Seeing patients fills your day. But sending bills should not drain your time, right?

If you have ever wondered “in what format are healthcare claims sent?” this guide answers that question and shows how the right claim submission format keeps healthcare reimbursements moving.

A clean claim starts the payment clock. Use the wrong healthcare claims format or leave out key data, and the clock stops. Insurers then delay, reduce, or even refuse payment. Knowing what format healthcare claims are submitted in—and using it every time—guards your cash flow.

You will hear two close‑sounding terms: ‘form’ and ‘format’. They sound alike, but here’s an easy way to keep them straight:

- Form = paper. Think CMS‑1500 or UB‑04.

- Format = electronic. Think files that zip through secure networks.

That shift from form to format changes the game. Paper forms still work for a few small offices, yet they move at postal speed and add data‑entry risk. In contrast, an electronic medical claim form format reaches the payer in minutes and meets every HIPAA‑compliant medical claim format rule.

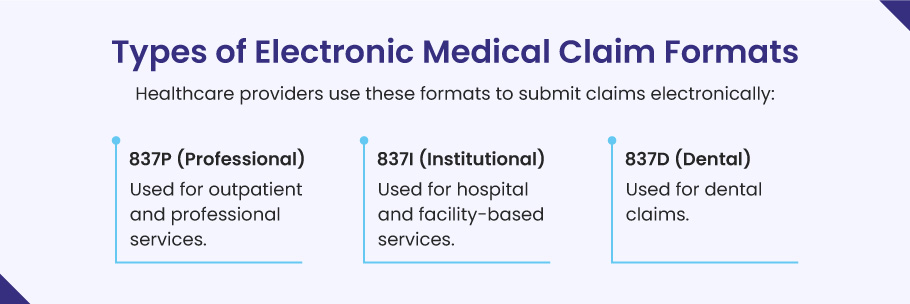

Most healthcare providers now rely on the HIPAA‑compliant 837 electronic insurance claim format because it moves fast and cuts errors. The 837 family has three files:

- 837P (Professional): office visits, lab work, therapy, and other outpatient care

- 837I (Institutional): hospital stays, skilled‑nursing days, and other facility fees

- 837D (Dental): cleanings, fillings, crowns, and all oral services

Additionally, pharmacies follow a different (but equally strict) insurance claim format called NCPDP for every prescription they fill.

In what format are healthcare claims submitted to the healthcare payers?

Each healthcare claim exists in two matched formats—paper (CMS‑1500, UB‑04, ADA) and its electronic twin (837P, 837I, 837D, NCPDP). Knowing this mirror healthcare claims format lets you shift from paper to EDI, or back again, whenever a payer mandate, state rule, or system outage requires a different submission path.

| Claim type | Paper form (fallback) | Electronic file (preferred) | Common services you bill |

|---|---|---|---|

| Professional | CMS‑1500 | 837P | Office visits, lab draws, mental‑health therapy, ambulance runs |

| Institutional / Facility | UB‑04 (CMS‑1450) | 837I | Inpatient stays, outpatient surgery, rehab days, skilled‑nursing care |

| Dental | ADA Dental Claim | 837D | Exams, cleanings, crowns, implants, braces |

| Pharmacy | Paper claim or log (rare) | NCPDP telecommunication file | Retail fills, mail‑order refills, specialty injectables |

How to read this chart:

- Pick the claim type that matches your service.

- Send the electronic medical claim form format first; payers process EDI files faster and with fewer errors.

- Keep the paper form ready. Some state Medicaid plans, small payers, or network outages may still require the paper healthcare claims format for a short time.

⫘⫘⫘⫘⫘⫘

In the United States, healthcare claims move in matched pairs of paper and electronic files. When paper is still required, providers mail the CMS-1500 for office services, the UB-04 (CMS-1450) for hospital or facility charges, and the ADA Dental Claim for tooth work.

