If you’re a healthcare provider, you’ve likely wondered how long you should keep those Explanation of Benefits (EOB) documents.

Proper storage of EOBs isn’t just about keeping your office organized. But it’s also about protecting patient information, staying compliant with regulations, and having the records you need when billing questions arise.

You know the ones: a patient calls saying, “I don’t think I should’ve been charged for this,” or an insurance company asks, “Can you justify this claim?” With EOBs on hand, you’re ready to respond.

In this guide, we’ll walk through everything you need to know about EOB retention periods, from IRS guidelines to HIPAA requirements, and help you develop a storage system that works for your practice.

Keep your EOB documents for at least 7 years to comply with IRS tax guidelines. However, HIPAA has different requirements, mandating a 6-year retention period from creation or last use. Meanwhile, CMS sets the most variable standard, requiring between 5 and 10 years of retention depending on your provider type. Although these timelines differ, all three authorities agree that EOBs, despite being financial rather than clinical documents, must be properly maintained.

What Is an Explanation of Benefits (EOB) Statement?

An EOB is a statement that insurance companies send to patients after they receive medical care. This document isn’t a medical bill. Instead, it explains what medical treatments and services the insurance company paid for on behalf of the patient. Each EOB breaks down:

- The medical services provided

- How much the provider charged

- What portion the insurance covered

- What the patient still owes (if anything)

Think of an EOB as a healthcare receipt that helps everyone understand who paid for what.

Picture this ➜ A patient comes in for a routine exam, and you bill $150. The EOB shows the insurance covered $120, leaving a $30 copay. It’s your roadmap to understanding who paid what, and it’s a lifesaver when patients or insurers start asking questions.

Why EOBs Matter for Your Practice?

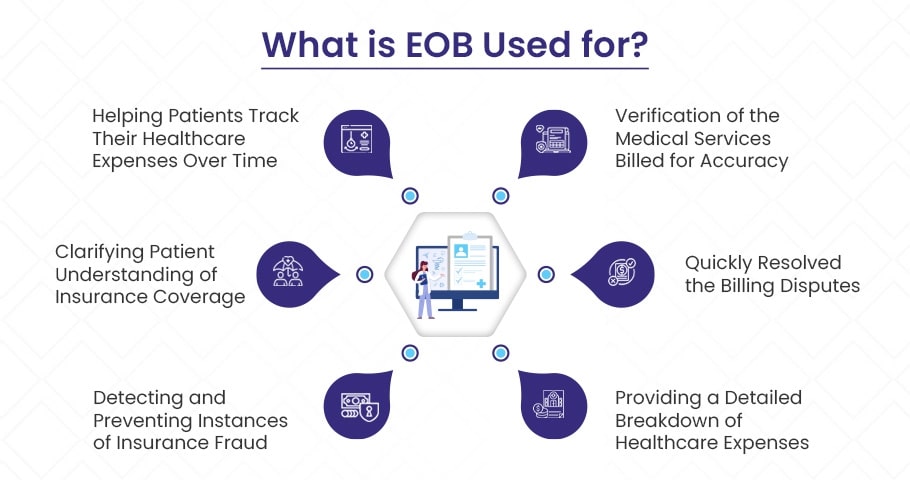

EOBs several important purposes which include:

✅ They Verify Billing Accuracy

EOBs help both you and your patients check that services were billed correctly. You can use them to spot errors before they become bigger problems, like charges for services that weren’t provided or incorrect procedure codes.

For instance, suppose a patient was billed for a blood test they didn’t receive. By reviewing the EOB, you notice the error and correct it before the patient is overcharged or your practice faces a claim denial.

✅ They Help Resolve Billing Disputes Quickly

When questions arise about charges or payments, EOBs provide a clear record of what was billed and paid. Having these documents readily available can turn a potentially frustrating dispute into a quick resolution.

For example, a patient might dispute a $50 charge, believing it was already paid. You refer to the EOB, which shows it was for a specialist consultation with only partial insurance coverage, and explain this to resolve the confusion on the spot.

✅ They Provide a Clear Picture of Healthcare Costs

EOBs outline exactly what services cost, what insurance paid, and what patients owe. This transparency helps everyone understand the financial side of healthcare.

For example, after a surgery costing $5,000, a patient’s EOB shows insurance covered $4,000, leaving them with $1,000 to pay. This clarity helps the patient budget for future medical expenses, like planning for upcoming procedures.

✅ They Help Track Healthcare Spending Patterns

By reviewing EOBs over time, you can identify trends in services, payments, and denials that might affect your practice’s financial health.

For instance, you might notice an increase in denied claims for a specific procedure code. Analyzing the EOBs reveals the code is being used incorrectly, allowing you to adjust billing practices to reduce denials and improve revenue.

