Clearinghouse rejections are not denials, so you have the chance to fix the issue and get paid. That is good news because the insurance company can still pay the rejected claim once it’s fixed.

A clearinghouse rejection is a term that healthcare providers encounter when their claims are denied by the clearinghouse, an essential intermediary between the provider and insurance companies. This rejection happens when there are mistakes or missing details in the claim submission. This can include wrong patient or provider information, coding problems, or not enough documentation.

For healthcare providers, a clearinghouse rejection can cause a delay in getting paid for the services they provided. The provider needs to check why the claim was rejected, fix any mistakes, and then send the claim again to the clearinghouse.

★★★ Try Our Medical Clearinghouse for FREE ➡ ★★★

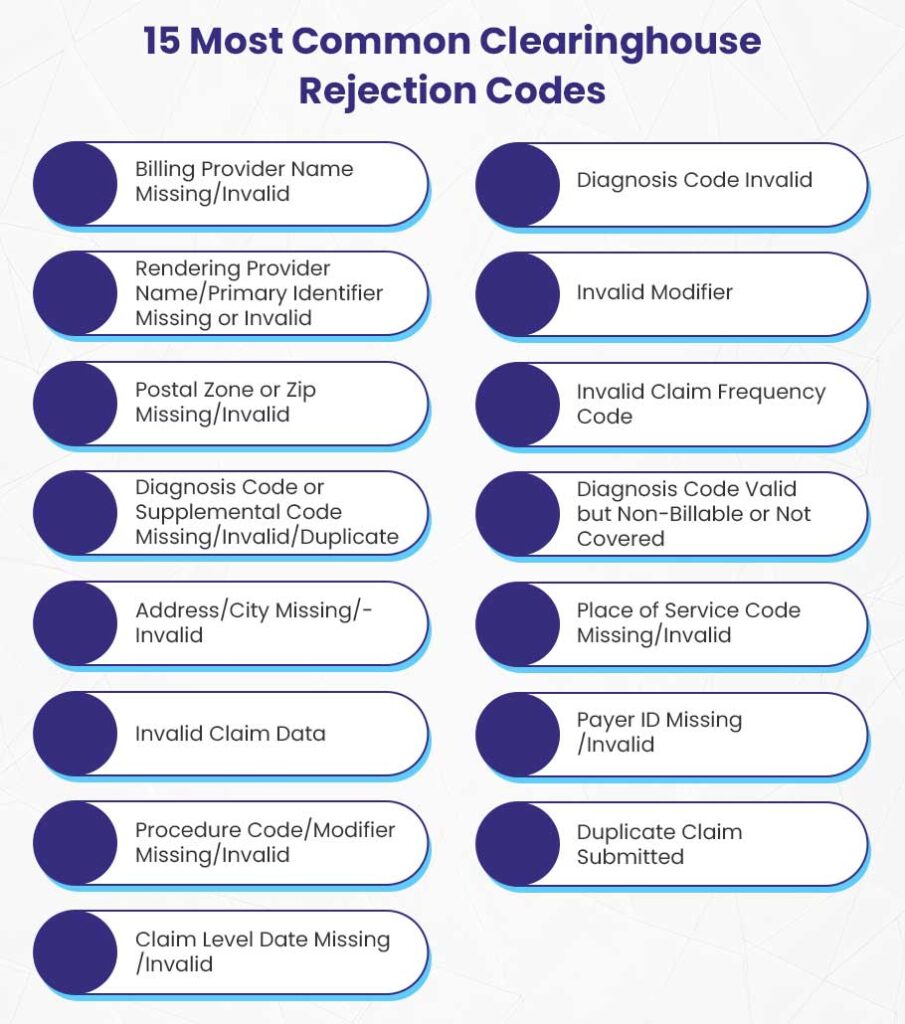

15 Most Common Clearinghouse Rejection Codes

Clearinghouse rejections can be frustrating, but they are important for keeping accuracy and following rules in healthcare billing. They make sure that claims are correctly formatted and meet the necessary requirements before being sent to insurance companies for processing.

This guide helps providers understand and resolve 15 most common clearinghouse rejection codes to get reimbursed faster.

1. Billing Provider Name Missing/Invalid

One common reason for clearinghouse rejections is when the billing provider’s name is missing or invalid. This happens if the claim doesn’t include the name of the provider or if the name doesn’t match the insurance records.

The billing provider is identified using a National Provider Identifier (NPI) and a tax ID number. If either of these is incorrect or not included, the payer will reject the claim.

To avoid this rejection, ensure that you have the correct NPI and tax ID for the billing provider. Double-check these details against the insurance company’s records before submitting a claim.

If your claim is rejected, you should verify that the NPI matches what the payer has on file. If there’s a discrepancy, correct it and resubmit the claim.

2. Rendering Provider Name/Primary Identifier Missing or Invalid

Another common clearinghouse rejection code is the missing or invalid name of the rendering provider, along with their primary identifier.

