Understanding billing rules and regulations is essential for healthcare providers to bill accordingly after services are provided to patients.

Sometimes, providers might not be aware of many benefits, such as incident-to-billing, which allows them to get 100% reimbursement from Medicare even if the services were provided by Non-Physician Practitioners (NPPs).

However, here are some requirements for billing incident-to-services. Unless these conditions are not met, you cannot get the perks.

Before delving into the topic, let’s first understand the definition of Incident-to-Billing and the basic terminologies relevant to it.

What is Incident-to Billing?

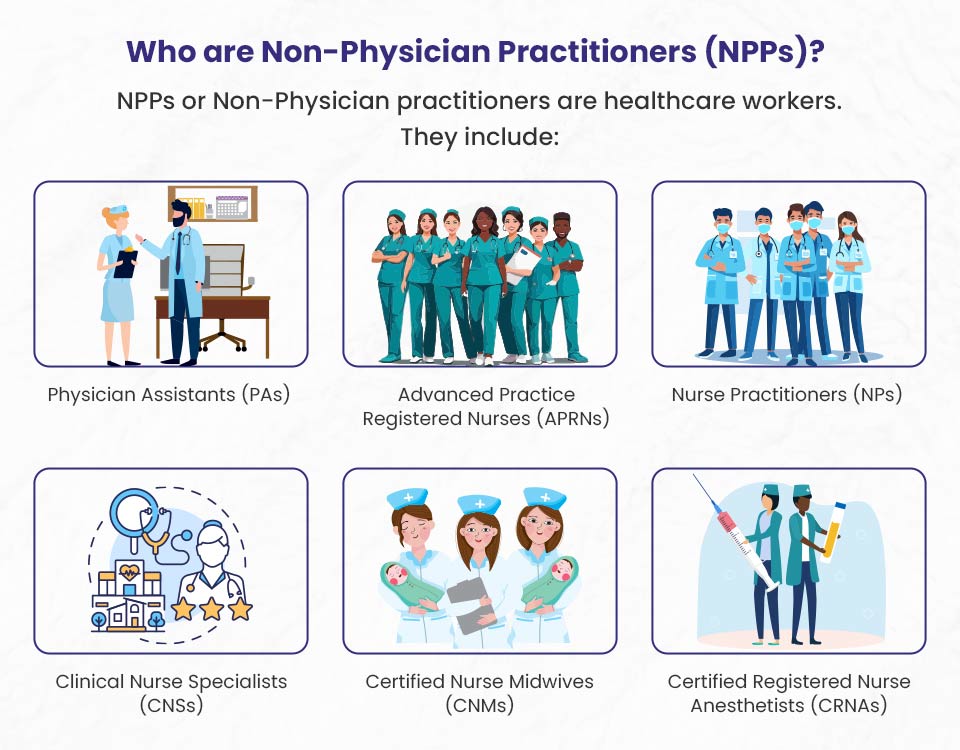

Incident-to billing is a specific way of billing for services in healthcare, especially in outpatient clinics. It allows Non-Physician Practitioners (NPPs) like Nurse Practitioners (NPs), Physician Assistants (PAs), Clinical Nurse Specialists (CNSs), and other licensed clinical social workers to provide services that can be billed using a supervising physician’s National Provider Identifier (NPI) and name.

Example:

Let’s say you visit a medical practice for a follow-up appointment after a recent surgery. Instead of the surgeon, you are seen by a physician assistant (PA). The PA checks your incision, removes any remaining stitches, and provides instructions for your continued recovery.

When it comes time to bill your insurance, the services provided by the PA are billed under the name and identification number of the supervising surgeon, even though the surgeon wasn’t directly involved in that particular visit.

This billing practice is called “incident-to billing,” where non-physician providers can bill under a supervising physician’s credentials.

Here are some key points about incident-to billing:

Supervision Requirement: The physician must directly supervise the services provided by the NPPs. The doctor must be in the office and ready to help if needed.

Initial Visit and Plan of Care: The physician must have seen the patient first and made a diagnosis and care plan. The NPP can do follow-up visits under the physician’s supervision.

Non-Institutional Setting: Incident-to billing is used for services given in non-institutional settings, like a doctor’s office or clinic. This does not include services given in hospitals or skilled nursing facilities.

Reimbursement Rates: Services billed incident-to are reimbursed at 100% of the physician’s fee schedule rate, while those billed directly by an NPP get paid at 85%.

