Every year, thousands of healthcare providers lose Medicare revenue due to MIPS penalties. These penalties are imposed by the Centers for Medicare & Medicaid Services (CMS). And they can reduce a provider’s Medicare Part B payments by up to 9%. That’s not a small hit. For a solo practitioner billing $200,000 in Medicare services, that’s an $18,000 loss.

That is why it’s important for individual providers and clinic owners to fully understand MIPS penalties and how to avoid them. Read on to dive deeper and contact us if you need help staying proactive and avoiding these penalties.

What are MIPS Penalties?

MIPS penalties are payment reductions given by the Centers for Medicare & Medicaid Services (CMS) to eligible clinicians who don’t meet the MIPS program’s performance standards.

MIPS, short for the Merit-Based Incentive Payment System, is CMS’s method for tying Part B Medicare payment to performance. While top performers can earn financial bonuses, those who don’t meet CMS’s annual performance threshold face penalties. These are reductions to future Medicare reimbursements.

MIPS penalties are calculated as a negative percentage adjustment, ranging up to -9%, based on a provider’s Composite Performance Score (CPS). Scores below the national threshold trigger penalties, applied two years after the performance year. For example, 2023 MIPS scores affect 2025 payments.

As CMS continues to raise standards, more clinicians, including physicians, nurse practitioners (NPs), and Physician Assistant (PAs), are being penalized. Unless exempt, any MIPS-eligible provider who fails to meet the required benchmarks is at risk.

Why Are MIPS Penalties Applied?

CMS uses MIPS penalties as a way to push providers toward better performance. The goal is simple: move the US healthcare system from volume-based to value-based care. This way, CMS encourages clinicians to improve outcomes, reduce costs, and report their data accurately.

These penalties are part of a budget-neutral system. That means money taken from low-performing clinicians is used to reward high performers. The structure helps promote fairness and continuous improvement, but it also creates pressure. Even small mistakes or missed submissions can lead to a loss in revenue.

CMS enforces MIPS penalties through the Quality Payment Program (QPP). Each year, it reviews submitted data, sets a performance threshold based on national averages, and determines payment adjustments. As participation grows and thresholds rise, more providers risk falling below the cut-off. The system is built to reward effort, but it also punishes gaps.

How Do MIPS Penalties Work?

MIPS penalties work by cutting into a provider’s Medicare Part B payments. If you don’t meet the minimum score set by CMS for a given year, you get paid less, up to 9% less, depending on how far below the cutoff your score falls.

Here’s how the process works:

First, CMS evaluates each provider’s performance across four categories:

- Quality (30%)

- Promoting Interoperability (25%)

- Improvement Activities (15%)

- Cost (30%)

Your performance in each category is scored and combined into one number: your Composite Performance Score (CPS). Each year, CMS sets a performance threshold, a minimum CPS you must reach to avoid penalties.

For example, the threshold for the 2023 performance year (which affects 2025 payments) is 75 points out of 100.

If your CPS is below that threshold, CMS applies a negative payment adjustment to your Medicare claims. The size of the penalty depends on how far below the cutoff your score is. Clinicians who score 0 to 18.75 points receive the maximum penalty: -9%. Those closer to the threshold receive smaller cuts on a sliding scale.

The penalty doesn’t come all at once. It’s applied throughout the year to every Medicare Part B payment you receive, starting two years after the performance year.

Penalties are calculated at the TIN/NPI level, which means CMS can apply them to an individual clinician or to everyone in a group.

What Triggers a MIPS Penalty?

