Schedule Free Billing Consultancy!

Need help with billing? Let’s talk.

An Explanation of Benefits (EOB) is equally important for patients and providers. It helps identify billing errors in claims and enables providers to fix them to avoid claim denials. EOBs improve the overall effectiveness of billing and patient communication in medical practices.

The healthcare providers should properly check the details in EOB to understand the fixes. They must collaborate with patients to address the mistakes that the insurer pointed out in the document to streamline the billing process.

This guide helps providers understand the EOB in medical billing, its significance, components, workflow, and actionable steps to optimize billing processes by taking help from the EOB document.

What Is EOB In Medical Billing?

“EOB” in medical billing stands for “Explanation of Benefits.” The EOB is a document an insurance company sends to a covered individual (patient) explaining what medical treatments and/or services were paid for on their behalf. It details the services’ costs, how much was covered by the insurance, any discounts applied, and what the patient is responsible for paying.

This document is not a bill but a breakdown of how the insurance claim was processed and what portion, if any, the patient owes to the healthcare provider.

To understand the differences between an Explanation of Benefits (EOB) and a Medical Bill, see the comparison table below:

EOB Vs Medical Bill: A Comparison

| Feature | EOB | Medical Bill |

| Purpose | To summarize the insurance claim process, show what the insurance paid and what you owe. | To request payment for healthcare services provided. |

| Sent by | Your insurance company. | Your healthcare provider. |

| Details | Details what the insurance company covered, including paid amounts and patient’s responsibility. | Details the total charges and specifies the amount due from the patient. |

| Action Required | No direct payment is made in response to an EOB. It is informational. | Payment is required. This is a bill you need to pay. |

| Timing | Sent after the insurance processes your healthcare provider’s claim. | Sent after your insurance has settled its portion and determined your share of the cost. |

| Items | This includes the date of service, type of service, provider, charges from the provider, what insurance is covered, and what you owe. | Includes date of service, type of service, total charges, and your specific payment responsibility (deductibles, copayments, etc.). |

Why Are EOBs Essential For Providers?

Explanation of Benefits (EOBs) are essential documents insurance companies provide that outline the services delivered to a patient, how much the insurance company paid, and what a patient has to pay the provider.

EOBs are essential for both patients and healthcare providers.

Here’s why they are essential for providers:

Ensures the Accuracy of Services and Providers

EOBs list the services the healthcare providers deliver to their patients. Reviewing this document helps ensure that all listed services were provided and that there are no errors, such as services that a provider did not deliver to the patient. In this way, EOBs help providers avoid overcharges or fraudulent claims.

Identifies Errors in Billing and Insurance

EOB helps providers compare a medical bill issued by an insurance company and the actual payment a patient pays. Providers can check the differences in billing information and insurance details. The provider can fix this issue if there is any inconsistency or mismatch between these two. So, EOBs can help providers address billing and insurance errors.

Assists in Payment Plans and Financial Options

Providers can review the costs (check the detailed breakdown costs mentioned by insurers) using EOBs in case of unexpected extra charges. The provider can easily discuss and negotiate the various payment options, such as setting up a payment plan or exploring other financial assistance options if the bills are too high for immediate payment.

Records Documentation for Disputes and Appeals

When a patient wants to appeal a decision made by the insurance company, he disputes a charge from the provider or clarifies tax deductions related to medical expenses. In this case, EOBs assist providers in sorting out the confusion of your patient. This contains a record of services and charges essential for appeals and disputes.

Ensure Compliance with Tax Regulations

EOBs can be used for tax purposes to verify medical expenses, especially when patients are itemizing deductions for healthcare costs on their tax returns. This can be important for ensuring providers claim the correct amounts and comply with tax regulations regarding medical expenses.