✅ They Clarify Insurance Coverage for Patients

EOBs help patients understand their insurance benefits, including coverage limits and out-of-pocket costs. This knowledge empowers them to make better healthcare decisions.

✅ They Help Detect and Prevent Fraud

Regular review of EOBs can reveal suspicious patterns or unauthorized charges, allowing you to address potential fraud early.

For example, you might notice multiple EOBs with duplicate charges for the same patient on the same day, a pattern known as “double billing.” This could indicate fraudulent activity, like billing for services not rendered, prompting you to investigate further.

✅ They Demonstrate Compliance with Healthcare Regulations

During audits or investigations, EOBs serve as evidence that your billing practices follow state and federal regulations. Examples of applicable regulations include:

- HIPAA (Health Insurance Portability and Accountability Act): Ensuring privacy and security of patient information tied to billing.

- False Claims Act (FCA): Avoiding fraudulent billing by maintaining proper documentation like EOBs to substantiate services rendered and billed.

- State Insurance Codes: Each state (e.g., California Insurance Code, Texas Insurance Code) has regulations governing claims processing, patient billing disclosures, and timelines for communication — EOBs help demonstrate that you’ve followed these requirements.

Are EOBs Part of the Medical Record?

An Explanation of Benefits (EOB) is a formal document issued by insurance providers following the processing of healthcare claims. This document itemizes the services rendered, associated costs, insurance coverage applied, and the patient’s financial responsibility.

So are EOBs a part of the medical records? Here’s the answer:

Medical Records consist of clinical documentation that chronicles a patient’s health status and care.

These include:

- Clinical notes and observations

- Diagnostic test results

- Treatment plans and medication orders

- Progress notes and clinical correspondence

- Surgical reports and procedural documentation

Financial Records, where EOBs are properly categorized, document the economic aspects of healthcare delivery.

These include:

- Billing information and payment processing

- Insurance claim documentation

- Patient payment history

- Cost accounting for services rendered

Explanation of Benefits (EOBs) are financial documents that detail insurance coverage and payment obligations, not clinical documentation, and thus remain separate from medical records. While medical records document a patient’s health status, diagnoses, and treatment plans, EOBs serve as financial instruments that track the monetary aspects of healthcare services, including insurance payments, patient responsibilities, and provider reimbursements.

Healthcare organizations maintain EOBs as part of their financial record-keeping systems, subject to different retention policies and regulatory requirements than those governing clinical documentation.

IRS Guidelines for Keeping Explanation of Benefits (EOBs)

The Internal Revenue Service (IRS) is a federal agency that collects taxes and enforces tax laws. The IRS provides specific guidelines for keeping Explanation of Benefits (EOBs), which help taxpayers verify their medical expense deductions on tax returns.

| Document Type | Retention Period | Purpose |

| EOBs | 7 years | Verify medical expense deductions |

| Tax Returns | 7 years | General recommendation for all tax documents |

| Medical Bills | 7 years | Support EOBs and deduction claims |

| Insurance Payment Records | 7 years | Confirm portions paid by insurance vs. out-of-pocket |

| Prescription Records | 7 years | Support medication expense deductions |

➜ Retention Period for EOBs

The IRS recommends that both healthcare providers and individuals keep EOBs for at least 7 years. This timeframe is important for several reasons:

Tax Deductions

EOBs serve as proof of medical expenses that can be claimed as deductions on tax returns. The IRS allows taxpayers to deduct qualified medical expenses that exceed a certain percentage of their adjusted gross income. Keeping EOBs for 7 years ensures you have the necessary documentation to support these deductions if questioned.

Audit Protection

The IRS can audit tax returns for up to 6 years if they suspect income underreporting of more than 25%. By keeping EOBs for 7 years, taxpayers can provide evidence of their medical expenses and avoid penalties.

Example

During an IRS audit, healthcare providers are asked to show proof of medical expenses. Because you’ve organized and kept your patients’ EOBs, you can quickly find them and show the detailed breakdown of services, costs, and insurance payments.

The IRS auditor reviews your patients’ EOBs and confirms the medical expense deduction is correct. The audit concludes smoothly with no penalties.

Remember: Keeping organized records not only helps during potential audits but also makes your annual tax filing process much simpler.

