For patients with two insurance plans, you must first submit the claim to the patient’s primary plan. Wait for the primary plan to provide an explanation of benefits before making a decision on billing the secondary plan.

Billing the secondary plan isn’t simply a chance to bill again. It will depend on how the two plans coordinate, what the primary plan allowed and your documentation/evidence. Good documentation and the appropriate order can add up to a successful billing experience.

In this guide, you will learn:

- How to determine which plan serves as primary

- How to know if it is appropriate to bill the secondary plan

- What are the must-have documents, like the EOB and any authorizations

- Examples of billing ABA claims to the secondary insurance in common scenarios

- How to identify information presented on an EOB that could contribute to billing denials

Follow the steps outlined in this guide and your claim submission to the patient’s secondary insurance will be cleaner for ABA services. As a result you will receive payments faster and with minimal back-and-forth with the 2ndry payers!

When Should You Bill Secondary Insurance for ABA—and How?

- Bill the ABA patient’s secondary insurance company only after the primary insurance carrier has processed the ABA claim and sent you an EOB.

- Once the primary insurance processes the ABA claim and sends the EOB, ABA providers should review the EOB to verify what was allowed, paid, and patient responsibility.

- Then, submit the secondary claim with all the same CPT codes, correct units, and details from the primary claim, including deductible, copay, or coinsurance amounts.

- Follow up, if necessary, based on the states timely filing deadlines.

- If there are any errors with the primary claim, fix them first and then submit the claim to the secondary insurance.

- Always submit to Medicaid as the last payer, and Medicare Advantage will only pay when ABA therapy is a covered benefit for that ABA patient.

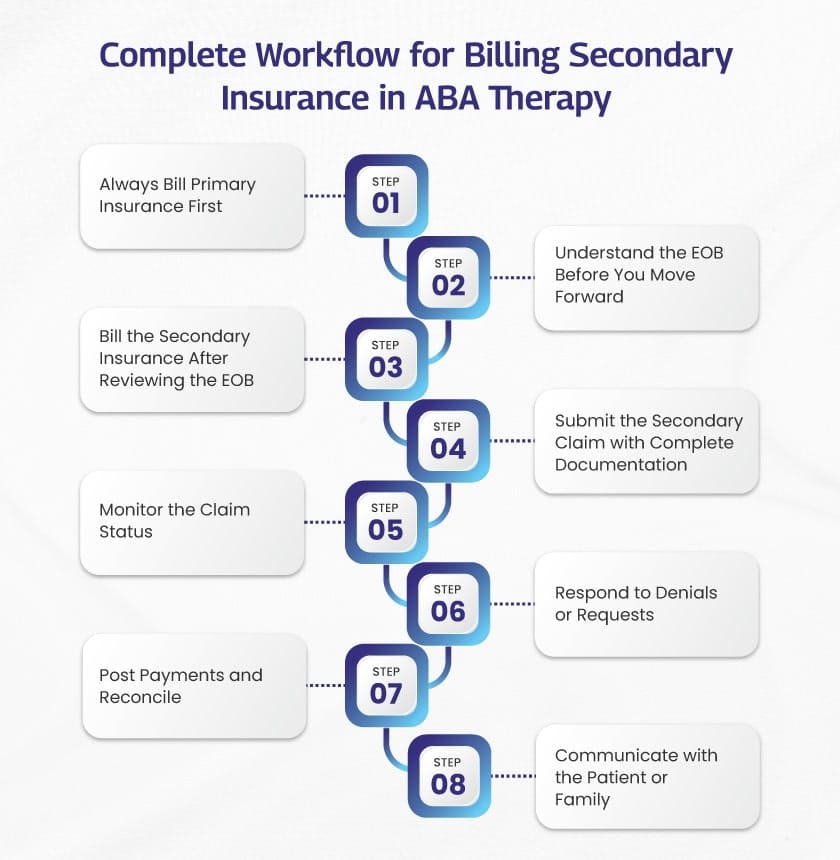

Here’s a detailed step by step guide to secondary insurance billing for ABA services:

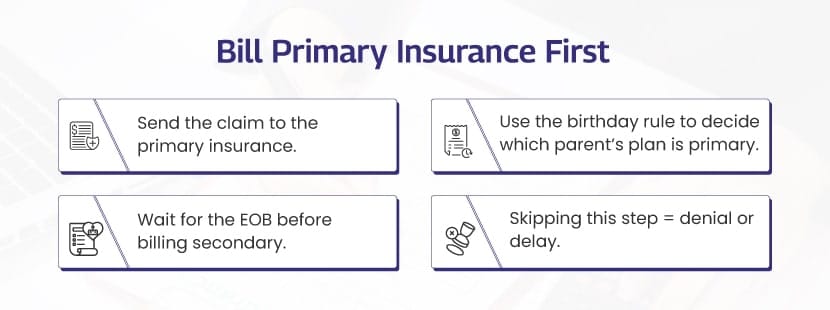

Step #1 — Always bill the primary plan first.

