In the U.S. healthcare system, there is a big change happening. Healthcare providers are moving from the old payment system, called “fee-for-service” (where providers get paid for each service they give), to a new system called “value-based care.”

In value-based care, providers are paid based on how well they help patients stay healthy and improve their outcomes, rather than just how many services they provide.

This change is happening because people want healthcare to be more efficient and affordable, while also focusing on the health of the patients.

The government programs like Medicare (which helps people over 65 and those with long-term disabilities) and Medicaid, as well as private insurance companies, are all encouraging providers to use new payment models. These include systems like Accountable Care Organizations (ACOs), where providers work together to improve care and save money, or “bundled payments,” where a group of services is paid for at once.

Value-based care is important for healthcare providers, including doctors, hospitals, and clinics. They need to understand these new payment models to stay financially stable while also giving the best care to their patients.

In this blog, we will explore what value-based care is, how it works, and how it can help providers deliver better care while managing costs.

Understanding Value-Based Care Model in Healthcare

Value-based care is a way of providing healthcare that focuses on giving patients the best care for their health, while also keeping costs down.

Unlike the old system called fee-for-service, where doctors and hospitals get paid for each service they provide, value-based care rewards healthcare providers for achieving better health outcomes and improving patient experiences.

In value-based care, “value” means what matters most to patients – getting the right treatment, staying healthy, and having a good experience with their healthcare. This system focuses on high-quality care, better patient results, and teamwork between doctors and other healthcare providers. It aims to prevent health problems and manage ongoing conditions in a way that reduces the need for unnecessary tests or hospital visits.

Key Features of Value-Based Care 🌟

➜ Quality Care: Doctors and hospitals are paid for delivering high-quality care that helps patients get better, not just for doing more tests or treatments.

➜ Patient-Centered: The system focuses on what patients need and want, like better health, easy access to care, and a good experience.

➜ Teamwork: Healthcare providers work together to make sure patients get all the care they need, reducing the chance of missing something important.

➜ Prevention: The system encourages doctors to prevent illness and manage long-term health problems to avoid expensive hospital stays.

| Advantages of Value-Based Care |

| ✅ Better Health: It helps improve patients’ overall health by focusing on the right care. ✅ Lower Costs: By reducing unnecessary treatments, tests, and hospital visits, value-based care helps lower the costs of healthcare for everyone. ✅ Happier Patients: Because the system cares about patient needs and satisfaction, patients tend to be more happy with their care. ✅ Better Coordination: Doctors and other healthcare providers work together to make sure patients get the best care without any gaps or confusion. |

| Disadvantages of Value-Based Care |

| ❌ Expensive Changes: Moving from the old system to value-based care can be costly for hospitals and doctors, as they need to invest in new technology and training. ❌ Financial Risks: Doctors may face penalties if their patients don’t do well or if they don’t meet certain care goals. ❌ Out-of-Pocket Costs: Patients might have to pay more if they see doctors or hospitals that are not part of their insurance network. ❌ More Work for Providers: Doctors and hospitals need to track more data and report their results, which can add extra work and cost. |

Value Based Care vs Fee-for-Service Care

Fee-for-service is about paying for each action or service, while value-based care is about paying for good outcomes and helping patients get better in the most efficient way.

Example of Fee-for-Service

Imagine you go to the doctor because you have a sore throat. The doctor charges you for each visit, test, or medicine you get. If you need to come back for more visits or tests, the doctor gets paid each time. The doctor is paid based on the number of things they do for you, not whether those things actually help you feel better.

Example of Value-Based Care

Now, in a value-based care system, the doctor is paid based on how well they help you get better, not just how many things they do for you. So, if the doctor helps you recover quickly, with fewer visits and tests, they get paid a fair amount. The goal is for doctors to give you the best care that helps you feel better without unnecessary treatments or costs.