Day-to-day, those same claims travel faster as their electronic twins—the CMS-1500 turns into the 837P, the UB-04 turns into the 837I, the ADA form turns into the 837D, and every paper pharmacy slip converts to the NCPDP telecom file. All four digital files ride on secure EDI, making them the standard format for submitting medical claims today.

⫘⫘⫘⫘⫘⫘

What is meant by the ‘format’ of a Healthcare Claim?

When people ask “in what format are healthcare claims sent?” they are talking about the exact layout—paper or electronic—that tells an insurer who was treated, what was done, when it happened, and how much it cost. In the United States, providers must send this information in a HIPAA‑compliant medical claim format so the payer can read it, check it, and pay it without delay.

Every claim line follows a standard format for submitting medical claims and carries well‑known code sets:

- ICD‑10‑CM — pinpoints the diagnosis

- CPT® or HCPCS — shows the procedure or service

- NDC, HCPCS Level II, or revenue codes — identify supplies, drugs, devices, or medical transport

Using the right healthcare claims format reduces back‑and‑forth, slashes errors, and speeds up cash flow. Put simply, the format is the blueprint that turns clinical work into dollars received.

Who decides the healthcare claim submission format?

Before you hit “send,” you need to know who writes the rules. In U.S. healthcare, four main bodies define what format healthcare claims are sent in and how those files must look. Master their playbook, embed them in your practice management software, and your claims move from “pending” to “paid” much faster.

1). Centers for Medicare & Medicaid Services (CMS)

CMS issues the familiar paper layouts, called the CMS‑1500 for professional services and the UB‑04 for hospital billing and facilities. Even in an e‑first world, many healthcare payers still scan these forms, so clean, crisp fields matter. As a healthcare provider, you need to follow every box, line, and font cue so that your paper claim sails through optical‑character recognition with fewer manual touch‑ups.

2). Accredited Standards Committee X12 (often called ANSI X12)

When you switch to electronic, X12 owns the road. Its 837P, 837I, and 837D EDI loops translate your service lines into machine‑readable data. The latest release—HIPAA version 5010—locks down field length, segment order, and code sets. Submit an 837 file that matches X12 specs and most clearinghouses will approve it in minutes.

3). National Council for Prescription Drug Programs (NCPDP)

Need to bill a pharmacy claim? NCPDP frames the real‑time electronic medical claim format for retail, mail‑order, and specialty drugs. It syncs each NDC code, quantity, and day‑supply field so the payer’s drug‑utilization engine can check safety and price in a single ping.

4). Health Insurance Portability and Accountability Act (HIPAA)

HIPAA is the federal backbone. It mandates that every covered entity—clinic, dentist, hospital, or health plan—uses a HIPAA‑compliant medical claim format and safeguards patient data at rest and in flight. Fail to follow these guardrails and you risk fines, data breaches, and slow payment.

Types of Healthcare Claim Form formats

1). the CMS‑1500 Paper Claim Format

Even in the EDI era, some payers still need a paper file. That file is the CMS‑1500 form. It is the standard insurance claim format for solo doctors, therapists, labs, and other non‑facility providers. Think of it as the paper twin of an 837P file. If you mail or fax a claim, this is the one that lands on the payer’s scanner.

Why CMS‑1500 is a standard claim format?

The CMS‑1500 is more than a sheet of paper. It follows firm layout rules that turn your data into a machine‑ready healthcare claims format:

- Fixed field map. Each red box lines up with a matching data field in HIPAA’s 837P file. That one‑to‑one link keeps your claim submission format in sync whether you print or send EDI.

- Code sets locked in. The form forces you to use ICD‑10‑CM for diagnoses, CPT®/HCPCS for services, and your ten‑digit NPI for provider ID. Those sets make the file a HIPAA‑compliant medical claim format by design.

- Scanner‑friendly ink. The “drop‑out” red ink lets optical readers lift each character cleanly. A clear scan speeds the payer’s first‑pass edit and cuts denials.

Because its layout never changes, the CMS‑1500 acts as a standard format for submitting medical claims (even when you submit on paper).

