Injuries at the workplace can happen to anyone, regardless of their profession or skill level. Injuring an employee on the job can significantly impact their ability to work and overall well-being. Workers’ compensation, also known as workers’ comp, is a system that benefits workers who are injured or become ill due to their jobs. One commonly asked question about workers’ comp is whether it pays for medical bills. This blog will explore this question and provide insights into the workers’ comp system.

Importance of Workers’ compensation

Workers’ compensation is a system designed to benefit employees injured on the job or ill due to their work. This system is a form of insurance that employers must provide to their employees in most states in the US. The benefits provided by workers’ comp can include medical treatment, wage replacement, disability benefits, and vocational rehabilitation.

The importance of workers’ comp cannot be overstated. Workplace injuries can have a significant impact on employees and their families. Medical bills, lost wages, and disability can strain an injured employee’s finances and well-being. Workers’ comp provides a safety net that helps injured employees get the care they need and stay financially afloat while recovering from their injuries.

From an employer’s perspective, workers’ comp is also essential. Workplace injuries can result in significant financial losses for employers in terms of medical costs and lost productivity. Workers’ comp provides a compensation system that helps limit these losses and can reduce the likelihood of costly lawsuits resulting from workplace injuries.

In short, workers’ compensation is a crucial system providing essential benefits to employees and employers. It ensures that injured employees receive the care they need and that employers are protected from the financial impact of workplace injuries.

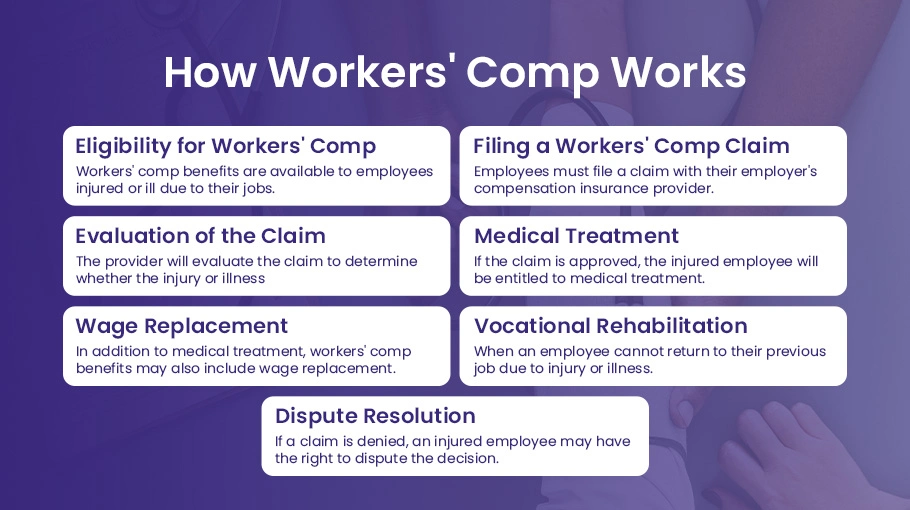

How Workers’ Comp Works

Before we delve into whether workers’ comp pays for medical bills, let’s first understand how the system works. Workers’ comp is a system designed to benefit employees injured or ill due to their work. These benefits include medical treatment, wage replacement, disability benefits, and vocational rehabilitation. Workers’ comp aims to protect employees and employers by ensuring that injured employees receive the care they need while also providing a compensation system that helps limit the financial impact of workplace injuries on employers.

Eligibility for Workers’ Comp

Workers’ comp benefits are available to employees injured or ill due to their jobs. In general, an employee may be eligible for workers’ comp benefits if an injury or illness occurs while an employee performs job-related duties. However, this general rule has some exceptions and limitations, such as injuries caused by an employee’s misconduct or injuries that occur during an employee’s commute to or from work.

Filing a Workers’ Comp Claim

Employees must file a claim with their employer’s compensation insurance provider to receive workers’ comp benefits. The employee should report the injury or illness to their supervisor immediately and complete the necessary paperwork to initiate the claim process.

Evaluation of the Claim

Once a claim is filed, the workers’ comp insurance provider will evaluate the claim to determine whether the injury or illness is covered under the policy. The insurance provider may request additional information, such as medical records or witness statements, to help evaluate the claim with the aid of medical billing companies.

