Medical costs could cripple a family’s budget in the blink of an eye. To provide relief from the looming threat of medical debt, forward-thinking employers created Medical Expense Reimbursement Plans or MERPs. These plans are designed with the noble goal of helping workers pay for essential medical care without facing financial ruin.

For employers mulling over whether to offer a MERP or for employees wanting to understand better their benefits package, this blog post can prove invaluable. It will explore what exactly MERPs are, how they operate, and the types of plans available in depth.

What is a Medical Expense Reimbursement Plan (MERP)?

A Medical Expense Reimbursement Plan, or MERP for short, is a Health Reimbursement Arrangement (HRA) between an employer and employee where the former helps cover some of the latter’s healthcare costs. The intent is to lighten the financial load that medical expenses can place on workers.

Specifically, the employer sets aside pre-tax funds that the employee can draw from to pay for things like health insurance deductibles, coinsurance, copays, and other qualified medical expenses. The employee submits documentation showing what they paid for said expenses, and the employer reimburses them from the MERP account. This way, the employee gets money back tax-free rather than having to pay the costs fully out-of-pocket.

The key parties involved are the employer, who provides the reimbursement funds, and the employee, who accrues and makes claims against those funds. The employer works with a third-party administrator to manage the logistics of the MERP. This includes holding the funds, processing reimbursement claims, and ensuring legal compliance. The Internal Revenue Service (IRS) oversees and regulates MERPs as a type of tax-advantaged health account.

What does MERP cover?

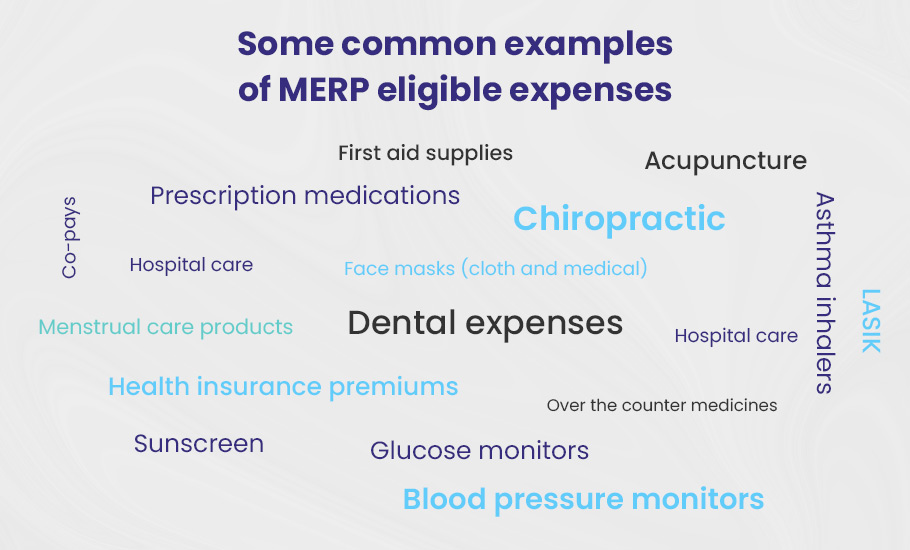

The specific medical expenses that can be reimbursed through a MERP depend on what the employer decides to include in their plan.

Generally speaking, any medical costs considered tax deductible by the IRS are eligible for MERP reimbursement. This encompasses a wide range of common healthcare expenses, from doctor visit co-pays and prescription medications to eyeglasses, dental work, and acupuncture. Over-the-counter medicines like pain relievers and cold medications usually qualify as well.

In addition to the standard eligible expenses, employers can also opt to reimburse employees for health insurance premiums and medical costs related to COVID-19, thanks to provisions in the CARES Act.

With so many options on the table, employers have significant flexibility in designing their MERP coverage. Some take a more expansive approach, allowing reimbursement for as many medical expenses as possible. Others prefer a more conservative route, limiting reimbursements to a core set of predictable, recurring costs like prescription drugs and office visit copays.

