It is useless to cry over denied claims due to medical coding errors or other possible reasons. Therefore, conducting a thorough medical coding audit is compulsory for the smooth performance of your healthcare practice.

You might have heard about the Trojan Horse…

“If the Troy troops had inspected the Trojan Horse, the Troy would not have fallen.”

So, be cautious about forthcoming risks before it’s too late, and you sit scratching your head, saying, “Would that I had audited claims before submitting them to the payers…”

What is a Medical Coding audit?

Healthcare practices conduct medical coding audits, either internally or externally, to ensure accuracy, compliance, and proper reimbursement. This proactive approach also helps to avoid potential charges for fraudulent activities that can result from audits conducted by state or insurance payers.

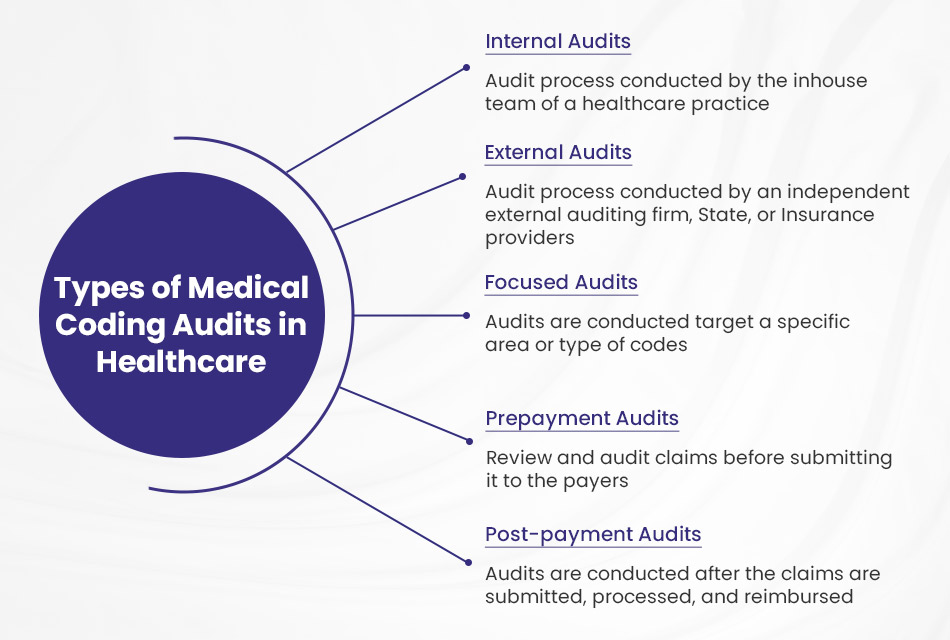

Types of Medical Coding Audits in Healthcare

The healthcare industry conducts medical coding audits using a variety of methods. They are:

- Internal Audits

- External Audits

- Focused Audits

- Prepayment Audits

- Post-payment Audits

Internal Audits

Internal audits are audit processes conducted by the in-house team of a healthcare practice within an organization. They are comparatively less expensive, but due to the internal auditors’ incomplete knowledge and lack of experience, they may not produce effective results.

Internal audits evaluate internal control, risk management processes, and operational efficiency within a healthcare organization. They also play a crucial role in identifying weaknesses and areas for improvement, thereby enhancing the practice’s overall performance.

Furthermore, they also assess coding accuracy and adherence to organizational policies and procedures.