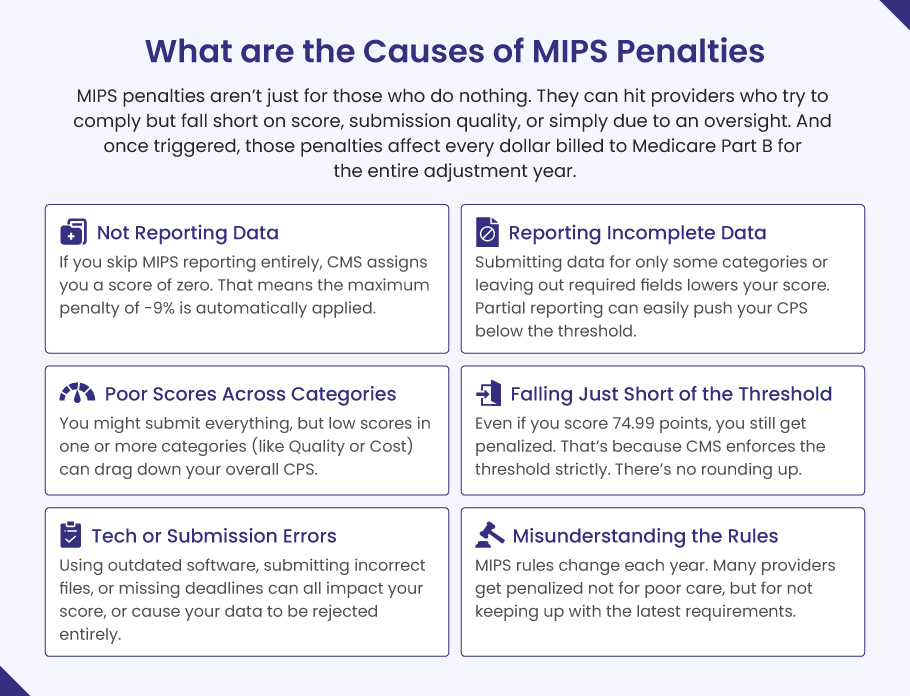

MIPS penalties are triggered when your Composite Performance Score (CPS) falls below the annual performance threshold set by CMS. For the 2025 payment year, that threshold is 75 points.

The most common triggers include:

❌ Not Reporting Data

If you skip MIPS reporting entirely, CMS assigns you a score of zero. That means the maximum penalty of -9% is automatically applied.

❌ Reporting Incomplete Data

Submitting data for only some categories or leaving out required fields lowers your score. Partial reporting can easily push your CPS below the threshold, even if your performance is decent.

❌ Poor Scores Across Categories

You might submit everything, but low scores in one or more categories (like Quality or Cost) can drag down your overall CPS.

❌ Falling Just Short of the Threshold

Even if you score 74.99 points, you still get penalized. That’s because CMS enforces the threshold strictly. There’s no rounding up.

❌ Tech or Submission Errors

Using outdated software, submitting incorrect files, or missing deadlines can all impact your score, or cause your data to be rejected entirely.

❌ Misunderstanding the Rules

MIPS rules change each year. Many providers get penalized not for poor care, but for not keeping up with the latest requirements.

In short, MIPS penalties aren’t just for those who do nothing. They can hit providers who try to comply but fall short on score, submission quality, or simply due to an oversight. And once triggered, those penalties affect every dollar billed to Medicare Part B for the entire adjustment year.

What Is the Penalty for Not Reporting MIPS?

If you don’t report MIPS data at all, and you’re not exempt, you’ll get hit with the maximum penalty. That means a 9% cut on all your Medicare Part B payments for the corresponding payment year. No data? Full penalty.

Here’s what that looks like in practice:

If a clinician bills $250,000 to Medicare Part B in a year, a 9% penalty means losing $22,500 in revenue. That’s a serious drop, especially for small or solo practices where margins are tight. This penalty doesn’t come in one lump sum. Instead, CMS reduces every Medicare payment by 9% throughout the year.

Does Practice Size Matter for MIPS Penalties?

Yes. The impact of MIPS penalties can be especially hard on small practices.

➜ Small practices: In 2022, about 27% of small practices and nearly 30% of solo clinicians received MIPS penalties (Source).

➜ Larger organizations: Bigger practices are more likely to have teams and tech to handle MIPS reporting, so they tend to avoid penalties more easily.

Even if you’re part of a group, failing to report individually (or not participating as a group) can still lead to individual-level penalties.

And it’s not just financial.

Not reporting MIPS also means you lose:

- A chance to earn positive payment adjustments.

- Visibility on CMS’s Care Compare site (which can affect patient trust).

- Access to performance feedback reports that help you improve care quality.

Some clinicians are exempt from MIPS automatically. These include:

- Providers new to Medicare in their first year.

- Those below the low-volume threshold (Under $90,000 in Part B charges or fewer than 200 Medicare patients).

- Participants in Advanced Alternative Payment Models (APMs).

If you’re not sure whether you qualify for an exemption, check directly with CMS or use their QPP participation status here.