Regardless of the specifics, a properly structured MERP enables companies to help employees manage healthcare expenses in a mutually beneficial manner. Employees receive assistance with medical bills, gaining access to tax-free reimbursements. Employers can attract and retain talent while also controlling benefit costs. For both parties, it’s an opportunity to remove some of the stress from navigating today’s high-cost healthcare system.

Some common examples of MERP-eligible expenses

- Co-pays

- Prescription medications

- Health insurance premiums

- Dental expenses

- Hospital care

- Sunscreen

- Acupuncture

- Chiropractic

- Glucose monitors

- Face masks (cloth and medical)

- Glasses, contact lenses, and contact lens solution

- Asthma inhalers

- Blood pressure monitors

- LASIK

- Many fertility procedures and medications

- Menstrual care products

- Over-the-counter medicines

- First aid supplies

Important Note

👉 The items eligible for reimbursement under a medical expense reimbursement plan vary depending on the type of plan offered by one’s employer.

👉 The complete list of eligible expenses can be found in IRS Publication 502, which provides an exhaustive catalog of medical expenses that qualify.

👉 More specific examples of eligible expenses are also outlined in the List of Eligible MERP Expenses provided by the plan administrator.

👉 Some items on the MERP eligible expenses list require an FSA Letter of Medical Necessity to qualify – essentially a note from a doctor confirming the item is medically necessary. These particular items are marked as such on this list, so it is wise to review them closely and contact the benefits administrator with any questions before making purchases.

👉 The benefits administrator can also confirm if an FSA letter will be needed for reimbursement by calling Pacific Source at 800-422-703.

Who is eligible for the Medical Expense Reimbursement Plan, or MERP?

The short answer is employers who provide group health insurance, and employees who participate in it.

Employers who provide health insurance to their employees through a group health plan are typically eligible to offer a Medical Expense Reimbursement Plan or MERP. A group health plan is an insurance plan that covers a group of employees, rather than individuals. Employers with high deductible health plans, plans that have higher out-of-pocket costs before insurance kicks in, often use MERPs to reduce the financial stress on their employees. These group plans also help the employer attract and retain talent while providing tax advantages.

For employees to take advantage of a MERP, they must first enroll in their employer’s group health plan. Once enrolled in the group health plan, employees are usually automatically enrolled in the MERP. The MERP then reimburses employees for health care expenses like copays, coinsurance, and deductibles. MERPs provide employees a way to pay for health care costs with pre-tax dollars, saving them money.

How does MERP work for employers?

The Medical Expense Reimbursement Plan operates in three stages for an employer looking to institute such a program.

1). First, when open enrollment occurs, the employer meets with employees and gets all who want to participate signed up for the Health Reimbursement Arrangement.

2). This HRA account is then funded by the employer, with the money becoming available on the first day of the new plan year, as per the particular structure put in place.

3). With funds now accessible, a third-party MERP administrator handles everything related to the MERP. As employees incur medical expenses and submit claims, this administrator reviews each claim and issues reimbursements from employer-funded accounts.

The entire process allows companies to assist their people with healthcare costs in an organized, regulated fashion.

How does MERP work for employees?

Signing up for the Medical Expense Reimbursement Plan (MERP) is easy for employees:

1). When an employee enrolls in their company’s group health plan, they are automatically signed up for the Medical Expense Reimbursement Plan (MERP). The employee can choose how much of their paycheck to contribute to the account if the plan allows it.

2). Then, the employee can use their health insurance or pay out-of-pocket for any eligible medical expenses.

3). To get reimbursed, the employee files a claim with the third-party MERP administrator chosen by their employer. The admin will verify the claim against the insurer’s benefits summary and reimburse the employee directly from the employer’s bank account.

