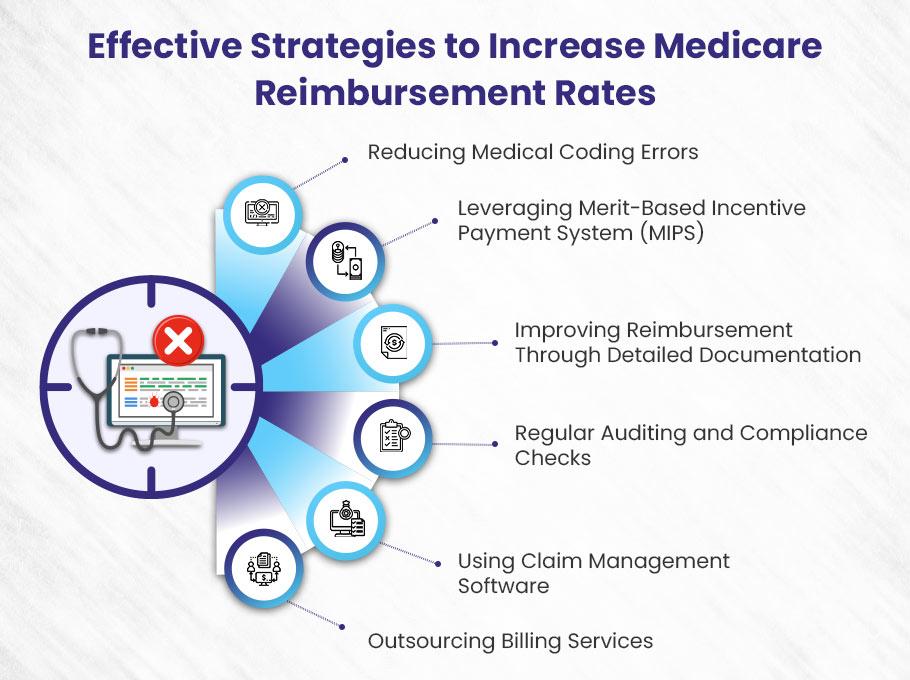

Key takeaways on how to increase Medicare reimbursement rates:

Accurate Coding ➜ Avoid errors to ensure full reimbursement.

Leverage MIPS ➜ Meet performance standards for bonus payments.

Improve Documentation ➜ Detailed records reduce rejections.

Regular Audits ➜ Stay compliant to avoid penalties.

Outsource Billing ➜ Hire experts to maximize reimbursement.

As a healthcare provider, do you feel the pinch of not getting your full Medicare reimbursement rates?

The Centers for Medicare & Medicaid Services (CMS) sets fixed reimbursement rates as per the Physician Fee Schedule, but providers often fall short.

Even though rates are set by the Physician Fee Schedule, with updates like the recent 2.93% increase to the 2024 Conversion Factor, simply being enrolled isn’t enough to guarantee full payment.

But worry not. We understand this financial stress.

Therefore…

In this blog, we’ll break down reasons for lower Medicare payments and give actionable steps to increase Medicare reimbursement rates.

You worked hard—now get fully paid!

What Is Medicare Reimbursement?

“Medicare Reimbursement” is the payment sent from the federal Medicare program to doctors, clinics, hospitals and other healthcare providers to compensate them for the medical care and services provided to patients enrolled in Medicare. It helps cover some of the costs incurred by providers for treating Medicare beneficiaries.

Medicare provides healthcare coverage to patients 65 years of age or above and patients with particular disabilities, even if they are below the age limit. The federal health insurance program covers expenses for the patients who receive care services from healthcare providers.

For example, a healthcare practitioner provides care services to Medicare beneficiaries in a private practice and submits claims to insurance providers (Medicare) for the services provided. Medicare will review these claims and pay the healthcare provider according to a particular reimbursement rate. Medicare’s payments to healthcare providers are called Medicare reimbursements.

This amount can be affected by various factors, including medical specialty, economic trends, legislative budgets, geographic location, performance of practice and quality of care, and physician’s fee schedule. However, Medicare reimbursement rates are predetermined, but these factors can cause providers to receive less payment than the allowed amount.

