Medical Billing Consulting Service

BellMedEx is a Medical Billing Help Company offering medical billing consulting services. Our professional billing consultants work side-by-side with healthcare providers to help them achieve billing success. We immerse ourselves in your practice to pinpoint opportunities for reducing denials and speeding up payments.

Our medical billing consulting group provides the strategic guidance and tactical support needed to optimize billing processes, technology, and staff skills. With our consultancy solutions, every practice is positioned to thrive through improved medical billing.

Schedule Free Consultation

Optimized RCM

Increased Revenue

Fast Claim Processing

BellMedEx's Medical Billing Consulting Service Gets Doctors Paid On Time

BellMedEx medical billing consulting company has subject-matter experts for every specialty’s billing and coding workflows. By leveraging efficient claim filing, precise coding, vigilant A/R follow-up, mastery of ICD-10 billing, and proper auditing – BellMedEx’s medical billing audit consultants help healthcare providers receive every dollar they’ve earned when they’ve earned it.

We assist practices large and small in overcoming lost, delayed, or underpaid claims. Engage our 24/7 medical billing and coding consultancy for the medical billing help your practice needs.

- Help providers get paid and provide better patient care

- Improve cash flow by speeding up claims payments

- Identify and resolve any billing issues that may be delaying payments.

- Reduce administrative burdens by automating claim processing.

- Avoid revenue leakage by identifying and correcting any errors in billing.

- Help practices meet compliance and regulatory requirements.

- Reduce claim processing time for quick reimbursements.

- Reduce the costs of hiring and training a medical biller.

- Zero out the cost of buying expensive medical billing softwares.

