Let’s start with a simple example. Imagine you are running a small cafe. Every item on your menu has a set price, right? But you also need to know where each item came from and how much it cost to make.

For instance, some items come from the kitchen, others from the barista station, and some from the pastry display. So, you charge each item based on the prices you have set for different sections.

Revenue codes work in a similar way in medical billing. They help categorize the various services provided in different departments of a healthcare facility. This is important because each service has a different cost.

For example, let’s say a patient comes to the hospital for knee surgery. During their stay, the hospital will provide them with treatment, which may include a stay in the recovery room, physical therapy sessions, and medications. In this case, each service and procedure will have a different revenue code.

Meanwhile, this coding system helps pinpoint exactly where the costs are coming from. This way, insurance companies can easily understand and identify the services provided. Then, they can process claims accurately and ensure that healthcare providers receive the correct payments.

What is a Revenue Code in Medical Billing?

Revenue codes are like special numbers that help doctors and hospitals keep track of the different services they provide to patients. These numbers make it easier for insurance companies to understand what they are being asked to pay for.

Each revenue code is a three- or four-digit number that stands for a specific service. For instance, the code 0100 means “room charges for staying in the hospital,” while 0360 means “charges for using the operating room.” By using the right code for each service, the insurance company can easily see what they are being billed for.

Revenue codes help doctors and hospitals in a few key ways:

- They make it easy to sort and group different services. This way, the billing is accurate and the insurance company pays the right amount.

- Every service has its own unique code. For example, there are separate codes for room charges, treatments, and medications.

- The codes give clear information to the insurance company. They can just look at the code on the bill and know exactly what service was provided.

- With the right code, the insurance company knows precisely how much they owe for that service.

In short, revenue codes are really important for keeping things organized. They allow doctors and hospitals to send accurate bills to health insurance companies. Then, the insurance company can pay the correct amount because they understand the codes. With revenue codes, both sides know what services were given and how much they cost.

Revenue Codes vs. Medical Codes: What’s the difference?

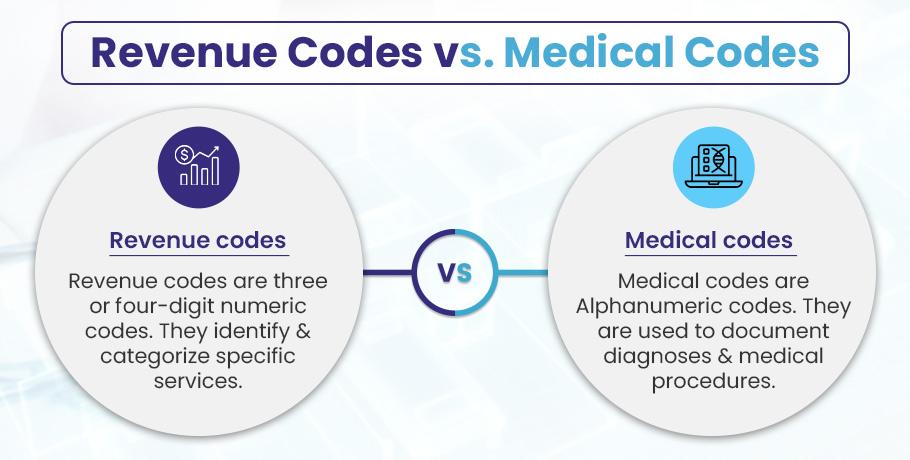

Medical billing involves using various codes to document services provided and bill payers. Revenue codes and medical codes are two important types of codes with distinct purposes:

| Aspect | Revenue Codes | Medical Codes |

| Purpose | Identify and categorize specific services provided to patients within a healthcare facility. | Document diagnoses and medical procedures. |

| Format | Typically, three or four-digit numeric codes. | It contains alphanumeric codes like both numbers and alphabets. |

| Usage | Indicate the type of service and the location of the service. For example, room and board, laboratory tests, and imaging services. | Describe the patient’s diagnosis and the specific medical procedures performed. |

| Example | A revenue code might specify that a patient received physical therapy in the rehabilitation department. | An ICD-10 code documents a diagnosis of pneumonia. And a CPT code documents the administration of a chest X-ray. |

| Scope | Focus on the location and type of service provided. | Focus on the specific medical condition and procedures. |

| Detail | Provide a broader categorization of services. | Provide detailed information about the patient’s diagnosis and treatment. |

➜ Revenue codes categorize services and items

Revenue codes are 3-4 digit numeric codes that categorize services, procedures, and items provided to patients. They indicate the general type of service such as room and board, labs, physical therapy etc. Revenue codes allow healthcare providers to bill payers for these broad categories of services.

➜ Medical codes specify diagnoses and procedures

In contrast, medical codes like ICD-10 and CPT codes specify the exact diagnosis made and procedures performed. ICD-10 codes use a alphanumeric system to precisely define medical diagnoses while CPT codes use 5 digit codes to describe specific medical procedures.