Medicare Physician Fee Schedule

Medicare Physician fee schedule is a table showing reimbursement rates updated annually by the Centre of Medicare and Medicaid Services (CMS) based on input from healthcare providers, medical societies, and other stakeholders. This schedule ensures fair compensation by standardizing payments across medical specialties and geographic locations.

The fee schedule evaluates the value of care services, the location of providers, and the costs of operating healthcare practice and determines how much Medicare will reimburse healthcare providers.

For each year, CMS proposes changes for the following year’s schedule—now for the year 2025. Healthcare providers can submit their feedback on the proposal in a specific allowed comment period. After closing the comment period, CMS reviews their feedback and decides on a new physician fee schedule. Then, the updated fee schedule will be released in November, 2024 and take effect from January 1, 2025.

It is worth noting that on March 9, 2024, President Biden signed the Consolidated Appropriations Act, 2024. This act brought a nice little update—a 2.93% increase to the 2024 Physician Fee Schedule Conversion Factor (CF) for services from March 9 to December 31, 2024. This new update replaces the earlier 1.25% increase that was part of the Consolidated Appropriations Act, 2023. So, just to clarify, the 2024 CF for services from January 1 to March 8, 2024, is set at $32.74. Meanwhile, CMS adjusted the 2023 CF of $33.07 by 2.93% to align with the new law. All in all, this brings us to a 2024 CF of $33.29 for services from March 9 to December 31, 2024

Staying updated on the Physician fee schedule allows providers to align their charge amount for healthcare services and get maximum reimbursement from Medicare.

Effective Strategies to Increase Medicare Reimbursement Rates

Here, we guide you on how to increase Medicare reimbursement rates, though they are fixed. Applying these proven strategies can help healthcare enterprises boost their revenue by getting the maximum reimbursement from Medicare.

Remember: The reimbursement rates are fixed, but you can apply practical strategies to get full of the allowed amount for the healthcare services you provide to patients covered by Medicare.

1). Reducing Medical Coding Errors

One of the most effective strategies for improving Medicare reimbursement rates is reducing medical coding errors. Inaccurate coding can lead to significant financial losses for healthcare providers, affecting their reimbursement rates from Medicare.

The Impact of Coding Errors on Reimbursement

Medical coding errors are a major factor that prevents providers from receiving the full reimbursement they are entitled to under Medicare. These errors can cause 15 to 20% losses in reimbursement because the services rendered may not be properly documented or classified in the billing system.

Inaccurate Coding = Lower Medicare Reimbursement ➜ Providers might not meet the estimated reimbursement amount due to errors in coding.

Claim Denials ➜ Incorrect codes can lead to Medicare denying claims altogether.

Why Accurate Coding Matters?

To maximize reimbursement, accurate medical coding is essential. Here’s why:

Correct Codes Ensure Appropriate Payment ➜ Providers must use precise codes for procedures and diagnoses to get the payment they deserve.

Avoid Revenue Loss ➜ Mistakes in coding can result in lower payments or delayed Medicare reimbursements, which can hurt the provider’s cash flow.

Common Coding Mistakes to Avoid

Here are some common mistakes made by medical coders that can reduce reimbursement, along with tips on how to avoid them:

❌ Failure to Code to the Highest Level of Specificity

Coders sometimes fail to select the most specific codes for a patient’s diagnosis or procedure. This may happen due to lack of knowledge or familiarity with certain codes.

Why It Matters: If a code doesn’t fully capture the patient’s condition, Medicare may reimburse at a lower level, assuming the treatment was less complex.

Solution: Coders should ensure they’re well-versed in CPT and ICD-10 codes and are thorough in reviewing the patient’s records to select the most accurate code.

❌ Inaccurate or Missing Modifiers

Modifiers provide additional details about a procedure or service, influencing the reimbursement amount. Incorrect or missing modifiers can lead to underpayment.

Example: If a patient receives care twice on the same day, coders must use Modifier-76 (Repeat procedure by the same physician). Without it, Medicare may only pay for the first service.

Solution: Ensure the correct use of modifiers to reflect the services provided fully. Consult AMA guidelines for accurate modifier application.

How Coding Mistakes Lead to Lower Reimbursement

To put it simply, when medical coders don’t capture the full scope of services provided, Medicare pays less. Let’s look at an example:

Scenario: A Medicare patient visits a clinic with severe back pain. The provider offers a comprehensive set of services: diagnosis, x-ray, chiropractic treatment, and a follow-up care plan.