Medical Treatment

If the claim is approved, the injured employee will be entitled to medical treatment for their injury or illness. The workers’ comp insurance provider will typically cover the cost of medical treatment, including doctor’s visits, hospital stays, and medication.

Wage Replacement

In addition to medical treatment, workers’ comp benefits may also include wage replacement. If an injured employee cannot work due to injury or illness, they may be eligible for temporary or permanent disability benefits. These benefits are designed to replace some of the employee’s lost wages.

Vocational Rehabilitation

Workers’ comp benefits may include vocational rehabilitation if an employee cannot return to their previous job due to injury or illness. This can include job training, education, or other services to help employees find new employment.

Dispute Resolution

If a workers’ comp claim is denied, an injured employee may have the right to dispute the decision. This can involve filing an appeal with the workers’ comp insurance provider or going through a formal dispute resolution process, such as a hearing before an administrative law judge.

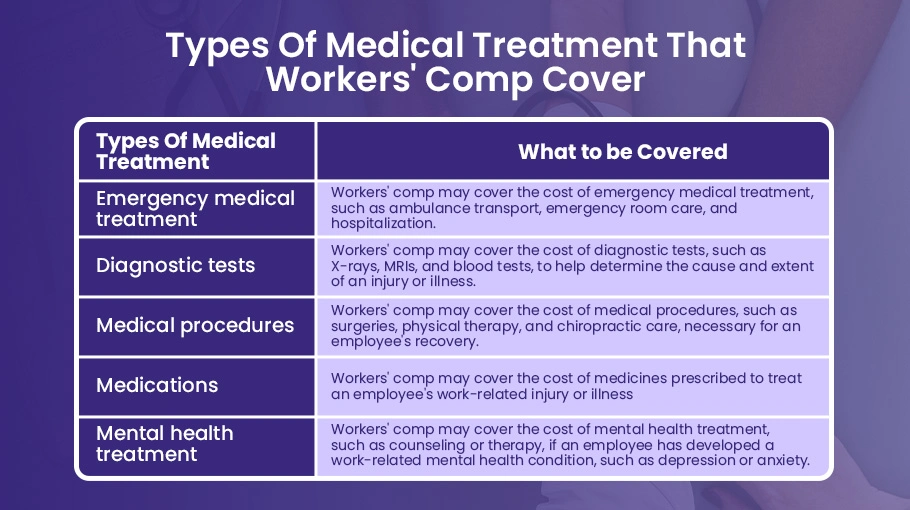

Medical Benefits under Workers’ Comp

Now that we understand how workers’ comp works let’s take a closer look at medical benefits. Workers’ comp typically covers medical bills related to workplace injuries or illnesses. This can include expenses related to doctor visits, hospital stays, surgeries, medications, and other necessary medical treatment. In most cases, there is no limit to the amount of medical benefits an injured employee can receive under workers’ comp. Let’s explain the medical benefits under workers’ comp, including the types of medical treatment covered and how employees can access medical care.

Types of Medical Treatment

Workers’ comp medical benefits can cover a wide range of medical treatments. This includes:

Doctor’s visits

Workers’ comp will cover the cost of doctor’s visits related to the employee’s work-related injury or illness. This includes both initial visits and follow-up appointments.

Hospital stays

If an employee requires hospitalization due to work-related injury or illness, workers’ comp will cover the cost of their hospital stay.

Surgery

If surgery is required to treat the employee’s work-related injury or illness, workers’ comp will cover the cost of the procedure.

Rehabilitation

Workers’ comp may cover the cost of rehabilitation services, such as physical therapy, to help the employee recover from their injury or illness.

Medication

Workers’ comp will cover the cost of medication related to the employee’s work-related injury or illness. This can include both prescription and over-the-counter medicines.

Here are some examples of the types of medical treatment that workers’ comp may cover:

Accessing Medical Care

If an employee is injured or becomes ill due to their job, they should seek medical care as soon as possible. In most cases, the employer will have a designated medical provider that employees must use for their initial medical treatment. Employees should check with their employer to determine which medical provider they should use.

Once an employee has received initial medical treatment, they may be referred to other medical providers for additional treatment. Employees must keep their employer and workers’ comp insurance provider informed of all medical treatment they receive.

