In medical billing, understanding write-offs helps healthcare providers maintain financial health. A write-off is the amount a provider reduces from a charge because they cannot collect it from a patient or payer. This can happen for various reasons, including insurance denials or patient financial difficulties.

While write-offs can sometimes be an agreed-upon reduction, they can also lead to bad debt and significant revenue loss if not managed correctly. This article breaks down what write-offs are, how they differ from adjustments, when to write off a claim, and how to avoid unapproved or unnecessary write-offs.

One quick thing; we know that effective provider write-offs and precise claim management are important. That’s why, we help you manage them with our expert medical billing RCM specialists. Get free consultation with us to learn how.

What is Provider Write Off in Medical Billing?

A provider write-off in medical billing is the portion of a billed charge that a healthcare provider decides not to collect, either from the patient or insurance company. It occurs when a provider is unable to collect the full amount for a service rendered, usually due to agreements with insurance companies, legal requirements, or internal policies.

Write-offs are important for maintaining accurate financial records and ensuring compliance with various contractual or regulatory standards. Instead of continuing to pursue payment for these uncollectible amounts, providers “write them off” as unpayable.

For example, if a healthcare provider charges $700 for a procedure, but the insurance company’s contract stipulates a payment of only $500, the $200 difference is written off as a contractual adjustment. This is a common form of write-off that happens in healthcare. Another example could be when a patient’s balance is too small to justify collection efforts.

💡 What’s the difference between Write-Offs and Adjustments in Medical Billing?

Write-offs and adjustments are two different terms in medical billing, although they are sometimes used interchangeably.

A write-off refers to a decision by the healthcare provider to forgive or not collect payment for a specific amount. This may happen for various reasons, such as patient financial hardship or payer contractual limits. Write-offs are voluntary reductions in what the provider originally charged.

On the other hand, an adjustment in medical billing is a modification made to correct a claim or comply with insurance policies. This can include discounts based on insurance agreements or correcting billing errors.

For example, if a procedure costs $90 and the insurer pays $80, the remaining $10 is a contractual adjustment. While write-offs are typically a choice made by the provider, adjustments ensure that the claim aligns with the terms of the insurance contract.

Major Types of Provider Write Offs

Here are some examples of provider’s write offs:

- Contractual Write-Offs

- Bad Debt Write-Offs

- Charity Care Write-Offs

- Small Balance Write-Offs

- No Insurance Write-Offs

- Promotional Write-Offs

- Timely Filing Write-Offs

- Uncredentialed Write-Offs

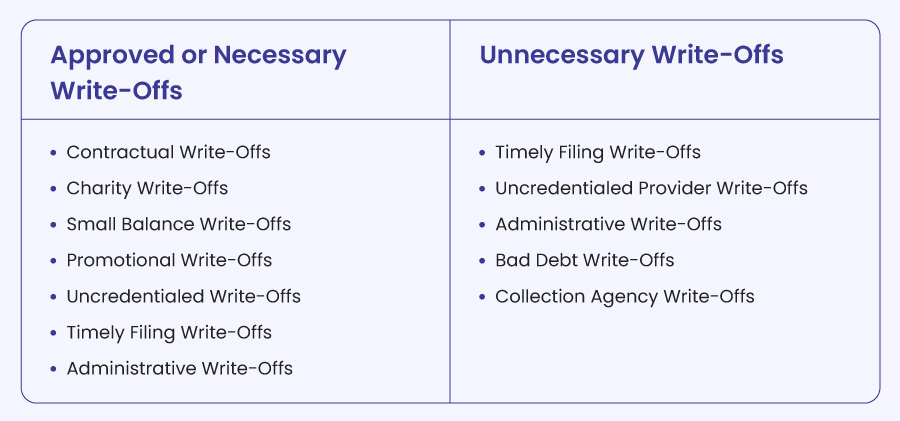

➜ Approved or Necessary Write-Offs

These write-offs are unavoidable and are part of the financial policies or contractual agreements between the provider and the payer.

Contractual Write-Offs

Contractual write-offs are necessary when a healthcare provider agrees to accept a lower payment from an insurance company than what was billed. This write-off is due to the allowable fee set by the payer, as per the terms of the contract.

For example, if a provider bills $1,000 for a service but the insurer’s contract allows only $700, the $300 difference is written off.

Charity Write-Offs

Charity write-offs are offered when a provider forgives a portion or the entire bill for patients who cannot afford to pay. This usually occurs when the patient qualifies for a financial assistance program due to their low income. These write-offs reflect the provider’s commitment to serving the community.

Small Balance Write-Offs

Small balance write-offs occur when the outstanding amount is too small to justify the administrative effort of billing or collection. For example, if a patient owes $12, the provider may choose to write off the balance rather than spending time and resources to collect it.

