Clearinghouses in healthcare act as an intermediary service, bridging the gap between healthcare service providers such as hospitals or clinics and payers such as insurance companies.

Clearinghouse for medical claims plays an integral role in the healthcare sector, particularly in medical billing. They manage and moderate the transactions between healthcare providers and payers. As well as facilitate smoother communication and faster reimbursements for an overall reduction in administrative costs and delays.

Healthcare clearinghouses simplify the billing process by checking medical claims for errors before they reach the insurance payers, helping streamline operations, reduce administrative burden, and minimize claim rejections due to errors. They convert claims data into a standardized format, ensuring compatibility with the payer’s systems.

This critical service helps achieve better efficiency and accuracy, making clearinghouses essential to healthcare revenue cycle management.

Clearinghouses also improve compliance with health data standards and privacy regulations, including the Health Insurance Portability and Accountability Act (HIPAA).

In essence, they provide a secure, efficient, and standardized method for the electronic transmission of healthcare data.

Understanding Clearinghouse Operations

Clearinghouse for medical claim‘s primary operation is to process and convert claims from the healthcare provider into a standard format, making them ready for the payer. The standardized format often aligns with the Electronic Data Interchange (EDI) standards, facilitating seamless and efficient electronic communication between different systems.

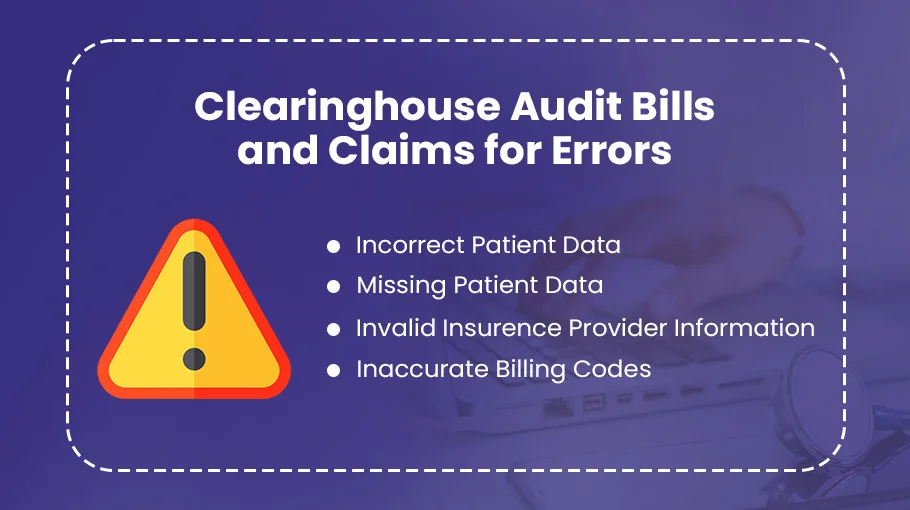

Additionally, clearinghouses check claims for errors or missing information, referred to as “scrubbing.” This is a crucial step as it helps avoid claim denials or delays in payment, significantly improving the efficiency of the medical billing process. Once the claims are scrubbed and formatted correctly, they are securely forwarded to the respective insurance payer for processing.

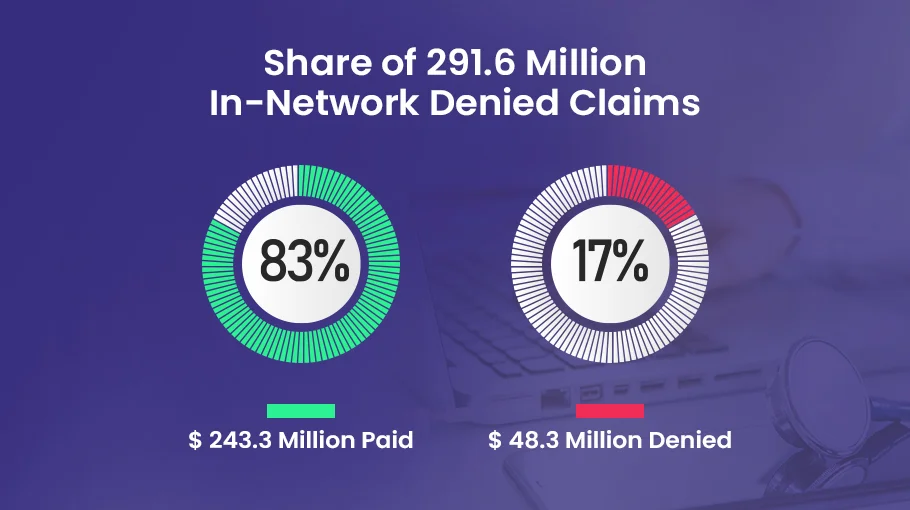

Healthcare Insurers denied 17% of in-network claims in 2021. Out of 291.6 million in-network claims, 243.3 million claims were paid and 48.3 million were denied.

