Your team submits a clean claim, the EOB arrives, and the numbers do not match what anyone expected. Sound familiar? That gap usually comes down to how the payer priced the service. The good news is you can predict it before the claim goes out.

In this guide, we will walk through a simple, repeatable way to calculate the allowed amount in medical billing. You will see how to pull the right rate from contracts and fee schedules, how units, place of service, and modifiers change the math, and how to spot underpayments fast. By the end, your front desk can quote with confidence and your billing team can verify payer pricing line by line.

What Is the Allowed Amount in Medical Billing?

The allowed amount is the maximum dollar figure a payer (for example, Aetna, Blue Cross, Medicare) will recognize for a covered service performed by a provider (for example, physician practice, hospital, clinic). It is the figure the payer uses to calculate payment and patient cost share. It is not the provider’s billed charge.

How payers set the allowed amount

➔ Contracted rates. For in-network claims, the allowed amount comes from the payer–provider contract.

➔ Government fee schedules. Programs like Medicare use published fee schedules for CPT and HCPCS codes.

➔ UCR or plan methodology. For out-of-network claims, many plans apply a Usual, Customary, and Reasonable rate or another plan formula.

What the allowed amount is not

❌ It is not the sticker price on the claim.

❌ It is not always the final payment. Deductibles, coinsurance, copays, bundling edits, multiple-procedure discounts, modifiers, and place of service can change how much is actually paid from that amount.

Provider-focused example: (in-network)

- Billed charge: $200 for a covered CPT code

- Contracted allowed amount: $120

- Contractual adjustment: $80 written off

Patient cost share is calculated on $120. If coinsurance is 20%, patient responsibility is $24 and payer pays $96.

⬇️⬇️⬇️

Formula:

Patient Responsibility = Allowed Amount × Coinsurance Rate → 120 × 0.20 = 24

Payer Payment = Allowed Amount – Patient Responsibility → 120 – 24 = 96.

Provider-focused example: out-of-network

- Billed charge: $400

- Plan allowed amount using UCR: $250

Patient cost share is calculated on $250 under plan rules. The remaining $150 may be balance billed to the patient if not limited by law or plan provisions.

Calculating the Allowed Amount in Medical Billing

Allowed amounts aren’t random numbers pulled from thin air. Instead, they’re the result of contracts, regulations, and payer-specific formulas.

Here’s how you figure them out step-by-step:

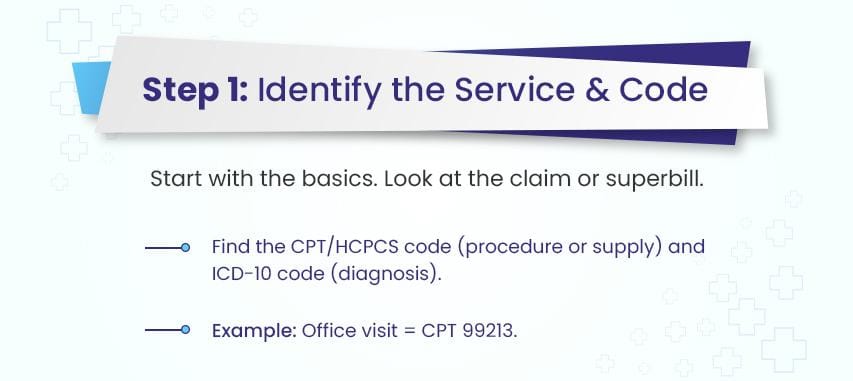

Step 1: Identify the Service & Its Code

Look at the claim or superbill. What service was performed?

Determine the corresponding CPT code (for procedures) or HCPCS code (for supplies, drugs, and some services) and the ICD-10 code (diagnosis).

The CPT/HCPCS is key for the Allowed Amount.

So, you must know the assigned codes before calculating the Allowed Amount.