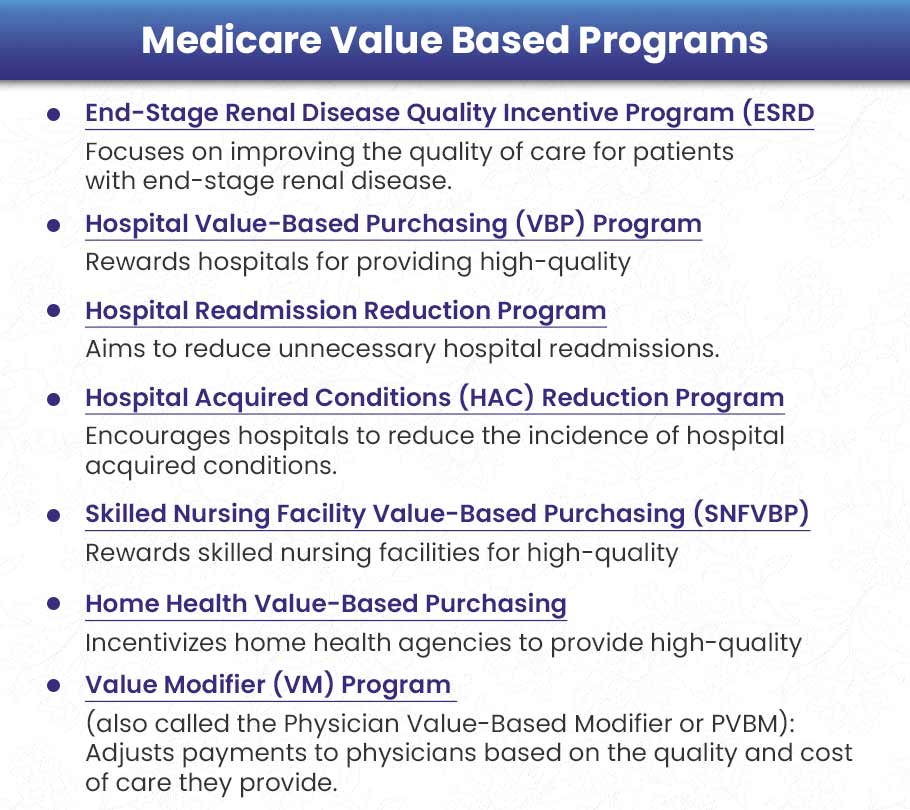

What are Medicare Value-Based Programs?

Medicare Value-Based Programs are special programs from the Centers for Medicare & Medicaid Services (CMS) that help improve the quality of patient care. These programs focus on giving better care, improving patient health, and reducing costs. Instead of paying healthcare providers based on how many services they give (called “fee-for-service”), these programs pay based on the quality of care and the results for patients.

Some of these programs include:

- End-Stage Renal Disease Quality Incentive Program (ESRD QIP)

- Hospital Value-Based Purchasing Program (VBP)

- Hospital Readmission Reduction Program (HRRP)

- Value Modifier Program (VM), also called Physician Value-Based Modifier (PVBM)

- Hospital Acquired Conditions Reduction Program (HAC)

- Skilled Nursing Facility Value-Based Purchasing Program (SNFVBP)

- Home Health Value-Based Purchasing Program (HHVBP)

Let’s explore each program in detail:

1). End-Stage Renal Disease Quality Incentive Program (ESRD QIP)

The ESRD Quality Incentive Program (ESRD QIP) started on January 1, 2012. It is the first program that requires dialysis centers to earn money based on how well they care for patients with kidney failure (also called end-stage renal disease or ESRD).

This program encourages dialysis centers to improve their care by linking part of their payment to how well they perform on certain tasks.

Example: A dialysis center works on making sure they use better methods to avoid infections. If they reduce infections, they improve patient safety and get all of their Medicare payment.

How it works?

Performance Measures: Dialysis centers are scored based on how well they prevent infections, how happy patients are, and how well they report their data.

Payment Adjustments: If the center does not do well, they may lose up to 2% of their Medicare payments.

Transparency: The scores of each dialysis center are made public, and they must show their scores for everyone to see.

2). Hospital Value-Based Purchasing (VBP) Program

The Hospital Value-Based Purchasing (VBP) program started in the early 2010s. This program rewards hospitals for providing better care and improving the patient experience.

Hospitals can earn more money by improving their care quality and patient satisfaction.

