Healthcare providers, including therapists, prefer to be part of the best insurance panels. They always choose those panels that facilitate providers with an easy credentialing process, grant approval on fewer requirements, provide high reimbursement rates, and process claims instantly. However, identifying the best among the available insurers depends upon therapists’ priorities and unique practice goals.

In this comprehensive guide, we will discuss the best insurance panels for therapists, the pros and cons of getting on the panel, and understand the key factors involved in choosing an insurance panel which can be proved the best for therapists.

🧠 Understanding Insurance Panels or Payer Panels

Insurance panels are networks of healthcare providers partnered or in-network with insurance companies to provide care services to their policyholders (patients) at pre-negotiated rates.

Becoming part of panels can be competitive as many insurance companies welcome only a certain number of healthcare professionals to their aligned insurance panels. Each panel is operated by its own insurance company. Patients that the insurance company covers are entitled to receive healthcare services according to their coverage plan from healthcare providers who are part of that particular insurance panel.

Insurance Panels for Therapists

An insurance panel for therapists is a group of therapists credentialed with an insurance company to provide healthcare services to patients in a network with that insurer. Joining an insurance panel requires a comprehensive process known as the credentialing process. The therapists must provide their qualifications before joining an insurance panel.

After joining a panel, therapists have access to a vast pool of patients who need therapy services. However, it can be challenging for therapists to get on panels, as they accept only those who can offer unique benefits to insurance company policyholders.

For example, insurance companies might be interested in onboarding therapists who:

- Provide care services on an in-demand schedule, including outside standard business hours

- Offer therapy services at competitive hourly rates

- Hold credentials as specialists in specific areas of therapy

- Have completed relevant education and training courses

- Support patients with less common diagnoses

Furthermore, therapists can apply to work with multiple insurance panels, whether state or nationwide companies. It is suggested that therapists look for the best insurance panels before applying to any panel. However, the process of getting on panels may take a few months or longer in some cases. Here, we provide them with easy steps to get on an insurance panel.

The Best Insurance Panels for Therapists in the USA

Here, we’ve compiled a list of top insurance panels for healthcare providers. Each offers unique features and benefits, though what qualifies as “best” may vary by provider needs. This list aims to give therapists valuable insights into which panel may align best with their practice goals:

- Blue Cross Blue Shield (BCBS) ➜ Best for therapists seeking broad patient reach and high provider participation.

- UnitedHealthcare ➜ Best for therapists who value easy access to digital tools and high reimbursement rates.

- Aetna ➜ Best for therapists looking for resourceful provider support.

- Cigna ➜ Best for therapists who need simple credentialing and efficient claims.

- Medicaid and Medicare ➜ Best for therapists aiming to serve low-income and elderly patients.

⬇️⬇️⬇️

1). Blue Cross Blue Shield

Blue Cross Blue Shield (BCBS) is known for providing comprehensive healthcare coverage to individuals and facilitating healthcare providers with high reimbursement rates for the services provided to patients in-network with BCBS. The main aim of the insurance company is to offer a personalized approach to health care. Their members live and work in different communities in various states of the US. For this purpose, they work with different healthcare providers to serve their policyholders with quality and affordable healthcare.

Blue Cross Blue Shield comprises 33 independent companies operating nationwide, providing healthcare coverage to 115 million members in all 50 states of the USA. In addition, 1.7 million doctors and hospitals are in contract with BCBS insurance companies, the highest number of paneled healthcare providers among other insurance companies.

Furthermore, it is advantageous for therapists in the US to get on a panel with BCBS as the insurance company has diverse application requirements in each state. For example, the insurance panel in Illinois uses the CAQH application for the credentialing process. In other states, the process of credentialing new therapists may be different. Similarly, the reimbursement rates also vary by location, specialty, and therapists’ qualifications.

Give us Just 10 Mins!

We’ll Get You On The BCBS Panel 💯

Our experts handle everything – paperwork, follow-ups, the works. Before you know it, you’ll be part of the BCBS network.

