When a patient has more than one health insurance plan, you must know which one to bill first. This means finding out which insurance is primary and which one is secondary.

It might seem like a small thing, but in medical billing, it’s a big deal. If you bill the wrong insurance first, the claim can get denied. Payments can be delayed. Worst of all, your patient might get charged for something that should have been covered.

This simple guide will help you figure out the correct billing order. You’ll learn how to spot the primary insurance and the secondary insurance. So that you can bill the right one at the right time. And get paid faster for your services provided to the patients.

What Does “Primary” vs. “Secondary” Mean in Insurance?

Knowing who pays first is key in healthcare billing. It helps you avoid surprise bills. It also ensures claims are handled the right way. And if a claim is denied, you’ll know which insurance to follow up with first.

If the primary insurance denies a claim—because of eligibility issues or wrong details—the secondary insurance usually won’t pay either. That’s because they wait for the primary to process everything first.

So, before billing, it’s important to understand what primary insurance means—and how it’s different from a secondary plan.

1️⃣ Primary Insurance in Healthcare Billing

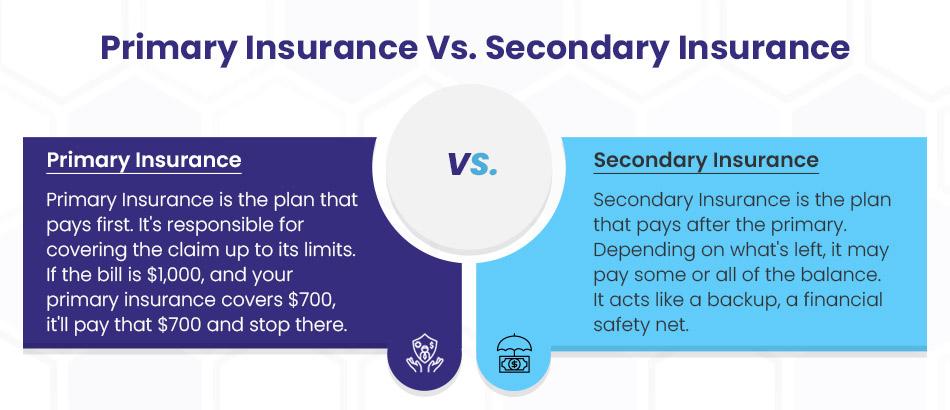

Primary insurance is the first plan that pays when a patient gets medical care and a bill is generated. Think of it like the first responder in the billing process.

If a patient has more than one health insurance plan—like one through their job and another through a spouse or parent—one plan must take the lead. That lead plan is called the primary insurance.

This plan processes the claim first. It reviews the bill, decides what’s covered, and then pays its part to the healthcare provider.

✅ For example:

If the total bill is $1,000 and the primary plan covers $700, it pays that $700 directly to the provider. The remaining $300 may then be sent to the secondary insurance, if there is one.

Knowing which plan is primary helps healthcare providers bill correctly and helps patients avoid delays or unexpected charges.

In short:

- Primary insurance pays first

- It sends payment to the healthcare provider

- It guides the rest of the billing process

- It’s important for both patients and providers to get this right

2️⃣ Secondary Insurance in Healthcare Billing

Secondary insurance is the plan that pays after the primary insurance has done its part. It works like a backup—a financial safety net for both the patient and the healthcare provider.

Why a safety net? ➜ Because it helps catch leftover costs that the primary plan doesn’t fully cover. This could include things like co-pays, deductibles, or any unpaid portion of a medical bill. For the patient, this means fewer out-of-pocket expenses. For the provider, it means a better chance of receiving full payment without chasing it later.

Once the primary plan processes the claim and pays its share, the secondary insurance takes a look at the rest. It may cover all or part of the remaining balance.

✅ For example:

- A medical bill is $1,000

- Primary insurance pays $700

- $300 remains

That’s when the secondary insurance steps in. Depending on its rules, it might cover some or all of that leftover amount.

