Healthcare is a complex industry with lots of moving parts, and timely filing the medical claims helps ensure a smooth reimbursement flow. If you miss a deadline, everything can stop working.

As a healthcare worker, you work really hard to help patients get the care they need. So getting paid for that care should be easy. But when claims aren’t filed on time, that’s exactly what happens. Denials pile up, revenue drops, and you’re left with a mountain of paperwork and rejection letters.

The good news? Filing claims on time doesn’t have to be a struggle! Insurance companies give you anywhere from 30 to 180 days to submit claims after the date of service. Some let you have up to a year or even longer. That’s plenty of wiggle room.

This article will be your timely filing roadmap. Let’s go over the basic filing limits for major insurance plans. You’ll find out how to avoid mistakes that slow down your claims. We’ll give you great tips to help you meet all your deadlines, every single time!

Stay with us, and you won’t miss any more cutoffs! Your reimbursements will go through easily. Your days of denial and deferred revenue will be over. Imagine this—you can use that saved time and money for what really counts: your patients.

First, let’s discuss what timely filing is in healthcare.

What is Timely Filing in Healthcare?

Timely filing refers to the specific timeframe within which healthcare providers must submit claims to insurance companies for the services they’ve provided. It’s essentially a deadline for filing claims. If providers fail to submit their claims within this predefined timely filing limit, the insurance companies will deny the claims, and the providers won’t get paid for the care they’ve given to patients covered by that insurance plan.

Additionally, the timely filing term also applies to the timeframe providers have to submit appeals for any denied claims. Some insurance companies set the same timely filing limits for both initial claims and appeals for denied claims.

✨ For example, let’s say a doctor sees a patient with ABC Insurance on January 1st. The doctor’s office has a timely filing limit of 90 days to submit the claim for that visit. This means they need to file the claim by March 31st. If they miss that 90-day window and submit the claim on April 15th, ABC Insurance can deny the claim, and the doctor won’t get paid for seeing that patient.

Similarly, if ABC Insurance initially denies the claim (let’s say it was filed on time), the doctor’s office may have that same 90-day timely filing period to submit an appeal contesting the denial.

How to Easily Find Timely Filing Limits?

Don’t stress about locating timely filing limits for insurance claims. We’ve got you covered with a valuable guide that clearly outlines the timely filing limits for various insurance providers. Save time and effort by referring to our comprehensive resource.

Filing limits vary, but here are some common ones:

- Medicare – 1 year

- Medicaid – Varies by state, often 90 days to 1 year

- Commercial Insurers – 90-180 days, but can be longer

Timely Filing Limits of Different Insurance Companies

The table below shows the timely filing limits for different healthcare insurance companies in the USA. These include Aetna, Ambetter, AvMed, Anthem, Beacon Health, Caresource, Champus, Cigna, Fidelis New York, GEHA, Humana, Kaiser Permanente, Magellan, McLaren Health Plan, Medicare, Medicaid, and United Healthcare.

*Keep in mind that these time frames can vary based on the state where the insurer operates. Many payers offer consistent time limits for denied claims, but we recommend checking their official websites for the most up-to-date information on denied claim filing deadlines.

| Insurance Company | Timely Filing Limit for Initial Claim (From the date of service) |

| Aetna | 120 Days |

| Aetna Better Health | 180 Days |

| Aetna Better Health Kids | 180 Days |

| Ambetter | 180 Days |

| AvMed | 1 Year |

| Beacon Health | 90 Days |

| Buckeye | 1 Year |

| Caresource | 90 Days |

| Cenpatico | 90 Days |

| Champus | 1 Year |

| Cigna | 90 Days |

| Cigna (Out of network) | 180 Days |

| Emblem Health | 120 Days |

| Fidelis New York | 90 Days |

| GEHA | 90 Days |

| Harvard Pilgrim Health Care | 90 Days |

| Humana | 90 Days |

| Kaiser Permanente | 180 Days |

| Magellan | 60 Days |

| McLaren Health Plan | 1 Year |

| Medical Mutual | 1 Year |

| Medicare | 1 Year |

| Medicaid | 180 Days |

| Meridian | 1 Year |

| United Healthcare | 90 Days |

Timely Filing Limit for BCBS (Blue Cross Blue Shield) in Different States

Explore the timely claim filing limits for BCBS in different states with our user-friendly guide. Plan ahead and make sure that claims are sent in on time so that reimbursements proceed smoothly.

