What is a PCN on an insurance card?

A PCN (Processor Control Number) is a special code used mainly for pharmacy claims. It helps pharmacies process prescriptions correctly under the patient’s plan. Healthcare providers don’t need this for regular medical bills, but pharmacists do. If you don’t see a PCN on the card, check the back for pharmacy details or ask the insurance company.

How do I read an insurance card correctly?

To read an insurance card, start by checking these key details:

- Patient’s name and ID number (this is unique to them).

- Insurance company name (the issuer, like Cigna or Medicare).

- Group number (if they have insurance through work or a group).

- Plan type (like HMO or PPO—this affects referrals).

- Customer service phone number (to call for questions).

Also, check the dates to make sure the plan is still active. If anything looks wrong, ask the patient to confirm with their insurance company.

What is a group number on an insurance card?

A group number is a code for people who get insurance through their job, union, or another group. It helps the insurance company know which company or organization pays for the plan. Not all cards have this—for example, Medicare or individual plans usually don’t use group numbers. If you see a group number, include it when billing to avoid errors.

What’s the difference between a policy ID and a plan number?

The policy ID is the patient’s personal insurance number, like a membership ID. The plan number refers to the specific package their group or employer chose (like a basic plan or premium plan). Both numbers help the insurance company process claims correctly. Always write down both if they’re on the card.

Where is the group number on an insurance card?

Look for the words “Group #” or “Group Number” on the front or back of the card. It’s often near the patient’s ID number. If you can’t find it, the patient might not have one (common with Medicare or individual plans). You can also ask the patient to check with their employer or insurance company.

Do all insurance cards have a group number?

No. Group numbers only appear on cards for people with insurance through a job, union, or group. If someone has Medicare, Medicaid, or bought their own plan (like through the Health Insurance Marketplace), the card won’t have a group number. For these plans, use the patient’s personal ID number instead.

![You are currently viewing How to Read a Patient’s Health Insurance Card? [Complete Guide]](https://bellmedex.com/wp-content/uploads/2025/02/reading-health-insurance-cards.jpg)