It may help pay for:

- Co-pays

- Co-insurance

- Deductibles

- Services not fully covered by the primary insurance

*Note: Secondary Insurance never pays first. It waits for the primary insurer to finish. And it will never pay more than the actual cost of the service.

Do you know?

Let’s say you’re 24 and still on your parent’s insurance, but you also have coverage through your job.

- Usually, your work insurance is primary, and your parents’ is secondary.

- So, if you go to the doctor, your job’s insurance gets billed first.

- If it doesn’t cover everything? That leftover balance might be sent to your parents’ plan to see if it’ll cover it.

Primary vs. Secondary Insurance Comparison Table

| Feature | Primary Insurance | Secondary Insurance |

| What it does | Pays first—handles the claim initially | Pays second—only steps in after primary has processed the claim |

| When it pays | As soon as a claim is submitted (assuming coverage is valid) | After the primary has been paid and there’s a remaining balance |

| Who decides on coverage order | Based on coordination of benefits rules (e.g., employer plan is usually primary) | Same rules apply—secondary is the “backup” |

| Example bill: $1,000 | Pays what it covers (e.g., $700) | May pay the leftover amount (e.g., up to $300), depending on its benefits |

| If a claim is denied | Denial reasons could include ineligibility, incorrect info, or non-covered service. | Usually denied, too, unless the denial was due to coordination or timing. |

| Key Role | First responder—main plan responsible for payment | Financial safety net—helps reduce out-of-pocket costs |

| Typical scenario | Employer plan, student plan, individual plan—whichever is considered “main” | Spouse’s plan, parent’s plan, or another supplemental policy |

| Who to contact first | Always contact the primary insurer first if there’s an issue | Only contact the secondary after the primary has processed the claim |

Step-by-step Process to determine Primary and Secondary Insurance Plans

You’re treating a patient who has more than one health insurance plan—now what? No need to stress.

As a healthcare provider, it’s important to know exactly which plan is primary and which is secondary. This way you can bill correctly and avoid insurance reimbursement delays or denials.

This section walks you through a simple, step-by-step process to help you identify the correct billing order for your patient’s insurance plans.

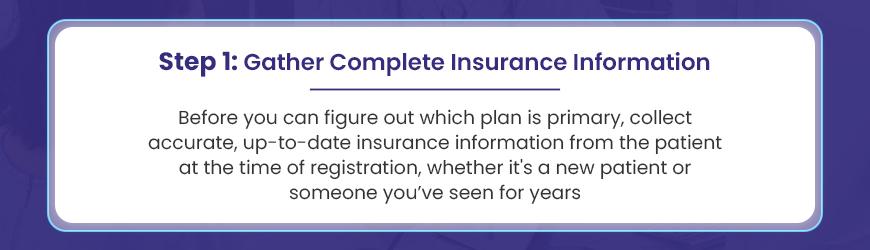

Step 1: Gather Complete Insurance Information

Before you can figure out which insurance is primary and which is secondary, you need accurate and latest details on the patient’s health insurance plans. This step should always happen during patient registration—whether it’s a new patient or someone you’ve seen before.

Start by asking the right questions:

- “Do you currently have more than one active insurance plan?”

- “Who is the policyholder for each plan—you, your spouse, or a parent?”

- “Is the coverage through an employer, government program, or private provider?”

- “Have there been any recent changes in your job, marital status, or insurance plans?”

Also, don’t just take one insurance card—ask for all of them. Patients often forget they’re still covered under a spouse’s or parent’s policy, which could affect the primary vs. secondary insurance order.

Check and record these key details for every plan:

- Effective dates

- Group numbers

- Coverage type

- Policyholder relationship

Be sure to document everything clearly in the patient’s chart, and flag the account for eligibility verification.

💡 Pro Tip: Scan both sides of every patient insurance card into your EHR. The back usually includes critical info like payer contact details and instructions for coordinating benefits. This thing is key when determining which insurance is primary or secondary.

Step 2: Use the COB Rules to Determine the Primary Payer

Once you’ve gathered the patient’s insurance details, the next step is to apply the Coordination of Benefits (COB) rules. These are standard guidelines used by insurance companies to figure out which insurance is primary and which is secondary.