Important Part of Treatment: The services given must be an important part of the patient’s regular treatment, which the physician personally performed during diagnosis and treatment.

Documentation: Proper documentation is very important to follow the rules for incident-to billing. This includes clear records of the physician’s role and oversight.

Incident-to billing can help practices earn more money and use healthcare providers’ time better. However, it is important to follow the rules closely to prevent billing mistakes and possible audits.

Non-Physician Practitioners (NPPs) in Incident-to Billing

Non-Physician Practitioners (NPPs) are very important in healthcare, especially for incident-to billing. This billing method lets NPPs offer services while being supervised by a physician. This way, the practice can charge the full rate that physicians usually get, instead of the lower rate that NPPs get when they bill on their own.

✅ Do you know? ➜ NPPs get paid 85% of the Medicare physician fee schedule rate when they bill for services using their own National Provider Identifier (NPI). However, when services are billed incident-to a supervising physician, the payment rate is 100% of the physician fee schedule. This higher payment rate can help medical practices earn more revenue while still providing excellent medical treatment for patients.

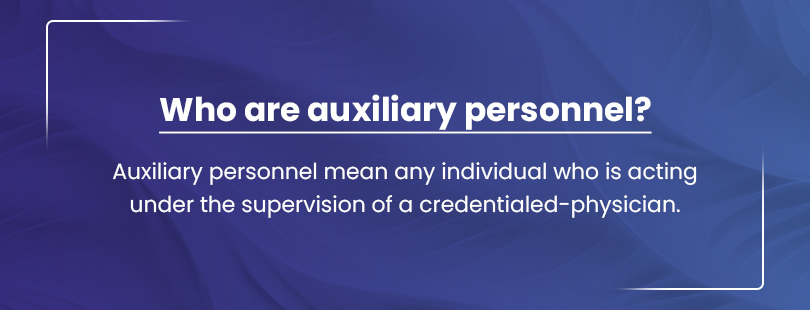

Auxiliary Personnel in Incident-to Billing

Auxiliary personnel are important for the effective implementation of incident-to billing in medical offices. They are people who help provide healthcare services while being supervised by a physician. This includes employees, leased employees, or independent workers who are part of the healthcare support team. This term includes many jobs, like medical assistants, nurses, technicians, and other support staff in healthcare.

For services done by auxiliary personnel to be eligible for incident-to billing, they must be done under the direct supervision of a physician or NPP. Direct supervision means that the supervising doctor or NPP must be in the office and ready to help right away if needed. This makes sure that the supervising provider can step in quickly if there are any problems while giving care.

If support staff give services that follow the rules for incident-to, these services can be billed using the supervising doctor’s NPI. This lets the practice get full payment at 100% of the Medicare physician fee schedule rate, instead of the lower rate usually linked to services given directly by NPPs.

Medicare Incident-to Billing Requirements and Guidelines 2024

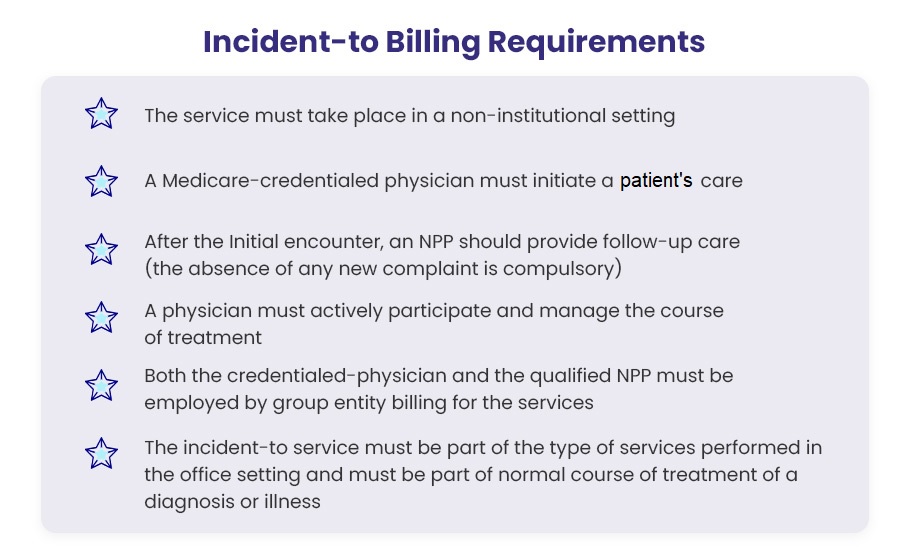

Healthcare services that meet the below requirements can be recorded and billed as incident-to services. They will be reimbursed at a 100% rate according to the Medicare fee schedule.