What Happens: If coders only use codes for a routine check-up, Medicare will reimburse based on that lower level of service, leaving the provider underpaid for the care actually given.

Solution: Coders must accurately document and code all services rendered, ensuring they reflect the full extent of care provided.

Best Practices for Reducing Coding Errors

Here are some best practices for coders to avoid mistakes and help providers increase reimbursement:

✅ Ongoing Education: Regular training on the latest CPT and ICD-10 codes is vital.

✅ Detailed Review: Always double-check patient records for the most specific and accurate codes.

✅ Modifier Accuracy: Make sure modifiers are used correctly to capture all aspects of a procedure or service.

✅ Audit Regularly: Conduct regular audits of coding practices to identify and address errors before they affect reimbursement.

2). Leveraging Merit-Based Incentive Payment System (MIPS)

However, the Medicare reimbursement rates are fixed, but providers can get maximum reimbursement in the shape of additional earnings by meeting performance standards in quality care and improving healthcare activities at practice. In this way, they can easily maximize their revenue by leveraging MIPS.

In addition, the merit-based incentive payment system (MIPS) is another component for practices to consider when increasing their earnings. Medicare uses this program to adjust payments using composite performance scores. Through the MIPS program, eligible practitioners may receive a bonus amount, a payment penalty, or no payment adjustment.

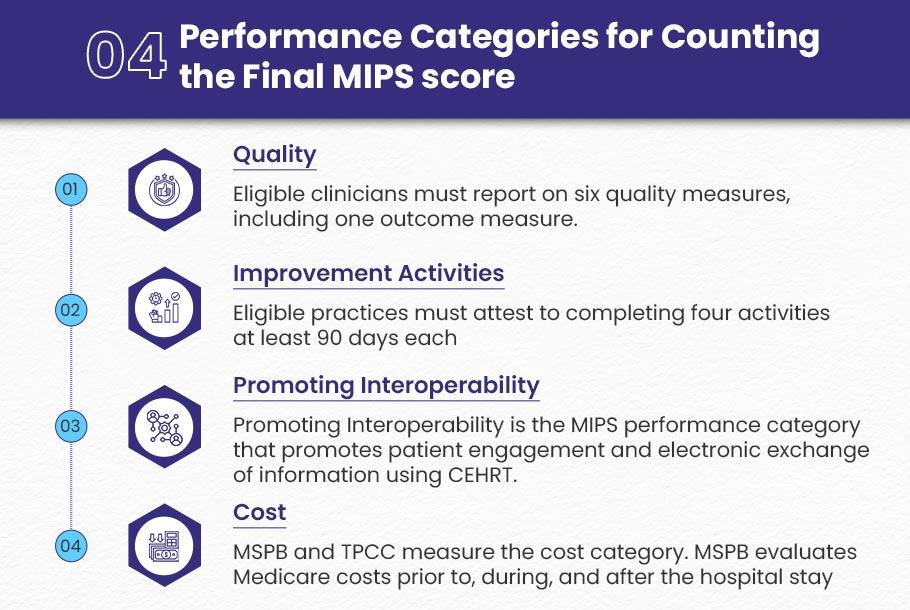

Medicare considers four performance categories for counting the final MIPS score. This score determines the payment adjustment applied to Medicare Part B claims. The categories are:

Quality

Eligible clinicians must report on six quality measures, including one outcome measure. But, they must select one high-priority measure if an outcome measure is not available. For this purpose, AAPM&R (The American Academy of Physical Medicine and Rehabilitation) has created a quality measure guide to help them with the most applicable measures.

Improvement Activities

Eligible practices must attest to completing four activities at least 90 days each. However, those who live in small or rural areas have to complete only two. The AAPM&R created an improvement guide to help members explore activities that are most applicable to the specialty.

Promoting Interoperability

Promoting Interoperability is the MIPS performance category that promotes patient engagement and electronic exchange of information using certified electronic health record technology (CEHRT). The performance category is worth 25% of your MIPS Final Score for 2024.

Cost

The cost category determines a practice’s performance and covers 30% of the final MIPS score. It replaces the Medicare Value Modifier Program for eligible clinicians.