These write-offs are commonly seen when the amount is under $15 or $20, and the provider may add it to a future visit or simply let it go.

Promotional Write-Offs

Promotional write-offs are offered to encourage patients to pay in full at the time of service. This is common for self-pay patients who do not have insurance. For example, if patients paying out of pocket agree to pay in full during their visit, doctors might offer a discount or reduce the bill.

➜ Unnecessary Write-Offs

Unnecessary write-offs are avoidable and occur due to errors or inefficiencies in the billing process and are avoidable.

Timely Filing Write-Offs

Timely filing write-offs occur when claims are submitted after the payer’s deadline. Each insurer has specific filing timeframes, such as Medicare requiring claims to be filed within 12 months. If your practice misses these deadlines, you may have to write off the charges.

To avoid this, track claim submission deadlines carefully and set reminders to ensure timely filings for each payer.

Uncredentialed Provider Write-Offs

Uncredentialed provider write-offs happen when claims are filed for a provider who isn’t yet credentialed with the insurance company. This results in a denial of the claim and a write-off of the amount.

To avoid this, always verify the provider’s credentialing status with the payer before providing services. If needed, inform patients about non-covered services or self-pay options in advance.

Administrative Write-Offs

Administrative write-offs are granted when mistakes occur in the practice, such as when a provider mistakenly tells a patient that they are in-network with their insurance, but they are not. These situations may result in the practice writing off the charges as a courtesy.

To minimize these errors, ensure your team is well-trained on insurance verification and communicate clearly with patients about in-network and out-of-network status.

Collection Agency Write-Offs

Collection agency write-offs occur when unpaid balances are transferred to a third-party agency. These amounts are no longer pursued by the provider but are instead handled by the collection agency. However, they should not be forgotten entirely.

Monitor accounts with unpaid balances and only schedule new appointments after patients agree to a payment plan.

Bad Debt Write-Offs

Bad debt write-offs occur when a provider chooses not to pursue payment from a patient or insurance company due to unsuccessful collection efforts. This usually happens after several attempts to collect payments have failed.

To reduce bad debt, ensure your practice follows up on outstanding balances, verifies insurance coverage before services are rendered, and offers payment plans when necessary.

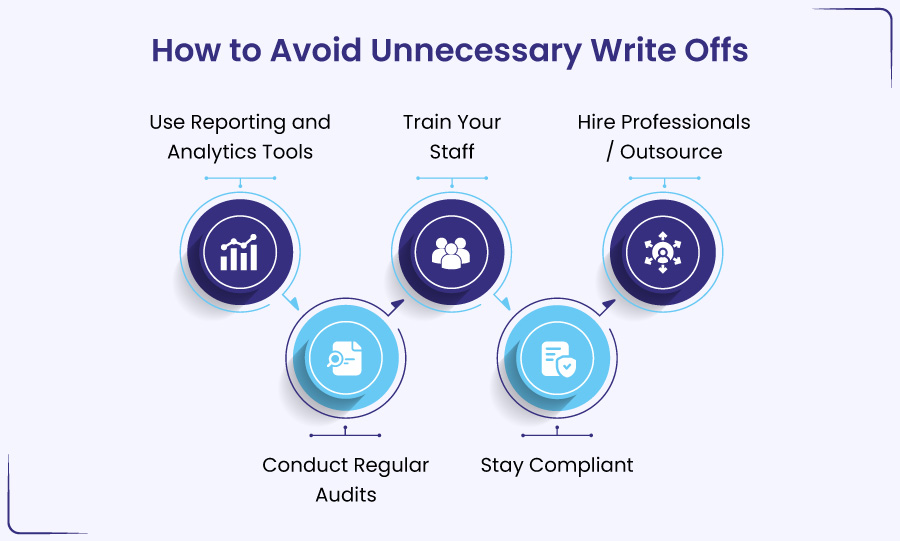

How to Avoid Unnecessary Write Offs

Avoiding unnecessary write-offs can significantly improve your practice’s bottom line.

Here are effective strategies to minimize revenue loss.

1. Use Reporting and Analytics Tools

Take advantage of medical billing software with built-in analytics. These tools can spot trends and areas where you’re losing money, allowing you to act before write-offs happen.

2. Conduct Regular Audits

Perform internal audits to identify any recurring issues, such as incorrect coding or billing mistakes. By catching these errors early, you can avoid unnecessary write-offs.

3. Train Your Staff

Ongoing training for your billing and coding team is essential. Ensure they understand the latest industry regulations and know the correct procedures to follow. Well-trained staff make fewer errors, which reduces write-offs.