Example: A hospital improves its treatment of serious infections like sepsis by using better methods. They also train staff to be more patient-friendly. As a result, patients are happier, and there are fewer deaths. The hospital earns back the money that was withheld and may get extra rewards.

How it works?

Scoring Metrics: Hospitals are judged based on how well they prevent deaths, how safe they are, how they use resources, and how happy patients are (measured by surveys like HCAHPS).

Payment Adjustments: Medicare holds back 2% of the payment, and hospitals can get this money back by doing well compared to other hospitals or their past performance.

3). Hospital Readmissions Reduction Program (HRRP)

The Hospital Readmissions Reduction Program (HRRP) started in 2010. This program focuses on reducing the number of patients who have to go back to the hospital soon after they leave. It looks at conditions like heart failure, pneumonia, and lung diseases (COPD).

If a patient needs to return to the hospital quickly, it can show that the hospital didn’t do enough to help them get better after they left. This program helps hospitals improve care to avoid these unnecessary readmissions.

Example: A hospital helps heart failure patients avoid going back to the hospital by checking if they take their medicine properly, offering follow-up calls, and giving access to online doctor visits. This leads to fewer readmissions and better patient care.

How it works?

Targeted Conditions: The program watches for readmissions related to conditions like heart failure and pneumonia, checking if patients need to return to the hospital within 30 days.

Payment Reductions: Hospitals with too many readmissions could lose up to 3% of their Medicare payments.

4). Hospital Acquired Conditions (HAC) Reduction Program

The Hospital Acquired Conditions (HAC) Reduction Program is a Medicare program that encourages hospitals to reduce infections or injuries that patients might get while staying in the hospital. These are called hospital-acquired conditions (HACs) because they happen during a hospital stay, not before.

Example: A hospital creates a rule to stop infections caused by medical tubes (called catheters). They make sure the staff follows strict guidelines for cleaning and using catheters. This reduces infections, keeps patients safer, and helps the hospital avoid losing money.

How it works?

Measures: Hospitals are judged on how well they prevent infections and injuries, such as bloodstream infections from tubes (called CLABSI), infections from surgeries, and bed sores (also known as pressure ulcers).

Payment Adjustments: Hospitals that score poorly on these measures may have their Medicare payments reduced. Hospitals in the lowest-performing group get less money.

5). Skilled Nursing Facility Value-Based Purchasing (SNFVBP)

The Skilled Nursing Facility Value-Based Purchasing (SNFVBP) program rewards nursing homes or skilled nursing facilities (SNFs) that work to improve patient care and reduce hospital readmissions. A skilled nursing facility is a place where people go to receive more care than they would at home but don’t need to stay in a hospital.

Example: To keep patients from going back to the hospital, a nursing facility sets up a program that includes reviewing patients’ medications and providing physical therapy. This reduces how often patients are readmitted to the hospital, and the nursing facility earns a bonus for their good work.

How it works?

Scoring Metrics: The facilities are scored based on how many of their patients have to go back to the hospital and how much they improve patient care.

Incentives: Skilled nursing facilities that perform well can earn some of the 2% of their Medicare payments that are held back until they prove they are providing good care.

6). Home Health Value-Based Purchasing (HHVBP)

The Home Health Value-Based Purchasing (HHVBP) program was started to improve the quality and efficiency of home health care, which is care provided at a patient’s home instead of a hospital. The program helps encourage home health agencies to provide better care for patients while reducing costs.

Example: A home health agency adds virtual physical therapy sessions (using video calls) along with in-person visits. This helps patients improve their movement and reduces the need for hospital visits. As a result, the agency gets higher payment because of their good performance.

How it works?

Performance Metrics: Home health agencies are evaluated on how well they help patients improve their ability to move, how quickly they start care, and how often their patients end up in the hospital.

Payment Adjustments: Agencies can either earn more money or lose some payments based on how well they perform. Payments can be increased or decreased by up to 7% depending on their scores.

7). Value Modifier (VM) Program to MIPS

The Value Modifier (VM) Program was replaced by MIPS (Merit-based Incentive Payment System) under the Quality Payment Program starting on January 1, 2019. This program adjusts how much Medicare pays healthcare providers based on their performance in four key areas: quality, cost, improvement activities, and technology use.

