Dealing with diabetes is tough, and it gets even harder when you have to stress about whether your insurance will cover your medical supplies. That’s why it’s super important to know which brands of diabetic testing supplies Medicare covers.

If you have diabetes and are on Medicare, it’s important to make sure you’re using blood sugar meters, test strips, lancet devices, and other supplies that are covered by your plan. If not, you could find yourself spending a pretty penny out of pocket – not exactly what you want!

Also, if healthcare providers prescribe or give out diabetic brands that aren’t covered, it leads to denied claims and a lot of administrative hassle.

Therefore, it’s important for both patients and providers to be aware of which brands of diabetic supplies are covered by Medicare.

Let’s take a closer look at what diabetic services and supplies Medicare covers, and which brands of diabetic supplies you can get reimbursed for. This will help you manage your diabetes smoothly and keep your wallet happy 😊.

Medicare Covered Services and Supplies

Having good health insurance coverage is really important for managing diabetes.

And that’s where Medicare steps in like a trusty sidekick!

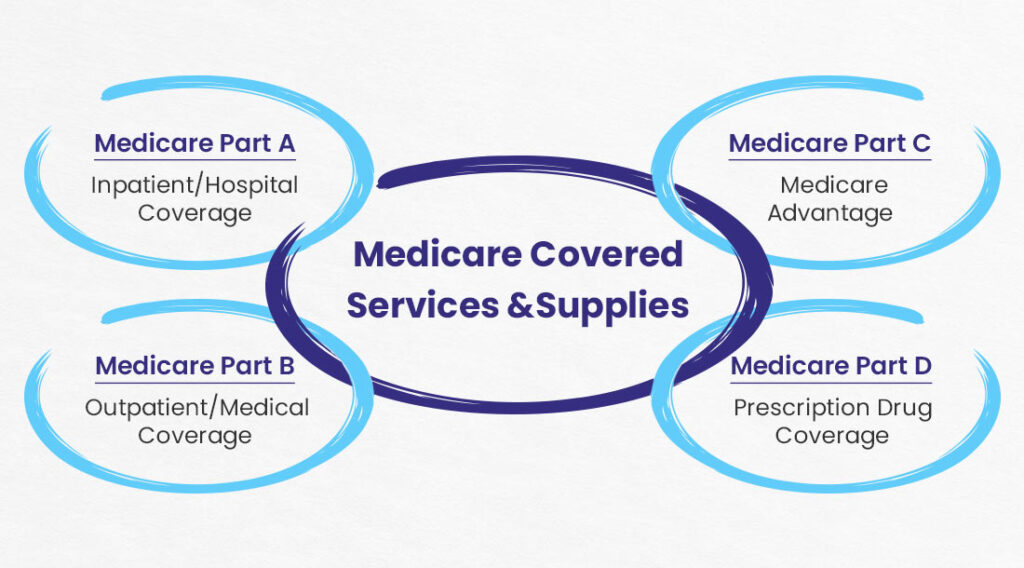

Medicare has 4 parts. Each part covers different healthcare services and supplies.

So let’s first go over what each part covers in simple terms. After that, we will get into the details of how different parts of Medicare can assist with your diabetes care costs.

1). Medicare Part A: Inpatient/Hospital Coverage

Medicare Part A covers inpatient care like hospital stays, home health care, hospice care, and skilled nursing facilities. This is the basic hospital/inpatient coverage that comes with Original Medicare.

2). Medicare Part B: Outpatient/Medical Coverage

Medicare Part B is for outpatient and medical services like doctor visits, preventive screenings, lab tests, medical equipment, and physical therapy. It also comes with Original Medicare. Think of it as covering everything outside of a hospital stay.

3). Medicare Part C: Medicare Advantage

Medicare Part C, also called Medicare Advantage, is an alternative to Original Medicare. These private plans bundle Parts A, B, and usually D together in one plan. The coverage can be similar to Original Medicare but often includes extra benefits like vision and dental.

4). Medicare Part D: Prescription Drug Coverage

And lastly, Medicare Part D adds prescription drug coverage. It’s optional but can be really helpful to cover medications not included in Parts A and B. You can get it as part of a Part C plan or as a standalone policy.

Now, we will discuss Medicare plans for diabetic supplies and services.

