Key Insights

➟ When healthcare providers are paneled with insurance companies, they can become in-network doctors and reach a greater number of patients.

➟ The process involves several crucial steps: preparing documentation, researching insurance companies, submitting applications (often through CAQH ProView), and following up on application status.

➟ Joining multiple insurance networks increases patient access, boosts revenue potential, strengthens professional credibility, and allows for providing more affordable care options to patients, ultimately improving practice growth.

Do you want to help more patients and make your treatment better? Insurance paneling can help you a lot! More people can use your health care services when you join well-known insurance companies via insurance paneling.

Are you not sure what to do with the process of medical insurance paneling? Remember not to worry!

We’re here to help you all the way through.

Get to know the people who are giving out credentials i.e. the credentialing panel. It tells you what to do and what paperwork is needed to verify your skills. It will also help you meet the standards if you know the paneling rules for each insurance company.

Follow these simple steps to learn about insurance panels and help your practice grow. Let’s start!

Get paneled with any insurance company of your choice! 🔮

Understanding Insurance Paneling In Healthcare

An insurance panel refers to the list of healthcare providers that a health insurance payer (e.g. insurance company) has contracted with to provide medical services to its members at pre-negotiated rates. Joining an insurance panel means that a healthcare provider, such as a therapist, psychologist, or counselor, has entered into an agreement with a health insurance company to become an in-network provider for that insurer.

As an in-network provider, the healthcare professional agrees to the insurer’s contracted rates for services rendered to the insurance company’s members. In return, the provider gains access to the insurer’s covered patient population, with the advantage that patients face lower out-of-pocket costs for services from in-network providers compared to out-of-network providers.

Important terms related to insurance panels include in-network providers, who are healthcare professionals that have joined an insurer’s panel, and out-of-network providers, who have not contracted with a particular insurance company. Health insurance payers create provider networks by credentialing and contracting with providers who meet their criteria.

In contrast, providers who remain out-of-network do not join insurance panels. Out-of-network providers can set their own rates and are not bound to the terms and conditions set by insurers. They provide services to patients covered by that insurance, but the patient must pay upfront and submit claims themselves to seek reimbursement from their insurer at the out-of-network rate. Here the provider does not get paid directly by the insurer.

Tired of Credentialing? Outsource and Sleep Easy! 😴

Tossing and turning over your credentialing workload? The solution is simple – let us handle it for you! Our experts diligently manage every detail of the process so you can relax.

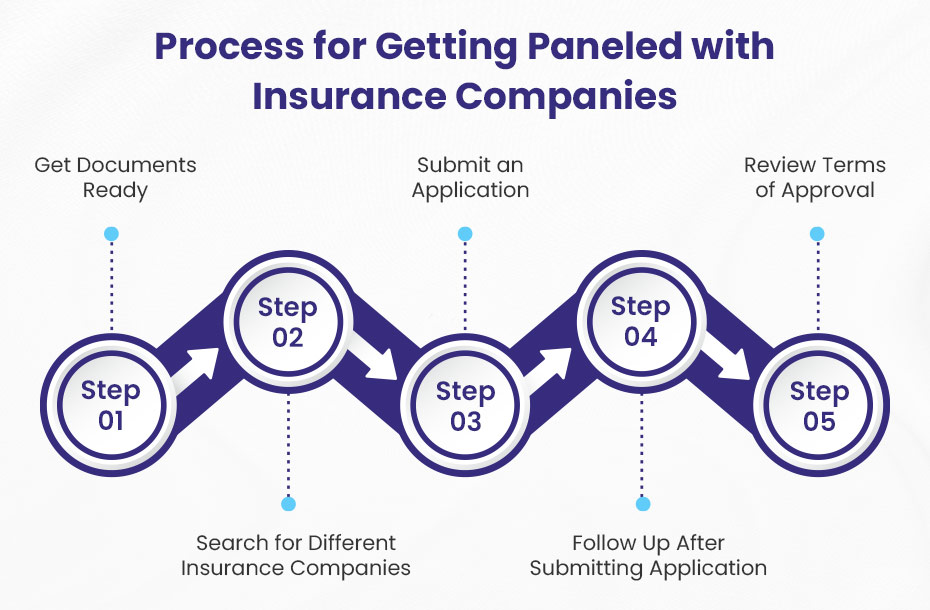

Step-by-Step Process for Getting Paneled with Insurance Companies

When you get paneled with an insurance company, you agree to work with them as a provider for a certain health insurance plan. After this insurance paneling, patients with a certain health insurance plan can come to your practice for care, and you can bill their insurance company for it.