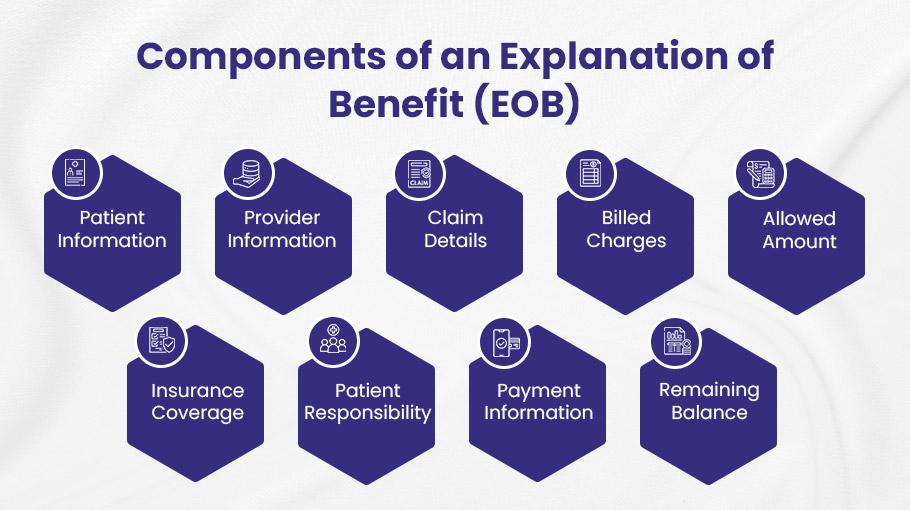

Components of an Explanation of Benefit (EOB)

There are various components of the Explanation of Benefit (EOB). Each provides a comprehensive overview of the claim and its financial implications.

Here’s what an EOB document may have:

➜ Patient Information: This section includes the insured individual or policyholder’s name, address, policy number, and other relevant details.

➜ Provider Information: This contains the name, address, and contact information of the healthcare provider who rendered the services.

➜ Claim Details: This consists of the services rendered and claim details, such as the service date, the description of the procedure or treatment, the claim no, and the billing codes.

➜ Billed Charges: The EOB shows the total charges billed by the healthcare provider for the services rendered. This amount represents the initial cost of the medical care before any adjustments or insurance coverage.

➜ Allowed Amount: The insurer wants to pay the maximum amount for the services rendered. This amount is the negotiated rate between the provider and the insurance company or based on the provider’s fee schedule.

➜ Insurance Coverage: These are the billed charges that the insurance company will cover. It includes deductibles, coinsurance, copayment amounts, and applicable limitations or exclusions.

➜ Patient Responsibility: This is the amount the patient is responsible for paying out-of-pocket. This may include copayments, deductibles, coinsurance, or any remaining balance after the insurance company’s payment.

➜ Payment Information: This is the information on the payment made by the insurance company to the healthcare provider. It includes the amount paid, the payment date, and any adjustments or write-offs applied.

➜ Remaining Balance: This is the remaining amount that the patient has to pay. This may include the non-covered services, the patient’s share of the allowed amount, or other outstanding charges.

Learn: How to read an EOB Document.

