Are you trying to understand the medical billing process and its complexities in depth? Whether you have specific questions or are simply looking to learn about each phase or step in detail—such as the claim submission process in medical billing—you’ve come to the right place!

Medical Claim Submission is one of the key steps in the medical billing process. It is a critical phase, as even a small mistake can trigger a chain of events that delays reimbursement.

In this guide, we will take a closer look at the physician claim submission phase, exploring the various aspects of the process. We will walk through the steps of healthcare claim submission, discuss the different types of claims, and much more.

The Basics of Claim Submission Process in Medical Billing

The phase in the medical billing process where a claim form is submitted to the insurance company by a healthcare provider or a medical billing company on behalf of the healthcare provider is known as “Claim Submission”.

Several steps lead up to this phase, and all of these steps, including the final submission, are collectively referred to as the Claim Submission Process. While the billing process as a whole is delicate, the submission of the claim requires a higher level of attention and responsibility.

The reimbursement amount a healthcare provider will receive, as well as the total time taken for the entire process, directly depends on this single claim form. Even a minor error can result in the insurance company denying the claim. A well-prepared claim not only minimizes errors but also increases the likelihood of receiving the maximum reimbursement from the insurance company. Therefore, the overall quality of the claim matters as much as its accuracy.

⭐ Key Points

❝The quality and accuracy of the claim submission directly impact reimbursement and processing time—small errors can result in costly denials.❞

Claim Submission: The phase where a claim form is submitted to an insurance company by a healthcare provider or billing company.

Importance: It’s a crucial part of the medical billing process, requiring attention and responsibility.

Impact on Reimbursement: The reimbursement amount and processing time depend on this claim submission.

Error Prevention: Minor errors can result in claim denial, so accuracy is vital.

Quality of Claim: A well-prepared claim increases the likelihood of maximum reimbursement.

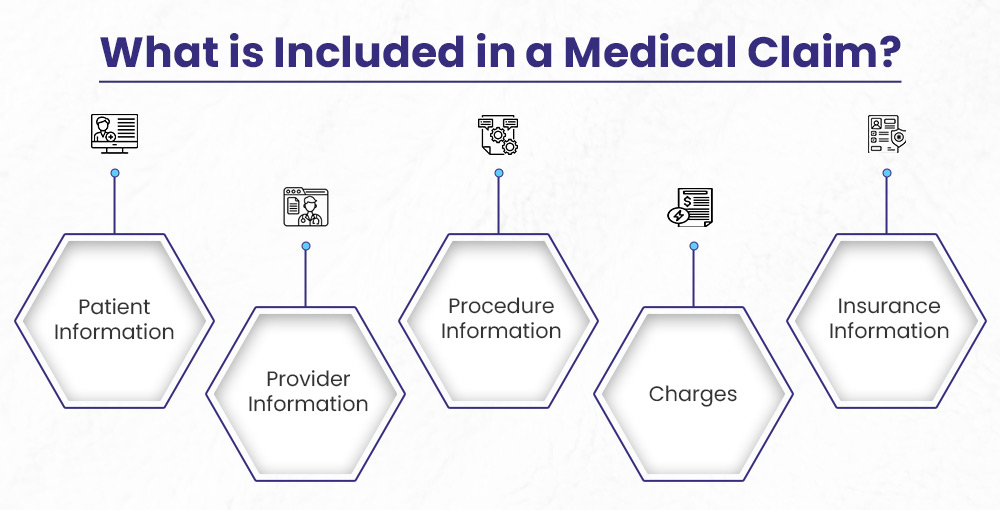

What is Included in a Medical Claim?

A medical claim has key details of the patient’s diagnosis that helps a healthcare provider with correct processing of the patient’s claim and get reimbursement from the insurance company.

Each part of the claim form has a specific job, like listing the patient and provider, describing the services given in the form of CPT and ICD-10 codes, and showing the total costs.

Knowing what’s in a medical claim is important for both doctors and insurance companies to make sure payments are made on time and are accurate.

✅ Patient Information

This section includes basic demographic details about the patient, such as their name, gender, date of birth, and the purpose of the visit.

✅ Provider Information

This section contains information about the healthcare provider, including their name, address, and identification number (NPI). It also includes details about the facility where the services were provided.

✅ Procedure Information

Here, you’ll find the diagnosis codes (ICD-10 codes) and the services provided at the facility, identified using CPT codes.