| Insurance Company | Timely Filing Limit for Initial Claim (From the date of service) |

| BCBS Florida | 1 Year |

| BCBS North Carolina | 18 Months |

| BCBS Rhode Island | 180 Days |

| BCBS Michigan | 180 Days; 1 Year for BCBS Complete Plans |

| BCBS Illinois | 180 Days |

| Blue Cross of California | 180 Days |

| BCBS Alaska | 1 Year |

| BCBS Arizona | 1 Year |

| Highmark BCBS Delaware | 120 Days |

| BCBS Mississippi | 1 year |

| BCBS Pennsylvania and West Virginia | 1 Year |

| Carefirst Washington DC | 1 Year |

| Florida Blue | 1 Year |

| BCBS Hawaii | 1 Year |

| BCBS Louisiana | 15 Months |

| Anthem BCBS Ohio, Kentucky, Indiana, Wisconsin | 90 Days |

| Wellmark BCBS Iowa and South Dakota | 180 Days |

| BCBS Alabama | 2 Years |

| BCBS Arkansas | 180 Days |

| BCBS Idaho | 180 Days |

| BCBS Kansas | 12 Months |

| Blue Cross Massachusetts (HMO, PPO Medicare Advantage Plans) | 90 Days |

| Blue Cross Massachusetts (Indemnity) | 1 Year |

| BCBS Minnesota | 180 Days |

| BCBS Montana | 180 Days |

| Horizon BCBS New Jersey | 180 Days |

| BCBS New Mexico | 180 Days |

| BCBS New York | 1 Year |

| BCBS of Northeastern New York | 1 Year |

| BCBS Oklahoma | 180 Days |

| BCBS Nebraska | Check with each individual plan as they are all different |

| Anthem BCBS Ohio, Kentucky, Indiana, Wisconsin | 90 Days |

| Independence Blue Cross | 120 Days |

| BCBS Tennessee | 120 Days |

| BCBS Texas | 95 Days |

| BCBS Vermont | 180 Days |

| BCBS Wyoming | 60 Days |

| Anthem California | 90 Days |

✅ Tips to Beat the Clock

- File ASAP. Don’t delay until the deadline nears. This gives time to fix any issues.

- Confirm eligibility and benefits before services. This avoids coverage issues that can hold up filing.

- Watch for payer requests. Respond quickly to avoid delays.

- Appeal denials right away. This often pauses the clock for original timely filing limit.

- Seek guidance on exceptions. Some cases may qualify for limit extensions.

The Importance of Timely Filing Limits for Healthcare Providers

It’s really important for healthcare providers in the United States to submit insurance claims on time. Filing on time might feel monotonous, but it can really help improve your medical practice’s bottom line. Here’s why it’s so important:

☑️ Speedy Reimbursement

The sooner you submit a claim, the sooner you’ll receive reimbursement. This improves cash flow, allowing you to cover overhead and pay employees and vendors on schedule. Fast reimbursements also let you spend more time taking care of patients instead of worrying about chasing payments.

☑️ Higher Acceptance Rates

Insurance companies are much more likely to pay claims if you submit them on time. After the deadline passes, they may outright deny the claim or reimburse at a lower rate. Submitting on time avoids these issues.

☑️ Fewer Hassles

Submitting late can lead to lengthy appeals and other headaches. You’ll waste time resubmitting forms and records. It gets really annoying for both the doctors and the patients. Filing on time stops these issues from happening.

☑️ Compliance

Insurance contracts require filing within a certain window, often 90-180 days from the date of service. If you file too late, it breaks this agreement. This might hurt your relationship with payers or could even cause audits later on.

☑️ More Revenue

Filing on time means you get paid more and earn more money for your practice. It helps money keep coming in and makes things easier to manage. This lets you concentrate on giving great care. Setting reminders, automating payments, and following good habits can help you meet your filing deadlines every time.