This step helps you as a healthcare provider avoid claim denials, billing delays, and confusion over who pays first.

👉 If the Patient Has Two Employer-Sponsored Plans

The general rule is simple:

- The plan provided through the patient’s own employer is primary.

- The plan from a spouse’s employer is secondary.

Example:

Amanda works full-time and has insurance through her job. She’s also listed on her husband James’s plan.

→ Amanda’s plan is primary, and James’s is secondary.

This rule ensures that the plan covering the individual directly pays first—not one where the patient is just a dependent.

👉 If a Dependent Child Is Covered by Both Parents

Here, the “birthday rule” usually applies:

- The parent whose birthday falls earlier in the calendar year (month and day, not year) has the primary plan.

- The other parent’s plan is secondary.

Example:

Parent A’s birthday is February 15.

Parent B’s birthday is July 9.

→ Parent A’s plan is primary.

This is a common industry rule. But some insurance companies may follow different methods, especially in divorce or court-ordered custody situations.

👉 If the Parents Are Divorced or Separated

The COB rules shift slightly:

- If there’s a court order assigning health coverage, that parent’s plan is primary.

- If there’s no court order, the custodial parent’s plan is usually primary.

- If the custodial parent remarries, the step-parent’s plan becomes secondary, and the non-custodial parent’s plan becomes tertiary (third in line).

These rules ensure the correct plan pays first, reducing delays for providers and out-of-pocket surprises for patients.

👉 When Medicare Is Involved

Medicare follows its own COB rules, which are governed by federal billing laws.

In these cases, it’s crucial to verify:

- Is Medicare the primary payer?

- Or is it secondary to a group or employer-sponsored plan?

Getting this right is essential to avoid denied claims and compliance issues with federal regulations.

Here are the most common Medicare scenarios:

| Situation | Primary | Secondary |

| The patient is still working and covered by an employer plan (20+ employees) | Employer Plan | Medicare |

| Retired patients with Medicare and retiree plan | Medicare | Retiree plan |

| Medicare + Medicaid | Medicare | Medicaid (always last) |

| Disabled patients with a large employer plan | Employer | Medicare |

💡 Pro Tip: Never assume Medicare is automatically primary.

Step 3: The Secondary Insurance Becomes Clear

Once you’ve identified the primary insurance, the next step is easy—the secondary insurance is the other active plan the patient has.

The role of secondary insurance is to review what the primary plan has already paid, and then decide whether it will cover any remaining balance.

Secondary insurance often helps cover:

- Deductibles

- Co-insurance

- Co-pays

- Extra services not fully covered by the primary plan

But keep in mind that it’s not a guarantee of full coverage. The secondary plan will only pay up to the allowed amount based on its own policy rules. That’s where Coordination of Benefits (COB) comes in.

What Is Coordination of Benefits?

Coordination of Benefits, or COB, is a process that insurance companies use to prevent duplicate payments. It ensures that both the primary and secondary insurance plans work together without paying more than the total cost of care. It also makes sure that providers are paid in the correct order and amount.

Example:

A $200 office visit is billed.

- The primary insurance pays $140, and applies the remaining $60 to the deductible.

- The secondary plan may pay some or all of that $60, depending on its coverage rules.

This helps patients lower out-of-pocket costs and helps healthcare providers collect full reimbursement for their medical services that they provide to their patient.