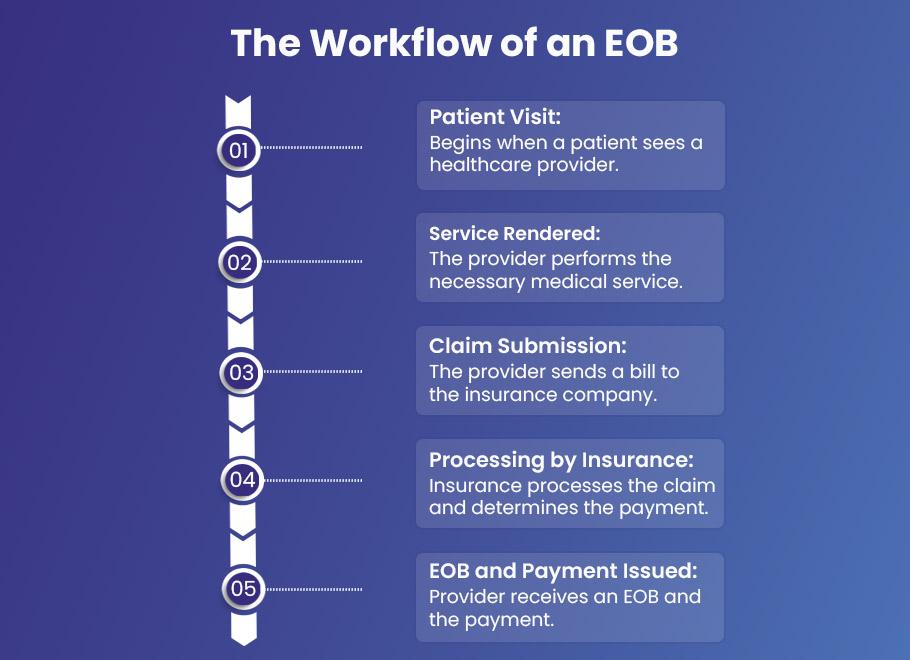

The Workflow of an EOB

The workflow of an Explanation of Benefits (EOB) is crucial for healthcare providers, ensuring accurate billing and timely payment for services rendered.

Let’s discuss the EOB workflow:

Patient Visit

- The EOB workflow starts when a patient visits a doctor and receives any service like a routine checkup, diagnostic test, etc.

- The physician documents the patient’s details, including the reason for the visit, any diagnosis made, and treatments provided.

Service Rendered

- The provider performs the necessary medical services based on the patient’s health needs.

- The physician ensures all services are medically necessary and correctly documented in the patient’s medical records.

Claim Submission

- The provider, or their billing office, compiles a detailed bill for services rendered and sends it to the patient’s insurance company via a clearinghouse.

- Provider submits all necessary service codes, patient information, and required documentation accurately.

Processing by Insurance

- Once the insurance company receives the claim, it processes it to determine the coverage and the amount payable.

- The provider may need to respond to queries from the insurance company or provide additional documentation if required.

EOB and Payment Issued

- After processing the claim, the insurance company issues an EOB to the provider, which details what has been covered, any deductions, and the final amount paid. Payment is usually made by check or electronic funds transfer (EFT).

- Review the EOB for accuracy, ensure the payment matches the EOB details, and address any discrepancies with the insurance company.

💡 Pro Tip for Providers:

Providers should partner with an efficient clearinghouse to reduce the chances of denied claims. A clearinghouse checks the claim details by claims scrubbing and integrating billing software. This can ensure accuracy in claim details before submission, minimizing billing errors.

Electronic Payment Process for Providers

Healthcare providers need to make transactions secure and transparent. There are two ways they can complete the payment process electronically:

- Electronic Funds Transfer (EFT)

- Electronic Remittance Advice (ERA)

EFT and ERA help providers save time, reduce errors, and ensure compliance with HIPAA regulations. Additionally, providers can make secure and transparent transactions.

Providers can create the EOB as an electronic file, usually in a format called an 835, and can download the ERA 835 file from the clearinghouse.

Electronic Funds Transfer (EFT)

According to CMS.gov, Electronic Funds Transfer (EFT) transmits healthcare payments from a health plan to a healthcare provider’s bank.

An EFT transaction contains payment processing information such as:

- Amount being paid

- Names and identification information of the payer and payee

- Bank account information for the payer and payee (including routing and account information)

- Date of payment

Electronic Remittance Advice (ERA)

According to CMS.gov, electronic remittance advice, or ERA, is an explanation from a health plan to a provider about a claim payment. An ERA explains how a health plan has adjusted claim charges based on factors like:

- Contract agreements

- Secondary payers

- Benefit coverage

- Expected copays and coinsurance

Healthcare providers can connect an EFT with the services they provide to their patients using ERA. This helps providers and health plans track transactions, making the payment process secure and streamlined.

💡 Pro Tip for Providers:

Healthcare providers must develop transparent and swift communication (sending e-mails, reminders, and SMS alerts) with their patients to address errors, such as mismatched details regarding insurance providers, patients, and claims. This can help them to avoid the denied claims and improve the billing process.