Medicare Spending Per Beneficiary (MSPB) and Total Per Capita Cost (TPCC) measure the cost category. MSPB evaluates Medicare costs prior to, during, and after the hospital stay of patients, and TPCC evaluates Medicare Part A and Part B costs associated with any beneficiary over a year.

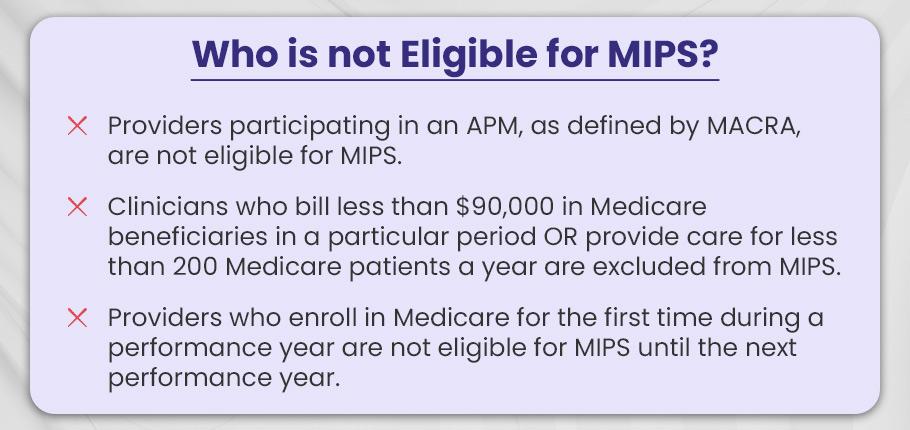

Who is not eligible for MIPS?

There are three types of healthcare providers who are excluded from MIPS eligibility:

- Providers who enroll in Medicare for the first time during a performance year are not eligible for MIPS until the next performance year.

- Providers participating in an APM, as defined by MACRA, are not eligible for MIPS.

- Clinicians who bill less than $90,000 in Medicare beneficiaries in a particular period OR provide care for less than 200 Medicare patients a year are excluded from MIPS.

3). Improving Reimbursement Through Detailed Documentation

Using poor quality, unclear, incomplete documentation, or missing documents that providers submit to Medicare can cause rejected or denied claims, which leads to less or no reimbursement. Healthcare providers must comply with detailed documentation to build a strong foundation for claims and consider all the billable aspects to get full payment on time. Experts at Medicare thoroughly review all the documents related to claims. Therefore, a slight mistake can cause providers to face losses.

Here are a few points discussed that clearly highlight the importance of effective documentation in maximizing Medicare reimbursement.

- Detailed and accurate documentation results in correct coding and fewer rejections or denials. It leads to better coding, which improves the chance of being reimbursed appropriately by Medicare for services provided.

- Thorough documentation helps coders to understand it better and apply appropriate codes. In this way, documentation can play a major role in maximizing reimbursement and the practice’s overall revenue growth.

- Document procedures should be as accurate and detailed as possible because reimbursement can be affected by even the smallest missing detail.

A properly documented medical record can facilitate practices with effective revenue cycle processes, boost payment, reduce hassles in claim processing, and ensure appropriate reimbursements. Healthcare practices are required to improve their documentation skills to get full benefits from care services provided in the shape of maximum reimbursements; here are steps to follow on how they can improve:

Standardization: They should focus on clear and concise communication while using industry standards and documenting procedures that are easily understood by readers of the medical records.

Regular Review: Providers should follow a simple process by reviewing previous records and encounters and aligning them with current EMRs.

Peer Support: Peer-to-peer documentation support can increase standardization and productivity as clinicians can understand the ins and outs of documentation quite well.

Continued Education: The clinician should never stop the learning process. Adhering to ideas for improvement helps them keep up to date and increase documentation compliance.

4). Regular Auditing and Compliance Checks

One of the most important strategies to maximize Medicare reimbursement is regular auditing and staying informed and up-to-date with the latest rules and regulations and CMS requirements. Medicare and Medicaid are constantly evolving and adopting new changes with current and updated trends. Therefore, healthcare providers must stay updated on any changes that may affect reimbursement rates.