In simple terms, the better a healthcare provider does in these areas, the more they can earn. Providers who score well can get extra payments from Medicare, while those with lower scores may receive less.

Example: A medical group starts using electronic health records (EHR) to better organize and share patient information between doctors. This improves the quality of care and communication. As a result, they score high on MIPS, especially for interoperability (how well their systems share information with other providers) and quality. They then earn positive payment adjustments.

How it works?

Scoring Categories: MIPS scores healthcare providers based on four categories:

Quality: How well the provider cares for patients (e.g., reducing infections, improving recovery times).

Cost: How efficiently the provider uses resources, meaning they can provide care without overspending.

Improvement Activities: Actions taken by the provider to improve patient care, such as offering better patient education or using new treatments.

Promoting Interoperability: How well the provider uses technology, like electronic health records (EHR), to share patient information with other doctors or hospitals. This makes sure all providers involved in a patient’s care are on the same page.

Incentives: Providers receive payment adjustments based on their overall score. A high score means they may get additional payment, while a lower score can result in a reduction of their payments.

What are Value-Based Payment Models in Healthcare?

The healthcare system has been transitioning from traditional fee-for-service models, which reward the quantity of services delivered, to value-based payment models that prioritize quality, efficiency, and patient outcomes.

These models encourage better care coordination, reduce healthcare costs, and improve patient experiences.

For healthcare providers, understanding how these models work, their advantages, and their challenges is critical to success.

1️⃣ Accountable Care Organizations (ACOs)

Accountable Care Organizations (ACOs) are groups of healthcare providers—including doctors, hospitals, and other health professionals—who work together to give coordinated care to a specific group of patients. These organizations come together voluntarily to make sure patients, especially those with long-term or chronic conditions, receive the best care possible.

Example: Imagine a person with diabetes. An ACO might have a primary care doctor, a specialist, and a hospital working together to monitor the patient’s blood sugar, offer advice on diet, and prevent complications that could lead to hospitalization. By coordinating care and avoiding unnecessary tests or hospital visits, the ACO reduces costs. If the ACO saves money while keeping the patient’s care quality high, it can keep a portion of those savings.

The main goal of ACOs is to provide the right care at the right time. This reduces unnecessary treatments or mistakes in patient care, and ensures that patients, especially those with chronic diseases, are looked after in a coordinated way.

How It Works?

Healthcare providers in an ACO work together to improve the overall health of their patients.

If the ACO can provide high-quality care while lowering costs, it can share in the savings with Medicare or other insurers (private health insurance companies).

There are different types of ACO models, including:

➜ Medicare Shared Savings Program (MSSP): This model allows ACOs to share savings based on their performance. There are different tracks, where some ACOs share only the savings, while others share both savings and risks (if costs go over a set amount).

➜ ACO REACH Model: This model focuses on fairness and health equity. ACOs in this model can create plans to reduce health care gaps for disadvantaged groups, and share financial risks with insurers.

➜ Vermont All-Payer Model: In this model, all insurers, including Medicare, Medicaid, and private insurance, work together to coordinate payments for patients across the entire state.

Advantages of ACOs

✔️ ACOs focus on preventing illness and managing chronic diseases, like diabetes or heart disease, to avoid costly treatments later.

✔️ ACOs aim to align financial rewards with better patient outcomes. This means that if the ACO keeps patients healthy and reduces costs, they can earn part of the savings.

✔️ ACOs promote teamwork between doctors, specialists, hospitals, and other healthcare providers to improve patient care and avoid unnecessary treatments.

Disadvantages of ACOs

❌ Setting up an ACO requires a significant investment in data systems and care coordination to track patient care and outcomes. Smaller practices may find it difficult to afford these upfront costs.

❌ In some ACO models, especially those that share losses (downside risk), healthcare providers can face financial challenges if they don’t meet cost-saving targets. This can be especially hard for smaller practices.

2️⃣ Capitation Payment Model

The Capitation Payment Model is a payment system in healthcare where providers (like doctors or hospitals) receive a set amount of money per patient for a specific period of time, no matter how many services the patient needs.