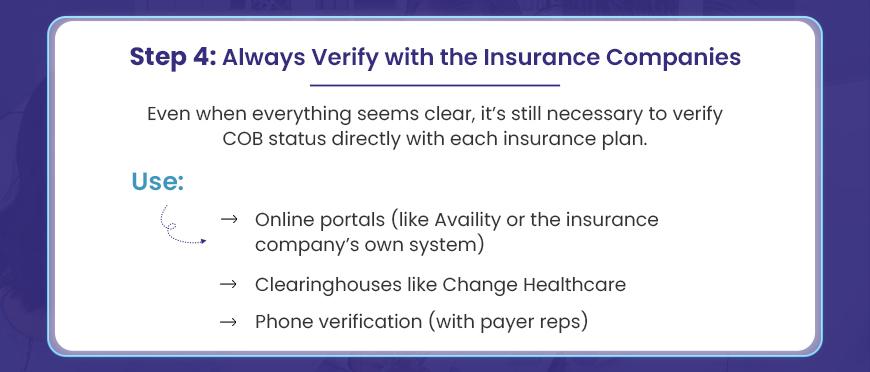

Step 4: Verify the patient’s COB Status with the Insurance Companies

Even when everything looks clear on paper, don’t stop there. Always verify the Coordination of Benefits (COB) status directly with the insurance companies.

Why? Because patient’s insurance information can change and this quick step can save you from billing headaches down the road.

As a healthcare provider, it’s your job (or your billing team’s job) to check which plan is officially listed as primary and which one is secondary for that specific patient—on that specific date of service.

You’re not just assuming, you’re confirming!

What does “COB Status” mean?

It’s the insurance company’s record of how a patient’s multiple plans are ranked. It shows which insurance is primary and which is secondary according to their system, based on the rules you already applied.

How to verify it:

You’ve got a few solid options:

- Use payer portals like Availity, or the insurance company’s direct system

- Check through a clearinghouse like Change Healthcare

- Or go the old-school route and call a payer rep on the phone

What to Ask the Rep:

When you get a payer rep on the line, ask clearly:

“Can you confirm whether this plan is primary or secondary for [patient’s name] as of [date of service]?”

This gives you a firm answer straight from the source and avoids errors due to outdated or missing info in your own system.

Don’t Forget to Document:

Always record the details of your verification:

- Name of the representative you spoke to

- The call reference number

- Date and time of the call

- Any notes about COB confirmation

This becomes your backup if a claim is ever questioned or denied.

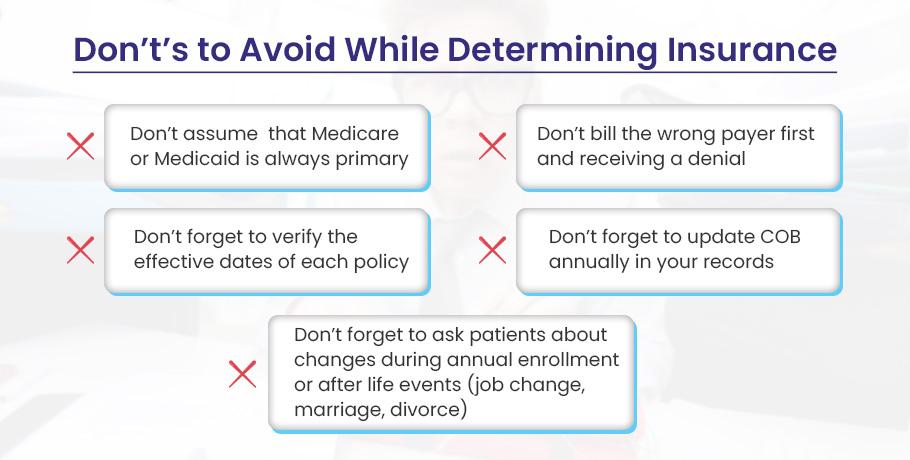

Common Pitfalls to Avoid When Determining Primary vs. Secondary Insurance

Dealing with patients who have more than one insurance plan is pretty common stuff. Making sure you know which plan pays first is the key step. When that’s clear from the start, claims have a much better chance of going through cleanly. This really helps your office run smoother, and gives patients one less thing to worry about. Let’s walk through the usual mix-ups so you can spot them ahead of time.

❌ Medicare Isn’t Always Primary

Yes, Medicare is often the primary payer. But there are key situations where it’s secondary instead. For example:

- The patient is still working and has a group health plan through an employer with 20 or more employees

- The patient is disabled and covered under a large group plan (100+ employees)

- The patient’s treatment is related to a workplace accident, and it’s covered by workers’ comp or liability insurance

In these cases, Medicare becomes the secondary payer, and the other insurance must be billed first.

