In medical service, you know the need of having a reliable health payer. With so many insurance companies, it becomes so tricky to know which is better and more reliable to collaborate with.

That’s why I’ve put together this handy guide on the top healthcare payer companies in the USA. Whether you are trying to change your insurers or just simply want to be well informed, this blog post will get you inside information about payers that just kill it on provider satisfaction, claims processing, and ease of doing business altogether.

So, grab a cup of coffee—or if that is not your style, then tea—and let us dive together into the world of the healthcare payers. By the time you are done reading this, you will know way better what companies you should consider for your practice. Let’s begin!

This is what makes Kaiser Permanente a top healthcare insurer for medical practices in the USA:

- Trusted name

- Steady patient flow

- Predictable payments

- Long-term growth

- Latest tools and tech

- Access to large member base

Here’s why healthcare specialists can trust United Healthcare as one of the best healthcare payer companies in the USA:

- Vast provider network

- Flexible coverage

- Engaged patients

- Convenient virtual visits

- Data analytics

- Provider-focused support

Here’s what makes Elevance Health a leading healthcare insurer for healthcare teams in the USA:

- Variety of plans

- Timely reimbursements

- Training and resources

- Focus on outcomes

- Expanding membership

- National presence with local focus

4. Oscar Health

This is why healthcare clinics should choose Oscar Health as one of the best insurers in the USA:

- Low denial rate

- Easy credentialing

- Values provider relationships

- Accessible, quality coverage

- Streamlined processes

- Timely reimbursements

5. HCSC

Here’s why HCSC is an ideal payer company for healthcare professionals in the USA:

- Comprehensive network

- Efficient claims

- Quick payments

- Responsive partner

- Resources to enhance care

- Security, efficiency, collaboration

What is a Healthcare Payer?

A healthcare payor, also written as a healthcare payer, is an organization that covers the expenses of healthcare services its members receive from credentialed healthcare providers. These payors can be government and private insurance providers, such as Medicaid and Medicare (government programs) and other commercial insurers.

Payors offer patients various health plans. A slight difference between a payor and a health plan is that the health plan includes all the details about covered treatment procedures and their costs, while the payor is the entity responsible for processing patient enrollment, services, and payments.

Insurance payors pay both healthcare providers for services rendered to their covered patients and patients if they receive services from out-of-network providers with the consent of their insurance provider. In the latter case, the patient pays healthcare providers out-of-pocket for services received and then submits claims, in the form of a superbill, to their insurance payor to receive payment for covered care services.

💡 Payor vs. Payer Difference

There is no particular difference between the insurance payor and the insurance payer. Both can be used interchangeably in the healthcare industry. However, the preferred word by the American Medical Association (AMA) is “Payor”.

Top 5 Best Healthcare Payors Companies in the USA

Choosing the best healthcare payor in the USA requires careful consideration of several important factors. Healthcare providers need a partner that ensures reliable reimbursements, comprehensive insurance coverage, and a long-term, trustworthy relationship.

Below is a list of the top-rated healthcare payors, known for their excellent services, timely payments, and commitment to both providers and patients.

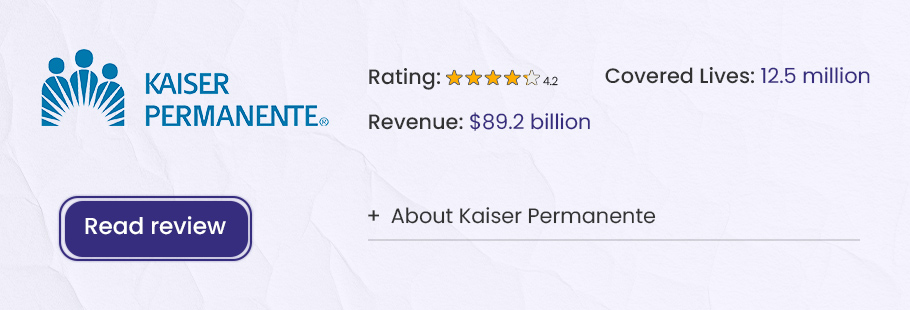

1️⃣ Kaiser Permanente

Kaiser Permanente is a trusted name among the best healthcare payer companies in the USA. It provides reliable coverage and high-quality care. With over 12 million members across the U.S., they have built a strong reputation. For healthcare providers, teaming up with Kaiser has some great benefits you might not find elsewhere.