Send every ABA claim to the primary insurance before you touch the secondary. This isn’t a courtesy, but it’s how coordination of benefits works in the U.S. The secondary insurance will not do anything until the primary processes the claim.

👉 Here’s a quick checklist that will help you figure out what insurance is “primary”:

Two parent plans? Use the birthday rule. The parent whose birthday comes first in the year is primary. (If the parents have the same birthday, look at which plan has been active the longest. Court Orders can affect this.)

Job vs. retiree/COBRA plan? The plan from the current job will pay first.

Is Medicaid involved? Medicaid will pay last. Bill a commercial insurance first.

Is TRICARE involved? Any other insurance will pay first. TRICARE will pay second (with some exceptions).

Is it an injury or accident? Worker’s compensation (or liability insurance) is primary for that care. Health insurance pays afterwards.

As an example, if your claim is for a 1:1 ABA session billed with CPT® 97153 (adaptive behavior treatment by protocol, 15-min units of service, delivered by a technician under the direction of a qualified healthcare professional), then you would still be sending that claim to the primary insurance carrier first.

Why You Should Not Bill Secondary Until You Have An EOB/ERA From The Primary Insurance?

This is important because after the primary processes the claim, they will send out an EOB (explanation of benefits), which will show how much the primary insurance allowed, how much they paid, and whatever reason that remains (deductible, coinsurance, not covered, etc.). That is what the secondary insurance is looking to use when they determine how much they will price their portion of the claim.

Numerous payers and healthcare clearinghouses require the primary amounts paid and primary adjustment codes on secondary claims. Otherwise, they will deny the claim for missing COB information.

Tip: Some primaries (notably Medicare) will auto crossover claims to certain secondaries. If you see crossover indicator (e.g., MA18 on a Medicare remittance), do not resubmit to that secondary because this way you will be creating a duplicate.

What To Send (And Not Send) To Secondary Insurance Payer

✅ Do send: The secondary claim with COB fields populated (or the paper CMS-1500 with the other-insurance section completed) plus the primary’s adjudication details.

❌ Do not send: Do not estimate “what the primary would have paid.” You need to use the EOB/ERA number and codes. (Medicare and commercial secondaries key on those fields.)

Timing Matters

Timely filing limits apply for secondary claims. Timely filing is often counted from the date of the primary EOB and not from the date of service.

For example, some UnitedHealthcare Community & State plans want that secondary claim submitted within 90 days from the date of the primary EOB. You always want to look up the contract or provider manual for the payer you are working with.

A few ABA-specific notes you’ll care about:

➔ Medicaid following a commercial denial: If there is a commercial plan denial for a substantive reason (i.e., service not covered under that plan) and the service is covered by Medicaid, then Medicaid will pay as secondary up to the limits. This is subject to what the states put in place under their “cost avoidance/third-party liability” rules. Check your state policy.

➔ Medicare patients: Original Medicare in general is not actually the payer for ABA services. If Medicare is involved, the rules get increasingly complicated and then coverage is limited or plan-specific (some MA plans add ABA). Check the patient’s benefits and who pays first using the MSP/COB rules before you bill.

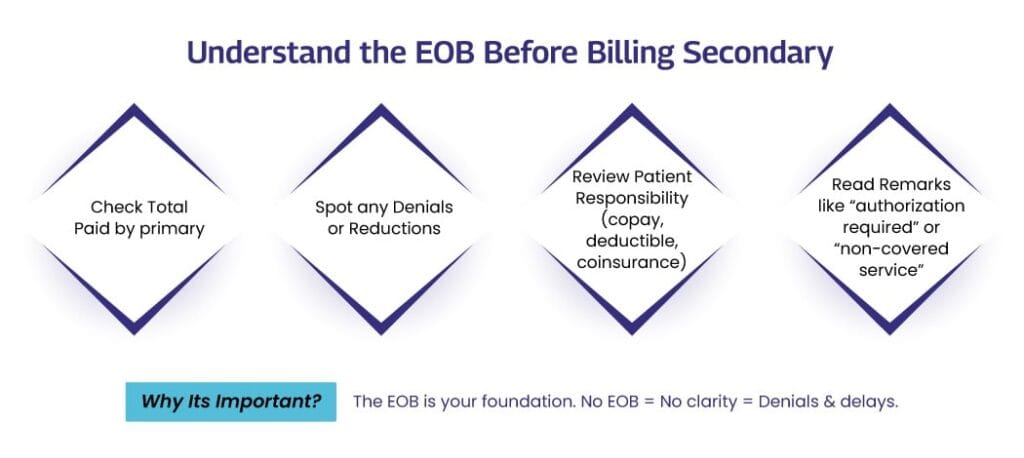

Step #2 — Understand the Explanation of Benefits (EOB)