The 5-Stage Process of Medical Expense Reimbursement Program

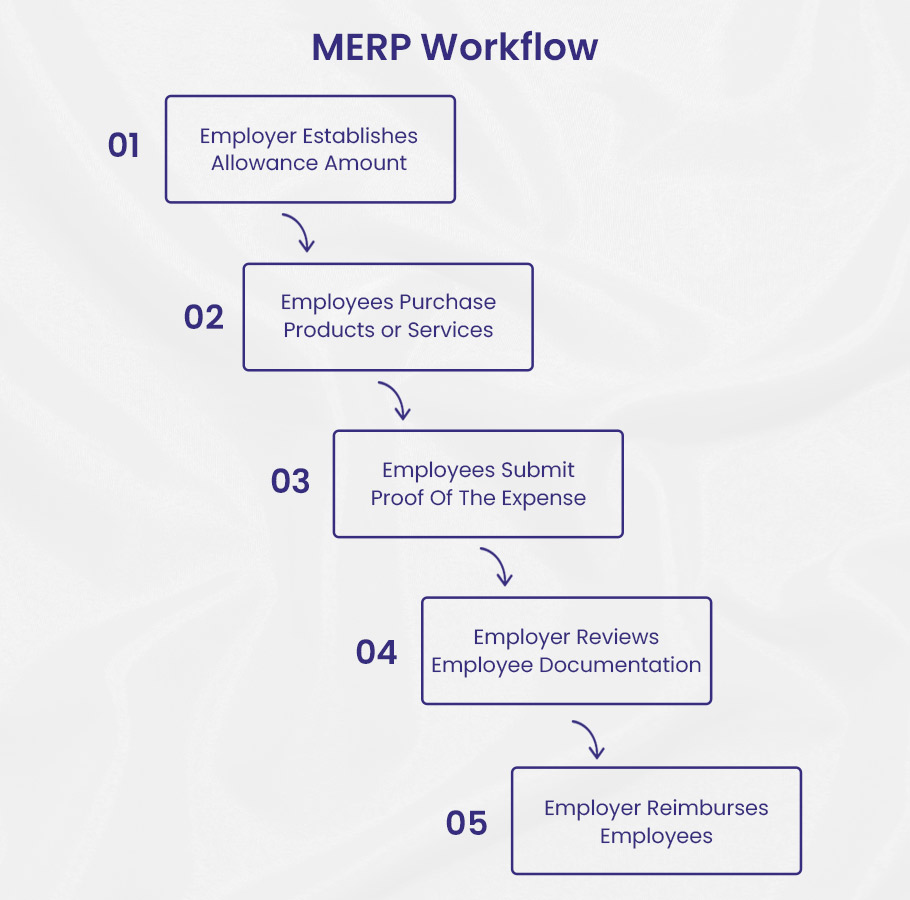

The Medical Expense Reimbursement Program (MERP) is a program that provides financial support to employees seeking medical attention. The program follows a 5-stage process that ensures that the individual is reimbursed for all expenses incurred:

1. The employer determines a set amount that each employee is allowed to be reimbursed for medical expenses.

Employers looking to establish a Medical Expense Reimbursement Plan (MERP) begin by selecting a monthly allowance for employees. This allowance sets the upper limit that the company will reimburse for medical care each month.

For example, BellMedEx Co. may provide $500 per month to each employee to use towards their medical expenses. Employees submit receipts for doctor visits, prescriptions, dental work, vision care, and other eligible expenses. BellMedEx Co. then reimburses the employee up to $500 per month. Unused portions of the allowance do not roll over to the next month.

2. The employee goes out and purchases healthcare services or products using the allotment provided by their employer.

After the company sets up the MERP and lays out the details of how it will work, the employees then take the reins. They are free to spend their money on any healthcare expenses they want or need, whether it’s prescription drugs, surgery, therapy, or health insurance premiums.

The specific offerings and rules of each MERP will determine exactly what employees can buy and still get money back. For instance, one MERP might reimburse 70% of costs for specialist care but not cover cosmetic procedures, while another may reimburse 50% of all healthcare costs with no restrictions. Employees can shop around and choose what they want, then the company helps them pay for it.

3. Employees furnish documentation such as bills and receipts to demonstrate the healthcare expenses.

Once an employee has made a qualified purchase under their company’s medical expense reimbursement program, the next step is for them to submit evidence of the cost to their employer. This proof comes in the form of documentation like a receipt or explanation of benefits statement. The receipt must show the date the expense was incurred, details about the product or service, the employee’s name, and how much was paid.