1). The service must take place in a non-institutional setting.

The healthcare service should happen in a place that is not an institution i.e. non-institutional settings other than a hospital or skilled nursing facility. This is an important part of incident-to billing. Medicare will not accept a claim as incident-to if the services were given in any institutional setting. To get full reimbursement at the Medicare rate, it is necessary to make sure that the POS is in a non-institutional setting.

2). A Medicare-credentialed physician must initiate a patient’s care.

A Medicare-credentialed physician must start patient care if the patient has a new or worse complaint. This is an important requirement of the incident-to billing process. The physician must establish the diagnosis and care plan. The first session must be done by a clinician who has Medicare credentials to allow incident-to services.

Note: New complaints that NPPs handle for patient care are not billed using the credentialed practitioner’s NPI. Incident-to billing does not apply during the patient’s first visit.

3). The NPP should provide follow-up care after the main physician’s initial encounter with the patient, ensuring that the patient’s needs are met and there are no new concerns.

According to the CMS Benefit Policy Manual, after the initial encounter, a qualified NPP should give follow-up care with the direct supervision of a Medicare-credentialed practitioner.

However, direct supervision of the credentialed practitioner does not mean that the physician must be in the same room as the non-physician practitioners for assistance. They should be available in the office suite to help and guide NPPs while they are working.

If auxiliary personnel (NPP) provide services outside the office – like at a patient’s home or another institution (not a hospital or skilled nursing facility) – the services are covered under the credentialed physician’s NPI if the physician is physically present for direct supervision and overseeing the care process. Availability of the physician over phone call is excluded from incident-to billing services.

Note: The supervising doctor does not need to be the one who provided the initial care. Any doctor in the group entity can supervise the care process, and this supervision is valid for incident-to billing.

4). A physician must actively participate and manage the course of the treatment.

To validate incident-to-services and submit bills under the NPI of a Medicare-credentialed physician, the physician must actively take part in and manage the patient’s treatment. The specific rules for this situation are clearly stated in the state laws for physicians who supervise NPPs. The rules say that the physician must see the patient every third visit.

5). Both the supervising physician and the non-physician practitioner (NPP) must be employed by the same medical group that is submitting the claim.

To get full Medicare reimbursement under incident-to rules, both the supervising physician and the non-physician practitioner (NPP) must be employed by the same medical group that is submitting the claim. However, if the physician is a solo practitioner, they must directly hire the NPP to provide incident-to services.

Here’s a quick example: Dr. Jones is part of ABC Medical Group which employs 2 NPs. Since both Dr. Jones and the NPs work for ABC, ABC can bill incident-to for services the NPs provide under Dr. Jones’ supervision, and receive full Medicare payment. However, if Dr. Jones left to open her own solo practice, she would need to directly hire an NP to provide incident-to services for her practice.

6). The incident-to service must be a routine part of the medical services provided in the office setting and must be directly related to the patient’s diagnosis or illness.

It is important for credentialed clinicians and qualified NPPs to know the clinical guidelines when offering incident-to services. The treatment needs to be done in the office setting and should be a regular part of the treatment for the diagnosis or illness. Providers cannot charge for services as incident-to if they are giving a different type of treatment for the diagnosis.

Healthcare services must follow all the rules mentioned above to qualify for “incident-to billing” and receive full reimbursement. In these situations, the services from the NPPs would be seen as if the supervising doctors did them themselves, and it would be billed using their NPI.

For MAximum Reimbursements

Incident-to Billing Done Right 💯

Many practices incorrectly bill services incident-to a physician when requirements aren’t met. This results in take-backs and penalties. Our compliant incident-to billing model ensures services meet guidelines to earn 100% of physician rates.

Services That Are Not Considered Incident-to

Incident-to billing only applies to certain services under Medicare coverage. The following scenarios are not eligible for incident-to billing:

- The patient is new to the practice

- The patient presents new or additional complaints during a follow-up visit

- Only one provider is Medicare-credentialed (e.g. the physician but not the NPP)

- The supervising physician is not physically present in the office suite to assist the NPP

Remember, incident-to billing is reserved for established patients receiving ongoing care from a physician-led team when the physician directly supervises the services. Any deviations from this situation cannot be billed incident-to.

