Consider that your practice’s cash flow is impacted for whatever reason, whether it is due to recent regulatory enforcement or not. You are receiving the appropriate payments. It’s time to look at the issues keeping your cash flow from being fully used and causing you to fall short of your profit targets. Several factors influence a practice’s overall effectiveness and cash flow. The secret to improving your practice’s cash flow is figuring out where your revenue cycle management procedures need improvement. In this blog post, we are discussing the 7 ways to enhance a practice’s cash flow.

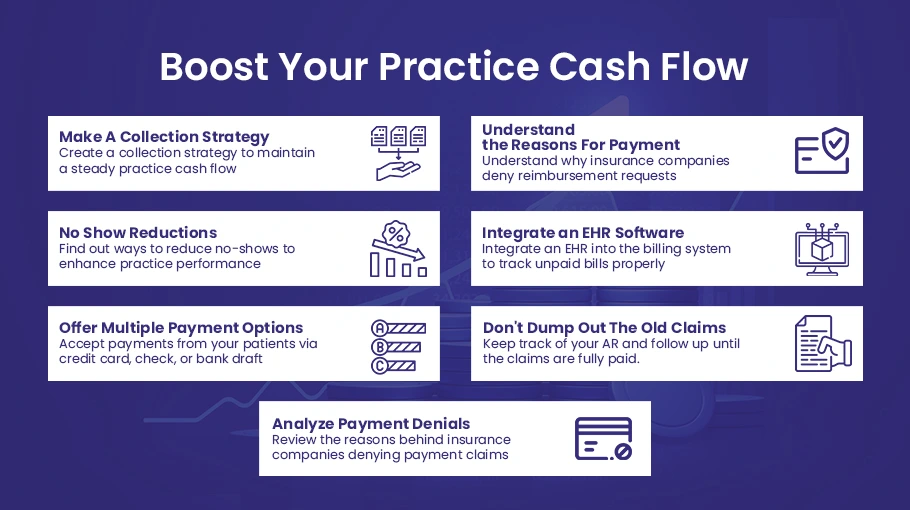

7 Way to Boost Your Practice Cash Flow

Practices need to put in added effort and energy to enhance the collections. Here are 7 proven ways to help you increase your overall practice cash flow.

Make A Collection Strategy

You’ll need a well-defined collection strategy to maintain a steady practice cash flow. Make sure the employees are well-versed in the intricacies of the collection process. Create a policy and prepare the billing and finance departments to follow it thoroughly.

Understand the Reasons For Denials

One of the leading causes of the low collection is claim denials. Examine the reasons why insurance companies are denying reimbursement requests. If the problem is incorrect paperwork or inexperienced billing handlers, you can remove all the variables triggering payment denials in the future.

No Show Reductions

As much as a delay in collecting an unpaid patient bill adds to the overall expenses, patients not showing up for their scheduled appointments will decrease your net income. Find out ways to reduce no-shows as it affects your overall practice performance. Plus no, shows waste time slots, room, and human resources. If some systematic processes are not working out in no-show reductions, we may have three or four overbookings to fill in the timeslots.

Integrate an EHR Software

The overall status of the payments becomes transparent by integrating EHR like Medifusion with your billing and revenue cycle management system. During a patient’s visit, the front desk can check for any unpaid bills from the previous visit and inform the patient when they arrive. If your billing system is combined with your practice management system, you can get a clear picture of your unpaid bills.

Offer Multiple Payment Options

Allow your patients to pay for whatever method they prefer. This convenience would help you get the most out of your collections. Accept payments from your patients via credit card, check, or bank draft, or remind them to pay the overdue bills via the patient portal. Payment notifications, follow-ups, and the availability of various payment platforms are all the quickest ways to boost the patients’ total collections.

Don’t Dump Out The Old Claims

Regardless of how old the claim is or whether you forgot to collect the balance or copay from the patient. You should keep track of any uncollected penny, even though it has existed for some time. Keep track of your accounts receivable and follow up until the claims are fully paid.

Analyze Payment Denials

Claim denials significantly contribute to reduced collections. Review the reasons behind insurance companies denying payment claims. Eliminate causes such as inaccurate documentation or inexperienced billing agents to prevent future refusals, thereby maximizing your medical practice’s cash flow.