Employees should also keep records of all medical treatment related to their work-related injury or illness. This includes forms of doctor’s visits, hospital stays, and medication. These records can support the employee’s workers’ comp claim.

Choosing a Doctor for Treatment

It’s important to note that under workers’ comp, an injured employee may be required to seek treatment from a doctor approved by their employer or insurance company. This is known as a managed care plan. If an injured employee seeks treatment from a doctor who is not part of the managed care plan, they may not be eligible for workers’ comp benefits related to that treatment.

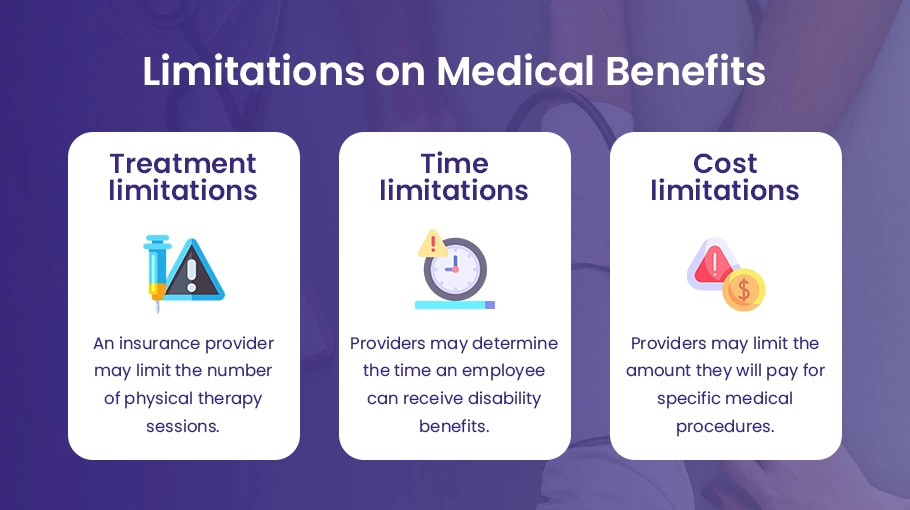

Limitations on Medical Benefits

Workers’ compensation provides significant medical benefits to employees injured or ill due to their jobs. However, there are limits on the medical benefits that employees can receive under workers’ comp. Let’s look at the limits on medical benefits under workers’ comp and what they mean for employees.

There are several types of limits on medical benefits under workers’ comp. These include:

Treatment limitations

Some workers’ comp insurance providers may limit the type or amount of medical treatment employees can receive. For example, an insurance provider may limit the number of physical therapy sessions employees can receive or require per authorization for specific medical procedures.

Time limitations

Workers’ comp insurance providers may limit how long employees can receive medical treatment. For example, an insurance provider may determine the time an employee can receive temporary disability benefits, which are designed to cover the period when the employee is unable to work due to injury or illness.

Cost limitations

Workers’ comp insurance providers may limit how much they will pay for medical treatment. For example, an insurance provider may limit the amount they will pay for specific medical procedures or may only cover the cost of generic medication.

Consequences of Medical Benefits Limitations

The limits on medical benefits under workers’ comp can have significant consequences for employees. For example:

Limited medical treatment

Suppose an insurance provider limits the type or amount of medical treatment an employee can receive. In that case, the employee may not receive all the care they need to recover from their injury or illness.

Financial strain

If an insurance provider limits the amount of money they will pay for medical treatment, the employee may be left with significant out-of-pocket costs.

Inability to return to work

If an employee does not receive adequate medical treatment, they may be unable to return to work as quickly as they would like or may not be able to return to work.