❌ Medicaid Is Never Primary

Unlike Medicare, Medicaid is governed by a strict federal rule: it is always the payer of last resort.

That means if a patient has any other form of insurance—whether it’s through an employer, spouse, or Medicare—you must bill that plan first. Medicaid only steps in after all other insurance options have been exhausted.

If you fail to do this, then your claim will almost certainly be denied.

💡 Pro Tip: Always ask patients, “Are you still working?” and “Is your coverage through a current employer?”

❌ Billing the Wrong Payer First

Even if you’ve gathered all the right info, billing the wrong insurance first can mess up everything. This is one of the most frustrating (and totally avoidable) issues for healthcare providers.

When you bill the incorrect payer—let’s say you guess wrong on which insurance is primary vs secondary—the claim will likely get denied. That denial means you now have to send it again to the correct payer, and the whole process starts over.

💡 Pro Tip: Use electronic eligibility tools (e.g., Availity, clearinghouse portals) to verify COB before submitting claims. It’s faster than guessing.

❌ Forgetting to Verify the Effective Dates of Each Policy

This one’s easy to miss. But it can cost you valuable time. Just because a patient shows a valid-looking insurance card doesn’t mean their coverage is still active. Insurance coverage isn’t always continuous. If a plan has expired or hasn’t started yet, and you bill it anyway, your medical claim is going to bounce back.

Here’s What Can Happen:

Let’s say a patient gives you a current insurance card. Everything looks fine and you bill the plan. But what you might not know is they changed jobs last month, and that plan might no longer be active.

As a result of this, you submit the claim only to get a denial. Now your team has to scramble to track down the new insurance info and resubmit the claim—and hope it’s not too late.

💡 Pro Tip: Always confirm the effective start and end dates for every insurance policy—especially during eligibility checks. This is extra important at the start of the year, when many insurance plans renew, update, or switch altogether.

❌ Not Asking Patients About Coverage Changes During Open Enrollment or Life Events

Here’s a pitfall that happens more often than you’d think: patients forget to mention their insurance has changed.

Why? It’s human nature. This kind of oversight is known as an “assumption trap”—people assume everything is fine and forget the details. They may not realize their update matters, or they think the process happens automatically.

This is especially common during:

- Open enrollment season

- Life changes like marriage, divorce, changing jobs, or turning 65 (and becoming eligible for Medicare)

If you don’t ask, they often won’t tell—until something goes wrong with their insurance claim.

Example:

A patient turns 65 and signs up for Medicare. But they don’t tell you, because they assume it “just kicks in.” So, you continue billing their employer-sponsored plan, not knowing Medicare should have been involved.

→ Result? The claim gets stuck. You’re left fixing a billing mess that could’ve been avoided with a quick question upfront.

💡 Pro Tip:

As a healthcare provider, make it a habit to ask about any recent life changes or enrollment updates during every visit—especially around the start of the year and during known enrollment periods. You can also train your front desk staff to ask about the patient’s insurance changes at every visit OR around the beginning of the year and during fall enrollment (October–December).

Questions like:

- “Have you had any changes in insurance recently?”

- “Have you or your spouse changed jobs, retired, or enrolled in Medicare?”

- “Did your coverage change during open enrollment this year?”

❌ Not Updating COB Can Lead to Costly Mistakes

Many providers make a common mistake: they don’t update the Coordination of Benefits (COB) each year. But COB status can change anytime, not just yearly — even mid-year.

Here’s why: employers often switch insurance carriers. Patients may change jobs. Parents may shift custody arrangements. If your system still uses old COB info, you’re likely billing the wrong plan. That means claim denials and unhappy patients.

For example: if a child’s custody changes mid-year but your EHR still lists the old parent’s insurance as primary, you’ll bill the wrong payer. The correct insurer then says, “We’re secondary,” and denies the claim.

This creates confusion about which insurance is primary and which is secondary. When a patient has two plans, it’s crucial to know how to determine primary vs secondary insurance to avoid billing issues.

