Health insurance is essential for medical practices and healthcare providers. It guarantees a consistent flow of clients who can afford to pay for their services. This financial security enables healthcare providers to invest in cutting-edge medical technology, hire skilled personnel, and deliver high-quality care. Additionally, working with insured patients lowers the chance of bad debt and non-payment. In this article, we’ll go into more detail on how important health insurance policies, claims procedures, and laws are for healthcare providers to maintain efficient operations and positive patient relationships.

Understanding Health Insurance

Health insurance is a type of coverage that pays for medical expenses incurred by the insured. It’s an agreement where the insurer provides financial coverage for medical expenses in exchange for premiums paid by the insured. Health insurance can reimburse the insured for costs incurred from illness or injury or pay the care provider directly.

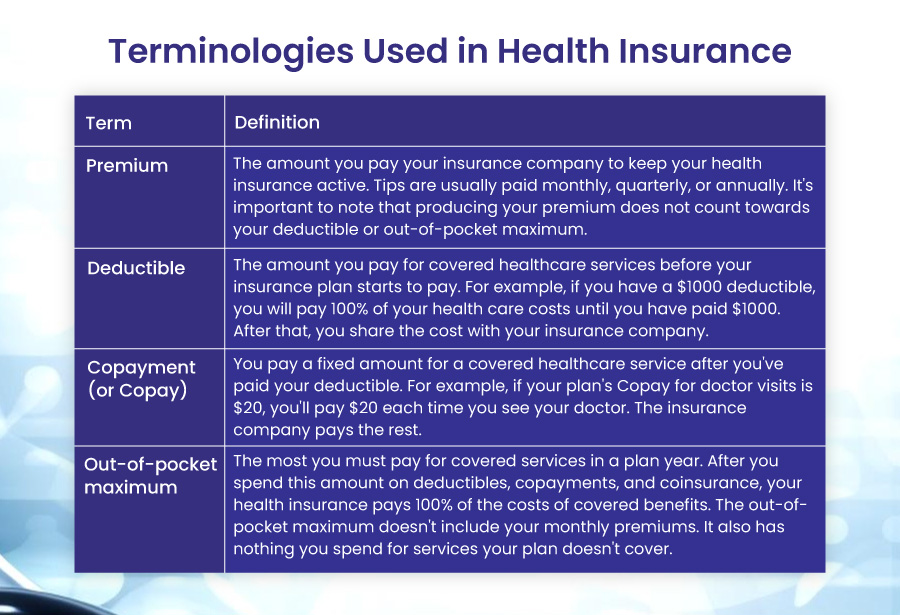

Terminologies Used in Health Insurance

Types of Health Insurance Plans

Health insurance plans come in different types that meet various demands. Some types of insurance plans limit your options for providers or push you to use the doctors, hospitals, pharmacies, and other medical service providers in the plan’s network. Others foot a more significant portion of the bill for healthcare providers outside the plan’s network.

The types of health insurance programs are defined below:

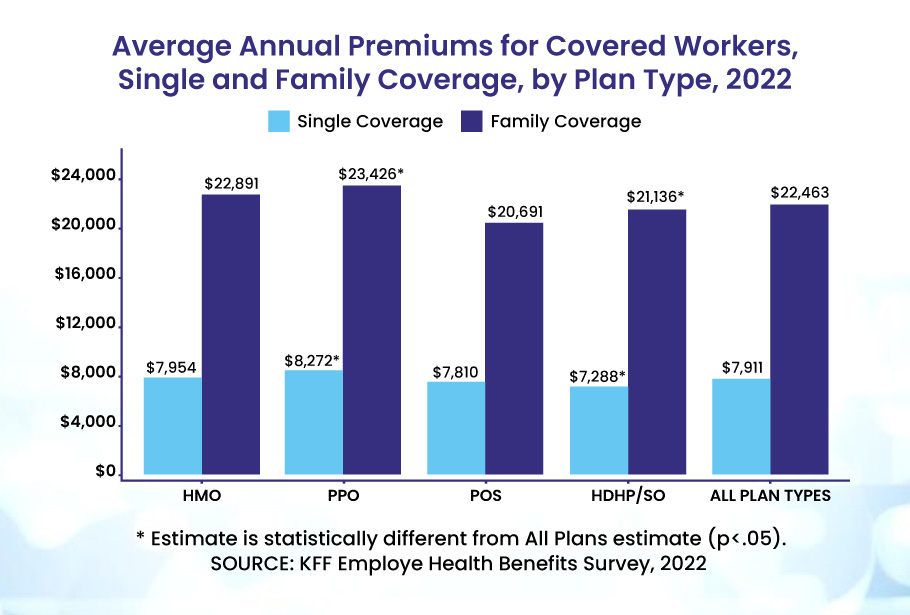

| Feature/Plan Type | PPO | HMO | POS | EPO | |

| Description | Preferred provider organization offers flexibility with a network of preferred doctors. | Health maintenance organization offers services through an exclusive network of providers. | Point of service combines features of HMO and PPO. | Exclusive provider organization, similar to HMOs, but members must use network doctors except in emergencies. | |