When the Explanation of Benefits (EOB) from the primary insurance company arrives, it is appropriate to review it carefully. It is not just a simple receipt. It communicates three key pieces of information:

- The dollar value assigned by the insurance company for the service

- The amount deemed “paid” by the insurance company

- The dollar amount remaining for the patient or some other plan to pay

This is precisely the information the secondary insurance carrier utilizes to make its coverage decision regarding reimbursement of the ABA clinician.

What Should You Review in This Document?

You will want to take a minute and review the EOB document closely and look for these specific pieces of information:

➜ Allowed amount – this is the amount accepted by the insurance as the allowed price for that particular ABA treatment/service.

➜ Paid amount – this is the dollar amount they report as “paid” to you.

➜ Reason codes – these are short codes that explain (or account for) why a portion of the claim wasn’t “paid.” Look for notes like PR (patient has to pay) or CO (you will need to write this off).

➜ Patient responsibility – this is the dollar amount that gets sent to deductible, copay, or coinsurance.

Key reminder: Across both plans, the total paid can never go over 100% of the allowed amount.

Example:

To illustrate, you bill $100 for 97153 ( a 15 minute ABA session). The primary plan allowed $85, paid $70 with $15 attributed to patient’s deductible.

If the secondary covers ABA and the patient’s secondary insurance were to pick up the patient cost-share; they would likely pay the $15.

This is important as some secondary plans do their own pricing first, then reduce or subtract that from the cost where the primary had already paid, and then may pay just a portion of that cost, the whole amount, or not pay anything at all.

What To Do If The Primary Insurance Denies The Claim?

Do not rush an ABA claim to the patient’s secondary insurance if there is a denial from the primary. Instead, you will take the following steps:

- Find the reason indicated on the EOB.

- If it is simply an error in the billing itself (wrong modifier, NPI, units etc.) that is an easy fix and you should resend it to the primary insurance after making the billing correction.

- If it is an error with pre-authorization, I would recommend obtaining authorization and then circling back on the primary insurer for claim resubmission.

- If the service simply isn’t covered by the primary but is covered by secondary, submit to the secondary with the EOB that has been attached.

Step #3 — Bill Secondary After You’ve Reviewed the EOB

You’ve reviewed the primary payers EOB/ERA (electronic remit advice), and everything appears correct, so it’s time to process the claim with the secondary payer.

But please do not submit the exact same claim “as is”.

You need to tell the secondary what the primary payer allowed, what they paid, and how much amount they left, so that the secondary payer can appropriately price out what is still due.

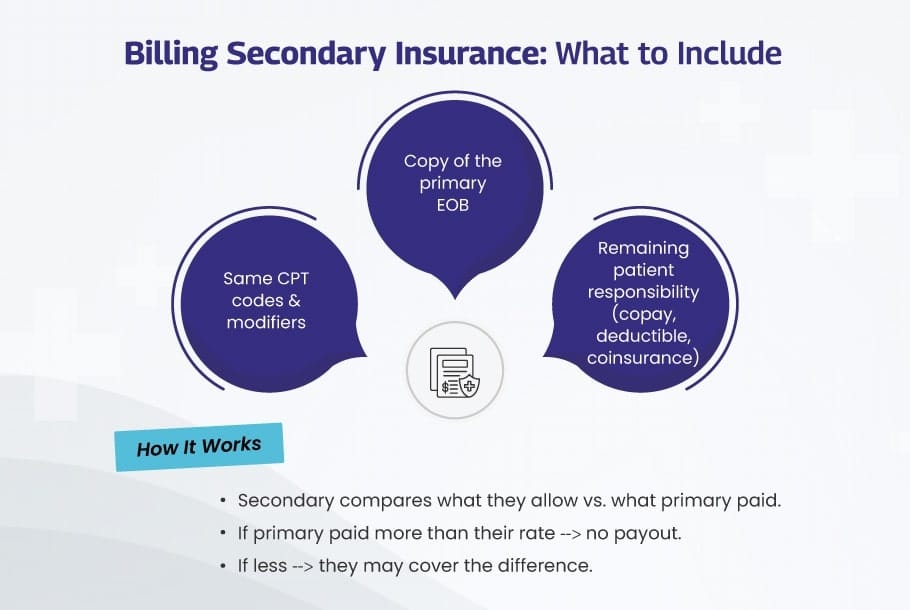

What To Include When Submitting An ABA Claim To The Secondary Insurance?