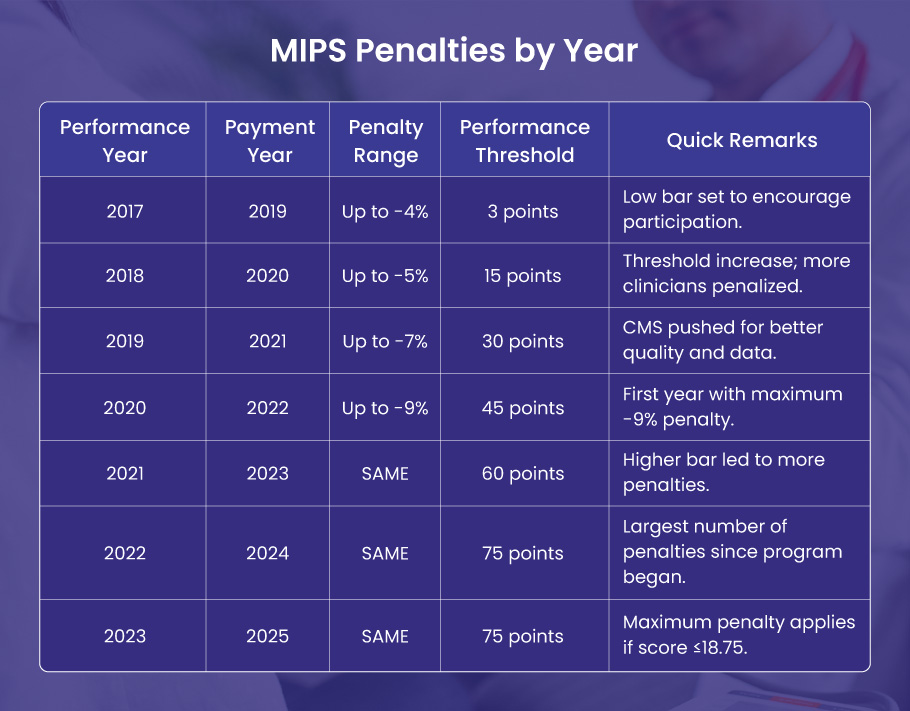

MIPS Penalties by Year (Historical Trends)

Since MIPS began, CMS has steadily increased both the penalty amounts and the difficulty to avoid them. The performance threshold has gone from just 3 points in 2017 to a demanding 75 points by 2022, and it’s stayed there.

Here’s a clear breakdown:

| MIPS Performance Year | Penalty Payment Year | MIPS Penalty Range | MIPS Performance Threshold | Key Notes for MIPS Penalties |

| 2017 | 2019 | Up to -4% | 3 points | Low bar set to encourage participation. |

| 2018 | 2020 | Up to -5% | 15 points | Threshold increase; more clinicians penalized. |

| 2019 | 2021 | Up to -7% | 30 points | CMS pushed for better quality and data. |

| 2020 | 2022 | Up to -9% | 45 points | First year with maximum -9% penalty. |

| 2021 | 2023 | Up to -9% | 60 points | Higher bar led to more penalties. |

| 2022 | 2024 | Up to -9% | 75 points | Largest number of penalties since program began. |

| 2023 | 2025 | Up to -9% | 75 points | Maximum penalty applies if score ≤18.75. |

MIPS Penalties: Impact, Criticism, and What Lies Ahead

For providers, the effects of MIPS penalties are wide-reaching. Financial losses from a full -9% cut can total tens of thousands of dollars, hitting small and solo practices the hardest.

Beyond lost revenue, compliance itself is resource-heavy. Accurate reporting across MIPS’s four categories; quality, cost, improvement activities, and interoperability, requires time, technology, and staff many practices lack. This burden often forces operational changes, from hiring consultants to investing in new EHRs or reorganizing workflows.

But the toll is more than operational.

Clinicians report burnout and frustration, especially when penalties stem from reporting technicalities rather than actual care quality. The pressure to meet metrics can pull focus from patient care, reducing both outcomes and satisfaction.

Also, MIPS scores are public, and a low rating can hurt a provider’s reputation, regardless of clinical performance. Appeals are allowed, but limited and often ineffective.

Criticism of the system is mounting. MIPS disproportionately penalizes small, rural, and independent practices that lack the resources for full compliance.

In 2024 alone, 27% of small practices and 18% of rural ones were penalized. Specialty providers, such as anesthesiologists and orthopedic surgeons, have also faced outsized challenges.

MIPS requires physicians to track and report across multiple categories, quality, cost, improvement activities, and interoperability. A JAMA study found that MIPS compliance costs about $12,811 per physician each year and eats up over 200 hours, time that could be spent on patient care.