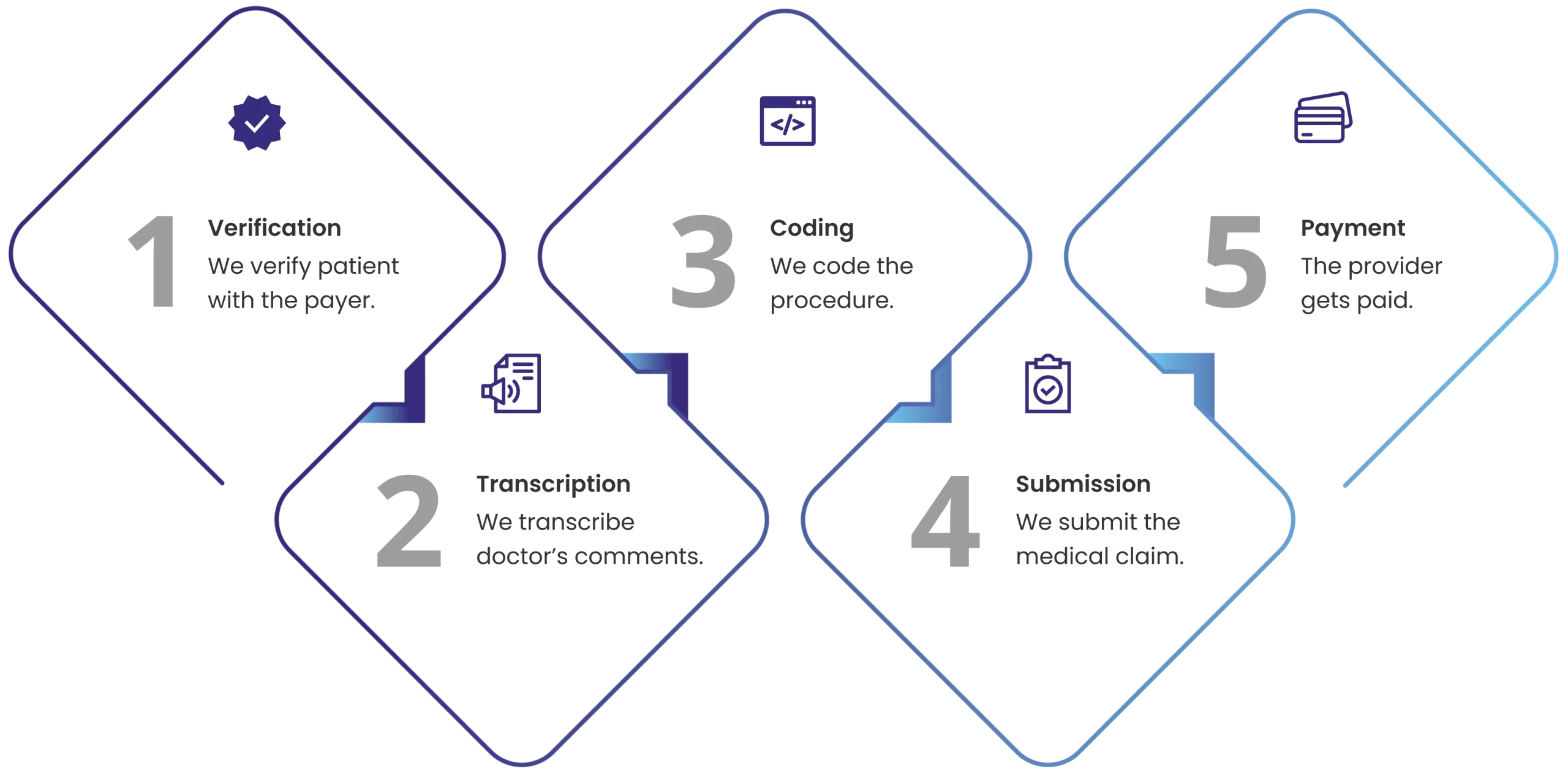

How Our Billing Process Works?

1. Verification

We verify patient with the payer.

2.Transcription

We transcribe doctor’s comments.

3. Coding

We code the procedure.

4. Submission

We submit the medical claim.

5. Payment

The provider gets paid.

WHAT DO WE OFFER

BellMedEx's Top Rated Billing Consultancy Group Is Here for Medical Billing Help

Our billing teams are more than just billers. We are every USA provider’s best-managed billing partner. Our medical billing advocates partner with physicians to improve their practice management and achieve sustainable growth. Here is how BellMedEx’s healthcare billing consultancy group is helping practices with patient billing:

Detailed Analysis and Bill Reporting

- Reporting on RVU to calculate the value of medical services

- Clearing up hidden glitches for better revenue collection

- Ensuring on-demand availability of latest billing reports

- Providing detailed billing reports

Proper Service Level Agreements

- Dealing with payment posting for healthy cash flow

- Doing charge entry for service payments

- Reviewing denials with quick clear-ups

- Creating specialty-specific SLA reports

- Tracking accounts receivable aging

Revenue Leakage Fix

- Identifying and resolving errors

- Coding medical records

- Benchmarking the coding

- Auditing medical records

Best Billing Associates

- Modern technology for fast claim processing

- Medical billing with 24/7 physician support

- Ensuring correct patient billing

Maximizing Clean Billing Claims %

- Identifying trends and patterns in claims data

- Tracking all aspects of the claims process

- Using advanced data analysis tools

- Appealing on denied claims

- Keeping the provider in loop

Specialty Specific Specialization

- Staying updated on the latest changes in healthcare regulations

- Offering tailor-made solutions to small and medium practices

- Providing comprehensive services for improved bottom line

- Resolving RCM-related challenges for every specialty

- Supporting medical practitioners of all specialties

Maximize Your Clinic’s Revenue with BellMedEx's Smart Billing Advisory Services

Healthcare providers turn to BellMedEx for medical billing consulting mastery. Our consultancy helps clients gain control of their revenue cycle management, including patient billing, collections, denials management, and accounts receivable. BellMedEx guides you to revenue growth through its customized consulting services.

Medicare Billing Services

Medicare billing is complex, but profitability is simple with our consultants. We combine billing expertise with practice-specific revenue solutions. The result? Maximum, hassle-free Medicare reimbursements. Let us design a roadmap to financial success for your practice.Provider Enrollment Consultancy

Our consultancy knows the difficulties of provider enrollment firsthand. Therefore, we aid practices in joining insurance networks, steering applications, credentialing, and payor contract negotiations. We target plans benefiting practice and patients equally, allowing stable growth and success. Our aim is your prosperity and peace.Advanced KPI Tracking

Powerful analytics tool allows medical providers to track essential KPIs, such as identifying high-value customers and areas with excessive costs. Such data crunching enables doctors to make the greatest revenue impact as they have the information they need to make informed decisions about their business. For example, it can be used to identify the most effective marketing campaigns or to determine the best prices to charge for services.Medicare Billing Services

Provider Enrollment Consultancy

BellMedEx’s superior medical billing consulting service knows the difficulties of provider enrollment firsthand. Therefore, we aid practices in joining insurance networks, steering applications, credentialing, and payor contract negotiations. We target plans benefiting practice and patients equally, allowing stable growth and success. Our aim is your prosperity and peace.