Do not forget! Remember! Insurance companies only prefer paneling those healthcare providers who can help them manage healthcare costs. They are always on the lookout for medical service providers who will take less money. In contrast, health care workers want to work with insurance companies that will pay them more for their services. So finding the perfect insurance company to get paneled with becomes challenging for a doctor, but not impossible.

Here is a step-by-step guide on how to get paneled with insurance companies as a healthcare provider:

Step 1: Getting Your Documents Ready

Before applying to get paneled with insurance companies, you will require a lot of information and documentation. It is crucial to arrange these documents to avoid any kind of delay and denial in your application approval.

The documents are:

- Licensure information

- Practice address

- NPI number

- Resume

- Proof of malpractice insurance

- Taxonomy code (if you plan to bill Medicare/Medicaid)

- Proof of liability insurance from your landlord (if you rent)

- Advanced training or credentialing paperwork (if you have any)

💡 These documents are important in provider insurance paneling for several reasons:

Verifying Credentials: Insurance companies use proof of qualifications and work history documents to make sure that providers meet the credentialing panel standards.

Meeting Paneling Criteria: Providers need to show that they meet the insurer’s requirements. This could mean showing their licensing, malpractice insurance, or proof of schooling.

Getting Approved Quickly: Documents that are well-organized and clear will help keep your application from being held up or turned down, which makes it easier to join an insurance panel.

Step 2: Searching For Different Insurance Companies

Now as you have arranged all these documents, it’s time to look for different insurance companies. Keep in mind that each insurance company has its own rules and payment rates. Even some of the companies require years of experience before they’ll sign insurance paneling agreements with you.

Therefore, before you look for an insurance company, here are some important things to keep in mind:

✅ Network Size — Look for insurers with large coverage networks in your geographic area to gain access to more potential patients. Larger insurers like UnitedHealthcare, Aetna, and Blue Cross Blue Shield often have expansive networks.

✅ Reimbursement Rates — You should compare the rates that different insurers offer for the typical procedures you do. Higher rates mean more revenue per patient visit. Get the fee plans from each insurance company to help you decide which one to go with.

✅ Experience Requirements — Some insurers require 1-2 years of practice experience before they will accept you as a provider. Therefore, when choosing an insurance company, you should look at these requirements and pick one without strict experience requirements.

✅ Credentialing Timeline — Keep in mind that provider insurance paneling process could take 3 to 6 months. Therefore, we advise you to pick plans like Cigna and Humana that can get you credentialed faster so you can start sooner.

✅ Payment Reliability — Make sure that insurance companies pay claims on time. You can find out about this by reading online reviews and asking coworkers about their own experiences. This step is very important because it will help you make steady money, which is important for any healthcare business.

✅ Plan Types — Determine which types of plans are dominant in your area – PPOs, HMOs, EPOs, etc. After that, focus on insurance companies that offer those specific plans to get in touch with more patients in your target area.

✅ Value-Based Care Initiatives — Check with each insurance company to see what role they play in value-based care models, such as responsible care organizations (ACOs) or patient-centered medical homes (PCMHs). These programs can change how care is given and how much is paid for it.

✅ Administrative Support — Last but not least, look for insurance companies that offer helpful tools like online portals, electronic claims filing, and specific reps for providers. This help could make it a lot easier for your team in the administrative process.

In addition, applying to 3-5 insurance companies that align with your geographic location, specialties, experience level, and business needs can position your practice for success as an in-network provider.

Step 3: Submitting The Credentialing Application

Health care workers must send a separate application to each health insurance company they wish to work with in order to begin the provider credentialing and paneling process.

Now, here’s a handy tip: many insurance companies use the Council for Affordable Quality Healthcare (CAQH) for provider insurance paneling. The streamlined application system created by CAQH is called CAQH ProView, and it really helps providers get their credentials more quickly.

Once you’ve sent your application via CAQH, the insurance company you’re targeting will provide you with a unique application number. This number is quite useful because it allows you to see where your application stands in the credentialing process and helps you keep track of everything.

The CAQH ProView application serves as a centralized repository for your professional and practice information. This means you won’t have to submit separate applications to multiple insurance companies, which is a real time-saver. This feature reduces administrative burden and ensures consistency in the information you provide to payers.