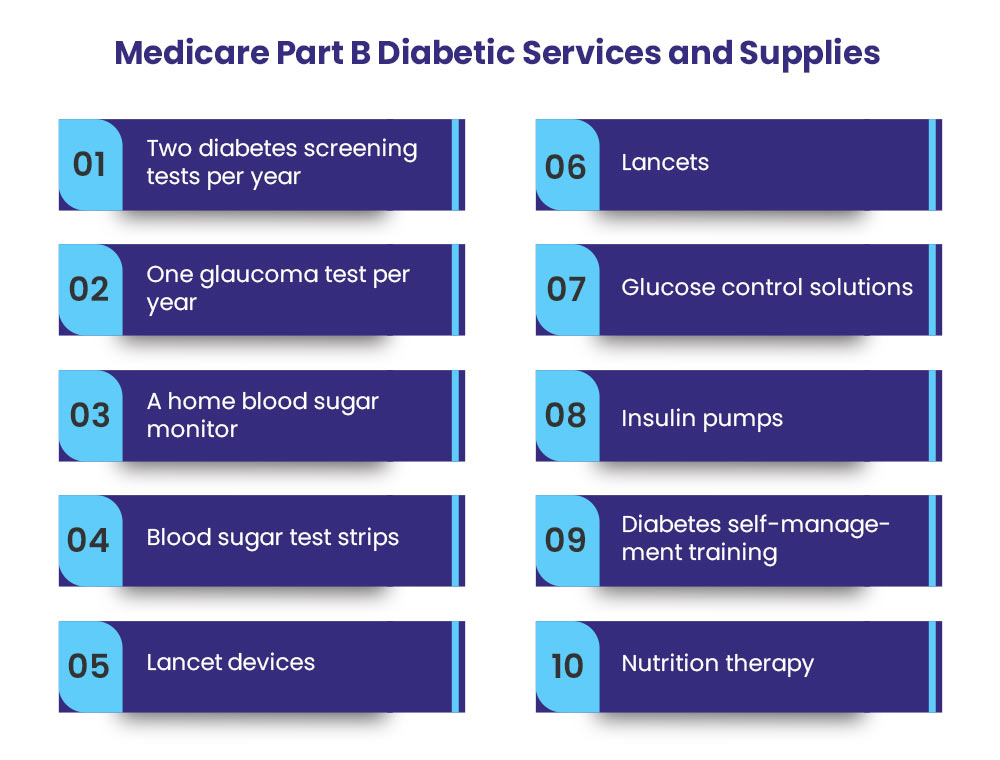

Medicare Part B Diabetic Services and Supplies

Part B covers people with diabetes for items like blood sugar monitors, test strips, lancets, glucose control solutions, and therapeutic shoes and inserts if you have serious foot problems from diabetes. These supplies are really important for keeping an eye on blood sugar levels and avoiding any issues.

Your doctor has to prescribe these supplies and confirm that you really need them for coverage. Next, you’ll need to visit a supplier that’s part of Medicare to get the supplies you need.

Once you start using your Part B benefits, you’ll need to pay 20% of the Medicare-approved cost after you’ve met your yearly Part B deductible. So for example, if a blood sugar monitor costs $100 with Medicare, you’d pay $20 after you’ve met your deductible.

The diabetic services and supplies covered by Medicare Part B, include:

- Two diabetes screening tests per year

- One glaucoma test per year

- A home blood sugar monitor

- Blood sugar test strips

- Lancet devices

- Lancets

- Glucose control solutions that will check the accuracy of your test strips

- Insulin pumps

- Diabetes self-management training

- A Medicare diabetes prevention program to help you prevent diabetes

- Nutrition therapy

Apart from these, Part B also covers diabetes foot care from a podiatrist if you suffer from foot ulcers, poor circulation, nerve damage in feet, or diabetic peripheral neuropathy. The services included in this coverage are:

- Two foot-exams every year

- Therapeutic shoes or inserts

- Custom-molded shoes or inserts

Furthermore, the list below shows services, screenings, and types of training covered under Medicare Part B.

| Diabetic services | What you pay out of pocket |

| Diabetes screening tests | No coinsurance, copayment, or Part B deductible |

| Hemoglobin A1c tests | No coinsurance, copayment, or Part B deductible |

| Foot exams | 20% of the Medicare-approved amount after you pay your annual Part B deductible |

| Medical nutrition therapy | No coinsurance, copayment, or Part B deductible |

| Flu vaccine | No coinsurance, copayment, or Part B deductible |

| Pneumonia vaccine | No coinsurance, copayment, or Part B deductible |

| Glaucoma tests | 20% of the Medicare-approved amount after you pay your annual Part B deductible |

| “Welcome to Medicare” preventive visit | No coinsurance, copayment, or Part B deductible |

| Yearly wellness visit | No coinsurance, copayment, or Part B deductible |

| Diabetes self-management training services | No coinsurance, copayment, or Part B deductible |

Medicare Part C Diabetic Services and Supplies

Medicare Part C, also known as Medicare Advantage, is a way to get your Medicare benefits through private insurance companies approved by Medicare. These plans must cover at least the same level of services as Original Medicare (Parts A and B), including services and supplies for managing diabetes.