4. The employer thoroughly reviews all paperwork submitted by the employee to confirm the purchases.

Once the employees submit the documents supporting their medical expenses, the ball is in the employers’ court. They have to scrutinize each receipt and bill to ensure the company’s money is only spent on legitimate costs. If any expense seems dubious or lacks some necessary evidence, the employers reach out to the employees and give them another chance to build a stronger case.

As one can imagine, this step requires a lot of time and effort. Rather than dealing with the hassle themselves, most employers delegate this task to professional MERP administrators.

5. Upon approval, the employer reimburses the employee for the verified medical expenditures.

The final step in the MERP process is the employer reimbursing the employee for their qualified medical expenses. Assuming all receipts and documents are satisfactory, the employer will transfer funds up to the allotted allowance into the employee’s account. More often than not, the employer outsources this payment to a third-party administrator.

Employers must wield Section 105 plan documents that communicate reimbursement particulars. And administration must align with rules. Therefore, employers routinely commission administrators to institute and operate the MERP.

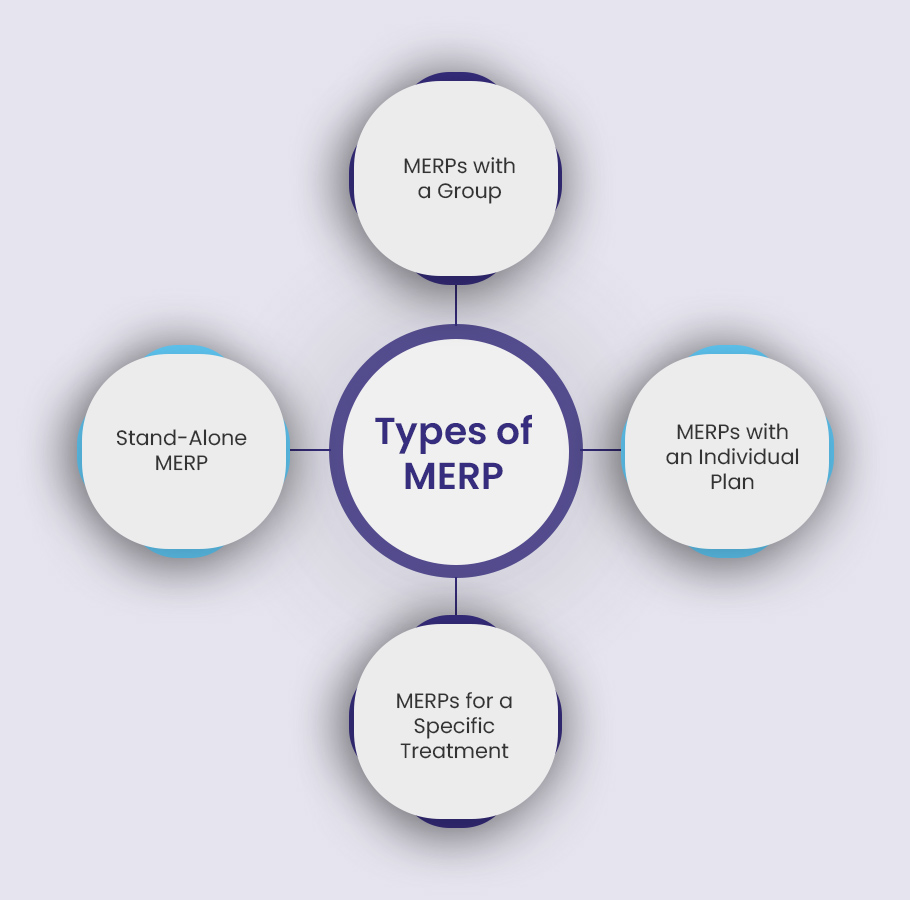

Types of MERPs

There are a few different types of Medical Expense Reimbursement Plans (MERPs) that employers can offer their employees. Some provide reimbursement for a wide range of medical expenses, while others focus on specific costs like prescription drugs or dental procedures.