Now, it’s very important to get the entry form right. Make sure to include all the necessary documents, such as your professional license, certifications, malpractice insurance, and details about your business. Paying close attention to every detail when you apply will help speed up the process.

💡 Once your application is sent and approved, remember to keep track of the information you provided, especially your CAQH ProView ID and login details.

Every few months—or about two to three times a year—insurance companies may ask you to confirm that the information on your application is still accurate. It’s essential to respond quickly to these requests for re-attestation. If you don’t, it could slow down or even halt the insurance companies from processing your medical billing claims, which is something you definitely want to avoid!

Step 4: Following Up After Application

Once you send your insurance paneling application to the health insurance company, you should check back soon. Most insurance companies will give you an idea of how long it will take to get your credentials, which is generally between 4 and 6 weeks. Check in with the provider relations group again in 4 weeks to see how your application is going.

Make sure you have your NPI number, Tax ID number, and application reference number with you when you follow up. Make sure they got your complete application. This includes everything that is attached, like licenses, certificates, liability insurance, and a DEA certificate. Make sure that no more information is needed to finish the process of getting credentialed as an in-network provider.

If the application is still being worked on, follow up again in 6 weeks. Always following up in a professional way lets them know that you want to be a part of their network.

If your application is turned down, request the reasons in writing. Not having enough malpractice insurance or not being eligible for Medicare are some common reasons for rejection. Fix any issues and try again.

In your subsequent application, mention improvements like extended hours, bilingual staff, EMR systems, or new services offered. Joining provider panels can take persistence through multiple application cycles.

You can finish the process quickly if you keep checking on your credentialing application. Checking status routinely demonstrates your commitment to the insurer’s network and patients.

💡 What steps should I take if the insurance company doesn’t have an available slot for my paneling?

If insurance companies do not have open slots for your specialty, even though you meet their requirements, do not feel discouraged. It is important to build relationships and keep in touch with providers regularly.

Here’s what you can do if the insurance company does not have an empty paneling slot for your practice:

🥨 Keep in touch with their provider relations representatives to show you still want to join their network. Request to be informed right away if a panel slot becomes available.

🥨 Think about adding more certifications or services to cover any gaps in your network. Tell the insurance providers about these updates.

🥨 Ask about any pending recruitment plans for your specialty or service area. Offer to assist with credentialing pre-screening if they are proactively preparing to expand their network.

🥨 Look for chances to meet face-to-face with medical directors or provider relations to build a better relationship. Discuss the potential mutual value of bringing you into their network.

🥨 Request to be waitlisted if they have an existing waitlist for potential new providers. This gets your foot in the door when slots become available.

🥨 Work together with hospitals, health systems, or big groups nearby that might have influence with payers. Alignment with key entities can strengthen your position.

Staying determined and building connections are important when there are not enough open panel slots. Think about expanding your area of expertise or services to attract more people. Keep in touch with payers to show that you want to join their network. By planning carefully, you can put yourself in a good position when openings come up.

Step 5: Reviewing The Terms of Approval

Once insurance companies agree to let you join their network of providers, it’s important to read the terms and conditions carefully before signing any contracts. This will help keep problems from happening in the future.

Key things to look over:

✅ Reimbursement Rates — Look over the fee schedules for your specialty to make sure the rates of reimbursement are fair. Keep a close eye on the relative value units (RVUs) that go with the CPT codes you bill most often.

✅ Billing and Coding — Make sure you can meet all the standards for billing and coding. You should know what variations, CPT codes, and ICD diagnostic codes are accepted. Also, look over how to submit claims, when they need to be sent, and whether electronic or paper claims should be used.

✅ Authorization Requirements — Write down any permissions, referrals, or other paperwork that you need to get before you can perform certain medical services or procedures.

✅ Contract Exclusions — Look out for exclusions for medical services, procedures, diagnoses, or types of providers that you might want to offer.

✅ Appeals Process — Understand the process and timeframes for claim appeals and denials.

✅ Penalties — Carefully review any fines, fees that need to be paid back, or other punishments for not following medical billing rules or other terms.

✅ Provider Portal Access — Make sure you can get to the portals that let you check on things like a patient’s eligibility, the state of their claims, the authorization requirements, and more.

Checking the contract terms carefully before signing will help you avoid problems and make sure the process goes smoothly with the payer. Use the network contract checklist and also have a lawyer look it over.

Credentialing is a Time-Suck!