Incident-to Billing Examples

Incident-to billing is not a complex procedure. You can get a clear idea after reading these examples.

Example 1: Covered as Incident-to billing (billed under the Physician’s NPI)

➡️ Scenario: Ureteroscopy services were provided to a patient (covered by Medicare) by a credentialed practitioner (urologist).

The patient does not mention any new complaints about urologic diseases or conditions.

Now the patient returns for the follow-up and is taken care of by a qualified NP (nurse practitioner). She is supervised as she follows the care plan prepared by the practice’s urologist. The NP examines the patient carefully.

After that, the NP records the patient’s progress and documents it in this way:

- Records the absence of new complaints

- Records the supervising physician’s presence in the office suite (non-institutional setting)

- Both the physician and NP are employed by the group entity billing for the services

So, the patient’s follow-up visit may qualify for incident-to billing as Medicare requirements are fulfilled. The clinic will be reimbursed at 100% of the Medicare physician fee schedule.

Example 2: Covered as common billing (billed under Non-Physician Practitioner’s NPI)

➡️ Scenario: Another Medicare patient to whom the same services (Ureteroscopy) were provided returns for a follow-up.

The patient informs the NPP of a new complaint unrelated to urologic disease or conditions. After that, the qualified nurse practitioner outlines a new treatment plan while addressing the new complaint. This visit will not be billed as incident-to because it addresses a new complaint. The clinic cannot bill Medicare under supervising physician’s NPI, rather the clinic must bill the visit under the nurse practitioner’s NPI to collect only 85% as per the Medicare fee schedule for NPPs.

Example 3: Not covered as incident-to billing

➡️ Scenario: Dr. ABC is currently treating a patient for diabetes.

The patient visits the office for follow up, and presents with an upper respiratory infection and sees a PA in the same group.

Now, this is not an incident to the situation and cannot be billed under the credentialed-physician. The qualified PA (NPP) would bill under their NPI since this is a new condition. It is neither an integral nor an incidental part of the physician’s treatment plan.

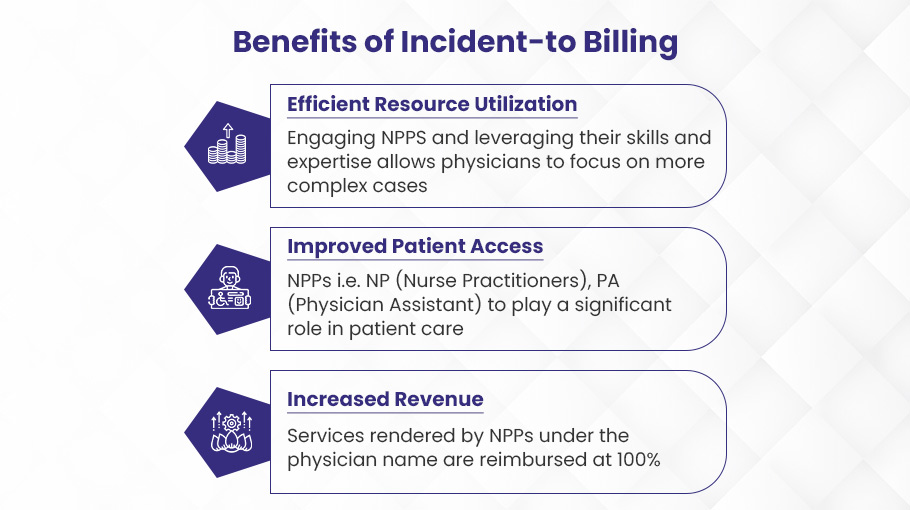

Benefits of Incident-to Billing

Incident-to billing can help your medical practice earn more money. Non-physician staff can bill under the doctor’s name, which means you’ll get paid more. Here are the major benefits of incident-to billing:

Increased Revenue

One of the key benefits of incident-to billing is that it can help healthcare providers earn more money. Non-Physician Practitioners (NPPs) can give services under a supervising physician’s National Provider Identifier (NPI). This incident-to billing helps practices get more money from payers like Medicare.

The Centers for Medicare & Medicaid Services (CMS) say that services from NPPs, such as Nurse Practitioners (NPs), Physician Assistants (PAs), and Clinical Nurse Specialists (CNSs), usually get reimbursed at 85% of the Medicare Physician Fee Schedule rate. But, when these services are billed as “incident-to” a physician’s professional services, they get reimbursed at the full 100% rate.