When setting up a MERP, it’s important for employers to consider what medical costs are most pressing for their workforce. A good MERP strikes a balance between comprehensiveness and affordability.

1). Stand-alone MERP

A stand-alone MERP is a neat benefit some employers offer to reimburse workers directly for their health insurance premiums and medical expenses. Rather than provide a group plan, the company simply gives each employee an allowance to buy their coverage. This approach gives the business more flexibility and control over costs compared to traditional group plans, whose premiums rise astronomically year after year.

One example is something called the qualified small employer HRA, or QSEHRA, which the federal government designed for small companies with less than 50 full-time employees on the payroll. With a QSEHRA, the employer can reimburse workers for all sorts of healthcare services and products, including their monthly insurance premiums to Aetna or Blue Cross.

It enables even a modest company to generously provide for its loyal employees without breaking the bank.

2). Group Plan MERP

Now, another way employers can structure their medical expense reimbursement plans is by pairing them with a group health plan. More often than not, this group plan is a high-deductible health plan or HDHP.

With this setup, the employer will typically raise the deductible on the existing health insurance. Then, they’ll reimburse employees for the difference in that new, higher deductible. This allows the employer to essentially self-insure part of their group plan using pre-tax dollars. And it leads to significant savings without really changing the coverage.

When done this way, these plans go by names like group coverage HRAs, integrated HRAs, deductible HRAs, traditional HRAs, or group HRAs. But no matter the label, the idea is the same – offsetting the burden of higher deductibles for the employees.

3). Individual Plan MERP

This is a kind of MERP where each employee gets their own individual plan. It’s called an Individual Coverage Health Reimbursement Arrangement (ICHRA). Here, the employer sets up an ICHRA for each employee, either as a stand-alone benefit or as a separate choice alongside group health insurance.

For instance, a company could offer group coverage to full-time staff, while making ICHRAs available to part-timers to buy their own personal policies. One thing the employer can’t do is give the same class of workers the option between group insurance and the individual ICHRA.

4). Limited MERP

Certain employers provide a tailored MERP that reimburses staff only for designated medical costs. Under this type of plan, the company decides to reimburse for a narrow range of medical expenses.

For example, they may choose to cover only vision and dental costs. So the employees enrolled in this MERP can submit claims to get money back for their eye exams, glasses, dental cleanings, and so on. But they can’t get reimbursement for other health expenses like doctor visits or prescriptions. The company sets up its program this way to keep the costs contained. So the MERP gives a little extra benefit to workers without breaking the bank.

MERP Compliance and Legal Considerations

Employers must understand and follow specific legal and compliance requirements when implementing a Medical Expense Reimbursement Plan (MERP). These plans are regulated by several federal laws, including the Affordable Care Act (ACA), the Internal Revenue Code, and the Employee Retirement Income Security Act (ERISA). Ensuring compliance with these laws helps MERPs provide tax advantages and protects employers and employees.

ERISA Requirements

- Group Health Plan Status: Most MERPs are considered group health plans under ERISA. Therefore, they must comply with ERISA’s reporting and disclosure requirements.

- Plan Descriptions: Employers must provide participants with detailed descriptions of the plan.

- Annual Reports: Employers must file annual reports with the federal government.

ACA Compliance

- Market Reforms: MERPs must comply with the ACA’s market reforms. For example, they must be integrated with a group health insurance plan that meets the ACA’s minimum essential coverage standards.

- Avoiding Penalties: Proper integration with a compliant health insurance plan is necessary to avoid penalties under the ACA.

Nondiscrimination Rules

- Internal Revenue Code Compliance: MERPs must not discriminate in favor of highly compensated employees regarding eligibility or benefits.

- Tax Benefits: Ensuring compliance with these nondiscrimination rules is essential to maintaining the plan’s tax benefits.

Employers should regularly review their MERP policies and operations to ensure they comply with current laws and regulations, which may change over time. Consulting with legal experts in employee benefits law is often necessary to navigate these complex requirements successfully. This helps ensure the plan remains compliant and beneficial for all parties involved.