💡 Pro Tip: Always confirm and update COB at least once a year, and anytime a patient mentions new coverage. Better yet, flag patients with more than one plan in your EHR. Set reminders to review COB details regularly. This helps ensure you’re billing the correct primary insurance and avoids claim rejections.

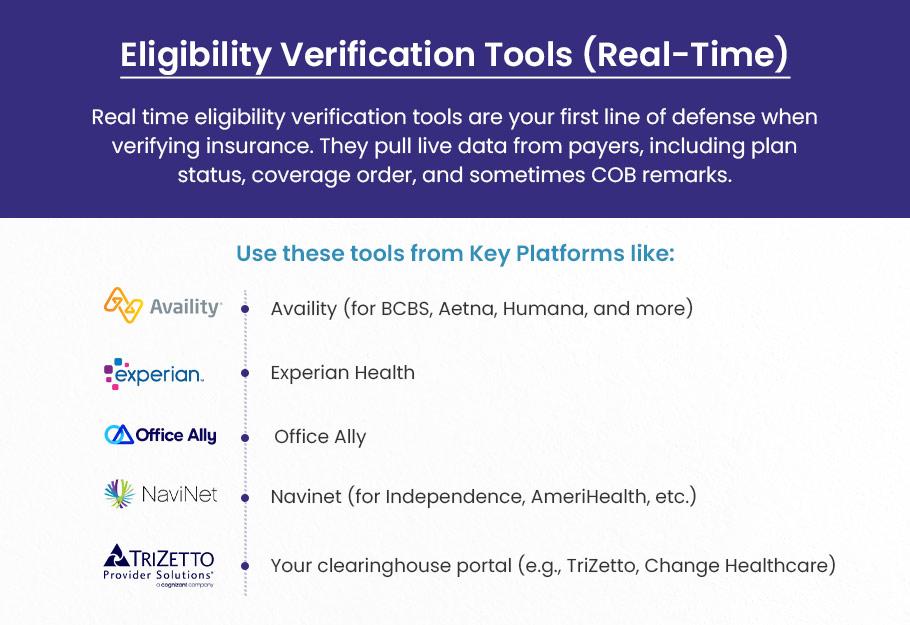

Tools to Identify Primary and Secondary Insurance

With the right tools, your team can verify coverage orders in real time, catch COB issues before billing, and ensure claims are submitted correctly the first time. Let’s break them down by type and how they specifically help identify primary vs. secondary insurance.

Eligibility Verification Tools (Real-Time)

These are your first line of defense when verifying patient insurance. They pull live data from payers, including plan status, coverage order, and sometimes COB remarks.

Key platforms that provide these tools include:

- Availity (for BCBS, Aetna, Humana, and more)

- Experian Health

- Office Ally

- Navinet (for Independence, AmeriHealth, etc.)

- Your clearinghouse portal (e.g., BellMedEx’s FusionEDI)

How do they help?

- Show the active vs. inactive status of policies

- Reveal if the plan is listed as primary or secondary

- Display COB indicators (like “COB on file,” “other coverage exists,” or “secondary to Medicare”)