First, because Kaiser has so many members, providers get a steady flow of patients. This means more chances to grow your practice and have consistent income. Plus, Kaiser’s closed network makes it easier for providers to work together and share patients. You can coordinate care smoothly with other professionals in the network.

Another bonus is predictable payments. Kaiser has set schedules for reimbursements, so you know when and how much you’ll get paid. This helps you plan your practice’s budget without surprises.

Kaiser has been around for over 75 years, so they bring a lot of experience to the table. Working with them means you can build long-term relationships and see your practice grow. Their focus on patient-centered care is something that aligns with most providers’ goals – offering quality care and good health outcomes.

Kaiser also invests in new tools and technology to help healthcare providers. You’ll have access to the latest resources, which can help take your practice to the next level and offer your patients the best treatment available.

And, with Kaiser’s big presence in states like California, partnering with them gives you the chance to reach more patients in popular markets. You’ll have access to a larger group of people who rely on Kaiser for their healthcare.

For healthcare providers, Kaiser Permanente is a great partner. They offer financial stability, the chance for growth, coordinated care, and tools to improve your practice. With their focus on both patients and providers, Kaiser is a smart choice for healthcare professionals.

So, if you’re looking for a trusted, reliable partner, Kaiser Permanente might be just what you need!

🔴 Click Here To Get Credentialed with Kaiser Permanente

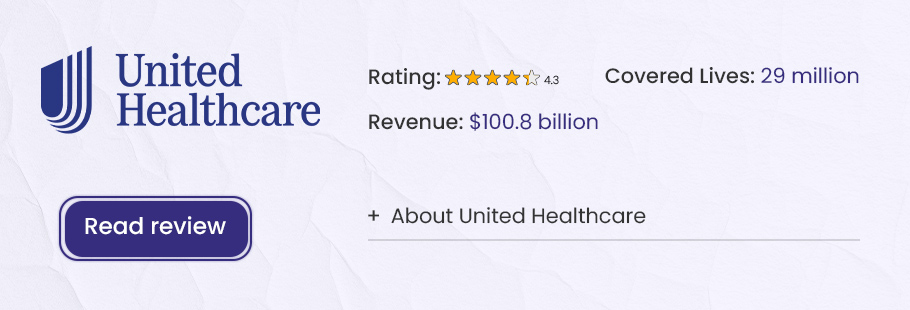

2️⃣ United Healthcare

United Healthcare is known as one of the best healthcare payer companies in the United States for good reason. With an expansive network of providers and innovative programs for members, United Healthcare makes it easy for doctors and hospitals to provide quality care.

Their vast network includes over 1.5 million physicians and 6,200 hospitals across the country. This gives members exceptional access to care, whether they are at home or traveling for work. Providers can trust United Healthcare to give their patients flexible coverage options at fair rates.

UnitedHealthcare offers affordable health plans that allow members to see in-network doctors with lower out-of-pocket costs. Programs like UnitedHealth Wellness also help patients better manage their health with resources focused on prevention. For providers, this means patients that are more engaged in their care.

With Oxford Health Plans, United Healthcare provides flexible products to meet diverse member needs. Virtual visits let patients conveniently access care through their phone or computer. This innovation makes life easier for both patient and physician.

Optum, United’s technology division, is another advantage for providers. Optum’s data analysis and research helps doctors improve quality and efficiency. By partnering with United Healthcare, physicians get tools to deliver better individual care and strengthen the healthcare system overall.

At the end of the day, United Healthcare’s provider-focused approach means doctors can devote their energy to patient care. Their programs give physicians useful support to better serve members. For these reasons, United Healthcare is regarded nationwide as a leading health payer that providers can trust.