The rendering provider is the healthcare professional who actually provided the service to the patient. For claims to be processed, it’s important to include either the rendering provider’s state license number, Universal Provider Identification Number (UPIN), or another form of identification.

If this information is missing, the payer cannot process the claim.

To resolve this issue, ensure that all necessary identifiers are accurately included in the claim. Check with the rendering provider to confirm their identification details before submission.

It’s possible that the provider has recently changed their identification number or that the patient is no longer covered under their plan. The solution is to gather the accurate information and promptly address the rejection to streamline the resubmission process.

3. Postal Zone or Zip Missing/Invalid

Claims can also be rejected if the postal zone or zip code is missing or invalid. This clearinghouse rejection occurs when the zip code entered does not correspond to the address provided in the claim.

An incorrect zip code can happen due to simple typographical errors, such as transposing numbers or omitting digits. Accurate address information is essential for proper claim routing and processing.

To fix this issue, double-check the address on the claim against official records. You can use the United States Postal Service (USPS) website to verify the correct zip code for the address listed. Ensure that the city, state, and zip code all match and are valid, if your claim is rejected due to incorrect postal code.

4. Diagnosis Code or Supplemental Code Missing/Invalid/Duplicate

A claim may also be rejected if there is a missing, invalid, or duplicate diagnosis code. The diagnosis codes are important because they help the payer understand the medical necessity of the services provided.

Each diagnosis code, such as an ICD-10 code or CPT code, must accurately reflect the patient’s condition at the time of service. If there are discrepancies, such as a mismatch between the diagnosis and the provided code or if duplicate codes are present, the claim will not be processed.

To prevent this issue, review the diagnosis codes for accuracy before submitting the claim. Ensure that all necessary supplemental codes are included to provide a complete picture of the patient’s condition.

5. Address/City Missing/Invalid

The absence of complete and valid address information, including the city, can also lead to claim rejections related to clearinghouse. Errors in patient addresses occur when forms are filled out incorrectly, or if the patient has recently moved and provided outdated information.

Even small mistakes, such as typos or missing details, can trigger a rejection, as payers need accurate address data to process claims effectively.

To address this rejection, ensure that all address details are thoroughly checked before submission. If the claim is rejected, reach out to the patient to confirm their current address and correct any inaccuracies. This can include validating the street name, city, state, and postal code.

6. Invalid Claim Data

Invalid claim data occurs when the information submitted does not meet the payer’s standards, including incorrect patient details, service dates, or service descriptions. These are basic data entry mistakes, like typing errors, that can cause rejection.

For example, if a patient’s name is spelled incorrectly or their date of birth is entered wrongly, the payer will reject the claim due to this invalid data.

To resolve invalid claim data, double-check all information before submission.

Ensure patient details like names and dates are correct by checking them against the insurance card or electronic health record. Always verify the EDI Payer ID with the insurance company to ensure it matches your records.

If you realize that a patient has switched insurance plans or no longer has coverage, update their information accordingly. Implement a system for verifying insurance details during each patient visit to prevent the error.

7. Procedure Code/Modifier Missing/Invalid

Procedure codes and modifiers are important for claims, showing what services were given to patients. If a claim is missing these codes or has invalid ones, it will be rejected. This occurs if the coder uses the wrong codes or misses specific modifiers.

For example, if the modifier 25 (which shows a significant separate service) is needed but not included, the claim will be denied.

To avoid problems with missing or invalid codes, learn the Current Procedural Terminology (CPT) codes and modifiers for your practice. And use an updated coding software for accuracy.

Always check that your codes match the latest payer guidelines. When coding multiple services on the same day, ensure each code and modifier is correctly entered based on the patient’s visit.

Regular training for your staff on coding updates can help them submit correct claims. If you get a rejection for missing or invalid codes, check the claim details, fix any mistakes, and resubmit quickly.

8. Claim Level Date Missing/Invalid

Claim dates are important for processing claims because they show the timeline of care. Missing or wrong dates, like the date of service or submission date, can cause a claim to be rejected. These dates help the payer evaluate the claim correctly, as they indicate if the services were appropriate.

For example, if a patient got a service but the claim has an incorrect date, it may be rejected due to confusion about the time of the service.

To prevent problems with claim dates, ensure all necessary dates are recorded correctly during patient care, including the date of service, admission date, and discharge date if needed. Use an efficient practice management software that reminds you to enter dates before submission.

Always double-check the dates for accuracy against the patient’s medical records.

If a claim is rejected because of an invalid date, check the patient’s file for the right information and update the claim. Keeping accurate records not only helps claims get accepted but also supports improved documentation.

9. Diagnosis Code Invalid

Diagnosis codes are important for describing a patient’s condition and determining services. If a diagnosis code is valid but not billable or doesn’t meet payer requirements, the claim can be rejected.

For example, using “F42” (OCD) without proper details can lead to rejection.