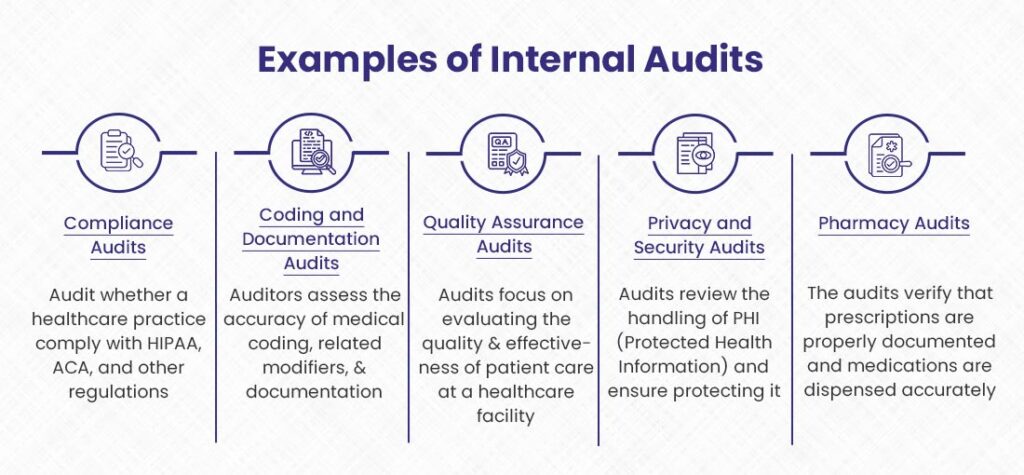

Some examples of internal audit are:

1). Compliance Audits

Compliance audits fall under the umbrella of internal audits. Their primary purpose is to ensure adherence to regulatory standards. Internal auditors check whether a healthcare practice complies with HIPAA, Affordable Care Act (ACA), and other regulations related to the healthcare industry.

2). Coding and Documentation Audits

During the coding and documentation audit, auditors assess the accuracy of medical coding, related modifiers, and completeness of documentation for treatment procedures. They ensure that a medical coder at the healthcare practice adequately documents patient visits and can support medical necessity for the services rendered to get proper reimbursement.

3). Quality Assurance Audits

Quality Assurance Audits are another subtype of internal audits that focus on evaluating the quality and effectiveness of patient care at a healthcare facility. The internal auditors review medical records, treatment protocols, and the facility’s performance to identify areas for improvement.

4). Privacy and Security Audits

Privacy and security audits review the handling of PHI (Protected Health Information) and ensure its protection. They also execute compliance guidelines issued by the HHS (Department of Health and Human Services).

5). Pharmacy Audits

Pharmacy audit is the process of reviewing medication dispensing, inventory management, and compliance with pharmacy regulations. The auditors verify that prescriptions are appropriately documented and medications are dispensed accurately.

External Audits

An external audit is a medical coding audit process conducted by an independent external auditing firm, State, or Insurance provider.

Here a team of professionals typically conducts the external audit to deliver the best results to a healthcare practice. They have extensive knowledge in the field of medical coding. The purpose of the external audit, carried out by a third-party firm, however, not by Insurance providers or the State, is to review the overall performance of a healthcare organization, find and correct any error that can raise a red flag for insurance payers, and to verify coding guidelines and regulations.

Some examples of external audits are:

1). Commercial Payer Audits

Commercial payer audits are conducted by insurance companies or commercial payers. The auditors review claims and billing procedures. The primary purpose of this audit is to ensure accuracy, detect fraudulent activities, and assess compliance with payers’ policies. Healthcare facilities usually conduct these audits when they raise a red flag due to not following healthcare protocols.

2). Federal Government Audits

In addition to insurance providers, when your healthcare practice raises a red flag, it can become vulnerable to federal government audits. Audits performed by government agencies, such as CMS, are called federal government audits.

The main aim of these audits is to ensure compliance of the practice with government healthcare programs like Medicaid and Medicare, reviewing claims and billing procedures, and monitoring the overall performance of the practice’s transparency in services provided to patients.

3). Third-Party Expert Audits

Third-party expert audits are proactive, independent reviews of a healthcare organization’s operations, conducted by specialized audit firms. They help identify deficiencies and vulnerabilities before government audits, allowing time for corrections. Healthcare providers commonly outsource these audits across areas like billing, coding, cybersecurity, HIPAA compliance, and patient safety. By self-identifying issues ahead of time, providers can avoid penalties and scrutiny from payers and regulators.