🔴 Click Here To Get Credentialed with United Healthcare

3️⃣ Elevance Health

Elevance Health is a top-tier healthcare payer for providers across the United States. With a presence in 14 states, it offers access to millions of members through renowned affiliates like Blue Cross Blue Shield and WellPoint. This extensive reach and strong reputation make Elevance Health a reliable partner for providers seeking growth and stability.

What draws providers to Elevance Health are the variety of coverage plans, timely reimbursements, and supportive partnerships. Medicaid, Medicare, and commercial options give providers access to diverse patient populations and needs. Prompt payment for services maintains robust cash flow. Resources, training, and tools help deliver quality care and ease administrative duties.

Elevance Health also focuses on improving patient outcomes. This aligns with providers’ goals of offering excellent care. Through investments in programs and technologies, Elevance Health assists providers in upholding stringent care standards.

In 2021, Elevance Health covered nearly 6 million members and earned over $43 billion in premiums. By the end of 2022, its membership had surged to nearly 46 million, solidifying its position as one of the leading payers in the industry. As of September 30, 2024, Elevance Health is providing coverage to approximately 45.8 million members, continuing its impressive growth and market presence.

For providers seeking reliable volume, administrative relief, and shared objectives, Elevance Health is an ideal payer partner. With comprehensive plans, expanding membership, and a dedication to service quality, Elevance Health offers robust support for providers across diverse specialties and care settings. Its national presence and locally-focused affiliates give providers the best of breadth and depth in a single payer relationship.

🔴 Click Here To Get Credentialed with Elevance Health

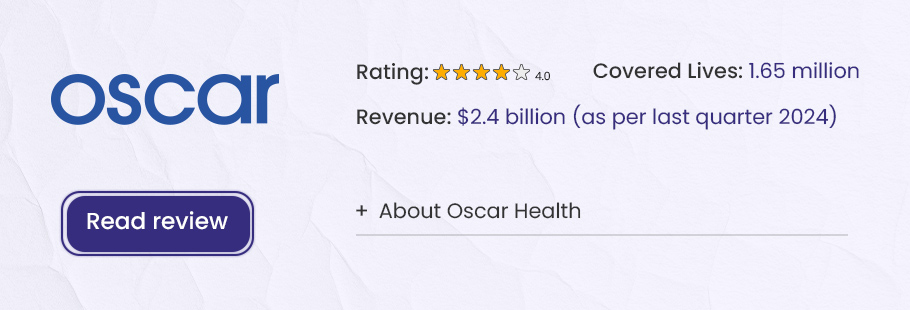

4️⃣ Oscar Health

Oscar Health is known for its low claim denial rate—just 7%! This means healthcare providers can count on getting paid quickly and fairly for their services. Doctors, hospitals, and clinics can trust Oscar to reimburse them promptly, which is a huge relief in an age when denied claims and delayed payments are common.

Joining Oscar Health is easy, too. The provider credentialing process is simple and smooth. Once you’re in the network, you can focus on what you do best—caring for patients—without worrying about payment issues. This makes it easier for you to spend less time on paperwork and more time helping people heal.

Oscar Health values strong relationships with its providers. They only partner with the best to give their 1.65 million members top-quality care. This shared focus on providing excellent care makes Oscar Health a great partner for healthcare professionals.

Oscar Health is a leader in offering accessible, high-quality insurance nationwide. But what really sets them apart is their streamlined processes and timely reimbursements. Doctors can confidently join Oscar’s network, treat their patients, and receive prompt payment for their services.

If you’re looking for a supportive payer partner, Oscar Health is a smart choice for healthcare providers!

🔴 Click Here To Get Credentialed with Oscar Health

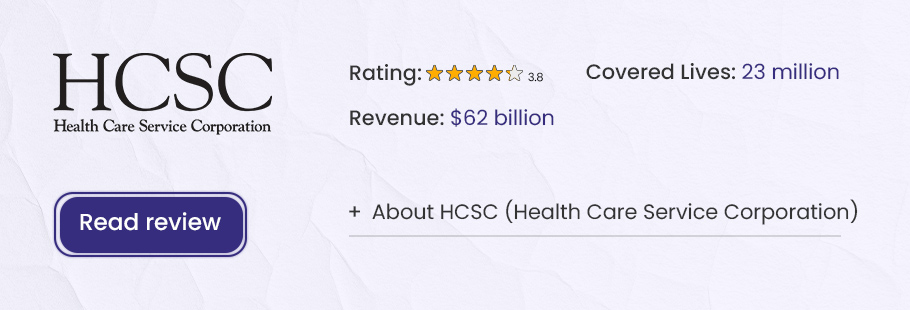

5️⃣ HCSC (Health Care Service Corporation)

