If you are a therapist and find it hard to get paid by insurance providers after providing services to patients in-network with that insurance company, you have landed on the right page. Here is an easy guide for you to get reimbursed for receiving all your payments on time.

Therapist insurance reimbursement is essential for timely payment, but it only happens if you meet all the requirements and regulations set by the insurance companies.

➡️ First, you should know that insurance payers only pay those healthcare providers who are credentialed with them and only for the care services provided to in-network patients having coverage benefits of that specific care service.

➡️ It is also essential for you to check whether the insurance company covers the patient’s therapy expenses because many insurers do not offer insurance coverage for mental health services.

➡️ Furthermore, getting paid is easy, but getting instant reimbursement depends on your network of insurance providers. Some insurance companies process insurance claims for therapists and pay healthcare providers instantly, while some take time. So, it would help if you always researched when credentialing with any insurance provider. However, it is on your end to submit insurance claims with no error to speed up the mental health claims process, get reimbursed without any delay, and avoid claim rejection or denials.

➡️ To avoid errors, you should familiarize yourself with the therapy billing codes and therapist fee schedules that are essential for proper billing.

➡️ Additionally, knowing the insurance provider reimbursement rates will help you understand how much you should expect for each service.

➡️ You also need to be aware of the copayments for therapy sessions as they are typically part of the overall insurance payment for therapy services.

➡️ It’s important to understand insurance authorization for therapy, especially if you are submitting claims for therapy services. If you are working out-of-network, payment may be slower, and the rates might differ from in-network therapy reimbursement. Make sure you have clear insurance provider contracts for therapists to ensure accurate and fair compensation for your services.

➡️ Finally, understanding therapist payment policies and engaging in insurance negotiation for therapists will help ensure that your services are compensated fairly. Always review the EOB (Explanation of Benefits) for therapists to understand how your claims are processed and what adjustments may need to be made for payment.

How Do Therapists Get Reimbursed by Insurers?

After providing therapy services to patients, therapists are either paid by patients or insurance providers, and sometimes by both. To get paid by insurance providers, you must be part of a particular insurance panel. Each insurance company facilitates therapists with various insurance panels. Some of the top insurance panels for therapists are Blue Cross Blue Shield (BCBS), Aetna, Cigna, and Medicare. The process of joining a panel is referred to as credentialing or paneling.

After getting on any of the insurance panels, you are now eligible to receive payments from insurance providers for the services you provide to covered patients. In simple words, a covered patient comes to see you for therapy services: you provide care services, prepare a bill, and submit an insurance claim for therapists to their health insurer, and the insurer reimburses you.

