When it comes to medical billing, “in-network” and “out-of-network” sound like slippery phrases.

But at their core, they’re simple.

In-network means healthcare providers partnered with an insurance company.

Out-of-network means no partnership with an insurance company.

And this matters for reimbursements!

With in-network providers, insurance companies negotiate rates and oversee payments.

But with out-of-network, no such middleman exists. Providers directly bill patients instead.

This article focuses on the out-of-network side, explaining the reimbursement process and how providers get paid after serving patients. Think of it as your out-of-network billing guidebook, walking you through each step to make out-of-network billing go as smoothly as possible.

What is OUT-OF-NETWORK medical billing?

OUT-OF-NETWORK BILLING, to put it simply, refers to the medical charges that physicians and hospitals issue to insurance companies or patients who are not part of their network coverage plan in the form of a “superbill”. Unlike in-network billing where agreed upon rates are established ahead of time, out of network charges are billed at the provider’s usual and customary rate.

When a doctor treats a patient who does not belong to their insurance network, they bill for those services as “out of network.” This means the insurance company and the patient have not already agreed to a contracted rate for that doctor’s fees. The doctor can then charge their full, typical price for the care provided. For the patient, this often means higher out-of-pocket costs.

Out of network billing is different from in-network billing where insurance companies and doctors have agreed on rates ahead of time.

The usage of Super Bills in OUT-OF-NETWORK Billing

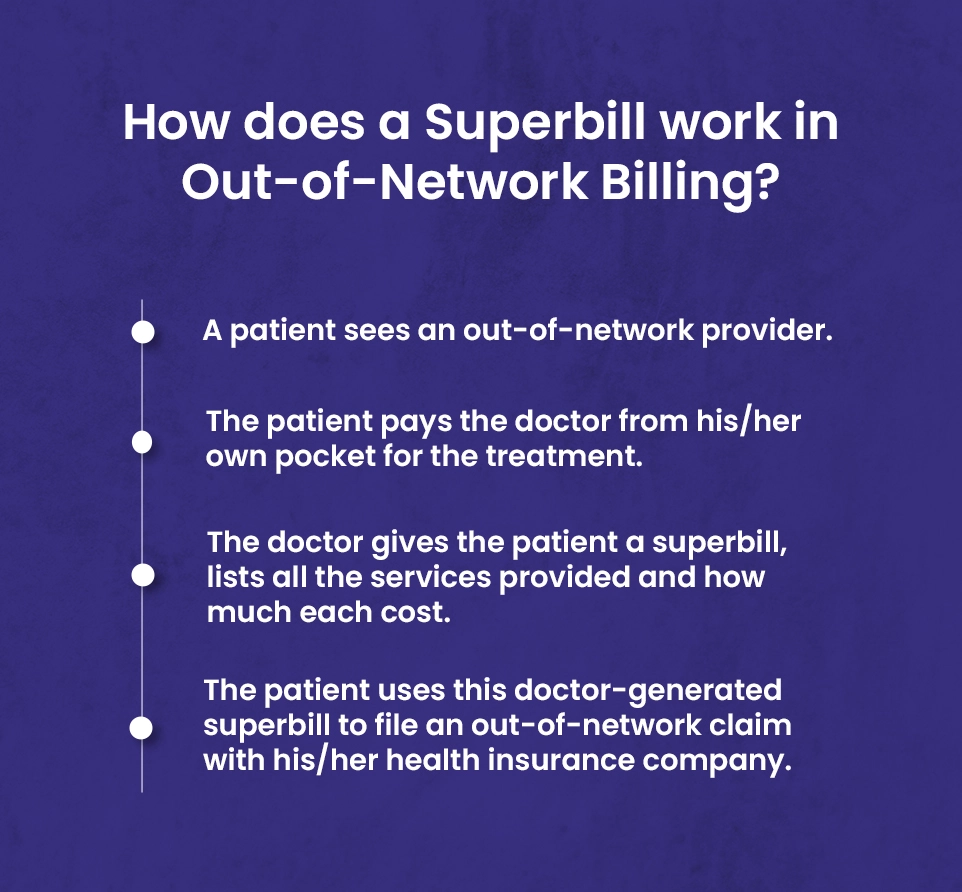

There is an integral connection between the superbill and out-of-network medical billing.

Superbills act as invoices documenting the services and charges of out-of-network providers.

When a patient sees a provider outside their insurance network, that provider bills the patient directly at their standard rates instead of pre-negotiated network rates.

The superbill outlines the date of service, specific services rendered, service codes, and the provider’s full charges. Patients pay out-of-pocket and then submit the superbill to insurance for reimbursement. Without the detailed information on the superbill, reimbursement would be difficult.

So for out-of-network billing, the superbill is essential for patients to get repaid for medical expenses. It is the key document enabling insurance reimbursement when providers are outside a patient’s network.

In-network providers vs. out-of-network provider differences

“In network” providers and “out of network” providers are two different terms used for healthcare providers. They are described on the basis of contracts with insurance companies.

a). In Network Providers

Health insurance companies have connections with many healthcare groups—hospitals, clinics, physicians, and other caregivers—with whom they’ve negotiated lower rates for patients who use their network, aka patients with in-network benefits.