When it comes to healthcare payers, providers need partners they can rely on. Partners with comprehensive networks, efficient claims processing, and timely reimbursements. Partners that make it easy to deliver quality care. In the vast healthcare insurance landscape, one payer stands out—HCSC.

As a licensee of the Blue Cross Blue Shield Association, HCSC offers providers access to an extensive member base across 5 states. Over 20 million lives are covered, opening doors to grow practices. This gives providers a wealth of resources to enhance patient care.

Processing power matters as well. HCSC is lauded for its smooth claims handling and quick payments. Fewer administrative headaches mean more time for what matters—patients. Strong finances also offer stability healthcare providers can count on.

When choosing payers to work with, providers need more than claims paid. They need responsive partners invested in better care. With its robust network, operations, and support, HCSC checks all the boxes. For providers looking for security, efficiency, and collaboration, HCSC is a payer that truly understands their needs.

🔴 Click Here To Get Credentialed with HCSC

How to Select the Best Healthcare Payer for Your Medical Practice?

Choosing the right healthcare payers is crucial for healthcare providers. It impacts everything from financial stability to the quality of care provided. Below are some key factors to consider when selecting the best healthcare payers for your practice:

✅️ Payer Mix Optimization

Understand Your Patient Population ➜ Look at the health needs of your patients. Identify the main health challenges they face and choose payers who specialize in covering those needs. A payer with a history of effectively managing specific conditions is key.

Diversify Your Payer Mix ➜ It’s important to have a balanced mix of payers—insurance companies, government programs (like Medicare and Medicaid), and self-pay options. This balance helps reduce financial risk and ensures a steady flow of revenue.

✅️ Payment Timeliness & Financial Stability

Payment History ➜ Make sure the payer has a good track record of making timely and accurate payments. Quick payments help maintain a consistent cash flow and keep your practice running smoothly.

Understand Reimbursement Rates ➜ Review the reimbursement rates offered by different payers. Ensure that the rates are fair and cover the costs of the services you provide, so you’re not underpaid.

✅️ Quality of Care & Patient Outcomes

Commitment to Quality ➜ Partner with payers that support quality care. This includes programs for preventive care, chronic disease management, and patient education. Payers who focus on patient health outcomes are valuable long-term partners.

Patient Satisfaction ➜ Check patient satisfaction ratings and reviews. Providers should partner with payers known for high levels of patient satisfaction. Happy patients are more likely to stay and recommend your services.

✅️ Administrative Support & Technology

Administrative Support ➜ Evaluate the payer’s administrative support in terms of claims processing, billing assistance, and customer service. A payer with strong support will reduce the administrative burden on your practice.

Leveraging Technology ➜ Look for payers that offer advanced technology solutions, like EHR integration, data analytics, and tools for managing population health. These technologies improve efficiency and patient care, making your practice more effective.

✅️ Contract Terms & Bargaining

Contract Review ➜ Carefully review contract terms, especially around payments, dispute resolution, and termination clauses. Ensure everything is clear and favorable to your practice.

Negotiation ➜ Don’t hesitate to negotiate better rates, payment schedules, and other terms. A well-negotiated contract will secure better financial health for your practice and avoid potential issues later on.

✅️ Regulatory Compliance & Risk Management

Compliance Check ➜ Ensure the payer is compliant with healthcare regulations like the Affordable Care Act, HIPAA, and other state or federal requirements. Compliance is essential to protect your practice from legal issues.

Risk Management ➜ Look into the payer’s risk management strategies. A good payer will have systems in place for handling disputes, preventing fraud, and managing any financial risks that could affect your practice.