Calls to cut MIPS burden are gaining traction. Physician groups like the American Medical Association (AMA) support replacing MIPS with the Data-Driven Performance Payment System. The new proposed program is reported to reduce penalties, simplify reporting, and better align metrics with care quality.

🚀 What’s Ahead?

CMS has signaled no major changes through at least 2026:

- Penalty cap: Still at -9%

- Threshold: Still 75 points

- Same 2-year lag: 2024 performance → 2026 payments

This makes MIPS penalties predictable, but also tough to avoid without strong performance and solid reporting.

How to Avoid MIPS Penalties

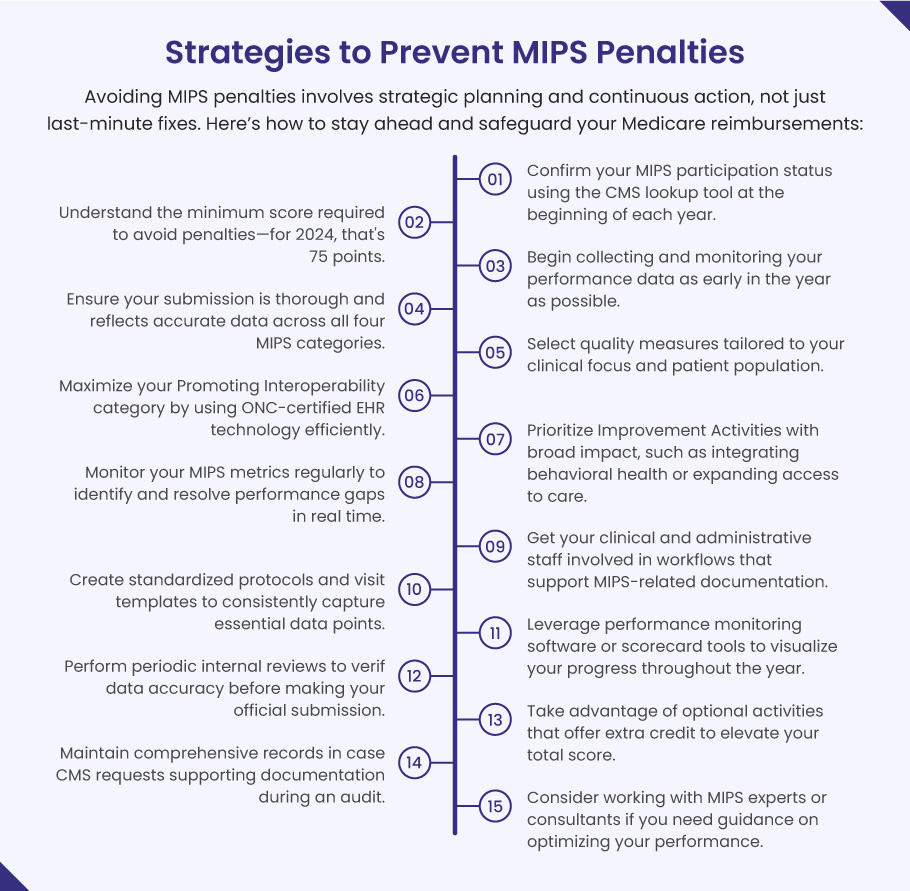

Avoiding MIPS penalties takes more than last-minute reporting. It requires proactive steps throughout the year. Here are proven ways to stay penalty-free:

- Check your MIPS eligibility with CMS at the start of the year

- Know the annual performance threshold (75 points for 2024)

- Start early with your data collection and tracking

- Submit complete and accurate data in all four MIPS categories

- Choose quality measures that match your specialty and practice

- Use certified EHR systems effectively to boost your Promoting Interoperability score

- Engage in high-impact Improvement Activities like care coordination and telehealth

- Track your MIPS performance monthly to catch issues early

- Involve your entire care team in documentation and workflow alignment

- Standardize checklists for visits to capture key MIPS data points

- Use dashboards or tools that show your real-time performance

- Conduct internal audits before submitting your final data

- Report bonus-eligible activities to gain extra points

- Document everything, CMS may request proof of activities

- Partner with MIPS consulting services if unsure how to improve your score

Get Expert Help and Peace of Mind with BellMedEx

MIPS isn’t just about checking boxes, it’s about protecting your revenue and your reputation as a healthcare provider. Working with a knowledgeable partner can make all the difference, especially when the risk of a 9% financial penalty is on the line.