The providers who are in network with insurance health plans are also called preferred or participating providers.

The healthcare providers that choose to be “in-network” have agreed to the stipulations in their contracts that they will bill at the insurance companies’ reduced rates.

For example, a physician may charge $120 out-of-pocket for a given service but will charge $90 for that same service for a patient insured by ABC Insurance, with whom the physician has a contract.

In that scenario, the patient pays $20 as their copayment, and ABC Insurance pays the remaining $70. The physician thus forgoes $30 of the total charge. However, the payments differ for each insurance provider. For instance, the charge for the identical service may be $110 for a patient insured by XYZ Insurance.

b). Out of Network Providers

Out-of-Network providers are those who are not in contract with insurance companies, and are not limited to particular plans and policies. They set their own fees, also called private pay, cash pay, or fee for services, as they are not part of any panel or agreement.

Furthermore, non-network healthcare providers do not accept negotiated rates which means that patients have to pay for the services they receive. These rates may be more or less different from the rates of the same services which patients have to pay if they are getting in-network benefits.

Generally, out-of-network providers charge high for their services provided. As discussed above, non-participating service providers might charge $120 for the same service. However, the insurance would pay some of the amount if the patient would have out-of-network benefits but still the patients would receive balance bills.

Out-of-Network Billing Laws

There are times when out of network billing is appropriate. When an out of network provider treats an out of network patient, or vice versa, everything is above board. The provider has every right to charge their fee, without being bound by the laws governing in-network providers. Here, the patient knows they are out of network, the provider knows it too, so there is an understanding. The provider can charge what they want, and the patient accepts they must pay it.

However, out of network billing laws come into play when an in-network patient unintentionally receives treatment from an out of network provider at their in-network facility. This is when surprise medical bills happen – when a patient unknowingly receives services from an out-of-network provider. In these cases, and these cases alone, out-of-network billing laws take effect. Not when it is done intentionally, but only when it happens unexpectedly.

The law aims to protect patients from exorbitant charges they did not agree to upfront. There are rules about how much out-of-network providers can charge in these circumstances. The intent is to remove the nasty shock of a sky-high medical bill arriving out of the blue. Patients should not be punished for an out-of-network provider treating them without their knowledge. The law tries to introduce some fairness into these accidental situations.

Law #1 ➜ Out-of-Network Billing and Payment Law (AB 72)

The AB 72 law protects patients from surprise medical bills when they receive them after getting services from an Out-of-Network provider at an In-Network healthcare facility without their consent. Sometimes not all the staff at the In-network facility are in contract with insurance companies i.e. the anesthesiologists who generally are not the hospital employee take part in medical care and make decisions separate from the hospital.

Law #2 ➜ No Surprises Act (NSA)

The No Surprise act took effect on January 1, 2022. According to the act it is illegal to send surprise bills to patients under these circumstances.

- Services received by patients from non-network healthcare provider during emergency

- Out-of-Network services provided to patients at in-network facilities. The facility may be a hospital, hospital OPD and ambulatory surgery center.

══•●•══

💡 Why patients opt Out of-Network health care?

You might wonder why one would go for Out-of-Network facilities if they charged high bills as compared to In-Network facilities. However, in some other cases receiving medical services from Out-of-Network providers is beneficial. Here are some explanations for obtaining health care out-of-network:

- Receiving emergency treatment when unable to reach an in-network facility;

- Seeing non-contracted providers at in-network facilities when alternatives are unavailable;

- Getting specialized care not offered within one’s network;

- Obtaining care while traveling outside of the service area for one’s network;

- Preventing harm caused by changing providers;

- Lacking an in-network provider within a reasonable distance;

- Accessing care after natural disasters constrain availability of in-network providers.

⬇️⬇️⬇️

🔹 Receiving emergency treatment when unable to reach an in-network facility

Good news for patients as the government passed the Affordable Care Act (ACA). Before that, the patient would still receive bills for the services they receive during an emergency. However, now the act has restricted the healthcare providers and insurers to cover emergency care.

Furthermore, before 2022 prior to the No Surprise Act, the healthcare provider could send balance bills to patients to cover the difference between the charged amount for the services and the insurance amount. So, in case of emergency, the No Surprise Act is another reason that facilitates patients to visit non contracted healthcare providers.

🔹 Seeing non-contracted providers at in-network facilities when alternatives are unavailable

Sometimes, healthcare facilities may be in network with insurance companies but some of the doctors and other providers there may not be in contract with insurance companies which patients are registered with. So, they have to be covered by the Out-of-Network providers.

Also, due to the Surprise Act the patients would not receive balance bills when they are treated at In-network facilities by Out-of-Network providers. So, therefore, going for non-contracted providers is in that case beneficial for patients.

🔹 Getting specialized care not offered within one’s network

If patients suffer from some rare ailments for which the concerned doctors or specialists are not included in the insurance plan, in that case Out-of-Network care is compulsory.