For example, a medical group might hire an auditing firm to evaluate its charge capture and coding processes annually. The audit would inspect a sample of past claims to check for errors or upcoding issues. It would also examine the workflows, technology, and staff training related to billing and coding. The group could then fix any problems prior to a Medicare audit.

Other Types of Medical Coding Audits

Internal and external audits are the two main types of medical coding audits. However, there are some more types of coding audits in healthcare as well. These are:

Focused Audits

A focused medical coding audit is a strategic quality assurance initiative that entails an in-depth examination of a specific subset of codes or coding areas identified as high-risk or error-prone within a healthcare provider’s revenue cycle operations.

Unlike comprehensive audits that assess coding accuracy across all areas, these audits channel resources toward evaluating coding practices in targeted domains where coding errors, overcoding, or undercoding may have an outsized impact on reimbursement and compliance. Common targets include high-dollar procedure codes, complex diagnosis coding for conditions like sepsis or respiratory failure, and coding for services furnished in high-risk clinical areas like the emergency department.

Prepayment Audits

In Prepayment or Prospective audits, professional auditors review and audit claims before submitting them to the payers. They identify and correct errors that could impact reimbursement.

Post-payment Audits

Post-payment audits, called Retrospective audits, are conducted after the claims are submitted, processed, and reimbursed. The coders review the submitted claims during the current audit and understand the current trends in medical coding while comparing past audits with present ones.

Claim your FREE medical coding audit now and unlock the key to maximizing your earnings.

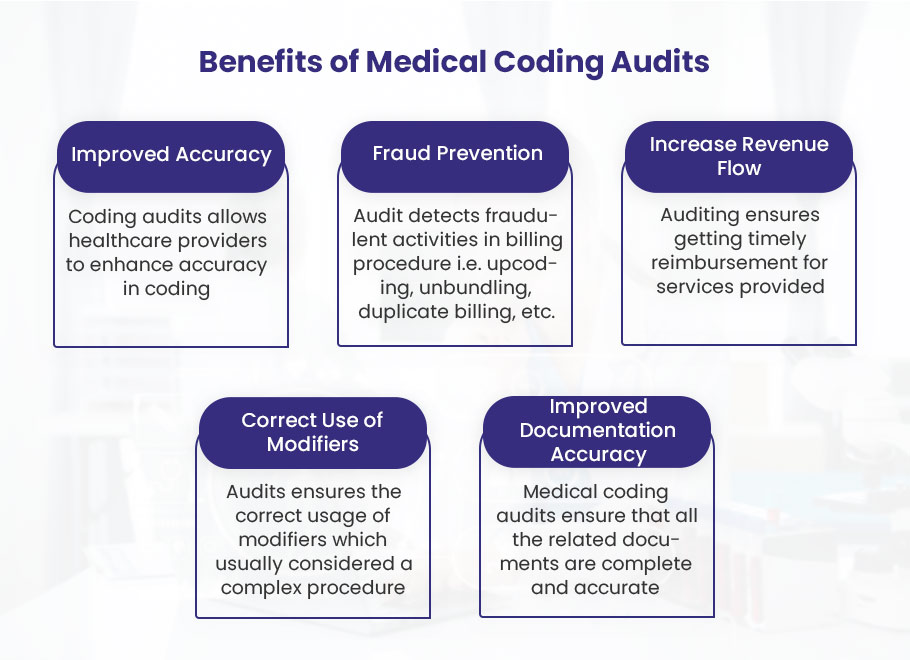

Key Benefits of Medical Coding Audits

It is essential to remember that medical coding audits are crucial for managing healthcare facilities’ revenue cycles and protecting them from fraudulent activities. Here are some expected benefits of medical coding audits for healthcare practices.

☑️ Improved Accuracy

Medical coding audits allow healthcare providers to enhance coding accuracy, reduce claim denials, and ensure proper reimbursement. During the audit process, auditors identify and correct errors that improve coding quality and mitigate the risks of external audits conducted by the federal government or insurance providers.