Functioning of Clearinghouses in the Healthcare Industry

Once the healthcare provider generates a claim, it is sent to the clearinghouse. The clearinghouse reviews the claim, checking for any errors, and converts it into a format compatible with the payer’s system.

The claims then undergo a validation process to ensure they meet all necessary procedural and diagnosis codes and HIPAA requirements. This process helps eliminate any potential issues that could lead to claim rejection. Once the claims pass this validation step, they are transmitted to the insurance payers for reimbursement.

Clearinghouse for medical claims also provides detailed reports to healthcare providers about the status of submitted claims, including accepted, rejected, or pending claims. This provides transparency and facilitates better tracking of the claim lifecycle.

Procedures Followed

Clearinghouses follow a step-by-step procedure, ensuring each claim is processed accurately and efficiently. The system generally consists of the following steps:

1). Claim Submission. Healthcare providers submit the claims to the clearinghouse. These claims may contain various details, including patient information, diagnosis, and treatment.

2). Claim Scrubbing. Clearinghouses review the claims for errors or missing data, ensuring that the diagnosis and procedure codes are valid and meet the payer’s requirements.

3). Claim Standardization. The claims are converted into a standardized format compatible with the payer’s system. This format is usually based on EDI standards.

4). Claim Transmission. The cleared and standardized claims are transmitted electronically to the payer, ensuring secure and efficient transmission.

5). Reporting. Clearinghouses provide regular reports to healthcare providers regarding the status of their claims. This helps the providers track their claims and promptly address any issues.

How Do Clearinghouse Services Address Common Healthcare Problems?

Clearinghouse services address several persistent challenges in the healthcare industry. Clearinghouses for medical claims mitigate inefficiency and delay in the medical billing process. By validating claims for accuracy before sending them to insurance companies, they drastically reduce the rate of rejected claims, accelerating the reimbursement cycle.

Clearinghouses also facilitate standardized communication between disparate healthcare systems, making interoperability less of a challenge. They translate healthcare data into standardized formats following EDI standards, enabling seamless data exchange between providers and payers, irrespective of their unique systems.

What Role Does an Insurance Clearinghouse Play During Claim Submission?

The function of an insurance clearinghouse extends beyond mere claim transformation and submission. Clearinghouses significantly contribute to the lifecycle management of healthcare claims. They track the status of submitted claims, providing real-time updates and comprehensive reports to healthcare providers.

This active tracking facilitates effective claim management, enabling providers to monitor claim statuses, identify and rectify denied or rejected claims, and maintain a clear overview of their reimbursement pipeline.

Insurance clearinghouses optimize the claim submission process by acting as an effective channel between healthcare providers and insurance payers. They minimize administrative workload, reduce the occurrence of claim errors, and contribute significantly to expediting the reimbursement process, thus playing an integral part in healthcare revenue cycle management.

Is it Mandatory for Providers to Use a Clearinghouse?

While there’s no explicit legal requirement compelling providers to use a clearinghouse, many insurance entities, including Medicaid, Medicare, and many private insurers, necessitate or favor electronic submission of healthcare claims. Given the rising intricacies of healthcare billing and compliance requisites stipulated by HIPAA, using a clearinghouse is becoming an increasingly common practice to simplify and streamline the medical claims process.

What Benefits Do Providers Gain from Using Clearinghouses?

There are several key benefits healthcare providers can derive from employing clearinghouses:

Claim Scrubbing

Clearinghouses perform rigorous data validation or ‘scrubbing’ on each claim, identifying coding errors, missing information, or discrepancies before claim submission. This significantly minimizes denial and rejection rates, enhancing the provider’s clean claim submission rate.

Operational Efficiency

Clearinghouses adeptly convert claim data into the necessary ANSI 837 format, accelerating the claim processing time and reducing the administrative overhead on healthcare staff.