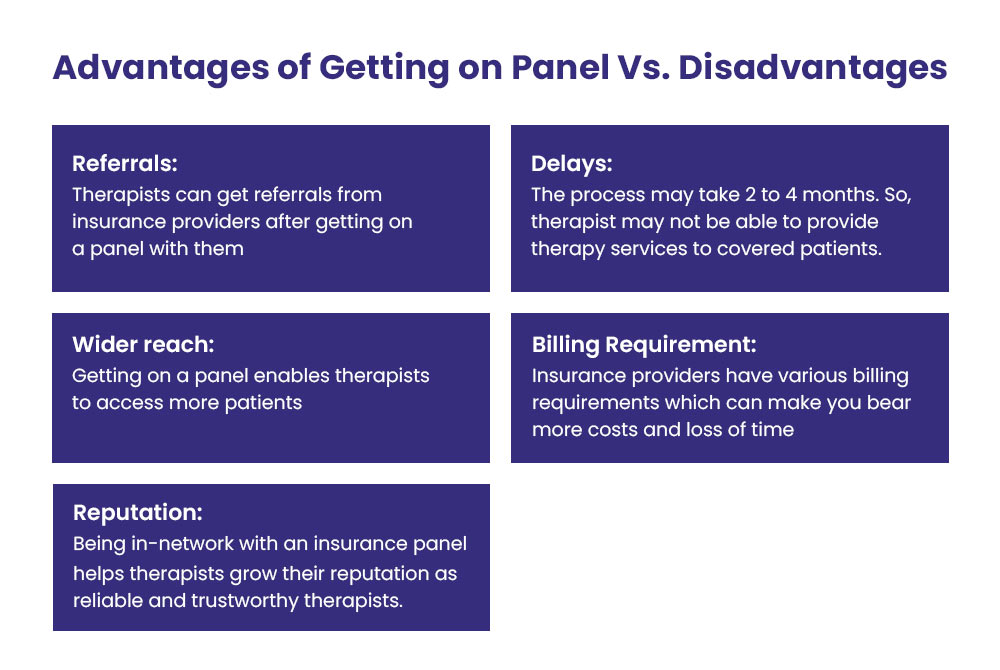

Getting on the panel is compulsory to get paid by insurance providers. But, being credentialed with insurers also brings some drawbacks. Here, we discuss both the benefits and disadvantages of paneling with insurers.

Benefits of Joining an Insurance Panel for Therapists

Benefits of becoming part of insurance panels include:

✅ Referrals

As a therapist, you can get referrals from your insurance providers after getting on a panel with them. This can help you grow your practice while caring for more therapy patients and receiving insurance payment for therapy services.

✅ Wider Reach

Getting on a panel enables you to access many patients who might need help to afford therapy care expenses if they were receiving it as out-of-network therapy payment. Being part of insurance panels allows you to receive timely reimbursement from insurance providers for services rendered.

✅ Reputation

Being in-network with an insurance panel helps you grow your reputation as a reliable and trustworthy therapist, and also helps ensure that insurance reimbursement is more consistent and predictable.

Drawbacks of Joining an Insurance Panel for Therapists

According to the California Health Report, 42% of therapists don’t accept insurance. Here are the reasons why:

❌ Delays

The therapist credentialing process may take two to four months. During that duration, a therapist may not be able to provide therapy services to covered patients and thus may experience delays in receiving insurance reimbursement.

❌ Administrative Duties

Insurance providers have various billing requirements. Claim filing may take a little more time for you to fulfill all their conditions. Additionally, opting for automated software or an insurance clearing house may add extra costs for processing insurance claims. Therefore, many therapists only accept insured patients to ensure payment for their services is consistent and timely.

Now, the next step is to get credentialed with insurance providers to get reimbursed by them. Here are some valuable tips for you to get on panels with insurance providers.

How to Choose an Insurance Provider as a Therapist in the USA?

There are many insurance providers.

Each has different reimbursement rates as per therapy session or per visit, as well as other requirements, restrictions, and guidelines for billing and payment.

It would help if you chose the most suitable providers whose rates are closer to your charge amount and who willingly accept providers at their panels. Asking your peer therapists can help you make the perfect decision when choosing an insurance provider. Inquire them about their experiences while working with an insurer you will be credentialed with.

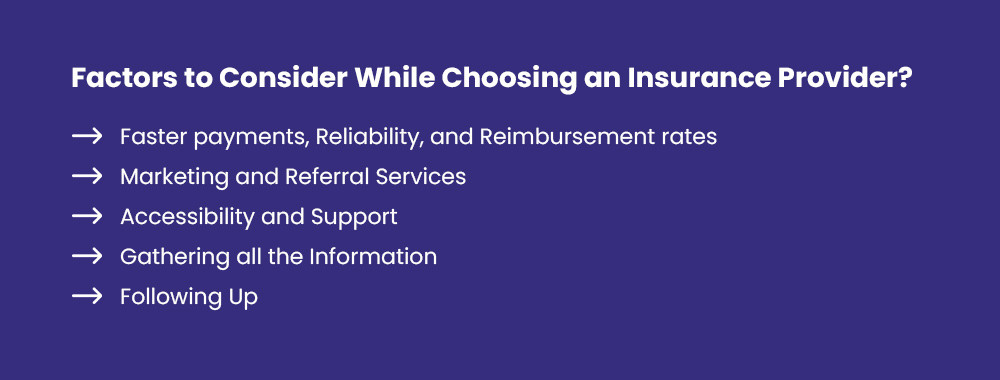

Here are some factors to consider when you’re checking out different providers.