Who can contribute to a MERP?

A Medical Expense Reimbursement Plan (MERP) is an employer-funded arrangement that reimburses employees for medical expenses. Typically, only the employer contributes funds to the MERP. But unlike a traditional Health Reimbursement Arrangement, the employer may choose to allow employee contributions as well in the MERP. So instead of the reimbursement funds coming solely from the employer’s coffers, employees can optionally chip in too.

This transforms the MERP into a joint savings account, with both parties adding money to the pot. The combined contributions create a larger pool for reimbursing employees’ out-of-pocket medical expenses.

Can the MERP funds only be used by the employee or do they also apply to dependents?

An employee may tap into MERP monies to cover their own eligible out-of-pocket medical costs. They may also apply MERP funds towards similar expenses accrued by dependents such as one’s spouse and children. However, there are limitations on what constitutes an eligible dependent.

Domestic partners and their children, if they are not also the biological or adopted children of the employee, do not qualify as dependents under federal regulations.

The same applies to other individuals one may support financially but who do not meet the technical definition laid out in tax codes. Their medical bills cannot be reimbursed through MERP, barring special circumstances where they are designated a “qualifying relative.” For more information on this particular designation, it is advisable to consult a knowledgeable tax professional.

In short, MERP is intended for employees and their legal family, with eligibility following the letter of the law.

When does an employee get access to MERP?

Employees gain access to their total annual reimbursement amount under the Medical Expense Reimbursement Plan, or MERP, at different times depending on when they become eligible. For those enrolling during open enrollment for the upcoming plan year, the date is January 1st. For new hires and those who experience eligible mid-year changes, the access date aligns with their plan effective date.

Whenever the access date, the employee can start submitting receipts for reimbursement up to their available limit for that plan year.

Is there an MERP debit card?

The MERP provides participants with a special debit card that assists in managing eligible medical expenses. When an employee first joins the MERP program, they can expect a MERP debit card to arrive by mail within a couple of weeks. This card, previously called the Benny card, grants access to approved pharmacies, drug stores, doctor’s offices, and certain online shops that offer the needed medical supplies.

By using the card, participants can pay for expenses directly instead of waiting for reimbursement later. But if the MERP debit card does not show up in a timely manner, the worker should contact their employer to request a replacement. Having this card in hand makes the process more convenient.

What’s the minimum amount for MERP and can the remaining funds be carried over to the next year?

The minimum annual contribution for a MERP is $240. The maximum allowable contribution is $3,050. If an employee spends less than the full amount, up to $640 can be carried forward to the next year. Any funds above this carryover limit will be forfeited, as per the “use it or lose it” rule.

However, if the plan ends prematurely due to unpaid leave, loss of eligibility, termination, or elective cancellation, no funds will roll over. The money will be lost.

What’s the difference between MERP and Health Stipends?

In simple terms, both allow employers to refund healthcare costs, but stipends permit more flexibility. Since stipends aren’t formal benefits, employers can reimburse more than just IRS-approved expenses.

However, there are tax implications to consider. Stipends count as taxable income for both employer and employee. So employers must report stipends on employees’ W-2 forms.

Offering a stipend does have some advantages. Contractors and international workers, often ineligible for plans, can receive assistance. For staff claiming premium tax credits, the stipend supplements this existing credit.

But a flaw emerges for larger employers: stipends don’t satisfy Affordable Care Act requirements. Employers with 50+ full-time staff need a MERP to comply and avoid penalties. So while stipends have perks, a MERP may prove essential for compliance.

Conclusion

Medical Expense Reimbursement Plans (MERPs) significantly benefit employers and employees. They provide financial relief for medical expenses, offer tax advantages, and enhance employee satisfaction and retention. By understanding how MERPs operate and ensuring compliance with legal standards, employers can create a valuable and flexible healthcare benefits package that meets diverse needs. This guide has outlined the key aspects of MERPs, empowering you to make informed decisions about implementing or participating in a MERP.