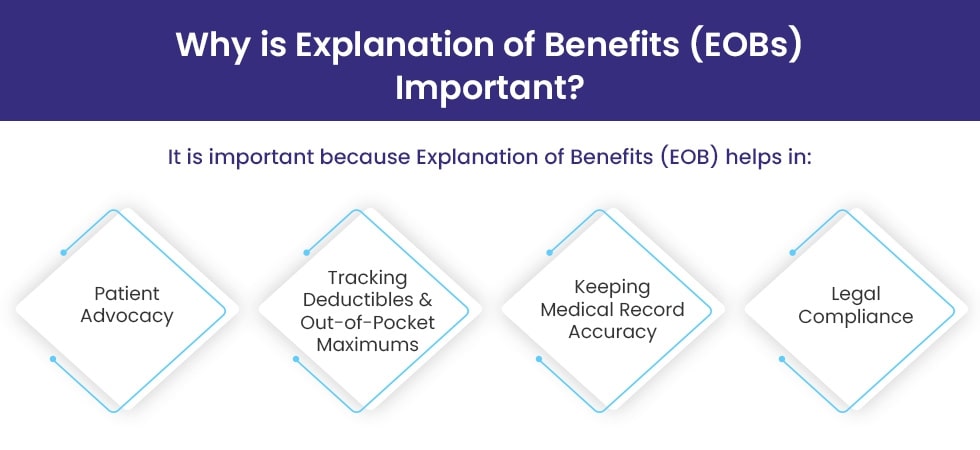

HIPAA and CMS Guidelines for Keeping Explanation of Benefits (EOBs)

When providing healthcare services, it’s important to follow federal regulations like HIPAA and CMS guidelines. These rules outline how Explanations of Benefits (EOBs) should be handled. This includes how they are delivered, stored securely, and how long they must be kept to protect patient privacy and ensure compliance.

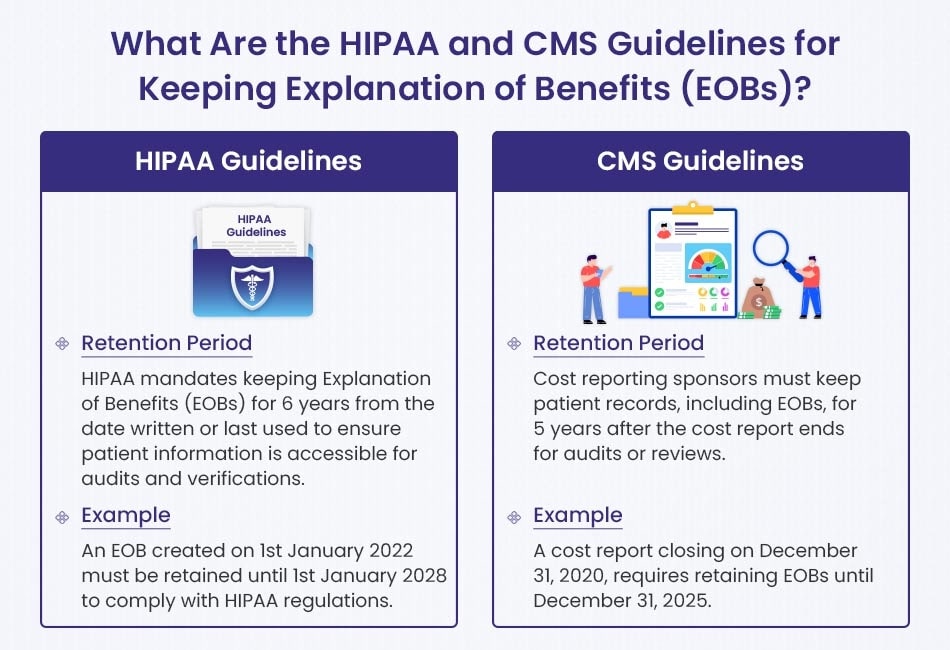

| Regulation | Retention Period | Example |

| HIPAA | 6 years from creation or last use | EOB from Jan 1, 2022 must be kept until Jan 1, 2028 |

| CMS (Cost Reporting Providers) | 5 years after cost report completion | Cost report ending Dec 31, 2020 → keep records until Dec 31, 2025 |

| CMS (Medicare Managed Care) | 10 years from contract termination | Program ends Dec 31, 2020 → keep records until Dec 31, 2030 |

HIPAA Guidelines

The Health Insurance Portability and Accountability Act (HIPAA) was created to protect patient health information. Under HIPAA, healthcare providers are required to maintain EOBs for 6 years from the date they were created or last used. This ensures that patient information is available if needed for audits, investigations, or other official purposes.

Example: If an EOB is created on January 1, 2022, it must be kept until January 1, 2028. This way, the document is available if questions or audits arise during that period.

CMS Guidelines

The Centers for Medicare & Medicaid Services (CMS) also set guidelines for retaining EOBs, depending on the type of healthcare service provider.

Under the general CMS retention rule for cost reporting, providers must keep all patient records, including EOBs, for 5 years after the completion of a cost report. This allows records to be available for review or audit.

Example: If a cost report is finalized on December 31, 2020, all related EOBs must be kept until December 31, 2025.