4. Stay Compliant

To prevent denials and bad debts, make sure to follow all payer requirements, including insurance verification, pre-authorizations, and timely claims submission. Compliance with these rules is key to avoiding unnecessary write-offs.

5. Hire Professionals / Outsource

Consider bringing in experts who specialize in medical billing like BellMedEx. Our experience can help you avoid mistakes that lead to write-offs and ensure your claims are properly submitted. You can schedule FREE consultation right away to learn how.

Can Doctors Write Off Unpaid Bills?

Yes, doctors can write off unpaid bills, but the process and reasons behind it vary based on the situation and the policies of the medical practice. There are several scenarios where write-offs may be appropriate, for example, bad debt, charity care, small balance, etc.

But you must take care of these points, when writing off unpaid bills:

- Ensure that write-offs are well-documented and compliant with internal policies.

- Constantly monitor unpaid bills and analyze patterns to minimize future write-offs.

- Adhere to IRS guidelines for bad debt deductions while maintaining efficient billing practices to minimize unnecessary write-offs.

Can a Provider Write Off a Deductible?

Providers cannot write off deductibles because these amounts are parts of the patient’s financial responsibility. Writing off deductibles, copayments, or coinsurance can violate insurance contracts and may lead to contract termination, HIPAA violations, or even charges of fraud. It can also run afoul of the federal Anti-Kickback Statute (AKS), which is a felony.

But there are limited exceptions where providers might waive fees, such as in hardship cases or charity care. Even so, the decision to lower or remove a copay or deductible must be made for each case separately and cannot be done regularly.

Always, consult with an attorney or a billing specialist like BellMedEx to understand the specific rules and regulations that apply to your situation. Speak to our medical billing specialist now.

When Can You Write Off Medical Bills?

You can write off medical bills on your taxes if they exceed 7.5% of your adjusted gross income (AGI) and you itemize your deductions on Schedule A (Form 1040). This includes payments for diagnosis, treatment, prevention, and other medical care expenses that aren’t reimbursed by insurance.

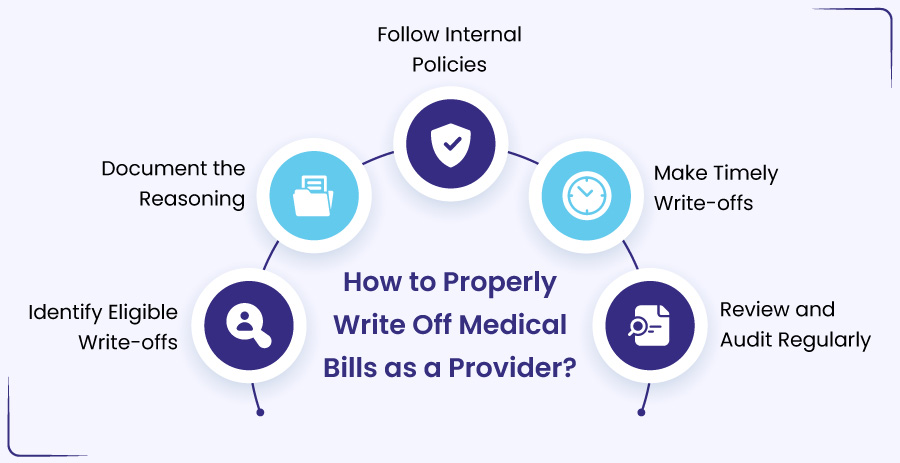

🛈 How to Properly Write Off Medical Bills as a Provider?

Let us share quick, actionable steps on how to rightly write off as a provider.

1. Identify Eligible Write-offs

- Review the claim to determine if it qualifies for a write-off.

- Look for reasons like insurance denials, patient financial hardship, or billing errors.

- Assess if the bill is uncollectible due to coverage limits or patient circumstances.

2. Document the Reasoning

- Keep detailed records of why you are writing off the bill.

- Note if it’s due to a payer’s denial, a patient’s inability to pay, or a contract issue.

- Ensure you document any supporting evidence like financial hardship applications or denial letters.

3. Follow Internal Policies

- Establish clear guidelines for when and how to write off claims.

- Ensure your policies are consistent with legal and ethical standards.

- Review your policies regularly to prevent unnecessary write-offs.

4. Make Timely Write-offs

- Once eligibility is determined, write off the claim immediately.

- Enter the write-off in your general ledger to avoid confusion later.

- Promptly mark unpaid claims as “not to be pursued” for future follow-ups.

5. Review and Audit Regularly

- Periodically audit your revenue cycle to identify trends in write-offs.

- Review your practice’s financial health to ensure you’re not overusing write-offs.

- Retrain your billing staff as needed to maintain accuracy and efficiency in the process.