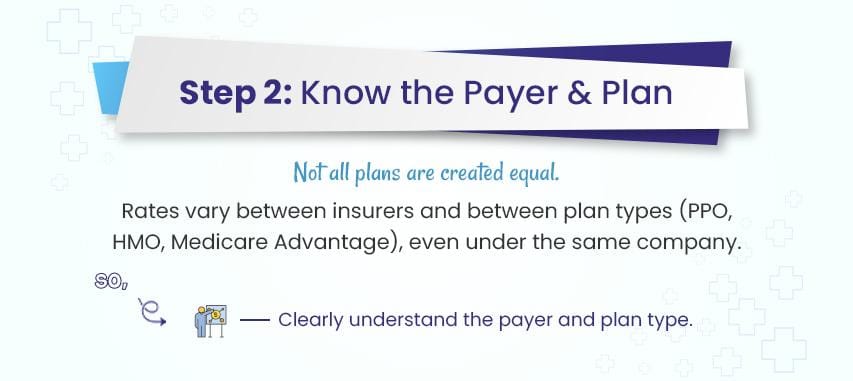

Step 2: Know Your Payer & Plan

Who is the insurance company? (e.g., Aetna, UnitedHealthcare, Blue Cross Blue Shield, Medicare, Medicaid).

What specific plan is the patient enrolled in? (e.g., PPO, HMO, POS, Medicare Advantage).

You must know all these correctly.

Because allowed amounts (rates by insurer) can vary wildly between plans under the same insurer.

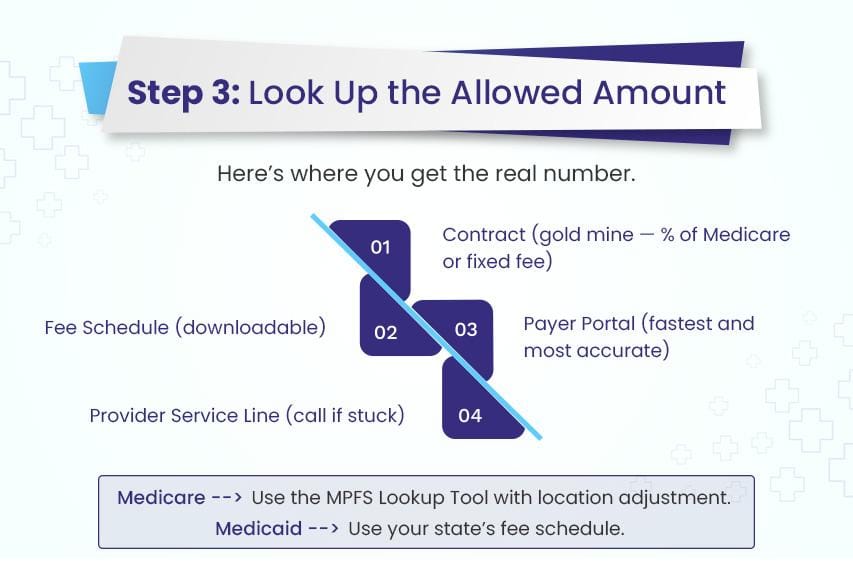

Step 3: Find the “Fee Schedule” or “Allowed Amount” Source

This is the crucial part. Where does this number come from?

You don’t usually “calculate” it from scratch; you look it up based on the payer’s rules.

Here are the primary sources for payers:

Commercial Insurance (PPO/HMO/POS):

- The contract: This is your GOLD MINE. Your practice has a contract with the insurer. This contract defines the allowed amounts, often as a percentage of Medicare (e.g., 120% of Medicare) or a fixed fee schedule. Dig out that contract!

- Payer portals: Most major insurers have secure online portals for providers. Log in! You can usually look up allowed amounts for specific CPT codes for a patient’s plan before you submit the claim. This is the easiest way for commercial payers.

- Payer fee schedules: Sometimes insurers provide downloadable fee schedules (Excel files, PDFs) for contracted providers. Check your provider’s resources section on their website or portal.

- Payer representatives: If you encounter any difficulties, don’t hesitate to get in touch with the provider service line. Please ensure you have the CPT code, patient ID, and date of service prepared. Ask, “What is the allowed amount for CPT code [XXXXX] for patient [Name], ID [ID#], DOS [Date]?”

Medicare (Fee-for-Service):

- The Medicare Physician Fee Schedule (MPFS) Database: This is the official source. You can look it up online yourself! Search for “Medicare Physician Fee Schedule Lookup Tool.”