2). UnitedHealthcare

UnitedHealthcare is a perfect choice for qualified therapists. The insurance company provides care services to a wide range of patients nationwide. It can help therapists get more patient appointments and increase the flow of their practices. UnitedHealthcare is on the list of the best insurance panels for therapists because it facilitates healthcare providers with instant payment and high reimbursement rates.

In addition, UnitedHealthcare allows healthcare providers, i.e., therapists, to become part of its insurance network easily. They have to follow these simple steps:

- Apply with relevant information and essential documents

- The panel will verify your experience and right to provide care services

- After that, they will review and sign your participation agreement

After joining their network, as a therapist, you can access a wide range of patients and become part of their insurance panels. They have onboarded 1.3 million healthcare professionals and 67,000 hospitals and care facilities across the US. They also facilitate their participants with a UnitedHealthcare Provider Portal and several digital tools where healthcare professionals can manage eligibility and referral activity.

UnitedHealthcare opens doors of opportunity for therapists as it has a large pool of patients with different coverage benefits. The insurance company provides health benefits plans to patients of all ages across the United States. Patients can have coverage benefits for individuals and families, health insurance through work, and Medicare and Medicaid benefits.

UH Approval Got You Like ➜😫?

Chill, We Got This!

We’ll optimize your application and won’t stop until you have that approval letter in hand.

3). Aetna

Aetna marks itself on the list of best insurance panels recognized for its commitment to providing support for therapists. The insurance company provides different healthcare plans that benefit patients and allow participant providers to reach them.

The insurance panel enables its in-network providers to find the tools and resources they need to stay informed and focus on caring for their patients. Becoming part of Aetna also provides healthcare professionals with resources to get paid faster while managing documents, claims, and reimbursements.

Seeking Aetna Approval?

Consider It Done 💯

Don’t waste time figuring out Aetna’s requirements. Our team knows the ins and outs to get you approved fast.

4). Cigna

Cigna welcomes therapists on its insurance panel, offering them a range of plans. The insurance panel is known for its supportive role for providers, facilitating them with easy credentialing, high reimbursement rates, hurdle-free claim processing, and fast reimbursement. Cigna Insurance Panel requires very little from the therapists to get credentialed. A few of the requirements are:

- CAQH Application

- Signed agreement to participate

- Signed and completed standard or state-mandated application

- State medical license

- Professional liability coverage

- Admitting privileges, if applicable

- Education and training, including board certification, if applicable

- History of employment

Furthermore, Cigna also provides therapists with digital tools to help them verify patient eligibility and benefits, check claims, payments, and fee schedules, and increase efficiency while providing healthcare services.

Cigna Enrollment Freaking You Out?

Take A Breather, We’ll Handle It! 😎

Hand us the reins and we’ll get you paneled and seeing Cigna patients in no time. Kick back, we’ve got this.

5). Medicaid And Medicare

Medicaid and Medicare are US government healthcare programs offering care services to low-income individuals, elderly individuals, and individuals with specific disabilities.

Medicare programs provide healthcare benefits to individuals who are above 65 years of age or suffering from particular disabilities, while Medicaid facilitates low-income individuals with healthcare benefits.

Both programs accept therapists in their network, but they usually pay less as they are government programs than private insurance panels.

However, these programs are on the list of the most secure, reliable, and best insurance panels, as sometimes they can pay high reimbursement rates for CPT codes for therapy sessions performed in various locations.

Medicare and Medicaid?

Let’s Do This! 🚀

We get it, government programs can be intimidating. But not for us! We’ll optimize your application and follow up persistently until you’re accepted.