- The exact same CPT®/HCPCS codes, units, and modifiers that you used for the primary payer. If you noted any coding mistake, fix the mistake with the primary payer first, and then you can move forward with the secondary.

- The details of the primary adjudication that includes the primary allowed amount, the primary paid amount, and all of the primary payer’s adjustment/remark codes (CARC/RARC with PR/CO, etc.). In an 837P electronic claim, these details live in the COB segments (loops 2320/2430). On the paper claim submission form (the CMS-1500), you would fill out “other insurance” fields and attach the EOB.

- You also need to copy the patient responsibility from the primary EOB (deductible, copay, coinsurance amount, etc). The secondary payer will use these numbers to assess what they can pay.

Medicare notes: Most Medicare claims will auto-crossover to a listed secondary payer by virtue of receipt. If the remit details a crossover, do not resubmit to the secondary payer as you will potentially create a duplicate billing.

How The Secondary Will Process The Claim For Payment?

After submission of the claim to the secondary payer, the secondary payer will price the claim based on it’s rules. It will then review what the primary insurance company already paid on the claim.

The secondary payer will not pay you in such a way that after all is combined the total is over 100% of the primary allowance. That is standard coordination of benefits.

Example (97153):

- You bill $100 for 97153.

- The primary payer allowed $85 and paid you $70 and put $15 toward the patient’s deductible (PR).

- The secondary allowed $95.

- In theory the secondary can pay up to their allowance ($95) minus what you have already been paid by the primary ($70) → ultimately a maximum of $25.

- If the plan has a cost-share adjustment, the secondary will typically pay the lesser of that $25 and the posted patient responsibility with the primary ($15) → ultimately the secondary pays $15.

- If the primary completely satisfied the allowed ($95) or beyond, you would ultimately receive $0 from the secondary payer as the claim has maxed out at the secondary allowable.

(Plan do vary, but for the most part they utilize the same method and cap: total pay cannot exceed allowed amount.)

Special Case: Medicaid As Secondary Payer

Medicaid is considered the payer of last resort. This means you need to bill every other insurance first, because Medicaid only pays its share when everyone else is done paying.

Most states follow something called a “lesser-of” rule. Essentially, Medicaid will pay up to its own rate. If the primary pays more than the Medicaid rate, Medicaid pays nothing, and that is normal.

For instance:

You bill $100 for a session. Primary insurance pays $80. Medicaid State Rate is $75. Because the primary paid more than the state rate, Medicaid pays $0.

Now imagine what if the primary paid $50? So here, the Medicaid would pay its rate ($75), so it would likely send you $25.

Always check your state’s rules, because some provide for a patient cost-share (copays, deductible) and some do not.

Step #4 — Submit the Secondary Claim (With All Required Information)

Now that you have reviewed the EOB from the primary plan and it appears to be correct, you are ready to submit the claim to the secondary.

This is the point in the claims process that will take the longest if you miss even one small step. Here are the things you should always include when submitting the claim to the secondary insurance for ABA services:

- The same CPT codes, units, and modifiers (if you had a modifier) that you used for the primary claim. If you had to fix anything with the primary, ensure you make that fix before you send the secondary claims.

- The primary EOB, which includes what the primary allowed, what they paid, and any reason codes (like PR for patient responsibility). If you are filing electronically, this will go into the coordination of benefits fields. If you are using paper submission, attach the EOB.

- The patient’s responsibility (if the patient has a deductible, coinsurance, or copay amount).

- Any other documentation the secondary insurer may request like authorization letters or session notes.

Take the extra minute to verify you are sending everything before you click submit. It is much easier to send everything correctly the first time than wait for another several weeks if you sent it incorrectly and get a denial.

Step #5 — Monitor the Claim Status After You Submit

Sending the claim in is not the end of your job. You will want to monitor the claim status within your billing system, or the payer portal.

- First and foremost, ensure that the claim was both received and accepted by the clearinghouse.

- When it comes to checking status, try to check in once or twice a week on the claim.

- Check for notes indicating “Payer needs further information.”

- If after 15 to 30 days, you have not received an update, check on it. Not all payers work at the same speed. If you are not careful, you may miss timely filing.

This step saves time later, as you will have caught the issue before it has turned into a delay in payment.

Step #6 — Respond to Denied Claims/Requests ASAP

Sometimes when the secondary payer gets the claim, they will deny payment, or send a notice to request more documentation. This happens.