CMS Guidelines for Medicare Managed Care Providers

Providers under Medicare Managed Care programs must retain EOBs and related records for 10 years. This longer period ensures full documentation of patient care and billing for potential audits.

Example: If a Medicare Managed Care contract ends on December 31, 2020, all relevant records must be retained until December 31, 2030.

How Long To Keep EOBs for Routine/Standard Health Conditions?

| When to keep: | When safe to dispose: |

| ➜ Until all payments are processed by insurance and provider ➜ Until any billing disputes are resolved ➜ Until your medical condition is completely resolved | ➜ After 3 years if no outstanding issues ➜ If you aren’t claiming medical tax deductions ➜ When all payments have been settled by all parties |

For routine medical care or one-time treatments, most healthcare experts recommend keeping EOBs for approximately 3 years. This timeframe allows patients to resolve any potential billing issues that might arise and provides adequate documentation for tax purposes if needed.

During this retention period, patients should organize their EOBs by keeping related documents together – for instance, grouping an office visit with any associated lab work or prescriptions. This organization helps patients track their deductible status throughout the year and ensures they can quickly identify any duplicate billings.

Once three years have passed, patients can typically dispose of these records if all payments have been settled, no billing disputes remain, and they aren’t claiming medical tax deductions. However, if there’s any uncertainty, it’s always better to retain these documents longer.

How Long To Keep EOBs for Serious/Chronic Health Conditions?

| When to keep: | When safe to dispose: |

| ➜ For ongoing or recurring health issues ➜ When balance remains due ➜ When there are billing discrepancies ➜ If claiming medical expenses on tax returns | ➜ For chronic conditions, keep records 5 years after final treatment ➜ For tax purposes, keep records 7 years after claiming deduction |

For patients managing serious or chronic health conditions, the retention guidelines become more stringent. In these cases, medical experts recommend keeping EOBs and related medical records for 5-7 years, depending on circumstances.

Patients dealing with ongoing health issues should establish a more comprehensive filing system, preferably organizing documents chronologically while still maintaining related services together. This approach creates a valuable historical record that can help providers understand treatment histories and insurance coverage patterns over time.

For chronic conditions specifically, patients should retain all records for at least 5 years following their final treatment date. If they’re claiming medical expenses as tax deductions, this retention period extends to 7 years after filing the tax return, in accordance with IRS requirements.

Retention Period for Different Types of Medical Records

Medical records must stay in file cabinets or computer systems for different lengths of time. Doctors cannot throw them away early because they might need them later. The government has rules about keeping these papers. Patients also expect their health stories to be available when they return for more care.

There are many kinds of health records, and each type stays for a different amount of time. The guide below shows how long each type should be kept. Healthcare workers should know these timeframes. This ensures they do not lose important information that could save a life someday.

1). Patient Health Records

Patient health records are the primary documentation of medical care. They include the patient’s health history, diagnoses, treatment plans, and progress notes. Different states have varying requirements about how long healthcare providers must retain these records. Most jurisdictions require retention periods of 5 to 11 years after the patient’s last visit.

Each state maintains its own regulations, which creates complexity for healthcare providers operating across multiple states. Special provisions exist for minors’ records, which typically have extended retention periods compared to adult records.

Key Requirements:

- Hospitals in California must retain records for 7 years, and for minors until they turn 19

- Hospitals in North Carolina must maintain records for 11 years

- In Colorado, Records must be kept for 10 years for adults and until age 28 for minors

- Federal privacy law (HIPAA) doesn’t specify retention periods but requires privacy protection for the duration of record existence

- In Alaska, records for minors must be retained until they reach age 21

- Different requirements may apply to hospitals versus private practices

- Electronic records must follow the same retention periods as paper records

- Records involved in litigation may require extended retention

2). Billing Statements and Receipts

Medical billing documentation and payment records must be retained for both compliance and operational purposes. Most regulations require retention periods of 6 to 10 years. These requirements originate from Medicare, Medicaid, state regulations, and tax agencies. These documents provide evidence of services rendered, payments received, and financial obligations fulfilled.

Medicare and Medicaid establish baseline requirements, but state regulations often extend these periods. Healthcare organizations typically follow the longest applicable retention period to ensure compliance across all jurisdictions.

Key Requirements:

- Medicare and Medicaid require retention of billing records for 6 years

- Florida mandates 7-year retention for hospital billing documentation

- Georgia requires physicians to maintain billing records for 10 years

- The IRS recommends 7-year retention for tax-related documents

- Legal considerations regarding fraud cases may extend retention up to 10 years

- State statutes of limitations for contractual disputes influence retention periods

- Insurance companies may specify additional retention requirements

- Documentation supporting medical necessity should align with billing record retention

3). Immunization Records

Immunization records document all vaccines administered to a patient throughout their lifetime. These records serve critical functions for both individual health and public health purposes. While no federal mandate specifies a retention period, healthcare experts recommend permanent retention due to their lifelong clinical relevance.