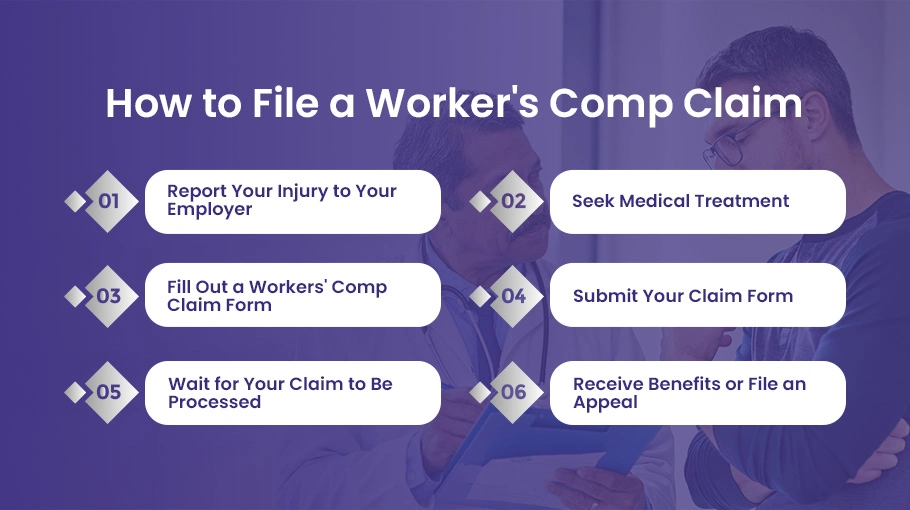

Filing a Workers’ Comp Claim

If you’ve been injured on the job, filing a workers’ compensation claim can help you get the medical treatment and financial compensation you need to recover. Here’s a step-by-step guide to filing a workers’ comp claim:

Report Your Injury to Your Employer

The first step in filing a workers’ comp claim is immediately reporting your injury to your employer. This may involve filling out an incident report or providing a written description of what happened. You should do this even if your injury seems minor initially, as some injuries may become more severe over time.

Seek Medical Treatment

The next step is to seek medical treatment for your injury. Depending on the severity of your injury, you may need to go to the emergency room or urgent care center. In other cases, you may be able to see your primary care physician. Be sure to tell the medical provider that your injury occurred on the job, as this will help ensure that your medical bills are covered under workers’ comp.

Fill Out a Workers’ Comp Claim Form

Once you’ve reported your injury to your employer and sought medical treatment, you must fill out a workers’ comp claim form. This form will ask for information about your injury, including when and how it occurred and the medical treatment you’ve received.

Submit Your Claim Form

After filling out the claim form, you’ll need to submit it to your employer’s workers’ comp insurance provider. Your employer should provide you with information on where to submit your claim form.

Wait for Your Claim to Be Processed

Once you’ve submitted your claim form, the workers’ comp insurance provider will review your claim and decide whether to approve or deny your claim. This process can take several weeks.

Receive Benefits or File an Appeal

If your claim is approved, you’ll receive benefits, including medical treatment, temporary disability benefits, and permanent disability benefits. If your claim is denied, you can file an appeal.

How BellMedEx Helps in Worker’s Compensation?

BellMedex is a medical billing and revenue cycle management company that provides services to healthcare providers, including those who treat injured workers covered under worker’s compensation insurance.

Regarding worker’s compensation cases, BellMedEx helps healthcare providers submit medical bills and related documentation to the insurance company responsible for the claim. They ensure that all necessary information is included in the claim and submitted promptly so that healthcare providers can get reimbursed for their services to the injured worker.

BellMedex also helps healthcare providers track the status of their worker’s compensation claims so they can follow up with insurance companies as needed to ensure they are paid promptly and accurately. In addition, they provide support and guidance to healthcare providers on worker’s compensation billing and reimbursement issues so that providers can focus on delivering high-quality care to their patients.

Worker’s compensation medical billing will typically include substantial interaction with the relevant law offices and for pre/prior authorizations. BellMedex has a lot of experience in both of these interactions.

BellMedEx’s services help healthcare providers streamline their worker’s compensation billing processes and improve their financial performance. In contrast, ensuring injured workers receive the care they need to recover.

Conclusion

Workers’ compensation is a crucial benefit that helps ensure that injured workers receive the medical treatment and financial compensation they need to recover from work-related injuries or illnesses. Medical benefits under workers’ comp can cover various expenses, from doctor’s visits and hospital stays to prescription medication and rehabilitation services. However, it’s important to note that there may be limits on the amount and duration of medical benefits, depending on the specific state laws and workers’ comp policy. If you’ve been injured on the job, you must report your injury to your employer, seek medical treatment, and file a workers’ comp claim as soon as possible to ensure you receive the benefits you’re entitled to.