Medical Billing Company

All-In-One Medical Billing Services for USA Providers

BellMedEx is a world-famous medical billing firm – deploying the best practices in medical billing and coding for physicians looking to outsource billing and coding to an expert 3rd party billing agency.

Our certified medical coders and billers help healthcare organizations recover Aged Receivables and resolve insurance Claim Denials, as well.

1500+ Satisfied Providers

Serving More Than 75 Specialties

1200+ Billing and Coding Experts

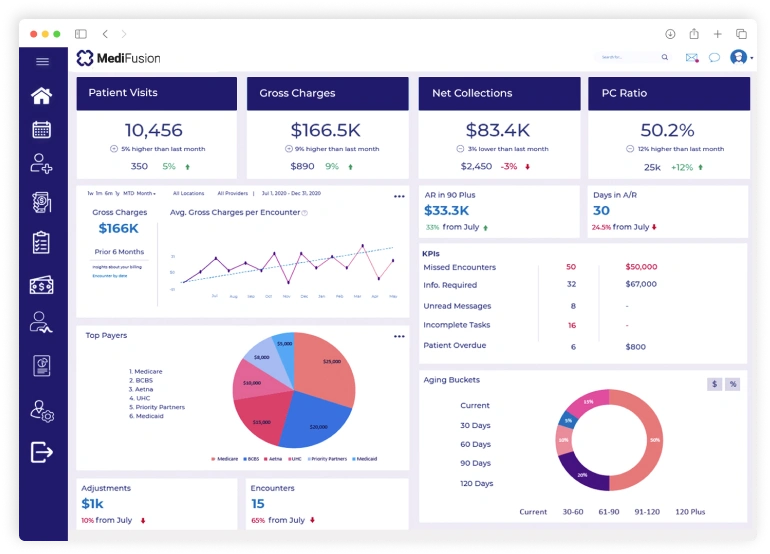

BellMedEx Offers Electronic Medical Billing Services

Our leading medical billing company has revolutionized healthcare billing solutions by replacing outdated, error-prone practice management procedures with smart, electronic medical billing services and clinical billing and accounts management solutions for all specialties.

The results? Fast reimbursements, accurate claim transmission, better patient care and smooth cash flow while adhering to HIPAA-compliant patient claims billing principles. BellMedEx’s medical billing management services make them the perfect ten for full billing services, including:

Medical Billing Services

Expert patient billers offer the most complete medical billing services that entail handling check-in/out, claims, payments, and denials for health care providers.

Medical Coding Services

Clinical coding officers translate patient services into ICD-10 and CPT codes and generate a clean “super-bill” for the biller to submit to the insurance payer.

Credentialing Services

Provider enrollment services by our credentialing specialists help healthcare providers join the network of desirable payors with maximum privileges.

Healthcare RCM Services

Revenue cycle management services are specialty-specific, which means a physician’s bespoke demands are met by a dedicated medical biller.

Medical Claims Billing Service.We boost healthcare income with quick, uncut reimbursements!

The billing firm that does medical claims processing

Safest digital encryption protects sensitive patient data.

Get full payments, without unfair cuts by the insurance networks.

Electronic billing service files claims instantly.

Denied claims are appealed and reprocessed successfully.

The billing firm that does medical claims processing

When “good enough” isn’t enough, you need a specialized medical billing agency.

Trust Your Billing To The Company That Ranks In “Top 10 Medical Billing Companies”

The Only Medical Billing Company Uniting Tech & Expertise to Meet Provider’s Vision

- Patient Verification

- Claim Scrubbing

- Claim Submission

- Revenue Cycle Management

- A/R Recovery

- Fast Reimbursement

96%

1.2k+

Lets experience our medical billing services for as low as 2.49%

Over 1500 medical practices trust BellMedEx medical billing services company. So let's have a chat.

- Patient's insurance coverage verification on the spot.

- HIPAA-compliant medical billing services for data safety.

- 24/7 medical billing services to handle every claim submission.

- 98% claim reimbursement rate for healthy cash flow.

Dedicated Accounts Managers & Expert Medical Billers for Health Centers

Healthcare organizations are at the heart of our medical billing and collections team. From primary care physicians to specialty clinics, our dedicated clinical coding officers and claims examiners implement a precision-driven approach so that revenue flows smoothly and claim denials fade away.

Which of these challenges are you facing as a provider?

Specialty Medical Billing

Our tailored medical billing services boost reimbursements through specialty-focused billing teams adept at ICD-10 coding rules and protocols unique to your medical niche. And we customize your EHR to match your specialty’s workflows.

Nationwide Availability

Affordable Pricing

Save over in-house billing with our affordable 2.49% collections rate, pay-for-paid model, free EMR software, scalability, and free denied claims appeals. Outsource to us for billing optimization with complimentary perks like:

- Billing Software

- Denial Management

- Accounts Management

- Electronic Statements

- Clearinghouse Services

- 1:1 Technical Support

In-House Billing Costs

| In-House Billing Costs | |

|---|---|

| *calculations based on a medium-scale practice with $100,000 collections | |

| Annual Salary | $30,000 |

| Overheads | $20,000 |

| Total | $50,000 |

BellMedEx Full Service Medical Billing Costs

| BellMedEx Full Service Medical Billing Costs | |

|---|---|

| *calculations based on a medium-scale practice with $100,000 collections | |

| Billing Service Rates | as low as 2.49% of the collections |

| Total | $2,490 |

Annual Savings with BellMedEx

| Annual Savings with BellMedEx | |

|---|---|

| $47,510 |

Get Instant FREE Pricing Quote

$50k

Collections$50k

$100k

$5 Million

$10 Million

Some billing companies bill once they submit a claim, but BellMedEx only bills for claims that are paid. We are very satisfied with the billing services provided to date.

See What Healthcare Providers Say About Us 💜

“BellMedEx responds to my inquiries within hours not days. They will argue with insurance for an hour to collect every penny owed, they learned my chiropractic software quickly and their fees are very reasonable. My life is easier because of Bell MedEx.”

US-based Chiropractor

Your All-in-One Medical Billing

Software Company

Whether you’re a doctor only looking for medical billing solutions or a hospital outsourcing full-cycle RCM, BellMedEx takes care of everything from billing services to clearinghouse solutions and everything in between. Not to forget, we give you complete freedom to choose medical billing software of your choice or else pick our in-house software that comes with free EHR and other powerful features to streamline your entire RCM cycle.

BellMedex Medical Billing @ 2.99%

Trusted by 300+ Verified Practices

Licensed Professional Counselor

I would like to send out a heartfelt appreciation for all of your hard work in helping my Health Counselling clinic take care of our billing and credentialing needs. You have made my job as a practice owner much easier.

Plastic Surgeon

We are more than satisfied with BellMedEx and would highly recommend them to anyone searching for an efficient billing company. Working with BellMedEx has felt effortless and we are vastly thankful for their services.

Internal Specialist Medicine

BellMedEx has been a phenomenal asset to our company. Assisting with billing, credentialing and enrollment, BellMedex has been consistently reliable from the first day of our relationship.

Psychiatrist

Catonsville, Maryland

Our medical facility has been working with BellMedEx for about 2 years now and we are very pleased with their services. BellMedEx Medical Billing is a great company for billing needs. The customer support is great.

FAQs

What is a medical billing company and how can it help me?

What are the services offered by your medical billing company?

How does your medical billing company handle medical claims reimbursement and denial management?

Can I monitor the performance and quality of the medical billing service I hire?

Do you offer independent and advanced medical billing services?

Schedule a FREE Demo

Sign up and book a free service demo

Get Started Today

Choose the best package for your practice