States address vaccine documentation differently. Some include immunization records under general medical record requirements, while others establish separate guidelines. Public health considerations strongly favor indefinite retention of these records.

Key Requirements:

- The CDC recommends permanent retention for disease management purposes

- Hawaii requires 25-year retention for basic patient information including immunization history

- Maine mandates permanent retention for X-ray reports but doesn’t explicitly address immunization records

- State immunization registries typically maintain records indefinitely

- Educational institutions and employers often require verification of immunizations regardless of when they were administered

- International travel may necessitate proof of vaccination from decades earlier

- Immunization records maintain clinical utility throughout a patient’s lifetime

- Healthcare providers commonly retain immunization records longer than other medical documentation

4). Radiology and Imaging Reports

Diagnostic imaging studies and their interpretative reports provide visual documentation of a patient’s condition at specific points in time. Most regulations require retention periods of 5 to 10 years. This timeframe balances storage constraints with the potential clinical value of historical comparison.

State regulations establish minimum retention periods, but clinical best practices may warrant longer retention, particularly for conditions requiring longitudinal monitoring. Digital storage capabilities have reduced some of the historical constraints on image retention.

Key Requirements:

- Texas requires hospitals to retain imaging records for 7 years

- Louisiana mandates 10-year retention for hospital imaging studies

- Federal lab regulations require 2-year retention for imaging related to laboratory testing

- The American College of Radiology recommends permanent retention of mammography images

- Retention periods typically begin on the date of service, not the last patient encounter

- Pediatric imaging often has extended retention requirements

- Digital imaging systems should include appropriate backup protocols

- Images with potential forensic value may warrant extended retention

5). Laboratory Reports

Laboratory test results provide objective measurements and diagnostic information about a patient’s health status. Federal regulations establish a baseline 2-year retention requirement, though many states impose longer periods ranging from 5 to 10 years. These records enable clinicians to track changes in a patient’s condition over time.

Healthcare organizations must navigate the requirements from federal regulations, state laws, and clinical best practices. For patients with chronic conditions, extended retention periods are often justified regardless of minimum requirements.

Key Requirements:

- Federal CLIA regulations mandate 2-year retention for laboratory test records

- Illinois requires 10-year retention for hospital laboratory results

- Idaho mandates 5-year retention for clinical laboratory tests

- Blood banking test results have unique, extended retention requirements

- Genetic testing results may warrant lifelong retention due to hereditary implications

- Laboratory accreditation programs may specify additional retention requirements

- Critical or panic values follow the same retention schedule

- Reference ranges should be preserved alongside test results for proper future interpretation

6). Prescription Records

Documentation of medications prescribed provides essential information about pharmaceutical treatments recommended for patients. Retention periods typically range from 2 to 10 years, based on federal drug enforcement regulations and state pharmacy board requirements.

These records serve multiple purposes, including prevention of adverse drug interactions, continuity of care support, and demonstration of compliance with prescribing regulations. Healthcare organizations consider both regulatory requirements and clinical utility when establishing retention policies.

Key Requirements:

- The Drug Enforcement Administration requires 2-year retention for controlled substance prescriptions

- Indiana mandates 7-year retention for prescription records

- Missouri requires 10-year retention for prescription documentation

- Many states align prescription record retention with malpractice statutes of limitations (typically 2-7 years)

- Electronic prescribing systems must maintain records for the same duration as paper systems

- Documentation of informed consent for high-risk medications should follow the same retention schedule

- Medication reconciliation records should be retained with similar considerations

- State prescription monitoring programs may maintain records longer than individual providers

- Some states have specific requirements for controlled substances beyond federal regulations

How to Store Explanation of Benefits (EOBs) Effectively

EOBs are the papers from insurance companies that show what medical care the patient got and who paid for it and they have important information that must be kept safe and organized so both the patient and the healthcare provider can find them when they need them and so others cannot see those private health details. The way you store these papers matters because good storage saves time and keeps information private and follows the laws about medical records.

▶️ Physical Storage Solutions for EOBs

When you have paper EOBs that you can hold in your hand, you need to put them somewhere safe where they will not get lost or damaged or seen by people who should not see them and this means thinking about special places to keep them.

➜ Secure File Cabinet Systems

Tip: Keep paper EOBs in a locked, fireproof, and waterproof file cabinet where only certain people can open it.