Comparison of Best Insurance Panels for Therapists in the USA

| Insurance Panel | Reimbursement Rates | Credentialing Process | Therapist Network Benefits | Special Requirements |

| Blue Cross Blue Shield (BCBS) | ● High rates, varies by location and specialty ● Rates depend on therapist’s qualifications | ● Credentialing varies by state ● Often requires CAQH application | ● Extensive network for increased patient access ● High patient acceptance rate | ● State-specific requirements ● CAQH application often needed |

| UnitedHealthcare | ● Competitive rates ● Options for quick payment | ● Simple three-step process ● Verification of experience | ● Large patient pool ● Access to Provider Portal and digital tools for eligibility and referral | ● Agreement to participate ● Verification of therapist’s credentials |

| Aetna | ● Moderate to high rates ● Faster claim processing | ● Streamlined process ● Faster claim management support | ● Access to claim tracking tools ● Document management resources | ● Prior experience often needed ● Signed participation agreement |

| Cigna | ● High rates ● Rapid reimbursement, smooth claims | ● Minimal requirements ● CAQH application, state license needed | ● High reimbursement rates ● Digital resources for practice efficiency | ● Requires liability coverage ● Education, training, and state-specific requirements |

| Medicaid and Medicare | ● Generally lower than private panels ● CPT code rates vary | ● State-based credentialing ● Federal standards apply | ● Stable demand from elderly and low-income patients ● Coverage for specific demographics | ● Federal and state eligibility requirements ● Lower reimbursement may affect acceptance |

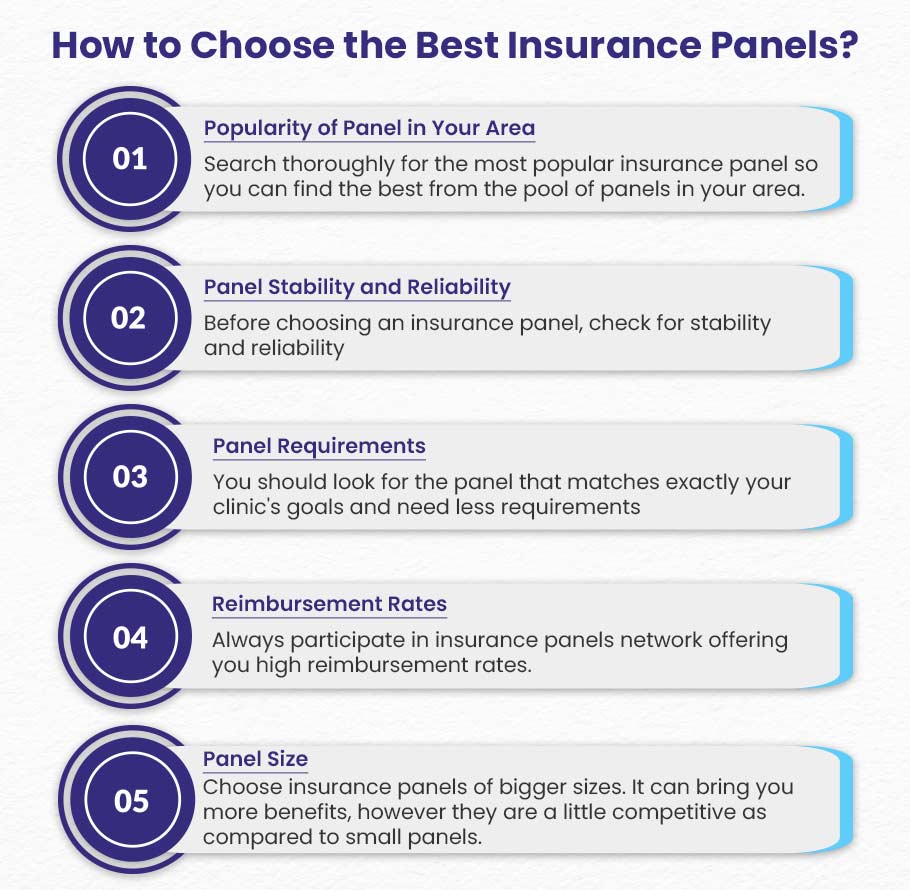

How to Choose the Best Insurance Panels?

Before choosing any insurance panel, we suggest therapists to consider a few points. It will help them choose the best insurance panel that benefits their practice. These points include but are not limited to only those mentioned here.

If you are a therapist looking for a perfect insurance panel, consider these key factors before getting on board. Many panels might accept your credentialing application, but the one with certain features could be the best fit for your practice.