➜ Faster Payments, Reliability, and Reimbursement Rates

Before joining the panel of any insurance provider, consider the following:

- How quickly do they typically pay a therapist after a claim is submitted?

- How reliable are they? Do you know of any therapists facing difficulties when getting reimbursed by this particular provider?

- What reimbursement rates do they offer? Are the rates close to your charges, and higher than those of other providers?

These factors can positively influence your decision when joining an insurance panel.

➜ Marketing and Referral Services

Choose insurance panels that can help market your therapy services or provide additional marketing support. Also, look for those that offer referrals.

➜ Accessibility and Support

Join panels with insurance providers who are easily accessible and offer support when you need to discuss something.

➜ Gather All the Information

Before joining any therapist insurance panel, gather the following information to streamline the credentialing process:

- Your license information

- Your NPI number

- A copy of your resume

- Professional liability insurance

- Paperwork for any advanced training you have received

- Complete CAQH application

The CAQH is a standardized application used to credential healthcare providers (therapists) with insurance providers. During the credentialing process, you will need to complete the application after receiving it from an insurance provider.

When you apply for credentialing, the insurance provider will send you a CAQH number, which allows you to access the application. Complete and submit the form.

The CAQH form only needs to be filled out once. You can use the same application to credential with other insurance panels.

➜ Follow Up

After submitting your application, contact the insurance provider to ensure they have received everything. Some providers may require a specific processing time. However, you should follow up after three or four weeks.

What If Your Application is Rejected?

If an insurance provider rejects your credentialing application, don’t be discouraged. Consider hiring a third-party medical credentialing service to handle the process on your behalf.

How Do You Bill and Get Paid by Insurance Providers?

Once you become part of an insurance network, you can submit bills and receive reimbursement for the services you provide to patients covered by that provider. However, you must learn how to bill insurers for healthcare services rendered. Many therapists prefer outsourcing the claims submission process to third-party medical billing companies, but you can also handle it yourself, though it may be time-consuming and challenging.

You can manually submit a claim via email using the CMS-1500 form, a standard claim form for medical and mental health services.

Alternatively, insurance providers often allow you to submit claims through their online portal. When using the online portal, you follow the prompts on the screen, and the system automatically fills out the CMS-1500 form for you.

Before completing the CMS-1500 form, gather the following patient information:

- Patient’s full name

- Date of birth and SSN (if required)

- Policyholder ID

- The main insured person on the plan (if the client is a dependent)

- Date and place services were provided (in-office or online)

- ICD-10 codes

- Service code and modifier for each service provided

- Your NPI

- Your practice’s tax ID

- Your practice’s NPI (if different from your own)

- Your practice’s address

Claims can sometimes be rejected, denied, or clawed back by insurance providers due to errors. Claims are rejected when a mistake is detected before processing. They are denied when the insurance provider processes the claim and refuses reimbursement due to major issues, such as duplicate billing, invalid medical necessity, or patient ineligibility.

Occasionally, insurance providers reimburse therapists but later determine that the payment was invalid and ask the therapist to return the funds, a process known as a claim “clawback“.

Therefore, always double-check bills for errors and omissions before submission, as even a minor mistake can delay your reimbursement. Make sure the claim is completely error-free.

Finally, submit the claim either online or by mailing the CMS-1500 form. By following these steps, you can easily bill and get reimbursed by insurance providers.

Conclusion

For therapists, getting reimbursed by insurance providers is relatively easy if claims are submitted promptly, without errors, and in accordance with payer requirements and HIPAA regulations. However, it can become more complicated, as it often requires specific skills and expertise that an in-house team may lack. Therefore, outsourcing to a third-party medical billing company can be a game-changer, helping therapists receive timely payments from insurance providers.