- How it Works: Medicare calculates a base rate for each CPT code. This base rate is then adjusted by:

- Geographic Practice Cost Index (GPCI): Costs vary by location (e.g., Manhattan vs. rural Iowa). The tool applies the correct GPCI for your ZIP code.

- Conversion Factor (CF): A dollar amount set annually by Congress that converts the relative value units (RVUs) of the service into dollars.

- Result: The tool gives you the exact Medicare-allowed Amount for that CPT code in your specific location.

- Medicaid State Fee Schedules: Medicaid is run by each state. You must find your specific state’s Medicaid fee schedule. Search for “[Your State] Medicaid Provider Fee Schedule.” These are usually published annually.

- State Medicaid Portal: Like commercial payers, many states have provider portals where you can look up allowed amounts.

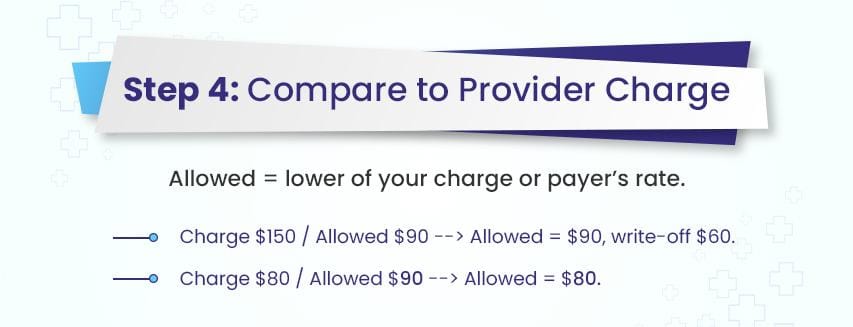

Step 4: Compare the provider’s charge to the allowed Amount.

- You have the provider’s billed charge (from the charge master or superbill).

- You have the payer’s allowed Amount (from Step 3).

- The allowed Amount is the lower value between the provider’s billed charge and the payer’s allowed Amount.

- If Provider Charge ($150) > Allowed Amount ($90): Allowed Amount = $90. The $60 difference is a contractual write-off.

- If Provider Charge ($80) < Allowed Amount ($90): Allowed Amount = $80. The insurer pays $80 (minus patient costs). (This is less common but possible)

Step 5: Apply Patient Responsibility & Calculate Payment.

Now, using the Allowed Amount:

- Deductible: If the patient hasn’t met their annual deductible, the insurer may apply the entire allowed Amount to the deductible (meaning the patient owes it all, and the insurer pays $0).

- Copay: A fixed dollar amount the patient pays at the time of service (e.g., $25). Subtract this from the allowed Amount before calculating coinsurance.

- Coinsurance: A percentage the patient pays after deductible/copay (e.g., 20%).

Calculate this percentage of the allowed Amount.

- Insurer Payment = Allowed Amount – Deductible Applied – Copay – Coinsurance

- Patient Responsibility = Deductible Applied + Copay + Coinsurance

Example:

- Service: Office Visit (CPT 99213)

- Provider Charge: $120

- Payer: ABC Insurance (PPO)

- Patient: Jane Doe (Deductible Met, $30 Copay, 20% Coinsurance)

- Allowed Amount Lookup (via ABC Portal): $90

- Calculation:

- Allowed Amount: $90 (lower of $120 charge and $90 allowed)

- Patient Copay: $30 (Collected at the visit)

- Remaining After Copay: $90 – $30 = $60

- Patient Coinsurance (20% of $60): $12

- Insurer Payment: $60 – $12 = $48

- Total Patient Responsibility: Copay ($30) + Coinsurance ($12) = $42

- Contractual Write-Off: $120 (Charge) – $90 (Allowed) = $30 (Cannot bill patient)

Why the Allowed Amount Matters (For Healthcare Providers)

As a healthcare provider, understanding the allowed amount is more than just knowing what a payer will pay (I mean, it’s about seeing how it shapes the entire payment process, from claim submission to patient collections).

Therefore, think of it as the foundation for calculating every dollar you’re entitled to receive.

1). It sets the baseline for the provider’s reimbursement.

First, the allowed amount sets the baseline for reimbursement. Payers don’t calculate their share from your billed charge; they use this pre-determined number instead.