This difference in reimbursement rates can lead to a big increase in income for healthcare practices. For example, if a nurse practitioner gives a service that usually gets paid $100 at the 85% rate, billing that service as part of a physician’s work would let the practice get the full $100 payment.

Also, incident-to billing helps practices use the skills of NPPs better. This means they can see more patients and offer more services in the same amount of time. This higher productivity, along with better payment rates, can lead to significant income growth for the practice.

Improved Patient Access

Incident-to billing helps patients get care more easily in a several important ways. When NPs, PAs, and other NPPs work with a physician, it increases the pool of healthcare providers available to see patients. This is very helpful in rural areas and places with few doctors. More providers mean patients can get appointments faster and face less wait times.

In addition, the team-based care model, supported by incident-to billing, allows patients to access more types of expertise. For example, an NP can give basic primary care services, freeing the supervising doctor to focus on more complicated cases. This way, patients receive advantages from both kinds of providers.

By adding more people to the care team and using providers’ skills better, incident-to billing makes it easier to get health services and reduces waiting times. This tool helps meet patient needs, especially in areas that have not received enough support in the past. Studies show that this better access is a clear and important advantage.

Better Resource Utilization

Incident-to billing helps healthcare facilities use resources better by allowing physicians to assign routine services to qualified non-physician practitioners (NPPs). This allows the physician to spend more time on complicated cases and patients who need more help.

NPPs providing services related to the physician’s billing helps the physician see more patients in a shorter time. Instead of spending time on routine tasks like medication refills or injections, the physician can focus on difficult diagnoses, creating treatment plans, and performing procedures. This optimizes the physician’s specialized expertise.

With incident-to billing, physicians can maximize their productivity and increase patient access. The facility can serve more patients per day as NPPs handle less complex patients under the physician’s supervision. This improves efficiency and lowers costs compared to the physician delivering all services themselves. More patients can be treated in a timely manner.

Risks of Improper Incident-to Billing Practices

While incident-to billing has many benefits, there are also risks if it is done incorrectly.

Administrative Sanctions and Penalties

Improper incident-to billing can result in serious penalties and administrative sanctions from Medicare. If the rules for documentation and billing are not followed, Medicare contractors such as the MAC and UPIC will check claims closely and likely issue an Additional Documentation Request (ADR). If the rules for incident-to services are not followed correctly, it can lead to big overpayments, even if the wrong claims are not seen as fraud at first.

Medicare contractors can decide to impose pre- and post-payment reviews. They can also pause payments and estimate overpayments if they find wrong billing patterns. If many claims checked under a physician’s NPI do not follow the incident-to rules during an audit, the UPIC can assume that all similar claims have been overpaid. The physician may then face recoupment of extrapolated overpayments across thousands of services.

These administrative actions may not be as serious as False Claims Act lawsuits or OIG permissive exclusion, but they can still greatly affect a practice’s finances and ability to function.

Civil Sanctions – False Claims Act Liability

Improper incident-to billing can lead to serious civil sanctions under the False Claims Act (FCA). The FCA imposes liability on any person who knowingly submits a false claim to the government for payment. Many physicians have faced FCA lawsuits due to improper incident-to billing practices.

The most common incident-to violations that can lead to FCA liability are charging for services provided by unlicensed staff and not having proper physician supervision of non-physician practitioners (NPPs). Charging for services by staff who do not have the proper state licenses and qualifications is wrong. Additionally, incident-to rules require direct physician supervision of NPPs for services to be payable under a physician’s billing number. Failure to properly supervise renders the service ineligible for incident-to billing.

Criminal Liability and Prosecution

Sometimes, incorrect incident-to billing can cause legal problems when services are done by a provider without credentials but billed under the name and NPI of a provider who is credentialed. If a doctor or medical group is accused of these practices, prosecutors will quickly take legal action against them.