Outsource it Now! 🤩

If credentialing is eating up your precious time, we have the solution. Our dedicated team gets you credentialed lightning-fast so you can spend more time with patients. Outsourcing is the secret weapon to free up your schedule.

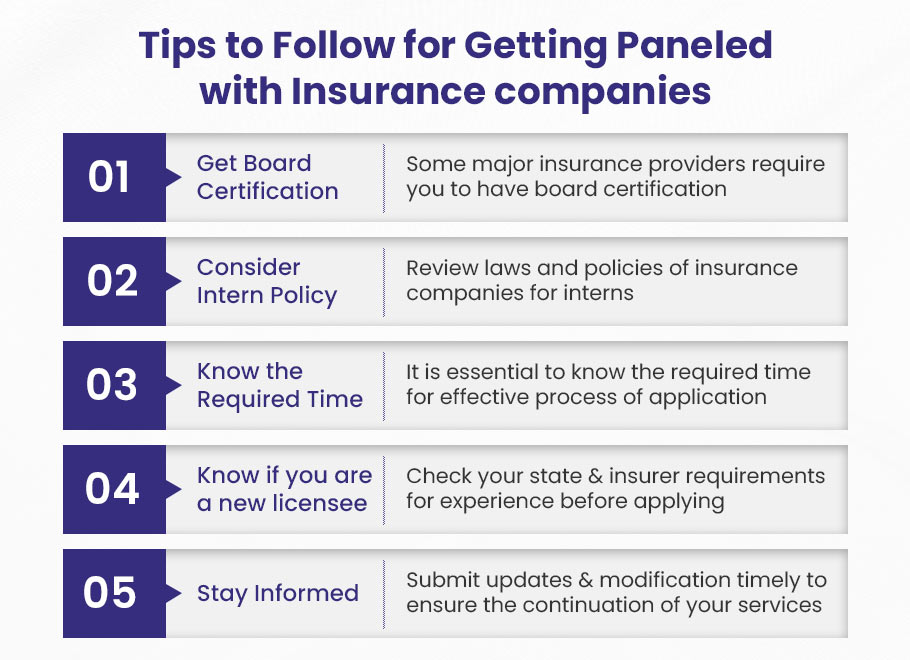

Some Important Tips

Here are some important things to keep in mind that could make it easy for you to get on the insurance companies’ lists and keep you out of trouble.

➡️ Get Board Certification

Getting board certification is an important step you don’t want to skip if you want to be accepted by big health insurance companies. This license is very important because it shows that you’ve been trained and tested very carefully in your field. It’s all about showing that you meet the high standards of ethics and practice that insurers want to see.

Most big insurance companies need this license to make sure that the doctors in their network are providing good care. So, when you’re done with your residency, you can choose to take an exam in your field, whether it’s internal medicine, pediatrics, or something else. Passing that test shows that you know what you’re talking about and are dedicated to keeping updated in your field.

Certain smaller insurers might not need board qualification right away, but having it makes you much more competitive. It’s a great way to show that you are committed to giving excellent care that is based on convincing evidence. So, you should definitely think about it!

➡️ Consider Intern Policy

When working with insurance companies as a healthcare provider, it is important to carefully consider your intern policies. Unlicensed interns, even if they have finished their degrees, are often not credentialed to bill for services on their own. In some states, Medicare and Medicaid let billing happen under a supervisor. But in other situations, this might be considered insurance fraud. To prevent problems, look up the laws in your state and understand the insurance policies for interns from each insurance company. If you check the rules carefully at the start, you can feel sure about making internship opportunities that follow billing regulations.

➡️ Know The Required Time

When you apply to work with insurance companies, it is important to know how long they take to review and approve your application. Every carrier has its own rules about how long the vetting process will take. Check how long it usually takes to get things done. This will help you know what to expect. Knowing the needed time helps you check in at the right times. During the paneling process, there are often many requests back and forth. It is important to keep track of response times to avoid delays on your side. Following the insurer’s schedule shows your professionalism and dedication to building the partnership.

➡️ Remember Previous Disciplinary Action (if any)

When you apply to get paneled with insurance companies, it is very important to be honest about any past disciplinary actions against you. Having a record of discipline does not mean you will be disqualified. However, if you do not tell about it, it can hurt your trustworthiness and slow down the approval process. Insurance companies will check your background very carefully, so being honest is always the best choice. Explain what happened with the discipline and highlight the good actions you have taken since that time. Showing that you have grown and take responsibility can help reduce worries. If you are honest and clear, you can still be accepted even if you had a past issue.