Revenue codes tell what medical service was provided. Medical codes tell why and how.

For example, a revenue code may indicate that a patient received physical therapy. The CPT code would specify exactly what therapy services were performed, like therapeutic exercises or neuromuscular reeducation.

While both are used for billing purposes, revenue codes categorize services and medical codes provide granular clinical detail. Using them together provides the complete picture for accurate billing and reimbursement.

Structure of Revenue Codes

Revenue codes are structured as follows:

- First Digit: Indicate the broad service category (e.g., room and board, radiology, surgery).

- Last Two Digits: Provide specific information about the service or item.

Example:

- 0120: Indicates room and board, specifically a semi-private (two beds) room, inpatient.

- 0450: Represents emergency room services, general classification.

Revenue Codes Used in Different Healthcare Settings

As a healthcare provider, it’s really important to properly code and bill for the services you provide. This is the only way you can get paid by insurance companies like Medicare, Medicaid, and private insurers. Revenue codes play a big role in this process. They tell the insurance company exactly what type of service you provided on the claim form, like the UB-04 form.

For example, revenue codes are used to show if you did a surgery, took an X-ray, or ran a lab test. The insurance company looks at these codes to decide how much they need to pay you. So, by using the right revenue codes, you can make sure you get paid correctly for the care you gave.

Additionally, revenue codes help you keep track of how much money is being spent in different areas of your healthcare facility. This way, you can make sure resources are being used efficiently.

Now, let’s take a look at some of the most common types of revenue codes used in healthcare settings:

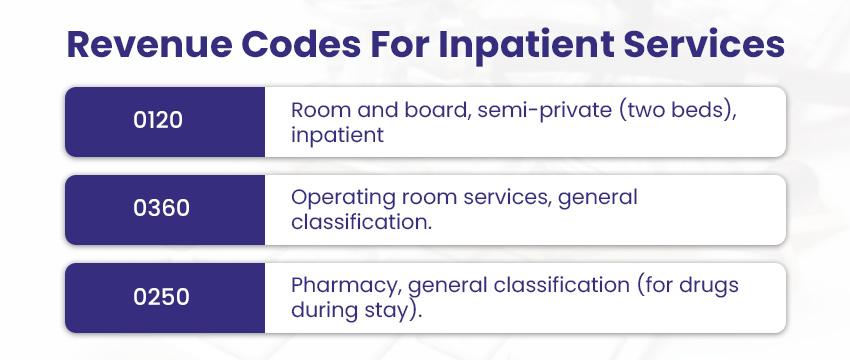

1). Revenue Codes for Inpatient Services

These codes help categorize the patient’s hospital stay, surgery, and medications. In this way, they help providers bill each treatment correctly.

- 0120: Room and board, semi-private (two beds), inpatient

- 0360: Operating room services, general classification

- 0250: Pharmacy, general classification (for medications administered during the stay)

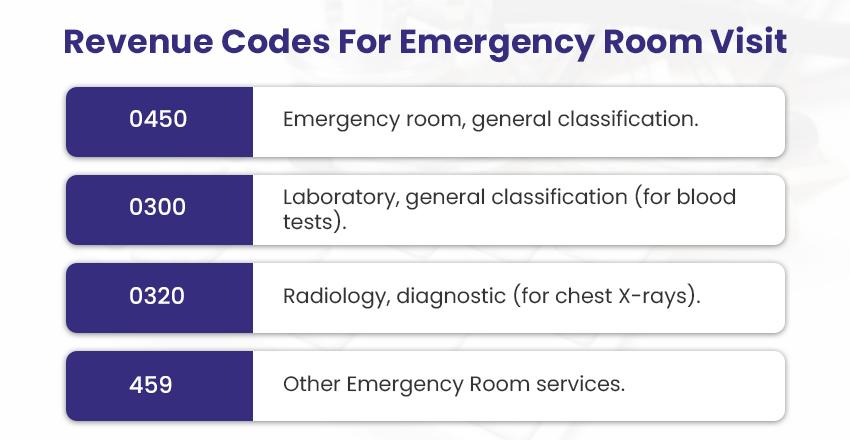

2). Revenue Codes for Emergency Room Visits

These codes are used to categorize and bill the emergency room services. For example, patient registration, lab tests, and radiology.