However, it depends upon insurers they may grant an exception to patients and cover their treatment expenses if they are in network with them and also the facility.

Yet, the healthcare providers can send balance bills to patients if the reimbursement paid by insurers does not cover the charges of treatment.

🔹 Obtaining care while traveling outside of the service area for one’s network

Patients have to go Out-of-Network if they are away from home and need medical care. Not all but some insurers may facilitate patients to handle their healthcare expenses in the same way as if they are in network if they visit non-participating providers. But, these provisions are only in case of emergencies.

However, policy holders should contact their insurers before they are leaving the area where they are in network with healthcare providers.

🔹 Preventing harm caused by changing providers

Life is precious. At a critical health condition of a patient, if a contracted provider leaves the network. In that case, avoiding treatment from Out-of-Network providers may result in severe health conditions. Therefore, it is indispensable for patients to continue treatment with non-contracted healthcare providers.

🔹 Lacking an in-network provider within a reasonable distance

Patients have to go Out-of-Network if they are away from home and need medical care.

Not all but some insurers may facilitate patients to handle their healthcare expenses in the same way as if they are in network if they visit non-participating providers. But, these provisions are only in case of emergencies.

However, policy holders should contact their insurers before they are leaving the area where they are in network with healthcare providers.

🔹 Accessing care after natural disasters constrain availability of in-network providers

Natural disasters i.e. floods, fires, earthquakes, hurricanes, and tornadoes can destroy medical facilities and the local population. As a result, people have to evacuate to other areas where they should seek healthcare. In that case, the affected people may get services from Out-of-Network facilities which will be treated as if they were in-network because of the declaration of the emergency by the state or federal government.

Key terms used in OUT-OF-NETWORK MEDICAL BILLING process

➠ Out-of-Pocket costs (OOP): Out of pocket costs are the expenses which are paid by patients, not insurance companies, to providers. These include deductibles, co-payments, and co-insurances.

➠ Deductibles: Deductible is the amount patients pay each year before coverage begins.

➠ Co-insurance: Co-insurance is a percentage of the amount patients pays to healthcare providers which takes effect after the approved deductible amount has been met.

➠ Co-payment: Copayment or co-pay is the fixed amount a patient pays to a healthcare facility after receiving services or treatment.

➠ Super bill: Usually, patients receive super bills after they receive services from healthcare providers who are non-participating with the patient’s insurance network. So, the patient has to pay these bills and later send it to the insurance companies for reimbursement.

➠ Balance billing: Balance billing or sometimes called surprise billing is the charged amount for services a patient receives from a healthcare provider. The amount is the difference between the full charges of the services and the amount which patients have agreed upon with insurance companies to pay.

What is the process of out-of-network insurance reimbursement?

Sometimes, insurers deny reimbursements to patients who have out of network benefits due to incorrect codes and errors in bills, and patients face unwanted delays in payments. Therefore, it is necessary to take some few steps to maximize the ratio of getting claims on time. Here is the complete process of getting reimbursed.

1). Check out of network coverage with insurance plans.

Checking out of network coverage with insurance plans is necessary. Insurance companies use various out of network policies. Patients or clients can check their policies by calling them or visiting their official websites. The essential thing to check is knowing the deductibles for out of network coverage. If the cost of a service which a patient wants to receive from a non-contracted practitioner does not comply with deductibles, the insurance company would not pay any reimbursement.

2). Gather necessary documentation.

Insurance companies accept reimbursement for out of network claims but they need specific documents. These documents include claim form, detailed receipt from the session which is provided by health care providers. In simple words, they need a “super bill” which is the summary of all details i.e. important details of the services, diagnosis and other codes from the healthcare session. These super bills can be auto generated by the practice management software.

3). Submit the medical claim

After providing them all the important details, now clients or patients can submit the claim for reimbursement. They can submit it online or by mail. After submitting the claim correctly, it can be reimbursed based on the provider rates. Clients should keep the copy of the bills as record.

4). Wait for reimbursement

After submission of the claim by the clients, the insurers will review and decide how much of the cost they would pay to the clients who have out-of-network benefits. However, this is a long process and may take up to 90 days. But, incorrect data, misspelled details, and missing codes can result in even more days of delays.

5). Appeal (if needed)

The clients can also appeal if the insurance companies do not accept the amount or reject the claims. In support of their appeal, they can provide them with additional documentation i.e. letters from healthcare practices explaining medical services they have provided to the clients.

Apart from this, as a healthcare provider submitting and getting out-of-network claims is not a rocket science, but you need to keep these things in mind.

- Ensure that patients which you are going to provide services have out-of-Network coverage benefits.

- Check your credentials in Out-of-Network insurers’ systems. If they do not have your information in their record they may reject your claims.

Out-of-Network Billing Bringing You Down?

For providers, out-of-network billing with manual superbill creation can negatively impact both time and revenue.

But with our medical billing service, you can automate superbill creation for your out-of-network patients and integrate into a streamlined revenue cycle management process.