Why polish your CMS‑1500 workflow?

- Fewer re‑works. A tight, HIPAA‑compliant medical claim format gets past OCR edits on the first scan.

- Quicker cash flow. Clean paper claims can still clear in ten business days. This is vital when clearinghouses are down.

- Easy pivot to EDI. Every well‑filled CMS‑1500 mirrors the field order of an 837P. When you upgrade, the map is ready.

Quick tips for a high‑readability claim

- Keep service lines neat (one procedure per row).

- Use correct two‑digit modifiers and leave unused cells blank.

- Double check the patient’s group number before you print.

2). the UB‑04 (CMS‑1450) Facility Claim Format

Hospitals, rehab centers, and skilled-nursing homes do not bill on the CMS‑1500 claim format. Instead, they use the UB‑04 form, also called CMS‑1450. This single page carries every charge for a full stay—room, board, drugs, supplies, lab work, even the swing‑bed fee. So if you ask in what format are healthcare claims sent for facilities?, the answer is almost always UB‑04 in paper or 837I in EDI.

What makes the UB‑04 a standard format?

- Fixed line map. Every line has a locator number (FL 01–81). That grid links one‑for‑one with the 837I segments in a HIPAA 5010 file, keeping your healthcare claims format consistent across paper and electronic routes.

- Revenue codes first. Each charge line starts with a three‑digit revenue code, then the CPT®/HCPCS code when needed. This layout meets the healthcare claim submission format requirements that drive auto‑adjudication.

- Header holds payer data. The top blocks lock in Medicare, Medicaid, or private plan IDs. Drop the wrong payer code and the claim bounces before anyone checks medical need.

Sections you must get right:

- Patient and subscriber data (FL 12–17). Copy the name, date of birth, and member ID exactly from the card.

- Occurrence and value codes (FL 31–41). These tiny two‑digit flags mark why the stay started, when benefits kicked in, and how much the patient paid.

- Service lines (FL 42–47). List each daily room rate, therapy charge, or drug cost on its own line so the payer’s system can total them.

Quick tips to speed payment

- Double‑check that all dates use the MMDDYY format. Don’t use slashes.

- Print in the approved “drop‑out” red ink. Avoid black ink as it causes scanner rejects.

- Use the nine‑digit ZIP code in FL 02 and FL 03 to avoid locality edits.

3). the ADA Dental Claim Format

Dentists do not bill on a CMS form. They use the ADA Dental Claim Form, built by the American Dental Association for easy review by dental payers. It runs on paper or as an electronic flat file that mirrors its boxes.

Key details the form captures:

- Patient facts. Full name, birth date, address, policy or group number.

- Provider identity. Dentist’s name, NPI, practice address, phone, and pay‑to number.

- Service codes. Each procedure uses a CDT code (e.g., D1110 for adult cleanings).

- Tooth data. The form shows tooth numbers, surfaces, and quadrants to prove need.

- Clinical notes. A short box lets you add a narrative. This is beneficial for crowns, implants, or ortho claims because payers need clear proof of medical need (cracks, bone loss, malocclusion) before they sign off on these higher‑cost services.

Why this dental format matters?

- Uniform language. CDT codes and tooth charts let payers price claims fast.

- HIPAA alignment. The form meets HIPAA‑compliant medical claim format rules and maps straight to the 837D EDI file.

- Low denial risk. *Clear tooth surfaces and dates stop “lack of info” rejections that delay checks.

* Clear tooth surfaces simply means spell out exactly which part of the tooth you treated—mesial (M), distal (D), lingual (L), buccal (B), or occlusal (O).

Example:

If you place a filling on tooth 3 that covers the mesial, occlusal, and distal faces, code it as 3‑MOD, not just “filling on tooth 3.”

When surfaces and service dates are this specific, the payer sees clear proof of where and when the work happened, so the claim meets medical‑need rules and avoids the common “missing detail” denial.