- 0450: Emergency room, general classification

- 0300: Laboratory, general classification (for blood tests)

- 0320: Radiology, diagnostic (for chest X-rays)

- 0459: Other Emergency Room

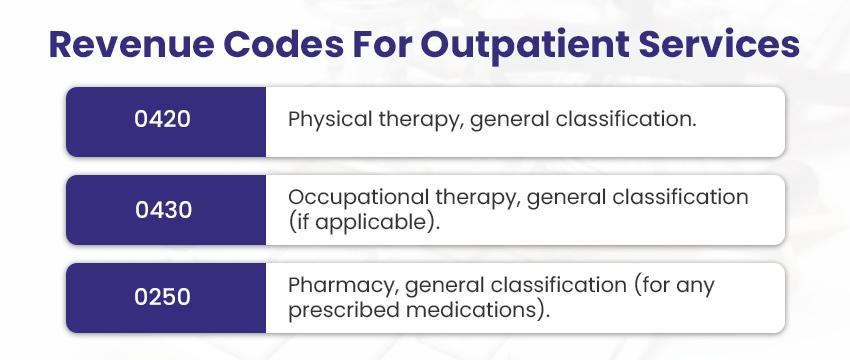

3). Revenue Codes for Outpatient Services

These revenue codes track and bill the specific outpatient services. Hence, providers get proper reimbursement from the insurance company.

- 0420: Physical therapy, general classification

- 0430: Occupational therapy, general classification (if applicable)

- 0250: Pharmacy, general classification (for any medications prescribed)

4). Revenue Codes for Intensive Care Unit (ICU)

Revenue codes for the Intensive Care Unit fall under the 20x series. These codes categorize different ICU services based on the specific treatment and care.

- 200: This code is for general intensive care services, not a specific sub-category

- 201: For ICU services provided to patients recovering from surgery

- 202: For ICU services provided for non-surgical medical conditions

- 203: For intensive care services provided to children

- 204: For intensive care services related to psychiatric conditions

- 206: For less intensive, intermediate care services

- 207: For intensive care services related to burn injuries

- 208: For ICU services provided to trauma patients

- 209: Other types of ICU services not specified by the different codes

5). Revenue Codes for Pharmacy

Revenue codes for pharmaceutical treatments fall under the 25x series. These codes categorize medications and related services provided in a healthcare setting.

- 250: General pharmacy services that don’t fall into a specific sub-category

- 251: For generic medications

- 252: For brand-name medications

- 253: Medications dispensed for patients to take home

- 254: Medications used in conjunction with diagnostic services

- 255: Medications used in radiologic procedures

- 256: Medications used in clinical trials or experimental treatments

- 257: Over-the-counter medications

- 258: Intravenous solutions

- 259: Any other pharmacy services not specified by the different codes

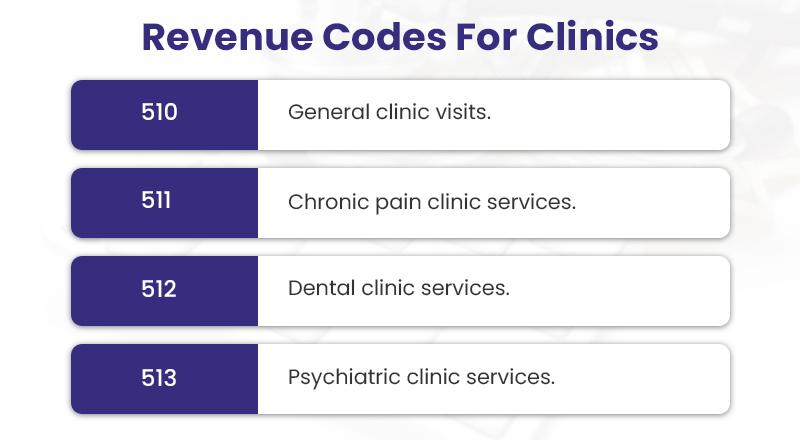

6). Revenue Codes for Clinic

Revenue codes for clinic visits fall under the 51x series. These codes help categorize services provided in different clinic settings.

- 510: General clinic visits that don’t fall into a specific sub-category

- 511: Services provided at a chronic pain clinic

- 512: Services provided at a dental clinic

- 513: Services provided at a psychiatric clinic

- 514: Services provided in obstetrics and gynecology

- 515: Services provided at a pediatric clinic

- 516: Services provided at an urgent care clinic

- 517: Services provided at a family practice clinic

- 519: Any other clinic services not specified by the different codes

Conclusion

In short, revenue codes are very important for healthcare providers. They are a standard system to group and identify the different services given to patients. By using the right code, providers can make sure billing is accurate and see-through.

When used properly, revenue codes help providers in two big ways. First and foremost, they get the right payments from insurance companies and patients. Moreover, they avoid billing mistakes and confusion. As a result, the codes make billing work smoother and have fewer errors.

Revenue codes are a key part of medical coding and billing. Therefore, it’s essential providers fully grasp how the codes work, what they’re for, and how to apply them. By mastering these codes, providers can optimize billing operations, lower claim rejections, and maintain financial health for healthcare groups.

As healthcare changes, staying current on revenue code rules and updates is vital. To achieve this, providers should train staff and use advanced medical billing software to follow the rules and maximize revenue cycle management.