Staying updated with these complex programs might be challenging for providers as these regulations vary by state. However, healthcare providers can stay informed by regularly reviewing Medicare reimbursement guidelines and ensuring that they are submitting accurate claims and receiving full reimbursement for the services they provide to Medicare patients.

Furthermore, healthcare providers should be aware of external audit outcomes to reduce the risks of rejected and denied claims that may lead to low reimbursement. Providers should perform internal audits by their in-house teams or outsource third-party auditors to demonstrate compliance with risk adjustment regulations to reduce the risk of penalties and fines.

5). Using a Claim Management Software

Effective claim management is a crucial factor for optimizing Medicare reimbursement. Sometimes, healthcare providers take the burden and fail to manage a high volume of claims, and it becomes challenging for them to submit these claims to Medicare. Also, it becomes a headache for them to keep track of records and ensure that each claim is processed properly and correctly.

By using claim management software effectively, healthcare practices can streamline the process of claim submitting and identify errors quickly to avoid any unpleasant result, i.e., rejection or denial of claims. This will ultimately improve the revenue of practices by getting properly reimbursed.

6). Outsourcing Billing Services

After following all the procedures, if providers fail to maximize their Medicare reimbursement rates, the ultimate solution is hiring a third-party medical billing company to do all of the work on their behalf. One of the reliable billing companies in the US is BellMedEx, providing billing services and supporting providers in optimizing their reimbursement rates.

The experts and professionals at the billing company can lessen the burden from providers’ shoulders by providing them with result-oriented services, for example, medical coding, compliance management, and claim management, which can prove extremely helpful in maximizing Medicare reimbursement rates.

After outsourcing the third-party billing services, the experienced staff at the company can ensure accuracy and alignment with CMS guidelines and requirements. We suggest this is one of the easiest ways to maximize reimbursement and grow healthcare practice’s revenue.

What’s Next for Medicare Reimbursement? My Take on the Future

When it comes to Medicare reimbursement, there’s a lot on the horizon for healthcare providers. The landscape is definitely shifting, and those who stay ahead of the curve will be the ones who can really capitalize on these changes.

In my opinion, the future of Medicare reimbursement is all about adapting to new trends, especially as CMS (Centers for Medicare & Medicaid Services) continues to refine its approach.

So, what can providers expect in the coming years? Let’s break it down.

👉 Focus on Quality Over Quantity

One major trend I see coming is the shift from the volume of services provided to the quality of care delivered. CMS seems to be heading in this direction with its value-based payment model, and I honestly think it’s a good thing for both patients and providers.

Instead of rewarding providers for simply seeing more patients or performing more procedures, they’ll be incentivized based on how well they actually take care of those patients.

What does this mean for reimbursement rates?

Well, providers who deliver better care can expect higher reimbursement. It’s that simple. A quality reporting program like MIPS (Merit-based Incentive Payment System) is a prime example of how CMS is linking reimbursement to performance metrics. The better your practice does in terms of patient outcomes and quality, the more you’ll get paid.

And it’s not just about seeing patients faster or getting through more appointments. Care coordination and patient engagement are going to become even more important. If you’re collaborating with other providers, sharing information, and really involving patients in their own healthcare decisions, you’re going to see better outcomes—and better reimbursement as a result.

👉 Embracing Technology

Another big factor that’s shaping the future of Medicare reimbursement is the adoption of new healthcare technologies.

I honestly believe that practices already using things like EHRs (Electronic Health Records), telehealth, and remote patient monitoring are going to have a serious edge moving forward.

CMS is pushing for the adoption of these technologies because they know how much potential they have to improve care and efficiency. Think about it: telehealth has become a game-changer, especially with how it helps providers see more patients remotely and manage care more effectively. Plus, remote patient monitoring means you can keep an eye on your patients’ health without them having to come into the office all the time.

The way I see it, practices that embrace these tools now will be better positioned to meet the evolving standards set by CMS and, in turn, secure higher reimbursement rates in the future. It’s all about staying ahead of the technology curve.

Don’t scratch your head if you fail to get full reimbursement from Medicare for services you provided to Medicare beneficiaries.

At BellMedEx, we help medical practices maximize reimbursement and help you optimize your clinic efficiency so you can earn more by focusing on your core goals.

🔥 We Have a plan for every specialty