✅ Charges

This section outlines the expenses for the services provided at the medical facility, detailing what the healthcare provider expects to receive from the insurance company.

✅ Insurance Information

This section includes detailed information about the insurance, such as the name of the insurance company, the coverage details, and the policy number.

Steps of the Medical Billing Claim Submission Process

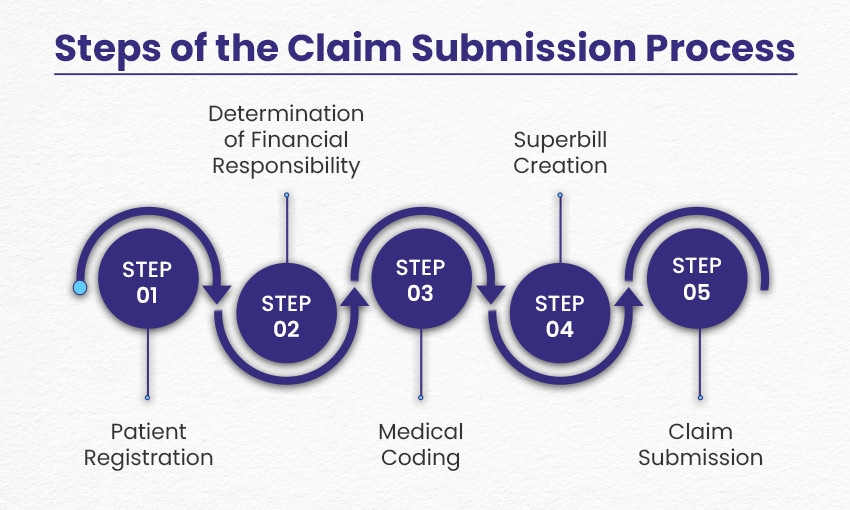

Claim submission is one of the most crucial steps in the medical billing process, serving as the central point of the entire billing cycle. Let’s take a quick overview of the claim submission process:

Step 1: Patient Registration

The medical billing process begins with the registration of the patient. During this stage, the medical office collects basic patient information such as:

- Name

- Age

- Gender

- Insurance Information

- Purpose of Visit

- Medical History

- Financial Information

Following this, the insurance is verified by professional billers, who determine the insurance status and coverage in relation to the required treatment. This information is then shared with the patient.

Step 2: Determination of Financial Responsibility

In some cases, insurance companies do not cover the entire cost of treatment. When this happens, the patient becomes responsible for the remaining balance. To ensure transparency, it’s important that the patient is informed in advance about any financial responsibilities.

During this step, the financial responsibility for the services to be provided is determined and communicated to the patient. This ensures both the healthcare provider and the patient have clarity from the start, allowing the patient to decide whether they can afford any copayments. The treatment is then provided based on the agreed terms.

Step 3: Medical Coding

Once the treatment has been provided, the diagnosis and procedures are translated into codes through medical coding. There are two main types of medical coding:

➜ ICD-10 Codes: The International Classification of Diseases (ICD) codes are used to represent the symptoms detected and treated by the healthcare provider. Currently, ICD-10 codes are in use, and ICD-11 codes are expected to be implemented by 2025.

➜ CPT Codes: Current Procedural Terminology (CPT) codes, developed by the American Medical Association (AMA) in 1966, correspond to the specific treatments or procedures given to the patient.

These codes are crucial for determining reimbursement amounts, making them an essential part of the claim process. The medical coding service is completed by a professional medical coder.

Step 4: Superbill Creation (only applies to out-of-network healthcare providers)

After the patient receives treatment and medical coding is completed, the next step is to compile the codes and create a superbill. This superbill serves as the foundation for the medical claim form.

The superbill contains the patient’s basic demographic information, medical history, healthcare provider details, and clinical information. It also includes the medical codes that represent the symptoms diagnosed and the treatments provided.

*Note: A superbill is created if the patient has seen a doctor outside of those affiliated with their insurance company, aka “out-of-network provider”.

Step 5: Claim Submission

The medical biller then carefully prepares the claim form. Once the form is completed, the biller reviews it thoroughly to ensure compliance with payer and HIPAA standards, including medical coding accuracy and proper formatting.

The claim form is then submitted to the relevant insurance company, with the expectation of timely reimbursement. The most commonly used claim forms are CMS-1500, UB-04, and ADA Dental forms.

If the claim is error-free (a clean submission), payment is typically processed by the insurance company as soon as possible. However, if errors are found, additional steps may be required to resolve the issue via a Coding Claim Denial Management Service.