Cost-effectiveness

Electronic submission of claims via clearinghouses reduces expenses associated with paper-based claims processing. This includes reduced expenditure on printing, postage, and manual labor, thereby contributing to overall cost efficiency.

Prompt Reimbursements

Claims are submitted electronically and rectified early on for errors, so claim settlement timelines are considerably shortened. This leads to improved cash flow and a more efficient revenue cycle for the provider.

Regulatory Compliance

Clearinghouses ensure that all healthcare transactions comply with HIPAA’s rigorous privacy and security standards, mitigating the risk of non-compliance penalties for the provider.

In essence, even though using a clearinghouse is not legally mandatory, the substantial benefits they present, from improved operational efficiency to better compliance, make them an invaluable tool for modern healthcare providers.

Evaluating the Cost of Clearinghouse Services for Medical Claims

In the healthcare billing landscape, clearinghouses for medical claims are a critical component that ensures efficient and error-free transactions. Understanding the cost dynamics of these clearinghouses is paramount for small to mid-sized businesses.

It’s common to find leading clearinghouses charging a monthly fee of $75 to $95 per provider or doctor for unlimited medical claims submissions. This fee typically pertains to the rendering provider, as indicated in box 24-J of the medical claim form.

However, a higher price tag does not always equate to superior service. Clearinghouses with steeper fees may not necessarily offer value commensurate with their additional cost. Thus, it’s essential for businesses to critically evaluate the cost-effectiveness of a clearinghouse before committing.

Businesses should know that checking eligibility usually incurs an extra charge and is not included in the monthly fee. The cost for eligibility verification is generally separate and should be considered in the overall expense evaluation. Small to mid-sized (SME) businesses looking to optimize their medical claims management should consider the costs, features, and potential return on investment when choosing a clearinghouse. Remember, a well-informed decision can significantly improve efficiency and cost-effectiveness in the healthcare billing process.

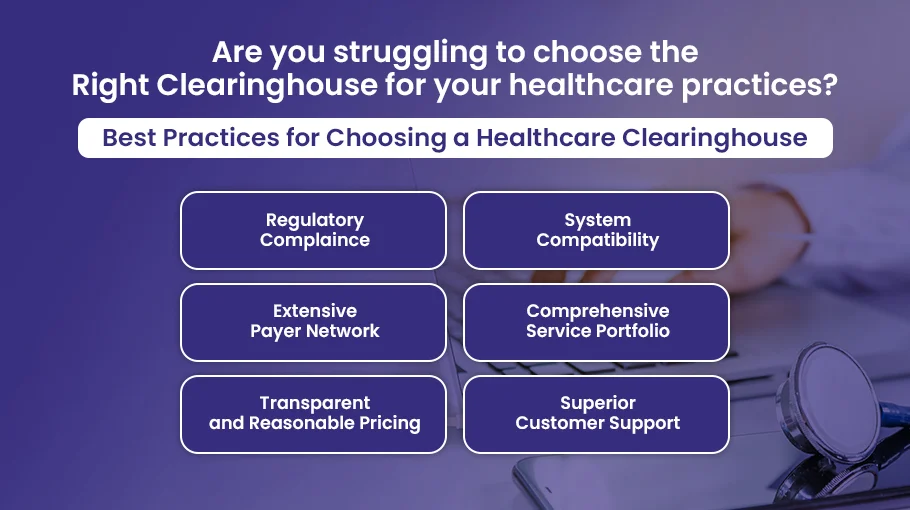

Remember, a healthcare clearinghouse is an extension of your practice and a strategic partner in your revenue cycle management. Careful consideration of these best practices will help to ensure a beneficial partnership that optimizes your claims process, reduces administrative burdens, and enhances revenue.