4). the Workers’ Compensation Claims Format

When an injury happens on the job, the claim does not go through a regular health plan. Instead, you bill the employer’s workers’ comp carrier in a special healthcare claims format that mixes state rules with HIPAA data sets.

What format are workers’ comp claims submitted in?

- Paper route. Many carriers still ask for a CMS‑1500 marked “Workers’ Compensation” in Box 10 d. Attach state‑required injury reports and mail the bundle to the adjuster.

- Electronic route. Larger payers accept an ANSI X12 837P or 837I file plus the state’s claim number in Loop 2300. This meets HIPAA‑compliant medical claim format rules while flagging the file as work‑related.

Either way, use the standard format for submitting medical claims. But add the extra comp fields listed below so the adjuster can link services to the injury event.

Must‑have fields that keep the claim moving:

- Employer data. Full company name, address, and the workers’ comp policy number prove coverage.

- Employee facts. Name, home address, birth date, and Social Security number pin the claim to one worker.

- Injury snapshot. Date, time, and place of the accident, plus a short injury story (e.g., “strained lower back lifting boxes”).

- Service lines. List each CPT® or HCPCS code, tied to ICD‑10‑CM trauma codes (S‑ and T‑series) that match the injury note.

- Claim number. The state or carrier issues this after the first report of injury. Put it on every claim so payment flows to the right file.

5). the Coordination of Benefits Claim Format

Patients who have two or more health plans need a clear hand‑off. That hand‑off happens in the Coordination of Benefits (COB) claim format—the fields inside every paper and electronic claim that tell payers who pays first and who pays next.

“Who pays first” means the primary plan—the policy that has the legal duty to process the bill before any other insurer. It allows or denies each charge, applies its own deductible or copay rules, and sends an Explanation of Benefits (EOB) that shows what it paid and what is still owed.

“Who pays next” refers to the secondary (or tertiary) plan. This plan cannot act until it sees the primary EOB. Once it has that record, it:

- checks the remaining balance,

- pays up to its own benefit limits, and

- may wipe out the left‑over patient share.

Example: A patient has an employer health plan and is also covered under a spouse’s plan. The employer plan is primary, so it handles the claim first. After it posts payment, you transmit the same claim—with the primary paid amount filled in—to the spouse’s plan. That plan is secondary and can now cover some or all of the leftover cost.

Stating this order in the COB claim format keeps every payer in line with federal Coordination‑of‑Benefits rules, stops over‑payment, and ensures the patient never gets billed twice for the same care.

When someone asks “in what format are healthcare claims sent when the patient has double coverage?” the answer is: CMS‑1500 or UB‑04 on paper, and ANSI X12 837 with COB loops on EDI.

What the COB data must show?

➜ Each policy in plain view

- Insurance name, plan type, and policy number

- Start and end dates so the payer sees the coverage line‑up

➜ Benefit check

- Does the plan pay primary or secondary on this visit?

- Any carve‑outs or limits that change how much it will cover

➜ Payment order

- You mark the primary carrier first, the secondary carrier second, and so on

- In an 837 file, this sits in Loop 2320—HIPAA’s built‑in spot for COB rules

Why the COB format cuts claim ping‑pong?

- Stops over‑payment. Clear policy data keeps payers from paying more than the charge.

- Speeds split‑payment. When the primary plan’s paid amount drops into the secondary plan’s field, the second payer can finish the bill without calling you.

- Meets every rule. COB elements sit inside the same HIPAA‑compliant medical claim format you already use, so you stay within federal privacy guardrails.

Quick tips for clean COB claims:

- Copy policy numbers exactly with no extra dashes or spaces.

- Enter the primary paid amount on each service line.

- Update coverage dates at each visit because a lapsed plan will block the claim.

6). the Medicare and Medicaid Claim Form Formats

Federal payers follow strict layout rules. When you bill Medicare or Medicaid, you choose the claim format first, then you fit every field to the CMS guide.

Pick the right form or its EDI twin:

- CMS‑1500 / 837P – Use this medical claim format for professional work: office visits, lab draws, therapy, ambulance runs.

