Small practices often grapple with managing their Accounts Receivable (AR). Ensuring quick AR recovery is not just about getting payments on time; it’s about building sustainable patient relationships, maintaining operational efficiency, and, most crucially, safeguarding the financial pulse of the practice. If you’re a small healthcare practice seeking to improve your AR recovery rate, this guide is tailor-made for you.

Understanding Account Receivables

Accounts Receivable (A/R) in healthcare refers to the outstanding amounts owed to a healthcare provider, a local clinic, a physician’s office, or a larger hospital. This usually comprises unpaid patient bills and insurance company reimbursements.

The A/R Process

Billing and Claim Initiation

Once a patient receives medical care, your practice generates a bill or, if they have insurance, submits a claim to their health insurer.

A/R Stage

From the moment the bill is generated or the claim is submitted until the payment is received, the account remains in the A/R category.

Payment Completion

When the patient settles their bill, or the insurance company processes the reimbursement, that specific A/R is closed.

Age-Based A/R Categories in Healthcare RCM

1. 1-30 days

2. 31-60 days

3. 61-90 days

4. 91-120 days

5. Over 120 days

Why Should Small Practices Prioritize A/R?

For small healthcare practices, understanding and effectively managing A/R is crucial. Not only does it ensure a stable cash flow, but it also positions the practice for sustained growth and success.

Financial Health

A high A/R means money owed to you isn’t in your bank. This impacts cash flow, affecting the practice’s ability to function smoothly and compensate staff.

Risk of Non-payment

The longer an invoice remains unpaid, the harder it becomes to collect the total amount. Over time, these might become ‘bad debts,’ which are amounts you’ll likely never recover.

Operational Efficiency

Efficient A/R management ensures a healthier financial flow, enabling you to provide better services, invest in new equipment, and grow your practice.

7 Practical AR Recovery Tips for Small Practices

Managing accounts receivable is essential for the financial health of any business, but it’s especially pertinent for small practices that may not have vast resources. Streamlining and enhancing your AR recovery process can significantly boost your cash flow and profitability. Here are seven practical tips to improve AR recovery for small practices:

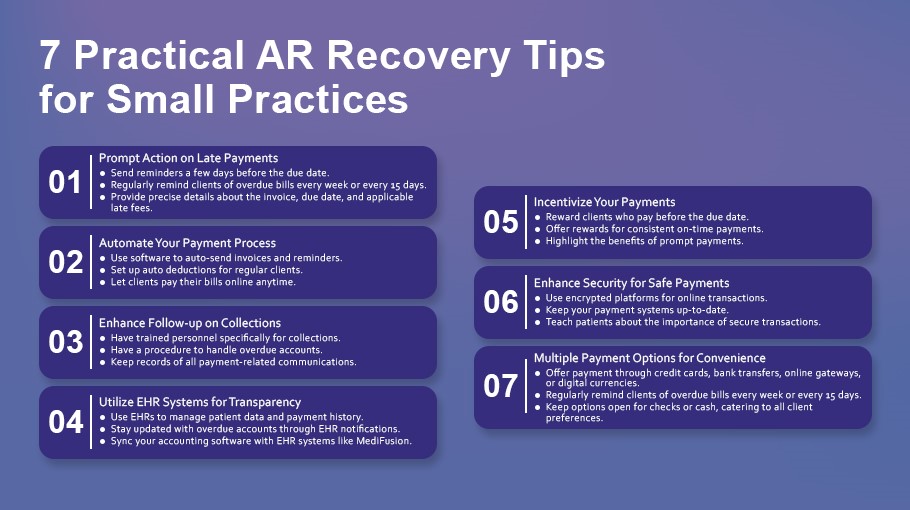

Prompt Action on Late Payments

Late payments can harm the cash flow of small practices. Ensuring timely payment for pending bills is essential to avoid any difficulty. Here’s what small practices should do to increase the A/R recovery process:

Timely Reminders

Start by sending reminders a few days before the payment is due. This can serve as a gentle prompt for clients or patients.

Consistent Follow-up

If payments are overdue, consistently follow up at regular intervals, such as every week or every 15 days. Being persistent without being aggressive can remind patients of their outstanding balances.

Clear Communication

Ensure your communication is clear, precise, and professional. Provide all relevant details related to the invoice, including the due date, the outstanding amount, and any applicable late fees.

Automate Your Payment Process

The payment process can be considerably improved by automation. Small practices should automate their payment process to reduce resource usage, decrease processing time, and speed up the entire process. Moreover, small practices can take these steps.

Billing Software

Invest in billing software that automatically sends out invoices, reminders, and alerts for late payments.

Recurring Payments

If appropriate, set up automatic deductions or recurring payments for clients with regular transactions.

Online Payment Portals

Integrate online payment portals that allow clients to settle their bills 24/7.

Enhance Follow-up on Collections

To receive the highest payment from the insurance companies, small practices must take care of denied claims and reopen them. Practices must keep on following up on collections. In this way, they can increase the A/R recovery. Practices must do these things to optimize the process more.

Designated Staff

Assign dedicated personnel to handle collections. Regularly training them ensures they approach the task effectively and professionally.

Focus Overdue Accounts

Have a straightforward procedure for focusing overdue accounts, such as involving a collections agency after a particular period.

Documentation

Maintain thorough records of all communications related to late payments.

Utilize EHR Systems for Transparency

Electronic Health Record Software (EHR) can help practices manage billing operations from patient registration to payment collection. Small practices should use EHRs for a swift A/R recovery process.

Patient History

Manage patient registration, details, payment history, and more using an electronic health record (EHR).

Notifications

Remain informed with modern EHRs like MediFusion that can automatically notify you of overdue accounts, ensuring none slip through the cracks.

Integration

Integrate your existing accounting or billing software for streamlined operations with an efficient EHR system like Medifusion.

Incentivize Your Payments

Small practices can improve the A/R recovery process by offering discount offers. They can offer various payment plans to provide patients with convenience. Practices should offer incentives on payment collections like:

Early Payment Discounts

Offer discounts to clients who pay their invoices before the due date.

Loyalty Programs

Consider setting up loyalty programs where consistent on-time payments earn points or rewards.

Transparent Communication

Communicate the benefits of early or on-time payments, emphasizing how it benefits both parties.

Enhance the Security for Safe Payments

Secure payment collection is the need for small practices. The practices must follow these steps to make the A/R recovery more secure and safe.

Secure Platforms

Use trusted and encrypted platforms for online payments.

Regular Updates

Ensure your payment systems are updated to guard against potential threats.

Educate Patients

Educate your patients on the importance of safe transactions and how to recognize potential red flags.

Multiple Payment Options for Convenience

Practices should not bind the patients only in one payment method. They must offer multiple payment options for patients’ convenience to enhance and increase the payment collection.

Multiple Options

Offer various ways to pay, such as credit cards, bank transfers, online payment gateways, or even digital currencies if viable.

Mobile Payments

Ensure your payment portal is mobile-friendly, as many clients prefer to pay via mobile devices.

Physical Payments

While digital is the way forward, catering to all your client’s needs is essential. Maintain an option for checks or cash payments, especially if a segment of your clientele prefers it.

By implementing these practical AR recovery tips, small practices can ensure steady cash flow, maintain positive patient relationships, and secure their financial health.

Conclusion

Managing Accounts Receivable is not just a financial practice but an art, especially for small healthcare establishments that often operate with limited resources. Ensuring that AR is effectively managed can distinguish between a practice that thrives and one that merely survives. By implementing the seven practical AR recovery tips outlined in this article, small practices can ensure a consistent cash inflow and foster patient trust, ensuring long-term relationships and practice growth.