➜ Popularity of Panel in Your Area

It will take some time to search thoroughly for the most popular insurance panel, but as a result, you can find the best from the pool of panels in your area. Also, search for panels that patients in that area mostly use. Discussing with your fellow therapists who are already part of insurance panels can give you insights into the popularity of insurers. Their experience with various panels lets you know about the pros and cons of a particular insurance panel. Remember! Look for something other than popular ones.

Here are some other factors to consider.

➜ Panel Stability and Reliability

Before choosing an insurance panel, check for stability and reliability. You can do this by checking its history and reputation in the industry and getting feedback from other healthcare providers in-network with that panel.

➜ Panel Requirements

Each panel requires the therapists to fulfill certain conditions to get approval for credentialing. You should look for the one that matches exactly your clinic’s goals and capacity.

For example, some insurance panels may want therapists to work a certain number of hours or provide services to a certain number of patients.

So, carefully read about their terms and know about the number of patients and working hours. If their conditions align with your practice, then go for it; otherwise, search for a better one.

➜ Reimbursement Rates

Each insurance provider (Medicare, Medicaid, private insurers) has its own fixed reimbursement rates, usually less than that of patients who pay out of pocket. Government plans, such as Medicare and Medicaid, even pay less. As a therapist, you should be part of insurance panels that reimburse you at rates closer to the rates you charge for healthcare services provided to out-of-network patients.

For example, three patients, A, B, and C, visit your clinic for therapy sessions. They are in a network with different insurance panels, AAA, BBB, and CCC. You provide the same therapy services to all of them. The AAA’s allowed amount for the care service is $50, the BBB’s is $60, and the CCC allows $45 for the same care service. Now, getting on a panel with the BBB can be the best choice as it can reimburse you $60 for the services you provide, which is a higher rate than the others.

➜ Panel Size

Checking for insurance panel size is also one of the critical factors to consider before choosing a panel. Large insurance companies have more slots in their panels for healthcare providers, offering higher reimbursement rates but high competition. In contrast, you may have less competition if you become part of small insurance panels. If you live in a rural area where therapists are in demand, you should go for small insurance panels.

Moreover, joining large insurance panels can help you grow your practice, as there might be a high number of patients in-network with those large insurance companies.