| Percentage of People with Employer-Sponsored Plan | 49% (According to KFF1) | – | – | – | |

| Need for Primary Care Provider (PCP) | No | Yes | Yes | Yes | |

| Referral for Specialist | No | Yes | Depends on in-network or out-of-network service | Depends on the plan | |

| Average Annual Premium (Small Businesses, Single Coverage) | $8,409 | $7,391 | – | – | |

| Average Annual Premium (Small Businesses, Family Plan) | $23,147 | $21,136 | – | – | |

| Average Annual Premium (Large Organizations, Single Coverage) | $8,227 | $8,154 | – | – | |

| Average Annual Premium (Large Organizations, Family Plan) | $23,516 | $23,503 | – | – | |

| Average Deductible (Single Coverage) | $1,204 (According to SHRM3) | Usually, none or low | Depends on in-network or out-of-network service | Depends on the plan | |

| Average Deductible (Family Plan) | $2,716 (According to SHRM3) | Usually, none or low | Depends on in-network or out-of-network service | Depends on the plan | |

| Out-of-Network Coverage | Some costs covered | Only for emergencies | Lower coverage level & may need to pay upfront | Only for emergencies | |

| Premium Cost | Higher | Lower | – | – | |

| Out-of-Pocket Costs | Vary, could be higher for out-of-network | Generally lower | Vary, could be higher for out-of-network | Depends on the plan | |

| Best For Employees Who… | Want freedom in doctor choice, some out-of-network coverage, & no need for referral. | Want no/low deductible, lower premium, & primary care physician coordination | Need flexibility in providers & prefer a balance between choice & premiums | Prefer fewer provider choices in exchange for lower rates & are okay with higher costs for unplanned events | |

| Disadvantages | Higher monthly premiums, deductible costs | Less flexibility, need for referral for specialists | – | Fewer provider choices, the potential for higher costs for unplanned events | |

Health Maintenance Organization (HMO)

A type of health insurance plan that primarily restricts coverage to medical services from providers under contract or employed by the HMO. Except in cases of urgency, out-of-network care is typically not covered. You might need to reside or work in an HMO’s service region to be eligible for coverage. HMOs frequently offer coordinated treatment with an emphasis on wellness and prevention.

Preferred Provider Organization (PPO)

A Preferred Provider Organization (PPO) enters agreements with hospitals and physicians to establish a network of participating providers. Utilizing providers in the network of the plan lowers your costs. You can use medical professionals, facilities, and suppliers outside the network for additional fees.

Exclusive Provider Organization (EPO)

A managed care plan known as an Exclusive Provider Organization (EPO) only covers services when you visit doctors, hospitals, and other medical facilities that are part of the network (except in cases of emergency).

An EPO is a more limited health insurance plan that only pays for services provided by medical professionals inside the EPO network. Out-of-network care, however, might not be covered unless there is an emergency. It resembles a cross between a PPO and an HMO.

Point of Service (POS)

An “HMO/PPO” hybrid plan is an “open-ended” HMO when provided by an HMO insurance provider. Care is covered both inside and outside the health plan’s provider network. However, you must pay the copayment in addition to a portion of “customary fees” for services when you go outside of the network.

When selecting a health insurance plan, it’s critical to comprehend the variations as each form has advantages and disadvantages.