Methods of Claim Submission

There are two major methods for submitting medical claims:

Electronic Submission

Thanks to advancements in technology, claim submission can now be done electronically. This method has become more popular than paper submission due to its efficiency. Electronic claims, submitted through a clearinghouse, are faster and less prone to errors, allowing for a more streamlined and accurate submission process.

Paper Submission

In paper submission, medical claim forms and supporting documentation are physically mailed to the insurance companies. While electronic claims have largely replaced paper submissions, many healthcare providers still use paper claims in certain circumstances, such as when the insurance company does not accept electronic submissions, when there are technical issues with electronic systems, or when a specific type of claim requires paper processing due to the nature of the service or provider.

Difference Between Electronic and Paper Claim Submission Process

| Electronic Claim Submission | Paper Claim Submission |

| Claims are submitted electronically through software | Claims are submitted manually through mail |

| Faster claim submission | Slow claim submission, relatively |

| Requires less effort in general | Requires more effort physically |

| Least chances of errors due to technology | More chances of errors due to human dependence |

Top 10 Reasons for Claim Denial by Insurance Companies

Here are the major reasons why a claim might be denied by insurance companies in medical billing:

❌ Wrong Information

One of the most common reasons for claim denial is incorrect or incomplete information. This could involve missing details or errors in the information provided on the claim form.

❌ Late Claim Submission

Claims may be denied if they are not submitted within the required timeframe. Some insurance companies allow 90 days for claim submission, while others may require it within 30 days. It’s important to be aware of the deadlines set by your insurance company.

❌ Errors in Coding or Billing

Medical billing is a complex and precise process. Any error in medical coding or billing can result in a claim denial. It is essential to double-check the codes and billing details to ensure accuracy and avoid denials.

❌ Services Not Covered

Insurance companies only cover a specific set of medical services. If the services provided are not included in the patient’s policy, the claim will be denied. Be sure to review the patient’s policy to confirm coverage before submitting the claim.

❌ Unnecessary Medical Services

Claims can be rejected if the insurance company deems the treatment unnecessary. In such cases, you may need to resubmit the claim with additional documentation or a letter from the doctor justifying the need for the treatment.

❌ Pre-existing Conditions

Some insurance policies exclude coverage for pre-existing conditions. If the treatment is related to a pre-existing condition, the claim may be denied. It’s essential to understand your policy’s terms regarding pre-existing conditions.

❌ Expired Policy

Claims submitted after a policy has expired are often denied. To avoid this, consider setting up automatic payments to ensure your premiums are paid on time, keeping your policy active.

❌ Lack of Pre-approval

For certain services, insurance companies require pre-approval. If this approval is not obtained before the service is provided, the claim will likely be denied. Always check in advance which procedures require pre-approval.

❌ Duplicate Claim Filed

Claim submission can be a hectic process, and duplicate claims are a common mistake. Keeping a record of all submitted claims can help prevent the error of submitting the same claim more than once.

❌ Claim Lost by the Insurance Company

While rare, claims can be lost by the insurance company itself. This unfortunate situation can lead to a denial. To avoid this, always keep a duplicate of the claim for your records.

Quick Summary

⚙ Claim submission is one of the most crucial steps of the medical billing process.

⚙ In claim submission a claim form is submitted by the healthcare provider, to the insurance company to get reimbursements.

⚙ The reimbursement amount that a doctor is going to receive depends on the claim form.

⚙ A claim form consists of:

- Patient information

- Provider information

- Procedure information

- Charges

- Insurance information

- Steps of the claim submission process:

- Patient’s registration

- Determination of financial responsibility

- Medical coding

- Superbill creation

- Claim submission

⚙ Methods of Claim Submission

- Electronic submission

- Paper submission

⚙ Common reasons for claim denial include wrong information, error in medical coding and billing, late claim submission, expired policy, unnecessary skills covered and more.

Wrapping Up

Claim submission is the backbone of the medical billing process. The goal with every claim submission is to achieve a clean submission—one that is free of errors and fully compliant with all requirements. While it may not be possible to achieve a 100% clean submission rate every time, even a small increase in your clean submission rate can yield significant benefits.

Understanding the claim submission process is crucial for anyone working in the medical billing or healthcare industry. Familiarity with the entire procedure will help you minimize errors that can hinder the best results and significantly improve your chances of successful reimbursement.