☑️ Fraud Prevention

Medical coding audits detect fraudulent activities in billing procedures, such as upcoding, unbundling, duplicate billing, and billing for unnecessary services provided. This will help the healthcare practice reduce losses and avoid being vulnerable to legal penalties.

☑️ Increased Revenue Flow

Medical coding auditing ensures timely reimbursement for services provided, increasing revenue flow to your healthcare practice. Approximately 70% of healthcare practices revealed that they had made losses due to improper coding and billing. Auditing mitigates these errors. So, correct documentation of services and submitting bills with appropriate codes can reduce the risks of losses.

☑️ Correct Use of Modifiers

Audits ensure the correct usage of modifiers, which is usually considered a complex procedure. Sometimes, expert coders make mistakes while adding a modifier to the CPT code. A medical coding audit helps to find missing or wrongly placed modifiers and correct them before submitting claims to payers to lessen the ratio of denials.

☑️ Improved Documentation Accuracy

Accurate documentation within a healthcare practice is essential for patient quality care, proper billing, and legal purposes. Medical coding audits ensure all related documents regarding diagnosis and treatment procedures are complete and accurate. However, inaccurate documentation can lead to misinterpretation of the treatment procedures, resulting in delayed payment or denied claims.

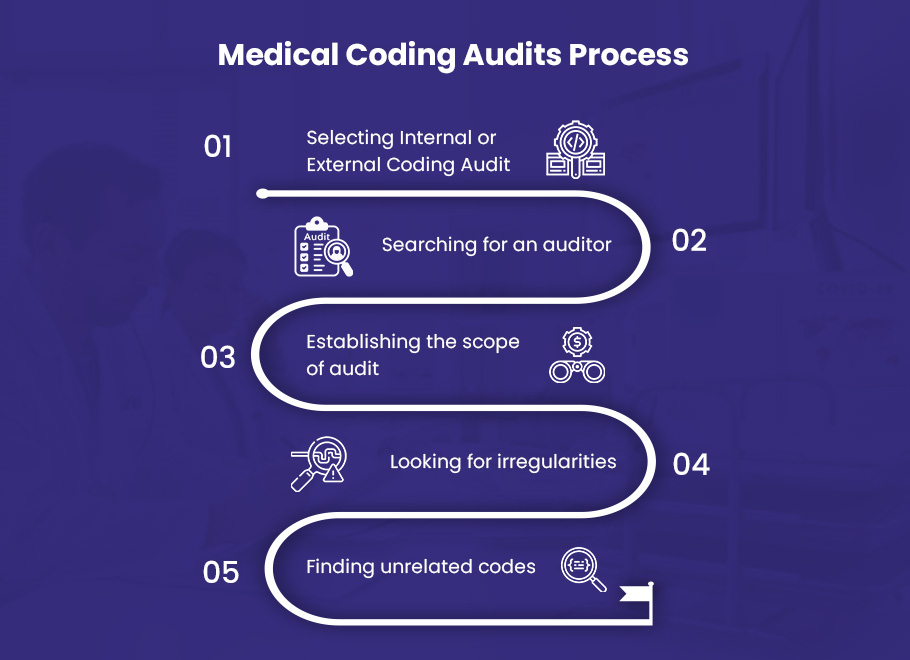

Medical Coding Audits Process

For healthcare providers, a medical coding audit is a comprehensive process to evaluate the healthcare practice and alarm the providers before any forthcoming activity that can negatively affect their healthcare, i.e., claim denials and vulnerability to fraudulent allegations.

Here is the step-by-step process that medical audit providers should undergo while auditing their healthcare practices.

1️⃣ Selecting Internal or External Coding Audit

Choose whether to undergo an internal or external audit as the first step in the audit process for your healthcare practice. Having your own in-house audit team for regular audits may seem convenient. However, most practices highly recommend an external audit by outsourced medical coding professionals.