Health Insurance Laws and Regulations

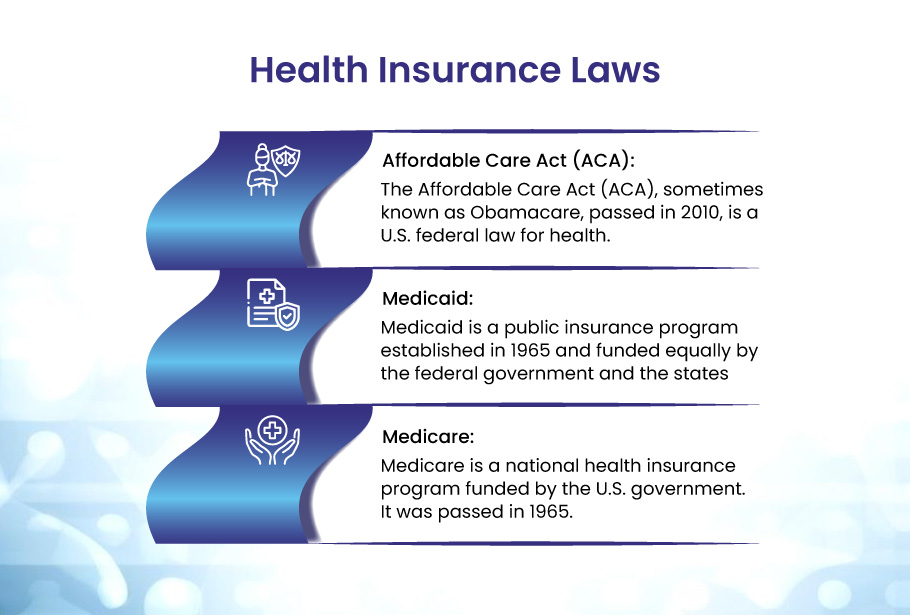

The Affordable Care Act (ACA), Medicaid, and Medicare are the three most important federal laws that govern health insurance in the United States.

Affordable Care Act (ACA)

The Affordable Care Act (ACA), sometimes known as Obamacare, was passed in 2010 to cut the uninsured rate by extending public and private insurance coverage, improving health insurance quality and affordability, and minimizing healthcare costs for individuals and the government. It brought several changes, such as banning pre-existing condition exclusions from coverage or increases in premiums, enabling dependents to remain on their parent’s insurance plan until age 26, and mandating that insurance plans provide several core health services.

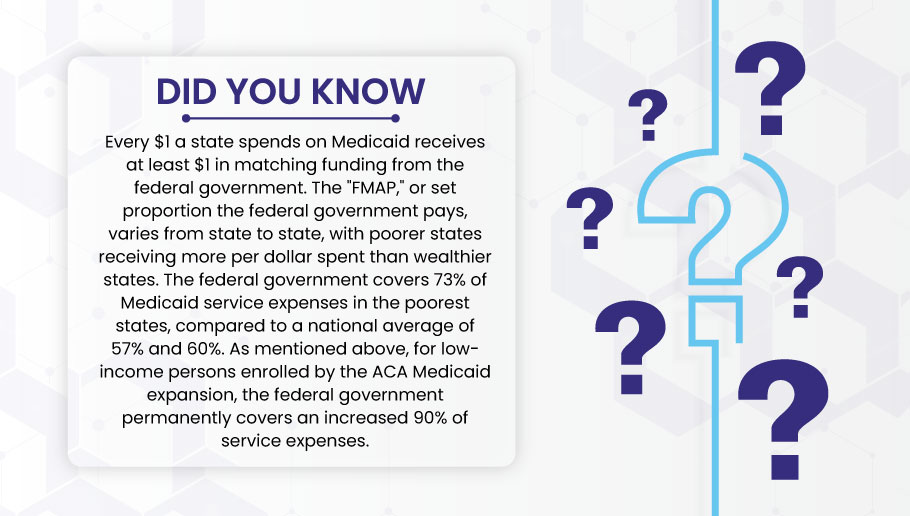

Medicaid

Medicaid is a public insurance program established in 1965 and funded equally by the federal government and the states. It offers health care to low-income families and individuals, including children, parents, pregnant women, elders, and persons with disabilities. Medicaid policies must follow federal guidelines but may vary slightly from state to state.

Medicare

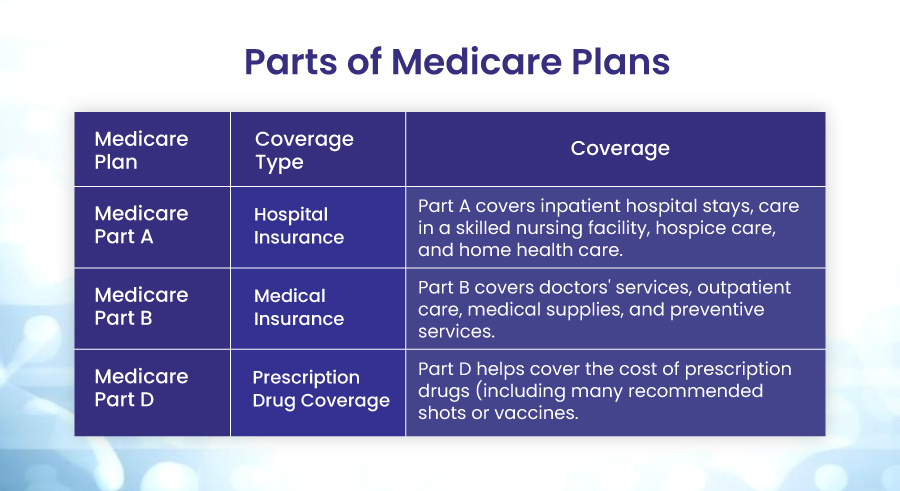

Medicare is a national health insurance program funded by the U.S. government. Congress created the program by amending the Social Security Act in 1965 to provide coverage for those 65 and older without health insurance. There are four different types of Medicare programs available to individuals. Basic Medicare coverage comes predominantly via Parts A and B or the Medicare Part C plan. Individuals also may opt to enroll in the Medicare Part D plan.

