Medical billing revenue cycle management is a complex and ever-evolving process, and one of the critical measures of success is first-pass claim acceptance rates. A claim is either accepted or denied when submitted to an insurance company. First-pass claim acceptance rates refer to the percentage of claims received on the first submission. This blog post will explore common reasons for claim denials and tips for improving first-pass acceptance rates for successful revenue cycle management.

First-Pass Claim Acceptance Rate

The First-Pass Acceptance Rate determines acceptance based on the original submission of the claims, as opposed to the claims acceptance rate, which is the total rate of all claims submitted, regardless of whether they were initially denied.

FPAR only determines acceptance based on the initial submission of the claims. Because the Claims Acceptance Rate (CCR) includes all claims submitted, even those denied initially, you shouldn’t utilize it.

Given that it demonstrates how well the service validates their claim and successfully processes claims via the CH edits during first-time submission, the First Pass Claims Acceptance Rate is a somewhat more accurate gauge of RCM service quality.

Since re-submissions are not considered, First Pass claims acceptance rates are often lower than a general claims acceptance rate. The optimal percentage is around 90%.

How to calculate – # of claims paid on first pass/ total # of claims submitted in a time frame

Target Benchmark – The industry target is 98%. An efficient, well-run physician practice should be more than 90%.

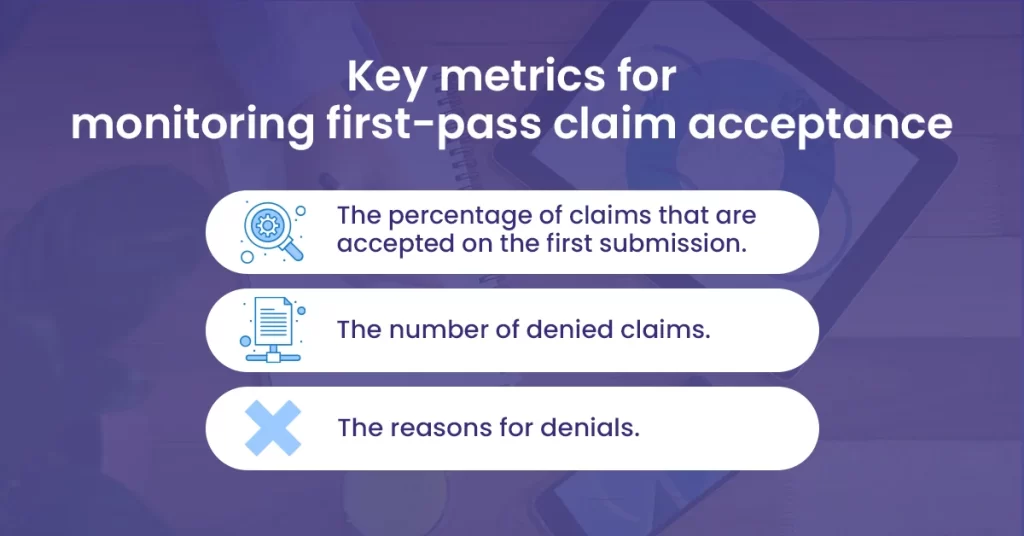

Measuring and evaluating first-pass claim acceptance rates is critical to revenue cycle management success. Key metrics for monitoring first-pass claim acceptance rates include:

- The percentage of claims that are accepted on the first submission.

- The number of denied claims.

- The reasons for denials.

Analyzing data and identifying trends can help healthcare providers make data-driven decisions and continuously improve their revenue cycle management process.

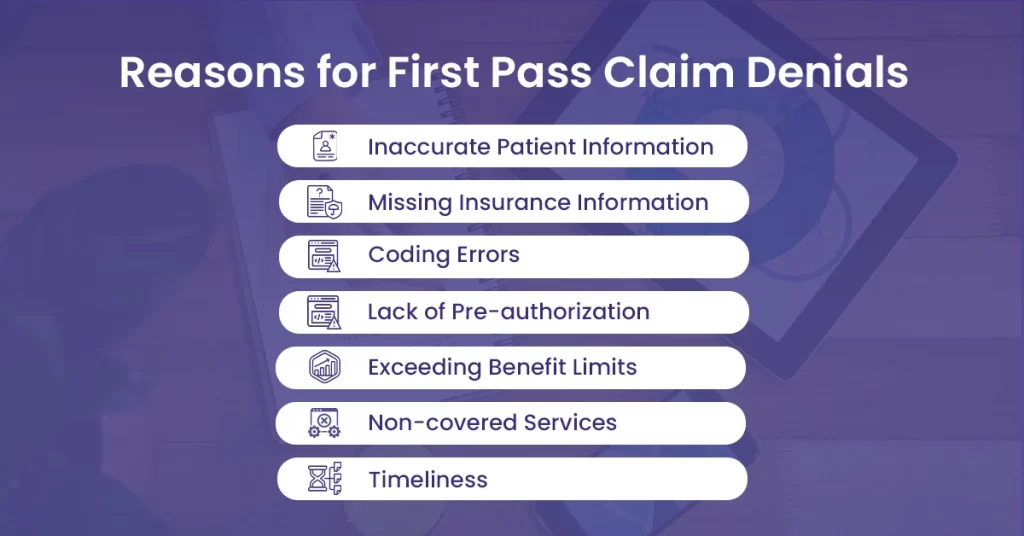

Common Reasons for First Pass Claim Denials

Claim denials can cause considerable delays in revenue cycle management and impact the financial health of healthcare providers. Let’s explore some of the common reasons for claim denials.