- UB‑04 / 837I – Use this format for facility fees: hospital stays, rehab days, dialysis, outpatient surgery.

Think of the paper form as a picture of the electronic file. The boxes on the page map line-for-line to the segments in the ANSI X12 file. That link keeps each claim HIPAA-compliant and easy to read by Medicare’s edits.

Key Medicare-Medicaid format rules:

- Use the right code sets. Stick to ICD‑10‑CM for the “why,” CPT®/HCPCS for the “what,” and revenue codes for room and board.

- Show the NPI every time. Place your ten-digit NPI in the provider ID box and in Loop 2010AA of the 837 file.

- Add the payer ID. Medicare uses payer ID “CMS.” State Medicaid plans list their own four- or five-character IDs—check your remittance advice if you forget.

- Lock the date style. Medicare denies claims with slashes. Enter dates as MMDDYYYY on paper and as CCYYMMDD in EDI.

- Include signature on file. On the CMS‑1500, mark “Signature on File” in Box 12 and Box 13. In the 837P use the HI segment flag. This shows you hold the patient’s consent.

Why tight formats speed payment?

Medicare and Medicaid run high-speed auto-adjudication. A clean healthcare claims format hits that system and clears in days, not weeks. Miss a digit, swap a code, or drop the NPI, and the claim flips to manual review, adding weeks of delay.

Electronic Claim Formats

Manual Claim Formats

FAQs

What is primary and secondary insurance?

Primary insurance is the first plan that reviews your claim and pays up to its own benefit limits. Secondary insurance steps in after the primary issues an Explanation of Benefits (EOB) and covers some or all of the leftover bill. Clear COB data on your claim tells payers in what order to pay.

What is the difference between a claim form and a claim format?

Form = a paper document (CMS-1500, UB-04, ADA) you print, sign, and mail or fax.

Format = an electronic data file (837P, 837I, 837D, NCPDP) you send through EDI. Each format mirrors its paper twin and meets all HIPAA-compliant medical claim format rules.

What is the CMS-1500 form used for?

Providers submit professional services—office visits, therapy, lab draws—on the CMS-1500 paper claim form when electronic filing is not an option.

What is the UB-04 form used for?

Hospitals, rehab centers, and skilled-nursing homes bill inpatient stays and other facility fees on the UB-04 (also called CMS-1450) when a payer still requires paper.

What does the 837P format represent?

The 837P is the electronic medical claim form format that replaces the CMS-1500. It travels by HIPAA-secure EDI and speeds professional claim processing.

How does the 837P differ from the 837I?

The 837P carries professional claims (outpatient visits, ambulance runs). The 837I carries institutional claims (inpatient room charges, outpatient surgery). Both follow the ANSI X12 healthcare claims format.

Why do most payers prefer electronic submission?

Electronic claims reach payers in seconds, cut keystroke errors, and meet every healthcare claim submission format requirement under HIPAA. Faster in, faster paid.

What is EDI in healthcare billing?

Electronic Data Interchange (EDI) is the secure network that moves 837 claim files, 835 remittances, and 270/271 eligibility checks between providers and payers.

Can I still use paper claim forms under HIPAA?

Yes. Smaller clinics and some state programs may mail claims. Yet most carriers now ask, “in what format are healthcare claims sent?”—and expect the electronic answer. Submitting the correct electronic claim format (837P, 837I, 837D, or NCPDP) speeds payment and keeps you compliant.

How can a medical billing service help with claim submission and denial management?

A medical billing services company knows every healthcare claims format inside out. It scrubs your data before you send a CMS-1500, UB-04, 837P, or 837I, catching code or NPI errors that cause denials. The team transmits each claim through its own high-speed clearinghouse link, tracks the payer’s edits in real time, and fixes any rejections the same day. When a denial does occur, the service applies denial management best practices and pulls the EOB, adds the missing detail, files an appeal, and resubmits in the proper claim submission format (often within 24 hours).