Reimbursement Forms Filing Support

Consultation on EHR Adoption and Integration

As certified EHR implementation specialists, BellMedEx’s 24/7 medical billing consultants advise on system selection, data migration, and workflow redesign to facilitate seamless EHR adoption and electronic billing integration in your practice.

BellMedEx's Medical Billing Consultancy Benefits

Claim Approval

Fast Reimbursements

Payer-Provider-Patient

Satisfaction

Overall Score

Get a Dedicated Billing Consultant For Your Clinic’s Revenue Cycle Management

Medical billing can be prone to errors, delays, and inefficiencies that affect your cash flow and profitability. BellMedEx’s billing associates streamline your clinic’s billing process by taking care of the entire RCM with real-time reports and analytics.

BELLMEDEX CONSULTANCY FEATURES

Benefits Of Choosing BellMedEx Medical Billing Consultation Service

KPI Dashboard

Get visibility into key performance indicators such as copays collected and accounts receivable per payer.

Revenue Monitoring

Track your practice’s revenue by monitoring patient and insurance payments, as well as identify trends and track financial progress.

Patient Balancing

Send reminder notices to patients

with overdue payments and collect outstanding balances to reduce owed money.

Automated Validation

The system checks a patient’s insurance benefits at check-in to avoid billing surprises. Patients are prompted to pay co-pays at this time.

Performance Metrics

Get a quick overview of your practice’s financial performance and create performance initiatives to improve your practice at scale.

Bills Collection

Get a summary of your medical bills, including status (paid, denied, in process, rejected). Our experts will follow up on these bills for you and provide one-click support for any billing problems.

AI Workflow

An AI-powered billing rules engine automatically detects & corrects errors in medical claims, ensuring faster payments and higher reimbursement rates.

Intelligent Billing

Smart billing with a well-defined charge coding means accurate and compliant superbills with zero chances of up/down coding.

Compliance Driven

AI-charged algorithms recommend

the appropriate E&M level, and identify and prevent medical fraud abuse to eliminate the need for a separate coder.

GET FAIRLY PAID EVERY TIME

Hire Medical Coding Consultants and Avoid Unfair Medicare Reimbursement Cuts

Physicians can benefit from the medical coding consultation offered by BellMedEx. This is because our medical coding consultancy services improve coding accuracy, reduce denials, expedite reimbursement, and boost cash flow. We do this by focusing on customizing services for each practice and addressing pain points with tailored solutions.

Proper Claim Scrubbing

Certified clinical coders scrub codes to identify and correct errors in claims. Our proprietary tools analyze patient statements to identify areas where providers can improve their billing practices. We also examine comparative and predictive data to develop strategies for minimizing denials.

Knowledge Base Automation (KBA)

Dedicated Account Management

An organized collections policy ensures accurate billing processes. Our platform merges charting, billing, scheduling, and telehealth services in the cloud. This helps keep patients, providers, and payers in sync. Experienced nosologists calculate the cost of rejections and provide healthcare organizations with a practical plan for managing denials that aligns with their practice.

BellMedEx's Medical Billing Consultancy Solutions Are Available for All Specialties

We're your partners in success.

BellMedEx is here to help you achieve practice success. Our billing experts have deep knowledge of the medical billing and coding regulations for all specialties, and we use the latest technology to ensure accurate claim processing with quick payments.

24/7 Medical Billers Support

Our dedicated account managers are available 24/7 to provide you with personal attention and support. They work with you to ensure that your claims are processed correctly and on time.

Out of State Medicaid Billing

We understand the complexities of billing out-of-state Medicaid. And can help you navigate the process to ensure you get paid. We have experience billing out-of-state Medicaid for specialties like family medicine, pediatrics, and oncology.

Clearinghouse Support

Our medical coding consultants have engineered a high-performance clearinghouse connecting seamlessly to top insurers such as Aetna, UnitedHealthcare, and Blue Cross Blue Shield. This direct integration empowers rapid claim submission and prompt reimbursement, fueling your revenue cycle efficiency.

Reduce Billing Claim Denials and Boost Your Medical Revenue Up to 30%

Claim denials are a major source of lost revenue for healthcare providers. They can result from errors in medical billing and coding. BellMedEx’s medical billing consulting service prevents these errors by ensuring claim submission that’s compliant with payer rules and regulations.