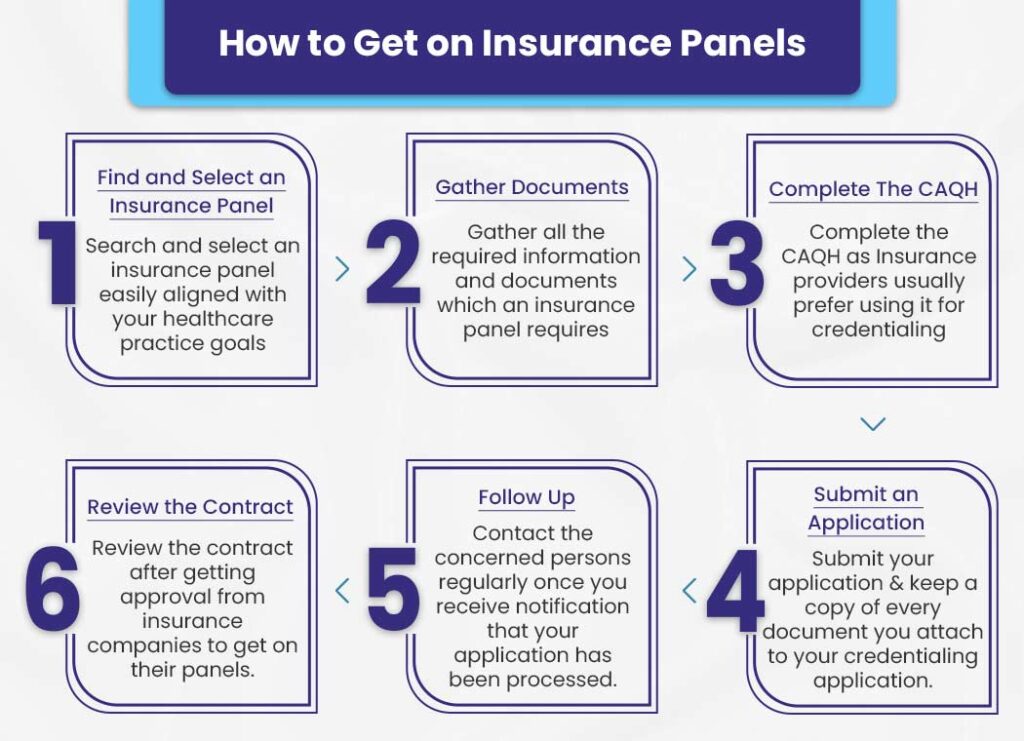

How to Get on Insurance Panels?

The process of getting paneled is also known as getting credentialed. It is a time-consuming process, but following these simple steps can assist you in getting enrolled with top payers in your region:

▶️ Find and Select an Insurance Panel

First, search and select an insurance panel(s) easily aligned with your healthcare practice goals. Use all your potential resources to get the best insurance options. Asking your colleagues or finding information through online sources will assist you in learning more about a particular panel.

▶️ Gather Documents

After choosing an insurance company, it is time to gather all the required information and documents. Each insurance panel requires its own set of eligibility criteria, including licensure type, years of experience, and certifications or specializations. Before applying, ensure that you have all the necessary documents, i.e., a resume, professional license, proof of liability insurance, and any relevant certifications. This will play an important role in streamlining the credentialing process.

▶️ Complete The CAQH

Insurance panels have their own application process, but you must complete the CAQH (Council for Affordable Quality Healthcare). Insurance providers usually prefer using CAQH for credentialing. To get on the panel, you must fill out a CAQH application, after which you will get a CAQH number from insurance providers. You can apply it to multiple panels using it. Through this form, insurance companies can verify your data.

CAQH allows you to apply in two ways: print or fill it out online. It is better to fill out the form online, as there are fewer chances of making errors. Before submitting the form, check it twice, as slight errors can slow down the credentialing process.

▶️ Submit an Application

Your application is now ready to be submitted. It is recommended that you keep a copy of every document you attach to your credentialing application.

▶️ Follow Up

Don’t be a sleeping rabbit after applying to get on insurance panels. Keep following up on your application, as insurance companies receive many applications. Contact the concerned persons regularly once you receive notification that your application has been processed.

Knowing whether your application is accepted may take 2 to 4 months. The insurance companies will inform you if anything needs to be added to your application. Contacting them enables you to fulfill requirements before any unpleasant response. Be prepared for any of the responses. If it is rejected, you can appeal for resubmission, but it may take another few months. Therefore, follow-up is necessary to act on time.

▶️ Review the Contract

At the final stage, before accepting, you must review the contract after getting approval from insurance companies to get on their panels. Review and negotiate terms such as reimbursement rates, company requirements from you, etc. Be sure that all the arrangements in the contract are beneficial for you and meet your practice goals.

Conclusion

In summary, picking the right insurance panel can greatly help therapists who want to grow their practice and claim reimbursements easier. Each of these main insurance companies—Blue Cross Blue Shield, UnitedHealthcare, Aetna, Cigna, and government programs like Medicaid and Medicare—has special benefits.

BCBS has a large network, UnitedHealthcare offers easy-to-use tools for providers, and Cigna has a simple process for credentialing. These options help therapists find patients, make administrative work easier, and improve their earnings.

Finding a panel that matches your goals can really help you create a successful and lasting practice, even though “best” can mean different things to different people.

Get Credentialed with Your Preferred Insurance Panels

We know getting credentialed can be a total pain, but we’ve got your back. Just tell us which payer networks you want in on, and we’ll have you credentialed and ready to roll in no time.

Assisting with credentialing and enrollment, BellMedEx has been consistently reliable from the first day of our relationship.

Dr. Mike

Internal Specialist Medicine

Top Features

✓ Provider Credentialing

✓ Payer Enrollment Service

✓ Hospital & Clinical Privileges