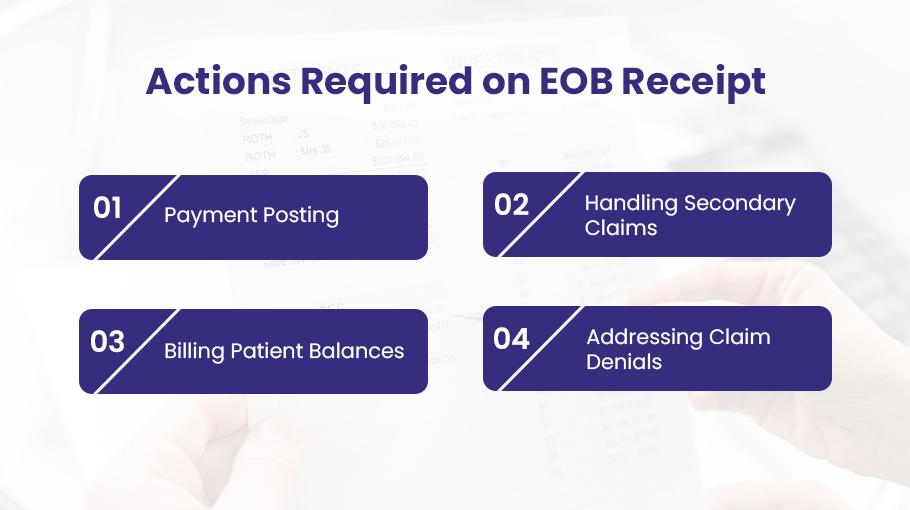

What Providers Should Do When They Receive EOB Receipt?

Upon receiving the ERA, the provider’s office should perform the following steps:

1). Payment Posting:

Payments must be applied to the correct patient accounts based on the information in the ERA. To efficiently post payments, the following details included in the EOB are essential:

- Payer Name and Address: The name and address of the insurance company making the payment.

- Patient Name: The name of the patient receiving the service.

- Provider Name and Address: The healthcare provider’s details.

- Member ID#: The policy identification number of the patient.

- Claim received Date: The date the payer received the claim from provider.

- Payment or denial date: The date the claim processed or denied by payer.

- Date of Service (DOS): The date service provided from provider to patient.

- CPT Code: Procedure code

- Billed Amount: The Amount for each service performed by providers.

- Claim Number: Number assigned by the payer for each claim.

2). Handle Secondary Claim

If the patient has secondary insurance, any remaining balances after the primary insurance’s payment should be billed to the secondary insurer.

- Allowed Amount: The amount suitable according to the payer for a specific service. AA = PA+ PR.

- Paid Amount: Paid Amount = Allowed Amount – Patient responsibility.

- Patient Responsibility: This is the balance percentage of reimbursement the patient must pay according to his policy with the insurance company. If they have one, the patient or his secondary insurance pays this.

- Write-off Amount: It is an amount that the provider waives off. Write-off amount = Billed Amount – Allowed Amount.

3). Billing Patient Balances

If there’s any amount due that is the patient’s responsibility and not covered by any insurance, the provider should bill the patient directly.

4). Address Claim Denials

If the insurer denies the claim, the provider must identify the reason for rejection and the denial code to resubmit the claim accurately.

Enhance Payment Processing with BellMedEx

If you’re in the medical business, paying and getting paid on time is important.

BellMedEx medical billing company has a solution for that!

We can set you up to manage your finances electronically using our patent Electronic Funds Transfer (EFT) and Electronic Remittance Advice (ERA) systems.

Our automated medical billing solutions follow the rules laid out in the HIPAA, so you stay compliant. More than that, we make the whole payment process quick and secure.

Here’s how our smart solutions are helping providers of all practices:

➜ Better Efficiency: BellMedEx allows providers to enroll with various payers through advanced PMS software and receive payments directly to their bank account via the Automated Clearing House (ACH) network.

➜ Comprehensive ERA Services: Providers can get detailed electronic explanations of benefits (EOBs), which include adjustments, deductions, and detailed reasons for denial, all accessible within our platform.

➜ Real-Time Updates: Enables providers to track payment statuses in real-time view, print, download, or export ERAs in multiple formats.

Final Thoughts

Healthcare providers cannot ignore the importance of EOB in medical billing. It is equally essential for patients and providers.

EOB documents give providers a roadmap to address billing issues, such as claim errors, inaccurate insurance details, etc.

Choosing proper payment plans, utilizing fund transfer tools like EFT and ERA, and partnering with an experienced clearinghouse like BellMedEx streamlines the payment posting process.

In a nutshell, EOB makes the transaction process easy and enables you to focus on quality patient care, which is the ultimate goal of every provider.