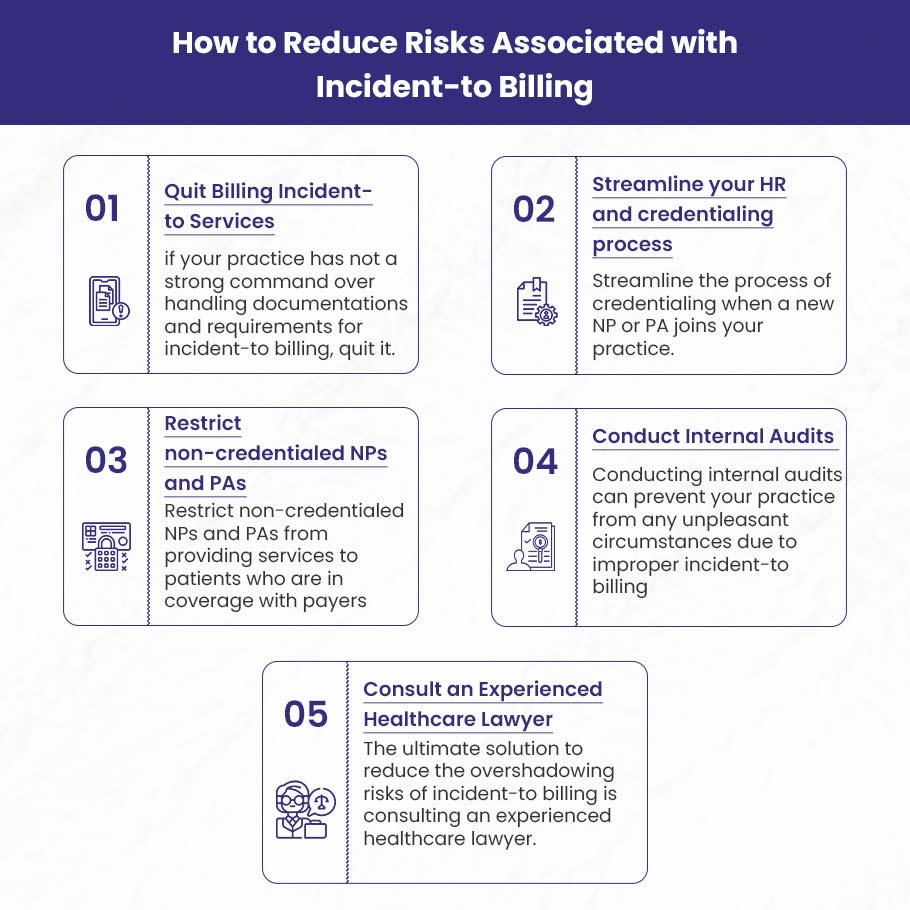

How to Reduce Risks Related to Incident-to Billing?

While incident-to billing can be risky, there are steps you can take to protect your practice.

Skip Incident-to Billing to Reduce Audit Risk

Many physician practices rely heavily on incident-to billing to maximize revenues from established patients. However, lax oversight frequently leads to problems like denied claims, recoupments, and audits. So the extra 15% reimbursement may not justify the headaches and risks.

Incident-to rules are complicated, but good documentation and supervision are needed to justify the higher rate. Even careful actions can lead to mistakes that cause problems later. Before you realize it, your practice may have to deal with recoupments or even more serious issues.

Instead of taking chances with incident-to billing, think about making your approach easier. Only submit claims using the treating provider’s NPI. You may lose some money, but you will feel better knowing your billing is safe from audits. Less administrative work could also reduce costs.

Today, with more rules being enforced, it is usually best to take a careful and safe approach. Make your billing easier and avoid incident-to claims to lower your audit risk. You may sacrifice some revenue, but you’ll sleep better knowing your practice is playing it safe.

Streamline Your HR and Credentialing Process

To lower risks with incident-to billing, it is important to have a well-structured HR and credentialing process. When you welcome new nurse practitioners (NPs) or physician assistants (PAs) to your practice, it is very important to focus on their credentialing before they start taking care of patients. Delay their official start date until their credentials have been thoroughly verified and approved.

This proactive approach ensures compliance with incident-to billing regulations, which require NPPs to be appropriately supervised and their services billed under a physician’s provider number. Make simple steps to collect and check all needed documents, like licenses, certifications, and records of clinical experience. Work closely with your HR team, credentialing specialists, and third-party payers to make the process easy and efficient.

Restrict Non-Credentialed NPs and PAs

Restricting non-credentialed NPs and PAs from seeing patients covered by insurance can reduce risks related to incident-to billing. This limits their services to only self-pay patients. Doing so ensures they don’t bill insurance for services, avoiding improper incident-to billing. It’s safer to restrict their practice to just self-pay patients until properly credentialed to avoid billing issues.