Inaccurate Patient Information

One of the most common reasons for claim denials is inaccurate patient information. This can include incorrect patient name, date of birth, or insurance information.

Missing Insurance Information

Insurance information is another common reason for claim denials. This can include wrong insurance ID numbers, group numbers, or policy numbers.

Coding Errors

Coding errors are another common reason for claim denials. This can include incorrect or outdated codes, codes that do not match the patient’s diagnosis, or insufficient documentation to support the codes used.

Lack of Pre-authorization

Some insurance plans require pre-authorization or referral for specific procedures or services. Claims may be denied if pre-authorization or referral is not obtained when required.

Exceeding Benefit Limits

Some insurance plans have benefit limits for specific procedures or services. If these limits are exceeded, claims may be denied.

Non-covered Services

Some services may not be covered by insurance plans. If services are covered, claims may be allowed.

Timelines: Claims must be submitted promptly. If claims are submitted after the deadline, they may be denied.

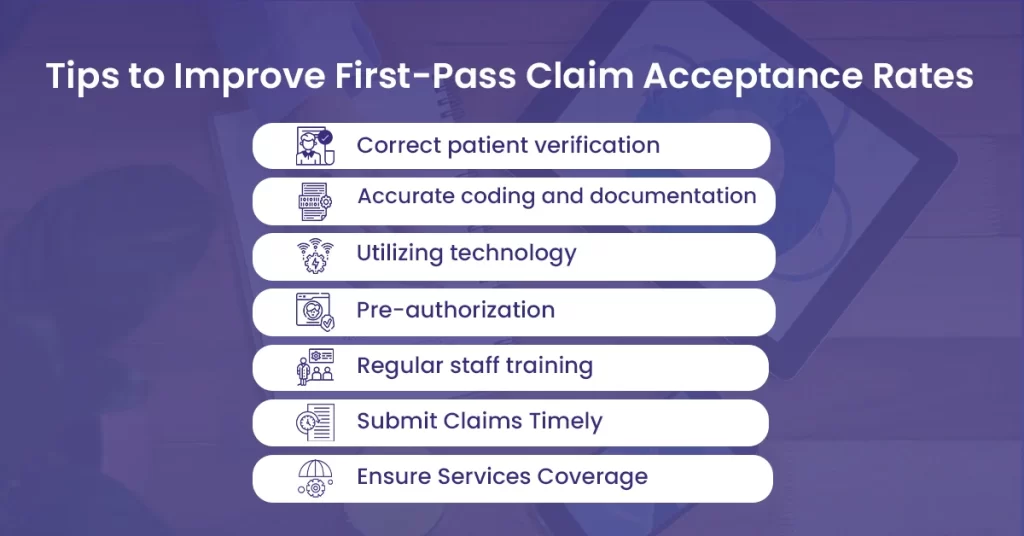

Tips for Improving First-Pass Claim Acceptance Rates

There are several tips for improving first-pass claim acceptance rates, including:

Accurate patient verification

Ensuring accurate patient information and coverage is critical to first-pass claim acceptance. Front desk staff should verify insurance coverage at the time of registration and ensure that all necessary information is accurately recorded.

Effective coding and documentation

Accurate coding and documentation are critical to first-pass claim acceptance rates. Providers should ensure they use the correct codes and provide sufficient documentation to support them.

Utilizing technology

Electronic claims submission can help streamline the claims process and reduce the risk of errors. Healthcare providers should use technology tools to automate claims submission and ensure accurate and timely compliance.

Pre-authorization

Ensuring pre-authorizations and referrals are obtained when necessary can help reduce claim denials. Providers should have clear procedures for obtaining pre-authorizations and referrals and ensure they are received promptly.

Regular staff training

Ongoing training and education for staff can ensure they are up-to-date with best practices and standard procedures. This can help reduce errors and improve first-pass claim acceptance rates.

Submit Claims Timely

Providers should have clear procedures for timely submission and ensure that claims are submitted within the required timeframe.

Ensure Services Coverage

Providers should know what services are covered by insurance plans and communicate this information to patients when necessary.

By implementing these best practices, healthcare providers can optimize their revenue cycle management process and improve first-pass claim acceptance rates.

Conclusion

First-pass claim acceptance rates are critical to medical billing revenue cycle management success. Healthcare providers can improve first-pass claim acceptance rates by ensuring accurate patient registration and insurance verification, effective coding and documentation, utilizing technology for claims submission, managing pre-authorizations and referrals, and providing regular staff training and education. Measuring and evaluating first-pass claim acceptance rates, implementing best practices for successful revenue cycle management, and continuously adapting to changes can improve revenue cycle management success.