However, one key difference is that Medicare Advantage plans can have different copayments, coinsurance, and deductibles than Original Medicare. So while the coverage may be similar, your out-of-pocket costs could vary.

Some Medicare Advantage plans actually offer additional benefits beyond what Original Medicare covers. For instance, a lot of them offer vision, hearing, dental, and even nutrition counseling or training—services that can be super useful for managing diabetes.

Another option to look into are the Special Needs Plans (SNPs) offered by some Medicare Advantage companies. These are specifically designed for people with chronic conditions like diabetes and tailor their coverage and care coordination around those needs.

Basically, with Medicare Advantage, you get at least the same diabetes coverage as Original Medicare, plus some extra benefits thrown in. Make sure to check the costs and coverage details of different plans because they can vary a lot. If you do some research, you can discover a plan that works for your diabetes care and your budget.

Medicare Part D Diabetic Services and Supplies

Medicare Part D provides prescription drug coverage. It helps pay for the medications, supplies, and support you need to keep your blood sugar in check.

The basics like insulin, diabetes pills, and injection devices are covered. So are must-haves like blood glucose meters, test strips, lancets, and syringes. With Part D, you can monitor your levels and administer medication without breaking the bank.

Some plans go above and beyond by offering extra resources too. You may get access to diabetes educators, nutritionists, or support groups. Useful tools to help you understand treatment options and stay on top of your health.

Just remember that each plan has its own rules about what’s covered and how much you’ll pay. Shop around during open enrollment to find one that’s a good fit. The goal is to get the coverage you need at a cost you can handle.

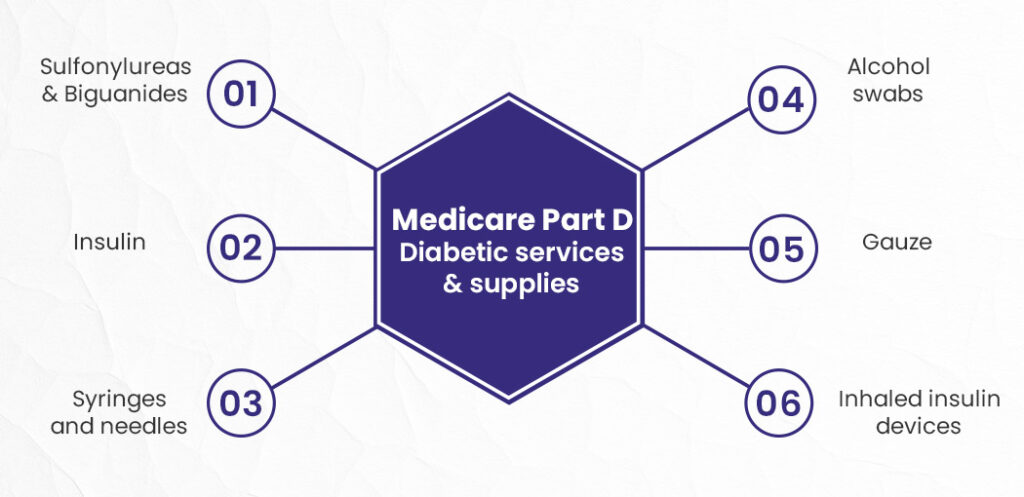

Medicare Part D may cover certain medical supplies for diabetes including:

- Anti-diabetic medications such as Sulfonylureas and Biguanides

- Insulin

- Syringes and needles

- Alcohol swabs

- Gauze

- Inhaled insulin devices

💡 Commonly Used Terms

As you read the article, you probably came across a bunch of terms about Medicare and diabetic services and supplies that were new to you. Let’s break down some common terms to make things easier for you.

Out-of-pocket costs:

The expenses a patient pays when Medicare doesn’t fully cover medical services, including deductibles, coinsurance, copayments, and premiums.

Deductible:

The annual out-of-pocket amount a patient must pay before insurance starts covering costs.

Coinsurance:

The percentage of treatment costs a patient pays, typically 20% for Medicare Part B.

Copayment:

A fixed amount paid by an insured patient for prescriptions or treatments.

Chronic Disease:

A long-lasting, often incurable illness like diabetes.

Insulin:

A hormone that regulates blood sugar. Injected to manage diabetes.