Conduct Internal Audits

Internal audits check patient records, billing practices, coding accuracy, and documentation to make sure they follow the incident-to billing rules. This means checking that the services given are a key part of the physician’s professional service, happen in the physician’s office or a non-institutional setting, and are performed by certified auxiliary personnel under the direct supervision of the billing physician.

By doing these audits, you can find possible areas where rules are not being followed before they become bigger problems. Finding problems early helps you take action, train your staff, and improve your billing processes to follow the rules for incident-to billing. This lowers the chance of penalties or refunds and shows that your practice cares about keeping high standards in billing honesty and clarity.

Furthermore, internal audits serve as a valuable preparatory step before undergoing external audits or reviews by payers.

🌟 Stop Losing Money:

Let BellMedEx Handle Your Incident-to Billing

Incident-to billing lets you bill for Non-Physician Practitioner services under a physician’s name at 100% of the fee schedule. But small errors lead to big problems. We are incident-to billing specialists with a proven process to ensure accurate claim submission and reimbursement. Trust us to leverage incident-to billing to its fullest potential, without audits or penalties.

Thanks to BellMedEx, our billing reimbursement is at its highest!

Dr. Esther

Counselor, Mental Health Clinic

Top Features

✓ Incident-to Billing Expertise

✓ Maximum Reimbursements

✓ 99% Clean Claim Ratio

FAQs

Does BCBS allow incident-to billing?

Blue Cross Blue Shield (BCBS) does allow “incident-to” billing, but it is subject to specific conditions. Generally, only providers who are not offered network participation can bill incident-to services under a supervising provider’s contract number. However, certain provider types, such as nurse practitioners and physician assistants, are required to file claims under their own provider number. It’s important to verify the specific policies of the member’s benefit plan and ensure compliance with BCBS guidelines.

Is incident-to billing only for Medicare?

Incident-to billing is primarily associated with Medicare, but it is not exclusively limited to it. While Medicare has specific guidelines for incident-to billing, some private insurance plans also allow it under similar rules. However, the requirements and applicability can vary significantly between different insurers. It’s essential to check the specific policies of each insurance provider to ensure compliance.

What is an example of incident-to billing?

An example of “incident-to” billing is when a physician initially sees a patient for a condition, such as elevated blood pressure, and establishes a treatment plan. On subsequent visits, a nurse practitioner (NP) or physician assistant (PA) can provide follow-up care for the same condition under the physician’s supervision. The services provided by the NP or PA are billed under the physician’s National Provider Identifier (NPI), allowing for full reimbursement as if the physician had provided the care.

Does Aetna allow incident-to billing?

Yes, Aetna does allow “incident-to” billing, but it is primarily for behavioral health services. This means that services provided by qualified, license-eligible clinicians under the supervision of a licensed provider can be billed under the supervising provider’s credentials. However, it’s important to verify the specific policies and requirements of the member’s benefit plan to ensure compliance.

Does Tricare allow incident-to billing?

Yes, TRICARE allows “incident to” billing under specific conditions. Services provided by employees of an authorized independent professional provider can be billed as “incident to” the provider’s services if they are performed under the provider’s direct supervision and are integral to the provider’s professional services. However, certain services, such as those provided by Physical Therapist Assistants (PTAs) or Occupational Therapy Assistants (OTAs), are excluded from “incident to” billing.

Does Cigna allow incident-to billing?

Cigna, now rebranded as Cigna Healthcare and Evernorth Health Services, allows providers to charge for professional services done by their supervisees, as long as these services are within what the supervisees are allowed to do and follow state licensing rules. This policy applies to both network-participating and non-participating providers. When billing under this arrangement, the fully credentialed and licensed provider must be listed as the rendering provider on the claim. It’s important to note that this does not eliminate the requirement for fully licensed providers to adhere to Evernorth Behavioral Health’s credentialing standards.

Additionally, Evernorth Behavioral Health does not allow Third Party Supervisory Billing in any provider contracts or agreements. This means that supervision must happen with the providers who work for the agency.

Does Anthem allow incident-to billing?

From October 1, 2024, Anthem has revised its Incident to Service — Professional policy to clarify reimbursement guidelines. The policy distinguishes between two types of incidents: “Incident to Billing,” where services billed under this category will be reimbursed at a rate 15% lower than the supervising provider’s fee schedule, and “Incident to Services or Supplies,” which are integral to the primary service and thus not eligible for separate reimbursement.