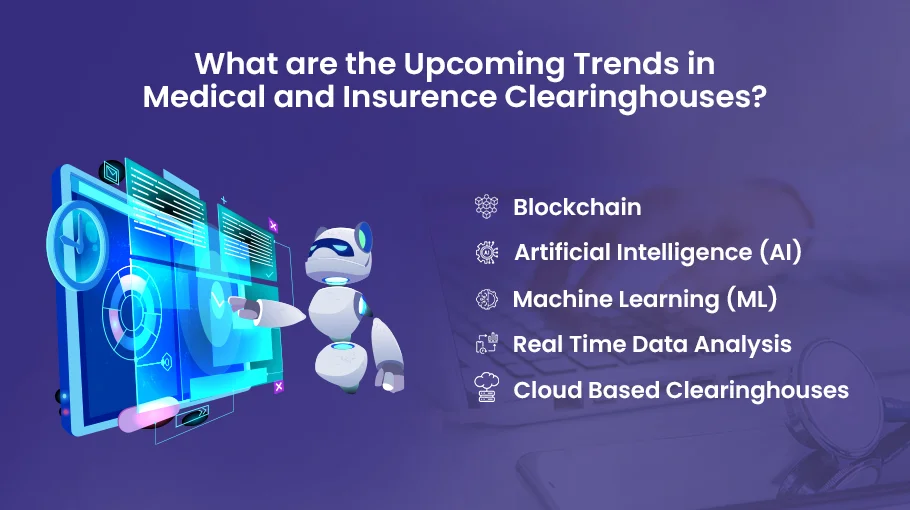

Upcoming Trends in Medical and Insurance Clearinghouses

Several emerging trends are poised to shape the future of medical and insurance clearinghouses:

➜ Artificial Intelligence (AI) and Machine Learning (ML) technologies are increasingly employed to further enhance the accuracy of claim scrubbing, reducing errors, and improving claim processing efficiency.

➜ Blockchain can offer greater security and transparency in healthcare transactions. It could transform how clearinghouses manage and validate data, reducing fraud and ensuring more reliable and secure data handling.

➜ Cloud-based clearinghouses are expected to gain prominence as the healthcare industry moves towards digitalization. These solutions provide scalability, accessibility, and cost benefits.

➜ Real-time data analysis can provide valuable insights into the claims process, helping providers and payers make decisions that are more informed, reduce denials, and improve the revenue cycle.

The Impact of Clearinghouses on the Healthcare Industry

Clearinghouses for medical claims have profoundly impacted the healthcare industry:

➜ By converting claim data into standardized formats like ANSI 837, clearinghouses have streamlined health information exchange, making data management more efficient.

➜ Through rigorous claim scrubbing processes, clearinghouses significantly reduce the error rate in claim submissions, leading to fewer rejections and denials.

➜ Clearinghouses have helped lower operational costs by reducing the need for manual, paper-based claim submissions, leading to significant cost savings for healthcare providers.

➜ Clearinghouses play a crucial role in ensuring HIPAA compliance in the healthcare industry, particularly in secure and privacy-complaint handling of patient information.

Improve Clean Claim Rates and Minimize Rejections with Bell MedEx’s Advanced Claim Scrubbing Solutions

Choosing Bell MedEx as your clearinghouse for medical claims will provide a technologically advanced, compliant, and effective solution to optimize your medical billing processes.

Here’s why choosing us is the best strategic decision for your healthcare organization:

★ Our team comprises professionals with in-depth knowledge of CPT, ICD-10, and HCPCS Level II coding systems and deep familiarity with payer-specific rules, ensuring accurate and compliant medical claim submission.

★ We offer seamless integration with leading Electronic Health Record (EHR) systems using HL7 interface standards. This results in streamlined data exchange, efficient claim submission, and real-time claim status tracking.

★ Our system adheres to the stringent data security and privacy requirements of the Health Insurance Portability and Accountability Act (HIPAA). All PHI is handled securely, ensuring your organization’s full compliance with regulatory standards.

★ We provide a cost-efficient solution with a transparent fee structure, eliminating the need for separate charges for eligibility verification, a service typically outsourced by other clearinghouses.

★ Our knowledgeable customer support team assists with EDI transactions, addressing any 837P and 837I claim form issues you may encounter.

★ Our sophisticated software performs rigorous claim scrubbing, detecting errors like missing modifiers, incorrect diagnosis codes, or wrong patient identifiers before submission. This dramatically reduces the risk of denials or rejections, improving your clean claim rate.

★ Our system is compatible with all major insurance payers, including Medicare, Medicaid, and private insurers. This universal compatibility simplifies the claims process, regardless of the patient’s coverage.

★ We offer automated, real-time patient eligibility checks, minimizing the risk of claim denials due to coverage issues and contributing to a more efficient revenue cycle management.

![Read more about the article Clearinghouse Rejection Codes [EXPLAINED]](https://bellmedex.com/wp-content/uploads/2024/10/blog-Fi-300x157.jpg)