The paper EOBs should go in a strong cabinet that has locks on the drawers and will not burn in a fire and will stay dry if water spills and the cabinet should be:

- Locked all the time so no one can just open it and look inside

- Made to not burn even in very hot fires for at least half an hour

- Built to keep water out if pipes break or sprinklers turn on

- Placed in a room where not many people walk through

- Hard to open without someone knowing it was opened

Buying a good strong cabinet costs money but it keeps patient information safe and follows the laws about privacy in healthcare.

➜ Logical Filing and Categorization

Tip: Make a simple system with different colored folders and clear labels so you can find papers quickly.

You should organize your files in a way that makes sense so you can find what you need without looking through every paper:

- Use folders that are different colors for different insurance companies or different years

- Put the patient folders in ABC order so names are easy to find

- Write clearly on each folder the patient name and when they got care and which insurance they had

- Make a list that shows how your filing system works

- Sometimes put information in more than one place if it belongs in more than one category

- Keep track of who takes folders out so nothing gets lost

When your filing system works well, you can find what you need in seconds instead of minutes and this makes your work easier every day.

▶️ Electronic Storage Systems

Keeping EOBs on computers or in the cloud takes less space and lets you search for things quickly but you must be very careful about computer security so private information stays private.

➜ Encrypted Storage Solutions

Tip: Use special healthcare computer systems that scramble the information so hackers cannot read it.

When you store EOBs on computers:

- Use computer programs made specially for healthcare information

- Make sure all information is scrambled with strong codes when it travels and when it sits on the computer

- Check that any cloud service has signed papers saying they will protect health information

- Think about using healthcare document systems instead of regular storage like normal Google Drive

- Set up two different ways to prove who you are when you log in

- Have a plan for managing the secret codes that unscramble the information

Remember that regular cloud storage like basic Dropbox is not automatically safe enough for health information without extra security steps and special agreements.

➜ Comprehensive Backup Procedures

Tip: Always have three copies of your EOB information in different places.

A good backup plan means:

- Having the original information plus two backup copies

- Keeping backups on different types of storage like your computer and also the cloud

- Having one backup in a different building

- Setting up automatic daily backups of new information

- Doing complete backups every week

- Checking monthly that you can actually get your information back from the backups

- Writing down the steps for how to recover information if something goes wrong

This way even if computers crash or buildings burn down your important EOB information will not be lost forever and you should regularly test your backups to make sure they work.

➜ Granular Access Controls

Tip: Control exactly who can see which EOBs and keep track of who looks at them.

Protect electronic EOBs by carefully managing who can see them:

- Give each staff member only the access they need for their job

- Make it so some people can look but not change information

- Set computers to log out automatically if no one uses them for a while

- Keep detailed records of who looked at which documents and when

- Regularly check the list of who has access and remove people who no longer need it

- Give each staff member their own login and never share accounts

- Make everyone change their passwords every few months

These steps not only keep patient information safe but also show exactly who looked at what information and when they looked at it.

▶️ Organization of Patient Data

How you organize your EOBs makes a big difference in how easily you can find them when you need them and a good system saves time and reduces frustration.

➜ Chronological and Categorical Sorting

Tip: Organize EOBs by patient name, then by date, then by type of medical service.

Design your filing system to help find information in different ways:

- First organize by patient name or ID number

- Then organize by year and month

- Then organize by what kind of medical service it was

- Make it possible to find all records for family members if needed

- Keep newer active records separate from older archived records

- Have clear steps for moving records from active to archive status

- Create special ways to get records quickly in emergencies

This system with multiple layers works well because sometimes you need to find recent activity and sometimes you need to find all records for one kind of medical service and sometimes you need a patient’s complete history.

➜ Searchable Metadata Implementation

Tip: Add extra information to each EOB file so you can search for many different things.

For computer systems, make searching easier by including:

- Patient information like name, birth date, and ID numbers

- Doctor information like name and facility

- Dates when service happened and what kind of service it was

- Claim numbers and whether they were paid

- Insurance plan details

- How much was paid and adjusted

- Medical codes for diagnosis and procedures

- Special tags for unusual cases or common searches

When you add all this extra information, your simple file storage becomes a powerful system that can quickly answer complex questions like “Show me all EOBs for heart procedures done in March that patients still need to pay.”

▶️ Retention and Disposal Protocols

Your storage plan should include clear rules about how long to keep records and how to safely get rid of them when that time is up.

➜ Scheduled Review System

Tip: Every three months, check for records that no longer need to be kept.