External coding auditors offer expertise and an objective perspective that even the most experienced internal auditor may not have. They provide detailed insights into the impacts of coding errors and patterns of non-compliance that internal staff may miss or downplay. External auditors stay up-to-date with the latest regulations and compliance mandates, while internal auditors may become complacent over time.

External auditors have no vested interests in maintaining the status quo or concealing potential problems. They assess deficiencies and provide specific, actionable steps to fix coding issues. This stops revenue loss from denials and maintains your practice’s good standing with regulatory authorities. Internal audits offer benefits, but external audits provide essential knowledge and transparency that help control risks and drive continuous improvement.

2️⃣ Searching for an auditor

If you have decided to go for an external audit, contact medical coding companies that provide audit services. There are various companies you can choose from to outsource your audit process. They have a team of experts in each specialty. These auditors are not only coding experts but also have vast knowledge about regulations and get updated with the changes applied by the state or insurance providers.

🌐 For Compliant, Optimized Medical Coding, Turn To The Experts at BellMedEx!

If you’re looking to outsource your medical coding audit, BellMedEx should be your top choice. As a leading medical coding company, we have a dedicated team of certified professional coders with expertise across all specialties. Our auditors go beyond checking accuracy – they analyze your coding practices to identify opportunities for improvement, ensuring you receive the maximum appropriate reimbursement.

3️⃣ Establishing the scope of the audit

The scope defines the specific areas, timeframes, and types of medical records that will be examined during the audit. By clearly defining the scope, healthcare providers can ensure that the audit is targeted, efficient, and aligned with their objectives.

Before initiating the audit, it is essential to engage in open communication with the auditors. This collaboration allows both parties to understand the provider’s goals, concerns, and specific areas of interest.

The scope should be tailored to address the provider’s unique needs and priorities. It may involve reviewing a specific subset of medical codes, focusing on high-risk or high-volume procedures, or evaluating coding practices within a particular department or timeframe. By narrowing the scope, the audit can be more targeted and provide valuable feedback on areas that require improvement or validation.

Some points that should be incorporated in the scope of the audit include:

- Auditing the proper use of CPT codes

- Determining the correct places of service

- Looking for missing modifiers

- Looking for incorrect use of modifiers

- Detecting incorrect diagnoses

- Identifying coding and documentation accuracy

- Verifying if supporting documentation is adequate

- Checking if services are necessary

4️⃣ Looking for irregularities

While conducting an audit, you should filter these irregularities, which can help you detect errors leading to claim denials and affecting the revenue cycle:

- Writing the correct code for the reason for the visit

- Avoiding use of outdated codes

- Using modifiers that support primary codes

- Using only the latest and updated codes

- Correcting all improper medical codes

5️⃣ Finding unrelated codes

It is also included in the audit process to check codes and modifiers unrelated to diagnosis or treatment procedure. If the medical coders have used unrelated codes, it can raise a red flag for payers and audit by the state or insurance payers.

For example, if a patient receives treatment for a broken arm, but the medical coder assigns codes for a heart condition, this is an unrelated code. Auditors pay special attention to irrelevant codes since they may be indicative of coding errors or even fraud.