For example, if the allowed amount is $100 and the plan has a 20% coinsurance, the patient owes $20 and the payer covers $80 (Formula: 100 × 0.20 = 20; 100 − 20 = 80). Even if you billed $150, the payment will still be based on that 100-dollar allowed amount, not the higher figure.

2). It drives the contractual adjustment you must write off.

This also explains why contractual adjustments exist. For in-network claims, the difference between your billed charge and the allowed amount is written off under your agreement with the payer. That “write-off” is not optional — it’s part of the contract you agreed to when you joined the network.

3). It determines your patient’s responsibility and improves upfront estimates.

Because deductibles, coinsurance, and copays are calculated from the allowed amount, having accurate figures helps you give patients clear, realistic estimates upfront. This reduces billing disputes later and makes financial counseling much smoother. When patients understand their share before treatment, they’re more likely to pay on time.

From a revenue cycle perspective, posting payments against the correct allowed amount also acts as a safeguard. It allows you to verify that payer payment plus patient responsibility equals the allowed amount listed on the remittance advice. If those numbers don’t match, it’s a signal to investigate for underpayments or claim processing errors.

4). It changes your exposure when you are out of network.

It’s worth noting that out-of-network services work differently. Without a contract, payers often set the allowed amount using a Usual, Customary, and Reasonable (UCR) rate or their own formula. In these cases, you may bill the patient for the difference between your charge and the allowed amount, unless state law or plan terms prevent it.

5). It informs your financial metrics and contract negotiations.

Finally, allowed amounts aren’t just about individual claims. But they also feed into your practice’s financial metrics. They affect your net collection rate, average contractual adjustment, and revenue forecasts. When you understand them fully, you’re better positioned to spot trends, negotiate payer contracts, and protect your bottom line.

In-Network vs. Out-of-Network Allowed Amount

In-network (contracted providers)

When a provider is in network, there is a signed payer contract that fixes the allowed amount for each covered code on the fee schedule. Under that agreement:

- The provider accepts the allowed amount as full consideration for a covered service.

- The difference between the billed charge and the allowed amount is a contractual adjustment that must be written off.

- Patient responsibility (copay, coinsurance, deductible) is calculated on the allowed amount.

Formula:

- Patient Responsibility = Allowed Amount × Coinsurance Rate

- Payer Payment = Allowed Amount − Patient Responsibility

- Contractual Adjustment = Billed Charge − Allowed Amount

Step-by-step explanation:

- You bill $200.

- The plan’s allowed amount is $120.

- The patient has a 20% coinsurance.

- The patient pays 20% of 120, which is $24 (120 × 0.20 = 24).

- The payer covers the remaining $96 (120 − 24 = 96).

- The difference between your billed charge and the allowed amount, $80 (200 − 120), is written off as a contractual adjustment.

Out-of-network (no contract in place)

When a provider is out of network, there is no contract to set a negotiated fee. In this case:

- The plan still sets an allowed amount, often using a UCR methodology or a percentage of a public fee schedule.

- Patient responsibility is calculated on that plan allowed amount, using the plan’s out-of-network cost share rules.

- The provider may balance bill the patient for the difference between the billed charge and the plan’s allowed amount if not restricted by law or plan terms. Federal and state protections can limit balance billing for emergency care and some services delivered at in-network facilities.

Formula:

- Patient Responsibility = Allowed Amount × Coinsurance Rate

- Payer Payment = Allowed Amount − Patient Responsibility

- Potential Balance Bill = Billed Charge − Allowed Amount

Step-by-step explanation:

- You bill $400.

- The plan sets an allowed amount of $250 using its UCR formula.

- The patient has a 40% out-of-network coinsurance.

- The patient pays 40% of 250, which is $100 (250 × 0.40 = 100).

- The payer covers the remaining $150 (250 − 100 = 150).

- The difference between your billed charge and the allowed amount, $150 (400 − 250), can be balance billed to the patient unless prohibited by law or plan rules.

Do You Want to Stop Revenue Leaks at the Allowed Amount?

Our medical billing company (called BellMedEx) has coders that apply correct modifiers, place of service, and bundling rules so the final allowed amount is accurate. You only write off what the contract requires and you keep what you earned.