➡️ Know If You Are A New Licensee

Some insurance payers like to choose providers who have many years of experience before bringing them on board. As a new licensee, find insurance companies that accept new practitioners. You might also think about starting with Medicaid or Medicare if your state permits new providers. Build up your patient roster and get that initial experience. In one or two years, you will be better able to meet stricter requirements from commercial insurers. Do your homework first. This way, you won’t waste time applying to panels that will not accept you.

➡️ Stay Informed

For healthcare workers, getting on the panels of insurance companies is a big deal, but it’s only the start. Learn the most recent rules and guidelines from these insurance groups. This is the most important thing you can do to keep a friendship going on with them.

Insurance firms are very active and often change their rules to keep costs low and help people get good care. Stay alert and watch for these changes. It will be simple to make your business fit what they want. Through trust and following through, this builds a strong connection that lasts. It also makes sure that you can keep your services running. Be ready to learn something new all the time. Read insurance company papers, go to their seminars, and communicate with the relevant people in your field every day.

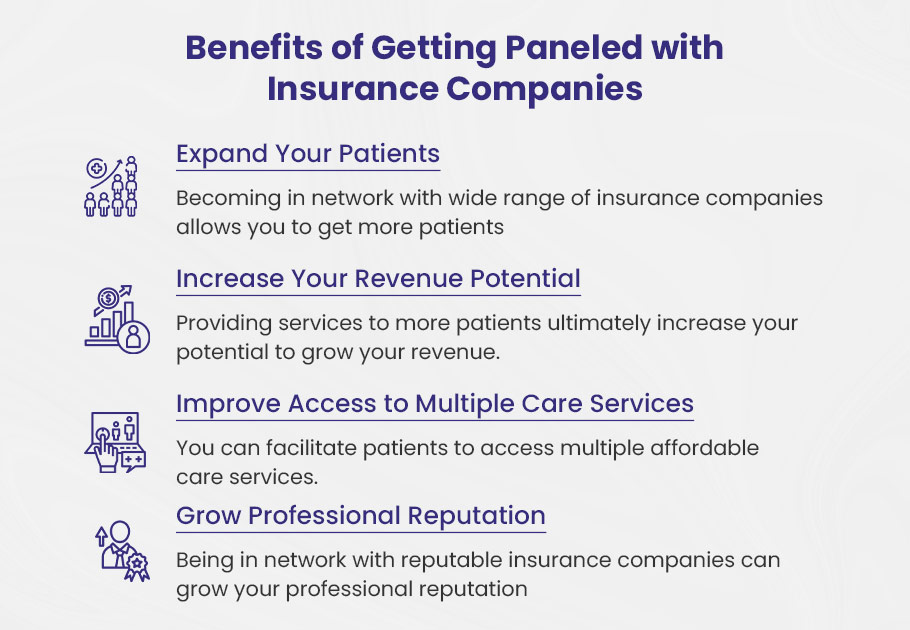

Benefits Of Getting Paneled With Insurance Companies

Getting paneled with insurance companies brings many benefits to healthcare providers. The most notable of them is that it opens windows to new opportunities, and assists you to grow footfalls of patients to your practice.

✅ It Gets You More Patients.

When you join a lot of different insurance networks, you can get more patients who can use their plans to find your healthcare office and get care services.

✅ It Boosts Your Chances Of Making Money.

More people will be able to get medical care from you if you are on the panels of more insurance companies. With this, you may be able to potentially make more money.

✅ It Makes It Easier For People To Get Multiple Care Services.

You can make it easier for people to get a variety of low-cost medical services. People who really need care but can’t pay for it will benefit from this.

✅ It Improves Your Professional Image.

One way to boost your credibility as an insurance agent is to be in network with respectable firms. This proves that your schooling, experience, and license are at the very best level required by these insurance companies.

🚀 Still Doing Credentialing Yourself? Stop the Madness!

Credentialing is a beast. It’s time to stop the do-it-yourself madness!

Our medical credentialing service empower you to see patients months sooner than doing it yourself.

No more staying late or working weekends on credentialing. Outsource to us and take back your evenings and weekends!

Assisting with billing, credentialing and enrollment, BellMedEx has been consistently reliable from the first day of our relationship.

Dr. Mike

Internal Specialist Medicine

Top Features

✓ Provider Enrollment

✓ Provider Credentialing

✓ Provider Privileging