- Include effective and termination dates for each plan

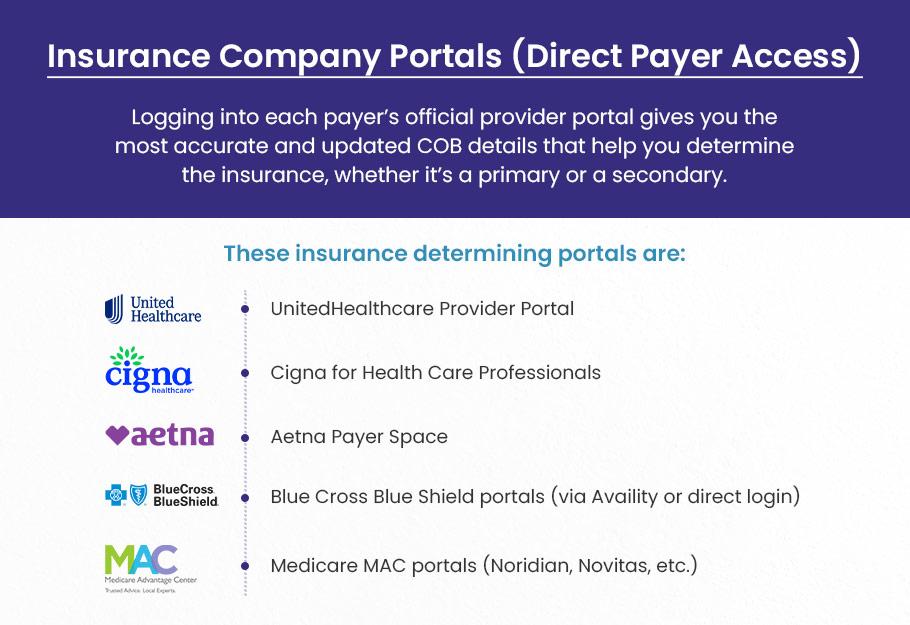

Insurance Company Portals (Direct Payer Access)

Logging into each payer’s official provider portal gives you the most accurate and updated COB details—especially for complex cases.

These insurance company portals are:

- UnitedHealthcare Provider Portal

- Cigna for Health Care Professionals

- Aetna Payer Space

- Blue Cross Blue Shield portals (via Availity or direct login)

- Medicare MAC portals (Noridian, Novitas, etc.)

How do they help?

- View plan hierarchy when multiple policies exist

- See which plan is listed as primary in the insurer’s system

- Often provide member plan history and previous COB notes

- May include recent COB questionnaires submitted by patients

Clearinghouses

Clearinghouses act as intermediaries between your EHR and payers. Many have built-in tools for identifying primary and secondary coverage during pre-claim.

Common Clearinghouses are:

- TriZetto (now part of Waystar)

- BellMedEx Clearinghouse

- Change Healthcare

- Office Ally

- Claim. MD

How do they help:

- Show payer response messages that indicate COB issues or mismatches

- Let you run batch eligibility checks for patients with dual coverage

- Provide denial codes and explanations that signal incorrect payer order (e.g., “this plan is secondary to another policy”)

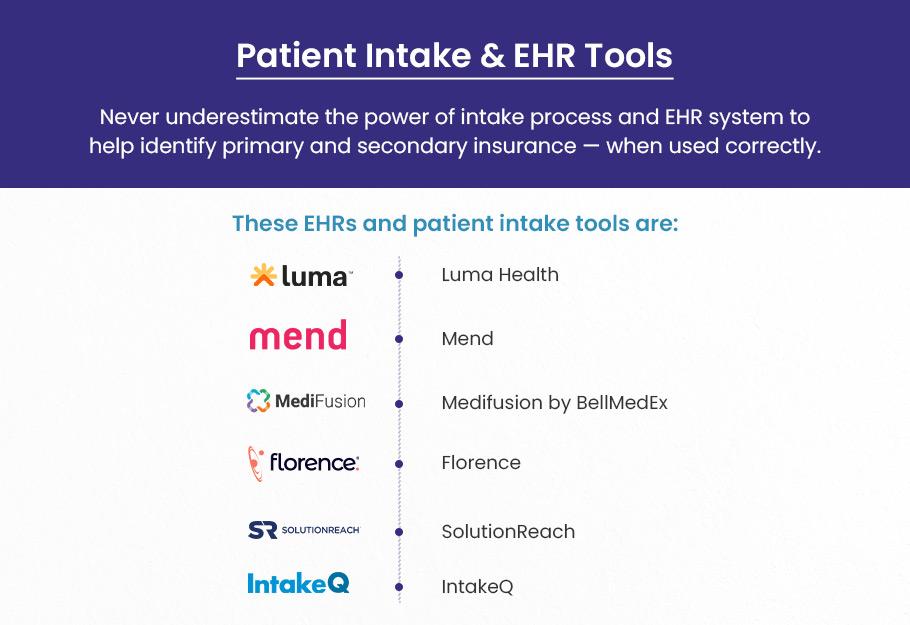

Patient Intake & EHR Tools

Never underestimate the power of your intake process and EHR system to help identify primary and secondary insurance — when used correctly.