Example: Let’s say a Health Maintenance Organization (HMO) pays a primary care doctor $500 every year for each patient they manage. This payment is fixed, so if the patient only needs $300 worth of services in that year, the doctor keeps the remaining $200. But if the patient needs more expensive care, like $700 worth of services, the doctor is responsible for covering the extra $200 cost.

In this model, the payment is based on how much healthcare the provider expects the patient to need over time. The goal is to encourage providers to keep patients healthy and manage their care costs efficiently.

How It Works?

Payments Based on Healthcare Needs: Payments are calculated based on what healthcare services a provider expects to deliver to a specific group of patients.

Primary Capitation: In this case, primary care doctors get paid directly to manage their patients’ overall health, from checkups to treatment.

Secondary Capitation: This covers payments for specialists, labs, and other services that go beyond primary care.

Advantages of Capitation for Providers

✔️ Since the doctor or healthcare provider gets a fixed amount of money, it simplifies billing. There’s no need to track every individual service for each patient.

✔️ Providers are encouraged to offer care in a way that reduces unnecessary services and costs. They’re incentivized to make sure patients stay healthy without wasting resources.

✔️ Since the doctor gets the same payment whether the patient needs a lot of care or not, there’s an incentive to focus on preventive care—like regular check-ups and lifestyle advice—to avoid expensive treatments in the future.

Disadvantages of Capitation for Providers

❌ Since the provider gets a fixed amount, they might try to avoid offering too much care to stay within their budget. This could lead to under-delivery of care, where some patients don’t get all the services they actually need.

❌ Patients may face limitations in what services are covered under the capitation agreement. If a service isn’t included in the agreement, they may not have access to it unless they pay extra.

❌ Patients who have serious health problems (high-risk patients) can use up more of the budget, potentially putting a strain on the provider’s resources and affecting care for other patients.

3️⃣ Bundled Payments

Bundled payments are a type of payment system where healthcare providers receive one fixed payment that covers all services related to a specific treatment or condition. Instead of paying separately for each service, everything needed for a patient’s treatment is combined into one price.

Example: For a hip replacement surgery, a bundled payment might cover everything from the surgery itself, to the hospital stay, physical therapy, and follow-up visits. If the total cost of all these services is lower than the bundled payment amount, the provider gets to keep the savings. However, if the cost goes over the payment, the provider is responsible for covering the extra cost.

This system encourages healthcare providers to work together to deliver efficient, high-quality care for the entire treatment process, whether it’s a surgery or managing a chronic condition.

How It Works?

There are different models for bundled payments:

Model 1: Covers just the hospital stay during the treatment (e.g., surgery).

Model 2: Includes the hospital stay as well as post-acute care (care after discharge, like physical therapy) for up to 90 days after the patient leaves the hospital.

Model 3: Focuses on post-acute care services after a hospital stay, like physical therapy or rehabilitation.

Model 4: Provides a single, upfront payment that covers all inpatient services, including everything a patient needs during their hospital stay.

Advantages of Bundled Payments

✔️ Bundled payments encourage providers from different specialties (like surgeons, physical therapists, and hospitals) to work together, ensuring the patient receives continuous care throughout their treatment.

✔️ Providers are motivated to offer more efficient care and focus on improving quality since they are rewarded for reducing unnecessary treatments and costs.

✔️ By encouraging providers to reduce unnecessary services and complications, bundled payments can lower overall healthcare costs for both patients and insurers.

Disadvantages of Bundled Payments

❌ To manage bundled payments effectively, providers must have good infrastructure in place to track services and manage care. This can be difficult and costly to set up.

❌ If the total cost of care exceeds the bundled payment amount, the provider must absorb the extra cost, which can be risky for them financially.

❌ In cases where patients have complications or require additional, unexpected care, bundled payments might not provide enough flexibility. Providers might be less willing to offer extra care if it’s not covered by the payment.