Insulin adjustment:

Changing insulin dosage based on diet, activity, and blood sugar levels.

Insulin pump:

A pager-sized device that delivers insulin through a catheter under the skin.

Lancet:

A spring-loaded needle for drawing a drop of blood to test glucose levels.

Secondary diabetes:

Diabetes caused by another condition, medication, or chemical exposure.

Sugar:

A sweet carbohydrate like glucose, fructose, or sucrose.

Syringe:

A hollow plastic tube with a needle for injecting insulin or other medication.

Ulcer:

A deep, open sore or lesion on the skin.

Unit of insulin:

The measure of insulin concentration, typically U-100 (100 units/mL) in the U.S.

Injection:

Using a syringe to administer liquid medication or nutrients into the body.

Do you know? Diabetes is the 8th leading cause of death in the United States, with around 101,209 deaths, according to the National Center for Health Statistics. This statistic shows how diabetes affects public health and emphasizes the need for good management and prevention strategies to lower its related death rates 🔗 .

Who Qualifies for Diabetic Supply Coverage Through Medicare?

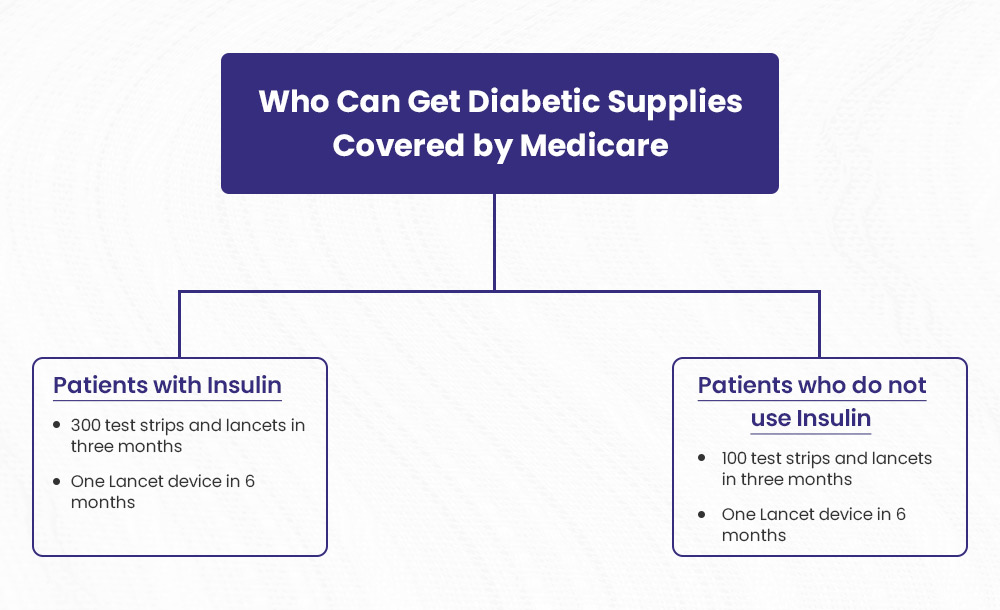

If you have diabetes, Medicare can help cover the cost of your testing supplies and insulin. But you have to meet certain requirements first. Let’s break down who’s eligible and what you could get covered.

➡️ To start, your doctor needs to confirm that you have diabetes and require specific supplies to manage it. This might include test strips, a glucose monitor, insulin, syringes, and other tools.

➡️ The amount you’re covered for depends on whether you use insulin or not. If you do, Medicare will cover up to 300 test strips and lancets every 3 months. You can also get 1 lancet device every 6 months.

➡️ If you don’t use insulin, you can get 100 test strips and lancets every 3 months. Plus a lancet device every 6 months. However, your doctor can request more supplies if it’s medically necessary.

➡️ Now, Medicare has approved brands they’ll cover. So make sure to choose those brands when ordering your diabetic supplies. Otherwise, you may end up paying out-of-pocket. It’s a good idea to verify with the supplier that they accept Medicare before purchasing anything. This helps avoid surprise bills.

Diabetic Supplies Brands Covered by Medicare

After your physician gives you a prescription for diabetic supplies, make sure to check if your suppliers are signed up with Medicare. Medicare doesn’t endorse specific suppliers; it only covers those that are part of the program. Here are some brands of diabetic supplies that Medicare covers:

One Touch

OneTouch is a top choice for blood glucose monitoring, offering reliable and budget-friendly diabetic supplies that are covered by Medicare. For more than 40 years, OneTouch has been focused on improving life for those with diabetes, aiming to create a world without diabetes. Over 20 million people use OneTouch products to manage their condition. Medicare counts on OneTouch for high-quality test strips, lancets, and blood glucose monitors, all at reasonable prices.