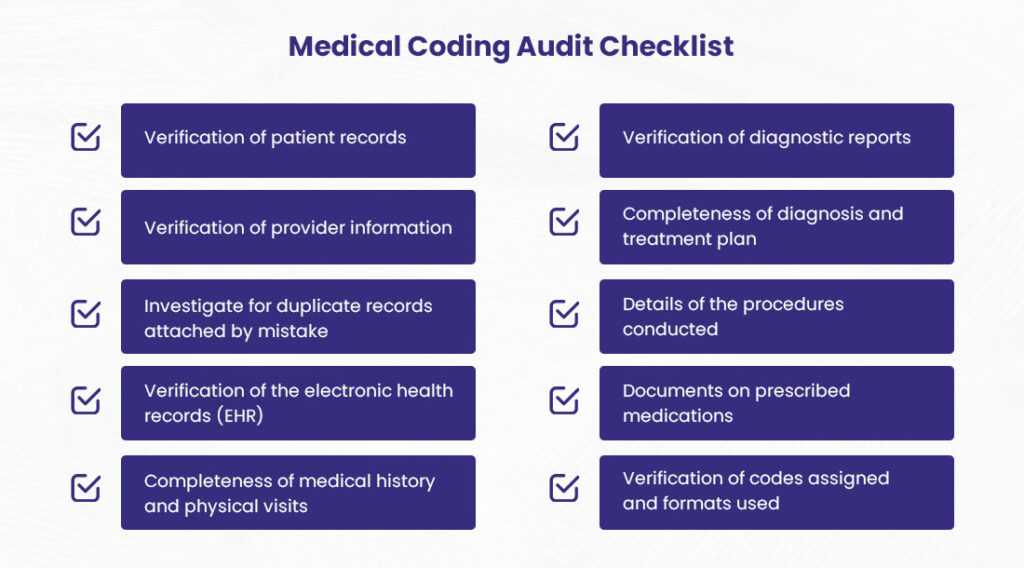

Medical Coding Audit Checklist

The medical coding audit checklist describes what to review during the audit process.

- Verification of patient records

- Verification of provider information

- Investigate for duplicate records attached by mistake

- Verification of the electronic health records (EHR)

- Completeness of medical history and physical visits

- Verification of diagnostic reports

- Completeness of diagnosis and treatment plan

- Details of the procedures conducted

- Documents on prescribed medications

- Verification of codes assigned and formats used

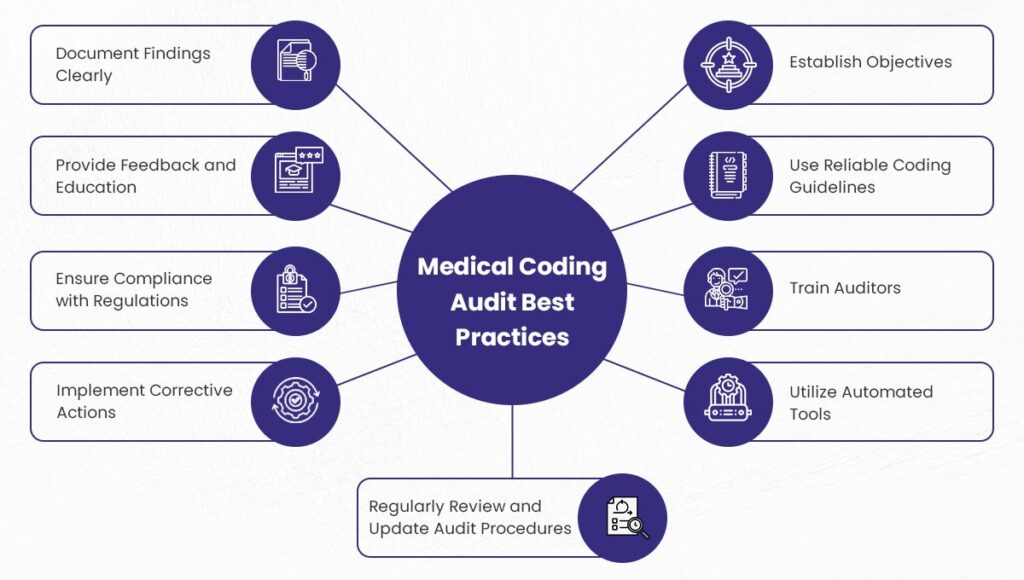

Medical Coding Audit Best Practices

Apply these practices to get the best results from medical coding audits:

- Establish audit objectives

- Use reliable coding guidelines

- Train auditors

- Implement corrective actions

- Review and update audit procedures

- Utilize automated tools

- Document findings clearly

- Provide feedback and education

- Ensure compliance with regulations

Doctors, are you ready to decode your revenue potential?

Get a FREE medical coding audit with us and say goodbye to billing errors and missed reimbursements.

Let’s maximize your earnings together!

🌊free

coding

audit