Create a system to:

- Mark records that are getting close to the end of their keeping time

- Look at each marked record to see if there is any special reason to keep it longer

- Write down all decisions about keeping or not keeping with reasons why

- Schedule safe destruction for records that can be removed

- Keep a list of what was destroyed and when it happened

How to Destroy Medical Records Safely

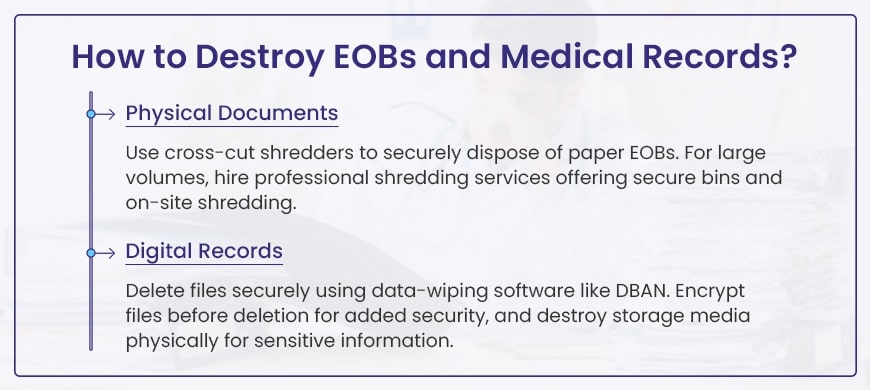

Medical records like EOBs must be destroyed carefully to protect patient information. Here’s how to do it right:

Destroying Paper Records

Paper medical records can be seen by the wrong people if not destroyed properly.

- Use a cross-cut or micro-cut shredder that cuts paper into tiny pieces

- Consider hiring professional shredding services – they give you a certificate proving destruction

- On-site shredding happens at your location so you can watch

- Regular shredding services work well for medical offices with many records

Destroying Digital Records

Deleting files normally doesn’t really remove them from your computer.

- Use special wiping software like DBAN or BitRaser that truly erases files

- Encrypt (scramble) sensitive files before deleting them for extra protection

- For complete safety, physically destroy old hard drives, USB drives and CDs

Important Steps to Remember

- Keep track of which records you destroy and when

- Train all staff on proper record destruction

- Check local laws about how long to keep records before destroying

- Make sure any company you hire signs agreements to protect patient information

Medical Records Retention Laws by State

Different U.S. states have different rules about how long doctors and hospitals must keep medical records. Here’s what you need to know:

- Most states say to keep records for 5-10 years

- Records for children usually must be kept longer – until they become adults (age 21) or even longer

- Some states use simple language like “keep as long as needed” (Alabama)

- A few states have special rules:

- Hawaii has different times for “Full” records versus “Basic” records

- Some states have separate rules for hospitals and private doctors

While many states follow the basic federal HIPAA rule (keep records for 6 years), always check your state’s specific rules to make sure you’re following the law correctly.

Below is a table summarizing the retention periods for medical doctors and hospitals, with distinctions for adults and minors where applicable:

| State | Medical Doctors (Years) | Hospitals (Years) |

| Alabama | As long as necessary for treatment and medical legal purposes | 5 |

| Alaska | 6 (HIPAA) | Adult: 7 after discharge; Minor: 7 after discharge or age 21, whichever longer |

| Arizona | Adult: 6 after last service; Minor: 6 after last service or age 21, whichever longer | Adult: 6 after last service; Minor: 6 after last service or age 21, whichever longer |

| Arkansas | 6 (HIPAA) | Adult: 10 after last discharge (master index permanently); Minor: 2 after age 18 (until 20) |

| California | 6 (HIPAA) | Adult: 7 after discharge; Minor: 7 after discharge or age 18 (until 19), whichever longer |

| Colorado | 6 (HIPAA) | Adult: 10 after last care; Minor: 10 after age 18 (until 28) |

| Connecticut | 7 from last treatment, or 3 after death | 10 after discharge |

| Delaware | 7 from last entry | 6 (HIPAA) |

| District of Columbia | Adult: 3 after last seen; Minor: 3 after last seen or age 18 (until 21) | 10 after discharge |

| Florida | 5 from last contact | Public: 7 after last entry |

| Georgia | 10 from record creation | Adult: 5 after discharge; Minor: 5 past age 18 (until 23) |

| Hawaii | Adult: Full 7 after last entry, Basic 25 after last entry; Minor: Full 7 after age 18 (until 25), Basic 25 after age 18 (until 43) | Adult: Full 7 after last entry, Basic 25 after last entry; Minor: Full 7 after age 18 (until 25), Basic 25 after age 18 (until 43) |

| Idaho | 6 (HIPAA) | Clinical lab: 5 after test date |

| Illinois | 6 (HIPAA) | 10 |

| Indiana | 7 | 7 |

| Iowa | Adult: 7 from last service; Minor: 1 after age 18 (until 19) | 6 (HIPAA) |

| Kansas | 10 from service provided | Adult: 10 after last discharge; Minor: 10 or 1 after age 18 (until 19), whichever longer; Summary: 25 |