Parts of Medicare Plans

Impact of Health Insurance Laws on Practices

These laws significantly impact healthcare providers and medical practices in several ways:

Reimbursement Rates

Medicare and Medicaid typically have lower reimbursement rates than private insurance. This can affect a provider’s revenue.

Increased Patient Access

The ACA has increased access to healthcare for many individuals, leading to a higher volume of patients for some providers.

Administrative Burden

Providers must navigate complex billing procedures for Medicare and Medicaid patients, which can increase administrative costs.

Quality Measures

The Centers for Medicare & Medicaid Services (CMS) has implemented quality measures that impact provider reimbursement. These measures aim to improve patient outcomes and care quality.

Changes in Practice Operations

Laws like the ACA have led to significant changes in how healthcare is delivered and paid for, requiring practices to adapt their operations accordingly.

Please note that the impact can vary based on numerous factors, including specific state regulations, the type of practice, and patient demographics.

Benefits of Health Insurance in Healthcare

There is always a chance that we will fall ill without warning and must pay for pricey treatments in our busy lives. There is always a small chance that someone close to us could need long-term care due to a chronic ailment. Thankfully, health insurance exists. Thanks to health insurance, long-term medical treatment does not put a family in financial ruin. You can enroll in a comprehensive health insurance plan by making a nominal premium payment to the insurer. Your savings will be protected from the unexpected shocks of medical procedures. So that you and your loved ones can continue to enjoy life, health insurance serves as a protective cover for healthcare and money.

Advance Payment

Fixed-benefit health insurance policies pay the whole sum upon the diagnosis of an illness. It is unnecessary to provide documentation of hospitalization and care, such as medical bills. These health insurance plans provide complete coverage for both before and after hospitalization costs in this way. There are no set time limitations or durations. The insurer will pay the policyholder the money without further inquiry if they are determined to have a condition covered by the policy.

Care at Preferred Facility

With the right health insurance, you can receive care anywhere in the world, including India. You do not need to compromise on therapy if you have enough health coverage. When you are diagnosed with a covered condition under a fixed-benefit health insurance plan like ICICI Pru Heart/Cancer Protect, you receive a lump sum payment, eliminating the need to be admitted to a network hospital for cashless treatment. You can receive treatment anywhere worldwide and conveniently use your health insurance claim money.

High Coverage at Discount

Plans with fixed benefits for health insurance offer substantial coverage for a relatively cheap payment. This helps you save money and gives you peace of mind, even if you are diagnosed with a severe illness. For a 35-year-old healthy male with a 20-year policy term inclusive of tax, ICICI Pru Heart/Cancer Protect offers you a cover of 20 lac at 387 per month. Additionally, the premium is entirely waived in the event of a modest claim or upon the diagnosis of permanent disability resulting from an accident.

Increase in Assured Amount

Health insurance is more than just a practical means of funding medical care. Additionally, it increases your coverage each year you avoid filing a claim. If it is a no-claims policy year, ICICI Pru Heart/Cancer Protect offers a 10% boost in sum assured. This implies that your premium money is not lost if there is a year without a claim. You receive more coverage for the premium you pay in a claim-free year.

Fixed Premium Cost

Plans for health insurance provide set benefits at a set cost. In such unique plans, the premium amount is fixed for the policy term. This means that the increasing cost of health insurance won’t significantly impact your household budget. Some plans even provide you and your spouse a discount on the first year’s cost if you are both covered.

Tax Benefits

Plans with fixed benefits for health insurance have tax advantages. If you pay the premium, you can deduct the cost of your health insurance premiums from your taxable income up to a maximum of 25,000. If you are under 60, you may be eligible for this benefit under Section 80D of the Income Tax Act. The most that can be deducted is 50,000 if you and your family are over 60. The premiums you pay for your parents’ insurance will also be eligible for the same benefit.

According to the American Hospital Association’s Report, around 90 percent of Americans have health insurance, with notable increases in coverage over the previous five years. Access to care is made more accessible by health insurance, and these factors are linked to decreased mortality, enhanced health, and increased productivity. Despite recent progress, more than 28 million people still do not have access to coverage, endangering their bodily, mental, and financial well-being.

Conclusion

Understanding health insurance is crucial for both healthcare providers and patients. It ensures financial security for providers and fosters positive patient relationships. With various types of health insurance plans available, choosing one that best suits your needs is essential. Remember, a well-informed decision can lead to better healthcare outcomes. Stay tuned with Bell MedEx for more insights into the healthcare industry.