These EHRs and patient intake tools include:

- Luma Health

- Mend

- Medifusion by BellMedEx

- Florence

- SolutionReach

- IntakeQ

How do they help?

- Some EHRs (e.g., Epic, Athenahealth, Kareo) offer custom insurance fields to mark payer order

- Intake forms can be set to prompt patients about other coverage, Medicare status, or recent insurance changes

- Patient self-check-in kiosks and portals can be used to update COB info digitally

CAQH (Council for Affordable Quality Healthcare)

Though CAQH is primarily for medical credentialing, many payers sync COB and provider data. It helps keep your practice’s information accurate, which impacts how claims are processed.

CAQH helps identify insurance using:

- CAQH ProView

- Payor portals

How it helps:

- Keeps your practice’s data in sync across multiple payers

- Some patients’ COB data gets stored/updated through CAQH

- Ensures payer systems recognize you correctly as a participating provider for both plans (impacts COB logic)

Coordination of Benefits Questionnaires (Direct from Payers or Patients)

Sometimes, the best way to determine an insurance order is straight from the source: the patient.

Most insurance companies send COB questionnaires when they detect multiple coverages. If unanswered, this can pause claims or delay processing.

A Coordination of Benefits (COB) Questionnaire is typically used to gather information about a patient’s multiple insurance policies to determine which insurance plan should be billed first (primary) and which will be billed second (secondary).

Healthcare providers and insurance companies often use these questionnaires to ensure that claims are processed correctly and that the right plan is responsible for the payment.

Here’s a list of common questions you might find on a COB Questionnaire:

Primary Insurance Information:

- What is the name of the primary insurance carrier?

- What is the policy number of the primary insurance plan?

- Is the primary insurance policy under the patient’s name or someone else’s (e.g., spouse or parent)?

Secondary Insurance Information:

- Do you have secondary insurance coverage? (Yes/No)

- What is the name of the secondary insurance carrier?

- What is the policy number of the secondary insurance plan?

Relationship to the Insured:

- What is your relationship to the primary policyholder? (e.g., self, spouse, child, etc.)

- If not the primary policyholder, who is? (Name and relationship)

Employment-Related Insurance:

- Does an insurance plan cover you through your employer? (Yes/No)

- If yes, provide the employer’s name and your group number.

- Does your spouse or another family member have employment-based insurance? (Yes/No)

Medicare Information (if applicable):

- Are you enrolled in Medicare? (Yes/No)

- Is Medicare your primary insurance? (Yes/No)

- What is your Medicare number?

Coverage for Dependents:

- Does another insurance plan cover any of your dependents? (Yes/No)

- If yes, provide the details (name, policyholder, policy number).

- Changes in Coverage:

- Have there been any recent changes to your insurance coverage? (Yes/No)

- If yes, provide details (e.g., change in policyholder, employment status, etc.).

Other Health Coverage:

- Do you or your family members have other health coverage not listed above? (Yes/No)

- If yes, provide details about the other health coverage.

- Coordination of Benefits Confirmation:

- Do you understand the coordination of the benefits process? (Yes/No)

- Have you provided accurate and complete information regarding your insurance coverage? (Yes/No)

How asking COB-relevant questions help:

- Confirms policyholder info and which plan is primarily based on employment or dependency

- Identifies court-ordered coverage arrangements (especially in divorce cases)

- Establishes Medicare + commercial plan priority

Final Thoughts

Understanding which plan is primary might seem difficult initially, but with a consistent system and precise knowledge of the rules, it becomes much more manageable.

Always focus on the relationship to the policy, the employment situation, and whether government programs are involved.

When in doubt, ask detailed questions, document everything, and use online tools when available.

Training your staff to follow a reliable process will reduce claim errors, avoid payment delays, and offer better patient service.