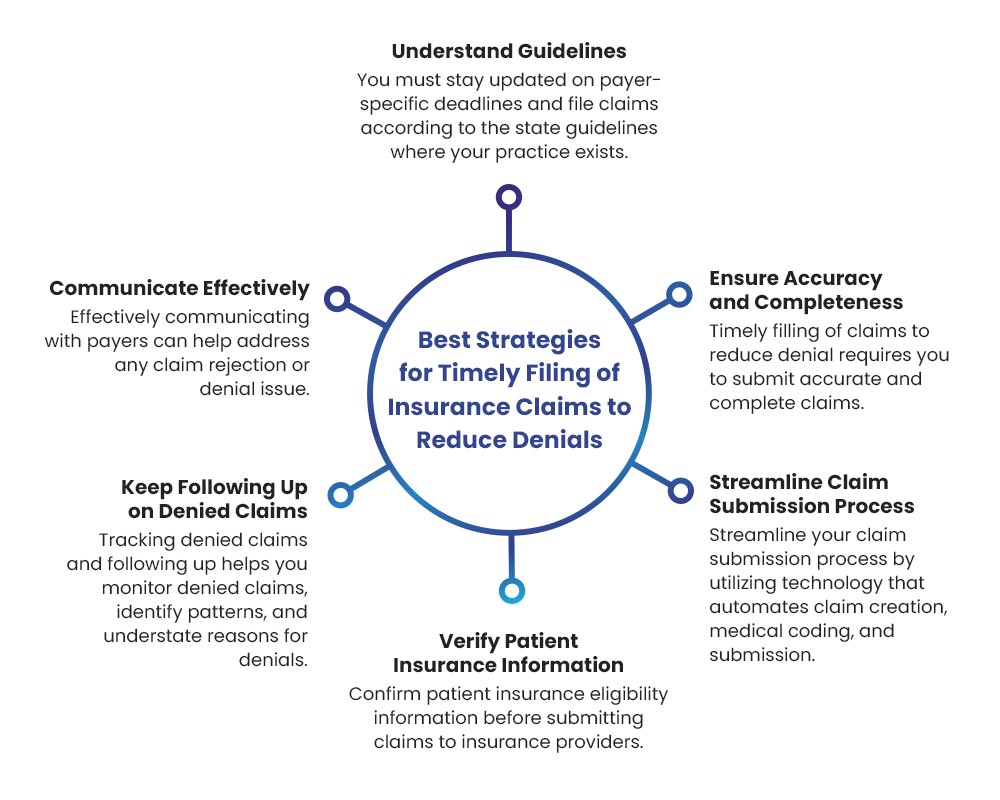

Smart Ways to File Insurance Claims on Time and Avoid Denials

When insurance claims get denied, it can really stress out healthcare workers. It makes them frustrated, slows down payments, and can even cost money. If you use some smart tips, you can make filing claims easier, send them in on time, and reduce the chances of getting denied. Let’s jump into some great tips that can help you save time and money!

👉 Get to Know Payer Guidelines Really Well

First, you need to know the rules and deadlines for each payer really well. These can be really different depending on where you live and which insurance company you choose. Keep track of these rules and any special cases or extra time they might give you. It’s really important to know the road rules so you can avoid problems later on.

👉 Automate and Streamline the Submission Process

Filing claims by hand can lead to mistakes and take longer than it should. Use technology to make things easier! Automate everything you can, like coding, patient treatment claim submission, and following up. Use billing software that finds errors, makes clear claims, and sends them out electronically. Make clear deadlines for your team and help everyone stick to the rules all the time.

👉 Prioritize Accuracy and Completeness

A small mistake or missing detail can mess up a claim. Teach the staff well about how to code and write down what they do so everyone understands the services provided. Make sure to have a strong quality check with different steps before you hit submit. Transmit supporting documentation electronically to expedite processing.

👉 Talk to Payers Early and Often

Talk to insurance companies right from the start. If problems come up, you can easily find ways to fix them fast. Be responsive to any inquiries or requests for more information from payers.

👉 Verify Patient Details Upfront

Wrong or outdated patient insurance information is a big reason why claims get denied. Confirm the patient’s plan enrollment, coverage details, and filing requirements before rendering services. Update records proactively to reflect any changes.

👉 Persistently Follow Up on Denials

Denials happen, but don’t just accept them at face value. Look at why denials happen, figure out the main reasons, and make sure you have a clear way to appeal and send things back in. Keep checking in to lower that denial rate!

Get Paid Fast with BellMedEx Claim Filing Services

Are you having a hard time with claims getting denied and waiting a long time for your money back? Outsource your claim filing to BellMedEx and get paid faster. Our skilled billing team makes sure your claims are sent in correctly and on time, so you get paid back as fast as possible. Plus, BellMedEx provides full revenue cycle management, coding, auditing and legal services to address any issues. Join forces with BellMedEx today and stop wasting time waiting for payments.