| Kentucky | 6 (HIPAA) | Adult: 5 from discharge; Minor: 5 from discharge or 3 after age 18 (until 21), whichever longer |

| Louisiana | 6 from last treated | 10 from discharge |

| Maine | 6 (HIPAA) | Adult: 7; Minor: 6 past age 18 (until 24); Patient logs/x-ray reports: permanently |

| Maryland | Adult: 5 after record made; Minor: 5 after record or age 18+3 (until 21), whichever later | Adult: 5 after record made; Minor: 5 after record or age 18+3 (until 21), whichever later |

| Massachusetts | Adult: 7 from last encounter; Minor: 7 from last encounter or age 9, whichever longer | 30 after discharge or final treatment |

| Michigan | 7 from date of service | 7 from date of service |

| Minnesota | 6 (HIPAA) | Most: permanently (microfilm); Misc: Adult 7, Minor 7 after age 18 (until 25) |

| Mississippi | 6 (HIPAA) | Adult sound mind: 10, death: 7; Minor: minority period + 7 |

| Missouri | 7 from last service | Adult: 10; Minor: 10 or until 23, whichever later |

| Montana | 6 (HIPAA) | Adult: 10 after discharge/death; Minor: 10 after age 18/death (until 28); Core: additional 10 years |

| Nebraska | 6 (HIPAA) | Adult: 10 after discharge; Minor: 10 or 3 after age 18 (until 22), whichever longer |

| Nevada | 5 after receipt/production | 5 after receipt/production |

| New Hampshire | 7 from last contact, unless transferred | Adult: 7 after discharge; Minor: 7 or until 19, whichever longer |

| New Jersey | 7 from most recent entry | Adult: 10 after discharge; Minor: 10 after discharge or until 23, whichever longer; Summary: 20 |

| New Mexico | Adult: 2 beyond insurance/Medicare/Medicaid; Minor: 2 after age 18 (until 20) | Adult: 10 after last treatment; Minor: age 18+1 (until 19) |

| New York | Adult: 6; Minor: 6 and 1 after age 18 (until 19) | Adult: 6 after discharge; Minor: 6 after discharge or 3 after age 18 (until 21), whichever longer; Deceased: 6 after death |

| North Carolina | 6 (HIPAA) | Adult: 11 after discharge; Minor: until 30th birthday |

| North Dakota | 6 (HIPAA) | Adult: 10 after last treatment; Minor: 10 after last treatment or 21, whichever later |

| Ohio | 6 (HIPAA) | 6 (HIPAA) |

| Oklahoma | 6 (HIPAA) | Adult: 5 beyond last seen; Minor: 3 past age 18 (until 21); Deceased: 3 after death |

| Oregon | 6 (HIPAA) | 10 after last discharge; Master index: permanently |

| Pennsylvania | Adult: 7 from last service; Minor: 7 from last service or 1 after age 21 (until 22), whichever longer | Adult: 7 after discharge; Minor: 7 after age 18 or as long as adult, whichever longer |

| Puerto Rico | 6 (HIPAA) | 6 (HIPAA) |

| Rhode Island | 5 unless otherwise required | Adult: 5 after discharge; Minor: 5 after age 18 (until 23) |

| South Carolina | Adult: 10 from last treatment; Minor: 13 from last treatment | Adult: 10; Minor: until 18 and 1 year after (usually until 19) |

| South Dakota | Inactive or whereabouts unknown | Adult: 10 from visit; Minor: 10 from visit or age 18+2 (until 20), whichever later |

| Tennessee | Adult: 10 from last contact; Minor: 10 from last contact or 1 after age 18 (until 19), whichever longer | Adult: 10 after discharge/death; Minor: 10 after discharge or minority+1 (until 19), whichever longer |

| Texas | Adult: 7 from last treatment; Minor: 7 from last treatment or until 21, whichever later | Adult: 10 after last treated; Minor: 10 after last treated or until 20, whichever longer |

| Utah | 6 (HIPAA) | Adult: 7; Minor: 7 or age 18+4 (until 22), whichever longer |

| Vermont | 6 (HIPAA) | 10 |

| Virginia | Adult: 6 after last contact; Minor: 6 after last contact or age 18/emancipation, whichever longer | Adult: 5 after discharge; Minor: 5 after age 18 (until 23) |

| Washington | 6 (HIPAA) | Adult: 10 after discharge; Minor: 10 after discharge or 3 after age 18 (until 21), whichever longer |

| West Virginia | 6 (HIPAA) | 6 (HIPAA) |

| Wisconsin | 5 from last entry | 5 |

| Wyoming | 6 (HIPAA) | 6 (HIPAA) |