4️⃣ Patient-Centered Medical Homes (PCMH)

Patient-Centered Medical Homes (PCMHs) are healthcare models where the focus is on providing comprehensive care that centers around the patient’s needs. This care is delivered by a primary care team that includes not only doctors, but also specialists like dietitians, social workers, and nurses. The team works together to provide coordinated, continuous care to improve patient health.

Example: For a patient with high blood pressure (hypertension), a PCMH would involve a team of healthcare professionals, such as a primary care doctor, a dietitian, and a social worker. They would work together to help the patient take their medication properly, make healthy lifestyle changes (like improving diet and exercise), and have regular follow-up visits. This teamwork helps prevent serious health problems, improves the patient’s health, and reduces the need for hospital visits.

PCMHs aim to focus on prevention, managing chronic diseases like diabetes or hypertension, and making sure all the patient’s healthcare needs are met through coordinated care.

How It Works?

Providers who adopt PCMH standards are rewarded with incentives like financial rewards or bonuses. These rewards are given for meeting specific goals related to the quality of care and patient satisfaction.

Payment models for PCMHs can include:

- Care management fees (for the time and effort spent managing a patient’s care)

- Shared savings (providers share in the savings if they reduce costs while maintaining or improving care quality)

- Performance bonuses (extra payments for meeting quality care targets)

Advantages of PCMHs

✔️ Since the care is patient-centered and coordinated by a team, it often leads to better health outcomes and happier patients.

✔️ By focusing on prevention and managing chronic conditions, PCMHs can reduce the need for hospitalizations and emergency room visits.

✔️ Patients get to know their healthcare team well, building trust and better communication, which can improve overall care.

Disadvantages of PCMHs

❌ Setting up a PCMH requires investing in technology (like electronic health records) and staff training to make sure the team works efficiently together.

❌ Success depends on the patient being actively involved in their care. If patients don’t follow through on recommended treatments or lifestyle changes, the model may not be as effective.

❌ Maintaining PCMH standards requires a lot of paperwork and documentation, which can be time-consuming for providers.

5️⃣ Shared Savings and Risk Model

The Shared Savings and Risk Model encourages healthcare providers to lower costs while maintaining or improving the quality of care. This model involves two parts: shared savings and shared risk.

Shared savings means that if a provider (like a hospital or doctor) reduces healthcare costs below a certain benchmark (a target or standard), they get to keep a portion of the savings.

Shared risk means that if costs go over the benchmark, the provider must pay back some of the extra costs.

Example: Imagine a hospital that reduces readmissions (when patients have to return to the hospital soon after discharge) by providing follow-up calls and telehealth monitoring after the patient leaves. If these efforts help keep costs lower than expected, the hospital gets to keep part of the savings.

However, if the hospital’s efforts fail and readmissions rise, causing costs to go over the benchmark, the hospital would have to pay part of those extra expenses back in a shared risk model.

How It Works?

➜ A benchmark is set, which is a target for how much a provider should spend and the quality of care they should deliver.

➜ Providers who meet the quality targets and keep costs below the benchmark can share in the savings (they get part of the money saved).

➜ In downside-risk models, if the provider’s costs go over the benchmark, they must repay a portion of the extra costs.

Advantages of Shared Savings and Risk Models

✔️ Providers are motivated to lower costs and improve care quality because they can earn a share of the savings.

✔️ Providers have the freedom to manage the health of a population in a way that works best for their patients, while still focusing on cost savings and quality.

✔️ If the system performs well and lowers costs without sacrificing quality, providers can earn significant financial rewards.

Disadvantages of Shared Savings and Risk Models

❌ In downside-risk models, if a provider doesn’t meet the benchmarks or exceeds the cost targets, they face financial penalties, which can be a challenge for underperforming organizations.

❌ To track and monitor performance accurately, providers need sophisticated data systems to manage costs, quality, and patient care efficiently.

Conclusion

Value-based payment models are changing how healthcare is provided and paid for. Instead of paying for each service separately, these models focus on giving better care and getting good results for patients. This helps save money and rewards doctors and hospitals for doing a good job.

However, these models can be challenging because they come with financial risks and need big changes in how healthcare is managed.

Doctors and hospitals that understand and adjust to these changes can succeed and provide better care for their patients.