To avoid issues, always check that your codes follow the latest ICD-10 guidelines. Ensure each code is valid and relevant to the services provided. Use coding tools to confirm correct codes and regularly train your coding staff on updates.

If a claim is rejected due to an invalid code, check the payer’s specific requirements. Some may need more details like laterality or severity. Fix any issues and resubmit the claim quickly for faster payment.

10. Invalid Modifier

Modifiers play a crucial role in the medical billing process by providing important details about the services provided. If a claim includes an invalid modifier, it may be rejected by the payer.

For example, using the modifier 95 for telehealth services when it is not accepted by the payer can result in a claim rejection.

Invalid modifiers often arise from not staying updated on the specific requirements of each payer or incorrectly applying them based on the service location.

To prevent this, familiarize yourself with the modifiers accepted by each insurance company, as their rules can vary. Check the payer’s guidelines before submitting claims to ensure that the modifiers accurately represent the services rendered.

You can also conduct regular audits of submitted claims to identify trends in rejected modifiers, helping you take corrective actions. If you get a rejection due to an invalid modifier, review the claim to identify the correct modifier for the services. If necessary, contact the payer for clarification.

11. Invalid Claim Frequency Code

The Invalid Claim Frequency Code occurs when a claim resubmission uses an inappropriate frequency code, such as code 6.

Each claim submission must specify a frequency code to show status of the claim, especially when re-submitting a previously denied claim. Valid resubmission codes include 7 for “replacement of prior claim” and 8 for “void/cancel prior claim.”

Using an invalid frequency code happens when you have some misunderstanding of coding requirements or oversight during the claim submission.

For example, if a provider mistakenly uses code 6, the clearinghouse will reject the claim because it does not comply with payer specifications.

To resolve this clearinghouse rejection code, providers must adjust the frequency code to either 7 or 8, depending on whether the claim is a replacement or a void. Also, check the clearinghouse or payer guidelines to prevent this error.

12. Diagnosis Code Valid but Non-Billable or Not Covered

You get this clearinghouse code rejection code when a submitted diagnosis code is technically valid but is either non-billable or not covered by the payer. The claim cannot be processed without the right codes that indicate billable conditions.

Providers may get this rejection because they don’t know which diagnosis codes are covered by specific insurance plans. Even valid codes can sometimes fall outside the covered conditions for particular policies, leading to rejection.

For example, a patient diagnosed with a common cold might be assigned a diagnosis code that the insurer does not cover.

To fix this issue, providers must review the patient’s insurance plan details and confirm which diagnosis codes are eligible for reimbursement. Adjusting the claim to include a billable diagnosis code is crucial for resubmission.

13. Place of Service Code Missing/Invalid

This code shows that a claim is missing a required place of service (POS) code or that the provided code is incorrect. The POS code is essential as it tells the payer where the medical service was provided.

Errors in entering the POS code or neglecting to include it can lead to this rejection. Providers may also misunderstand which codes are acceptable for different types of services.

For example, if a provider treats a patient at a hospital but forgets to append the correct POS code, the claim will be rejected.

To resolve this rejection, providers must ensure that the correct POS code (for hospital, outpatient facility, or the patient’s home) is appended.

14. Payer ID Missing/Invalid

The providers get this clearinghouse rejection code when a claim is submitted without a necessary payer ID or with an incorrect one. The payer ID is crucial for routing the claim to the correct insurance company for processing.

Common reasons for this rejection are typing errors when entering the payer ID or using an outdated or incorrect ID number. This can happen if providers do not regularly update their records for different payers.

For example, if a provider submits a claim to ABC Insurance using the ID for XYZ Insurance, the claim will be rejected.

To fix this, providers should double-check the payer ID against their records and ensure that the correct ID is used for each claim submission. Keeping an updated list of payer IDs can help avoid future issues.

15. Duplicate Claim Submitted

A duplicate claim is also one of the most common clearinghouse rejection codes providers get when a claim is submitted more than once for the same service. Each claim must be unique to avoid this rejection.

Duplicate claims may result from clerical errors, such as re-submitting a claim without realizing it was already sent. Providers might also submit claims at different intervals, thinking they are for different dates of service.

For example, if a provider submits a claim for a consultation and later submits another claim for the same consultation without adjusting the claim number, the second submission will be rejected as a duplicate.

To address this issue, providers should maintain accurate records of submitted claims, including dates and services rendered. If a claim was indeed submitted twice by mistake, it should be identified and corrected before resubmission.

Clearinghouse Rejections?

We’ll Shut That Down! 😎

Don’t let clearinghouse rejections rob you of your hard-earned money. BellMedEx’s medical coding service will make sure those rejection codes don’t stand a chance, paving the way for timely payments and a stress-free financial life.

![You are currently viewing Clearinghouse Rejection Codes [EXPLAINED]](https://bellmedex.com/wp-content/uploads/2024/10/blog-Fi.jpg)