- If it was a simple error, then it does not need to be resubmitted. Instead, you send a corrected claim with the error marked as fixed.

- If you notice something was not attached (such as session notes), just attach them and submit the claim again.

- If you believe it is an issue of inquiry that the original claim should have paid, just submit an appeal. Be sure to include proof, like the original EOB, the Authorization letters, or progress notes to support the claim.

The quicker you address each of these, the quicker your payment will process, and you will stay in the timely filing limit.

Step #7 — Post Payment and Reconcile Account

When the secondary payment comes in, make sure to take time to be thoughtful in the posting entry.

- Post the payment in your system, and make sure it is matched to the correct claim.

- Be sure to write-off any amount the payer lists as “Contractual Adjustment” on the EOB.

- You will then apply what is remaining into a balance owed by the patient, listed as patient responsibility on the EOB.

- Remember, if Medicaid is the secondary payer, you cannot bill the family any more than what Medicaid allows, except for small copays as permitted in your state.

Maintaining accuracy in your posting, will keep your records neat as well as provide an opportunity to spot any problems early.

Step #8 — Communicate with the Patient or Family

Once both insurances have paid the claim, there may still be a balance.

- Send a clear, readable statement to the family.

- Communicate what each insurance is paying, what is applied to deductible, copay, and the new balance due.

- The statement should also say you are available to explain, and can set up a payment plan if the patient’s family likes.

Clear communication, builds trust and supports the family when there is a balance owed.

Can Medicare Become the Secondary Insurance for ABA Claims?

Medicare functions as a secondary plan in a way that differs from most other insurances. It will only provide payment if the service is something that Medicare covers. Since ABA is not a covered service under Original Medicare, you typically won’t receive payment from Medicare for ABA, even if the primary plan has a remaining balance.

Here are some key points for you to know:

- Original Medicare (Part A and B) does not provide coverage for ABA therapy at all. If you submit a claim, it will not be paid.

- Medicare Advantage (Part C) plans are different. Some offer additional benefits, and a few may cover ABA. This varies by specific plan, so you need to confirm directly with the plan.

- Medigap plans only provide payment after Medicare has paid. If Medicare does not cover ABA, Medigap will not assist with the expenses.

What to do before billing ABA claims to Medicare?

Determine if the patient has Original Medicare or a Medicare Advantage plan. This is important because the rules differ.

➜ If it is Original Medicare, then do not bill for the ABA cost share, as Medicare will not pay. You may provide a voluntary notice to the family so they are aware that Medicare does not cover ABA. This is optional.

➜ If it is Medicare Advantage, then contact the plan to confirm whether ABA is a covered benefit. Inquire about age restrictions, service limits, and prior authorization requirements. Also, ensure you are in-network if that is necessary. Bill only after the primary insurance has processed the claim. Plus, don’t forget to attach the explanation of benefits (EOB) when submitting to the Medicare Advantage plan.

What to do if the patient also has Medicaid?

For children under 21, ABA might be covered by Medicaid under EPSDT, even if Medicare does not provide payment. In these cases, check Medicaid benefits first.

What to Include with the Claim (If Covered)

- The EOB from the primary insurance

- Any prior authorization number from the secondary plan

- Progress notes, treatment plan, and session records demonstrating medical necessity

- The correct ABA CPT codes accepted by the plan

Common Situations

▸ Primary pays, Medicare is secondary: Original Medicare will not pay the remaining balance for ABA. Follow your clinic’s financial policy or check Medicaid if the patient has it.

▸ Primary denies ABA as non-covered: Medicare still will not pay, as ABA is not a covered service under Medicare.

▸ Medicare Advantage is secondary: If ABA is covered and you have received authorization, submit the claim along with the EOB. If not covered, expect a denial.

Allow BellMedEx to Manage Your ABA Secondary Billing

ABA Billing is complicated, and BellMedEx Medical Billing Company knows it. Outsource your ABA Billing Services to us. We simplify the entire reimbursement process for primary and secondary insurance.

- Full COB workflow. We verify benefits, authorizations, primary EOB’s, and timely submit complete and accurate secondary claims.

- Payer-by-payer expertise. We customize each plan’s procedures for coverage, notes, modifiers, and appeals.

- Fewer denials. We appropriately code ABA services, include required documentation, and tackle issues before they reach the payer.

- Proactive follow up. We seek out responses, quickly resolve denials, and appeal with proof.

- Transparent visibility. You will get exact reports on cash, AR, denials, and trends.

Send us one difficult account or a months worth of claims and see the cash flow increase to you through BellMedEx ABA medical billing services.