OneTouch offers a range of products that help make managing diabetes simpler and more effective. Their blood glucose monitors provide accurate results and make testing super easy. The Ultra Blue test strips allow you to test from various spots and only require a small drop of blood. OneTouch has various lancets designed to make blood sampling easier and more comfortable. This Medicare-covered diabetic supplies company simplifies things by offering all-in-one meter kits that come with everything you need to begin monitoring your blood glucose.

To get Medicare to cover OneTouch products, you must have Original Medicare Part B. Medicare Part B covers costs for diabetic supplies like test strips, lancets, glucose meters, and other related items. To qualify, you need to have diabetes, either type 1 or type 2. Your doctor needs to write a prescription for your diabetic supplies and confirm your diagnosis. Once you have your prescription, you can grab your OneTouch diabetic supplies from a medical supplier that partners with Medicare. After you hit your Part B deductible, you’ll need to cover 20% of what Medicare approves under Part B. OneTouch offers savings programs that can help reduce your out-of-pocket costs.

Accu-Chek

Accu-Chek is a trusted brand for diabetic supplies that Medicare covers. If you have diabetes and are on Medicare, Part B will cover many of the diabetic supplies you get from Accu-Chek. Supplies that are covered include blood glucose monitors, test strips, control solutions, lancing devices, lancets, and insulin pumps.

Once you receive your Accu-Chek diabetic supplies, you’ll only have to pay 20% of the amount that Medicare approves, but only after you’ve met your yearly Part B deductible. This means you don’t have to pay extra to get quality Accu-Chek diabetic products, which are available at pharmacies nationwide.

To qualify for Medicare coverage of diabetic supplies from Accu-Chek, you must:

- Be enrolled in Original Medicare Part B

- Have a documented diagnosis of diabetes from your doctor

- Obtain a prescription for the diabetic supplies from your doctor

- Purchase your supplies from a Medicare-approved supplier

FreeStyle Libre

Another awesome brand of diabetic supplies that Medicare covers is Abbott’s FreeStyle Libre. This cool sensor-based glucose monitoring system is a hit in the U.S. and around the world, helping people with diabetes lead better lives. Abbott’s FreeStyle Libre provides you with precise, real-time blood sugar readings for as long as 14 days using its Continuous Glucose Monitoring System (iCGM). It’s the only one in the U.S. that works for both kids aged 4 and up and adults.

Abbott’s FreeStyle Libre has changed the game for managing diabetes with its simple and user-friendly sensor technology. The FreeStyle Libre sensor goes just under your skin and checks your glucose levels in the fluid around your cells, which is different from fingerstick meters. This helps users spot trends and patterns in real-time, making it easier to manage their diabetes. The sensor lasts up to 14 days and is water-resistant, which makes it really convenient compared to regular fingerstick devices.

If you use insulin, Medicare covers all the supplies for FreeStyle Libre. To qualify, you must have diabetes, use insulin, and get a prescription from your doctor for the FreeStyle Libre system. Medicare Part B includes coverage for sensors and readers as durable medical equipment. If you have a prescription, you can begin using FreeStyle Libre and take advantage of Medicare coverage to better manage your diabetes.

Dexcom G7

Dexcom G7 is a brand of diabetic supplies that is covered by Medicare for eligible patients. The Dexcom G7 continuous glucose monitoring (CGM) system is one of the most accurate options available. It allows diabetes patients to manage their condition without constant fingersticks. The Dexcom G7 sends real-time glucose readings right to a smartphone or smartwatch, enabling patients to easily see their levels and make informed decisions about food and activity.

To qualify for Medicare coverage of Dexcom G7 supplies, patients must meet certain criteria. You generally need to be enrolled in Medicare Part B and have a diagnosis of diabetes requiring frequent glucose testing. Your doctor will need to write a prescription for the specific Dexcom G7 products and indicate “do not substitute.” This allows you to get the exact brand prescribed without surprises.

It’s important to note that not all diabetic supply brands are covered by Medicare. Be sure to check your plan’s details for coverage specifics. There are other options beyond Dexcom G7 that may also be covered. The key is having your physician provide a prescription and documentation showing medical necessity.

With the proper Medicare enrollment, diagnoses, and prescriptions, the Dexcom G7 can be an accessible option for managing diabetes. Discuss your options with your healthcare provider to see if this advanced CGM is right for your needs. Consistent glucose monitoring is essential for many diabetes patients, and Medicare aims to make it affordable.