Denied claims occur for several reasons that can affect a practice’s financial growth. Healthcare providers can’t get paid successfully due to this issue. These denials can lead to delays in payment, increased administrative costs, and potential financial hardship for patients if they are left responsible for the cost of services. So, addressing the claim denial issues is crucial for compensating rendered services. This article discusses the top 10 reasons for insurance denials in medical billing and actionable advice to curb them, speeding up and simplifying your clinic’s billing process.

What Are Insurance Denials?

Insurance denials, in the context of medical billing, refer to the refusal of an insurance company or carrier to honor a request by an individual (or their provider) to pay for healthcare services obtained from a healthcare professional.

When a claim is denied, the healthcare provider typically receives an Explanation of Benefits (EOB) or a Remittance Advice (RA) from the insurance company, outlining the reason for the denial. The provider can correct the issue, resubmit the claim, or appeal the decision depending on the circumstances.

When a healthcare provider submits a claim to the patient’s insurance company for the services rendered, the company may deny the claim for various reasons. These reasons could range from errors in the claim submission, such as incorrect patient information or coding errors, to more complex issues, such as the insurance company’s belief that the treatment was not medically necessary or covered under the patient’s specific policy.

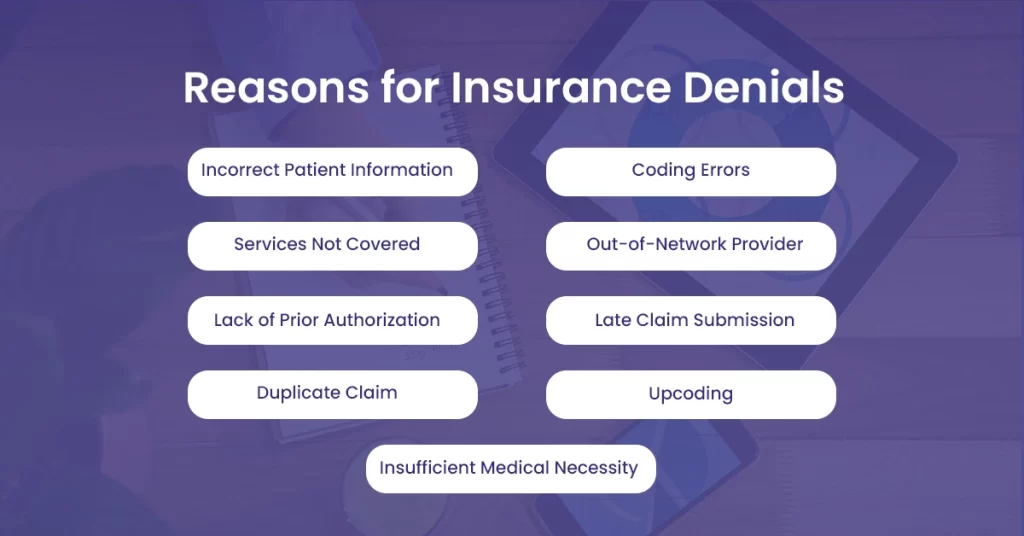

Reasons for Insurance Denials

Let’s discuss why insurance claims denials occur in medical billing.

Incorrect Patient Information

Incorrect patient information is the first and most common reason, due to which most practices face claim denials from insurance providers. The wrong information includes misspelled names, incorrect birth dates, wrong policy numbers, and other demographic and technical errors that lead to denials.

Coding Errors

Coding errors are another major factor that is a common reason for claim denials. The standard of care is inconsistent with the included diagnosis codes, which is an error. Other errors include undercoding and overcoding, which happen when the claim contains higher-level CPT or HCPCS codes than what is justified by medical necessity, medical facts, or the provider’s documentation.

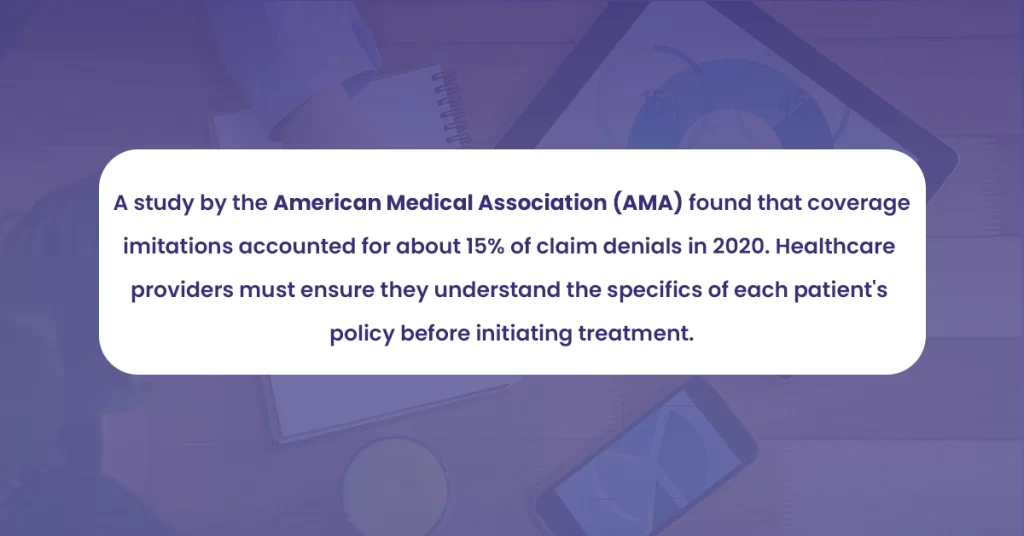

Services Not Covered

This denial occurs due to neglecting to perform insurance verification to determine if the procedures and services provided are covered under the patient’s current benefit plan. The other factors include no-patient requirements that have been satisfied, misuse of the emergency room, stay length, and insufficient level of care.

Out-of-Network Provider

Insurance companies have network agreements with specific providers. If a patient receives care from an out-of-network provider, their claim might be denied if they don’t have prior authorization before the medical service is performed.

Lack of Prior Authorization

Some procedures or treatments require prior authorization from the insurance company. Failure to secure this can result in denial. Medical billing frequently involves denials because there was no prior authorization or referral evidence. Claim denials may occur without the appropriate authorizations, referrals, or specialist consultations.

Late Claim Submission

Insurers have deadlines for claim submissions. Late filings can result in outright denials. The Healthcare Financial Management Association noted in 2022 that 14% of denials were due to late submissions.

Duplicate Claim

One common reason for denials is submitting duplicate claims for the same treatment or procedure. This frequently happens when billing systems or workflows incorrectly flag or identify duplicate claims before submission.

Upcoding

Upcoding is the deliberate use of a higher-paying code on a claim to obtain a more significant payment or billing for a Medicare-covered service rather than one that is not. Upcoding is the practice of a clinician billing a health insurance payer (private, Medicaid, or Medicare) for a higher-paying service than was rendered using CPT codes. Upcoding is prohibited, and that must be understood. It is seen as dishonest when suppliers charge for additional services that were either not documented or rendered. It is one of the primary reasons for denied claims and leads to legal penalties.

Insufficient Medical Necessity

If the insurance provider determines that a service or procedure is not medically essential, they may reject claims. This denial frequently results from insufficient evidence proving the service’s medical need.

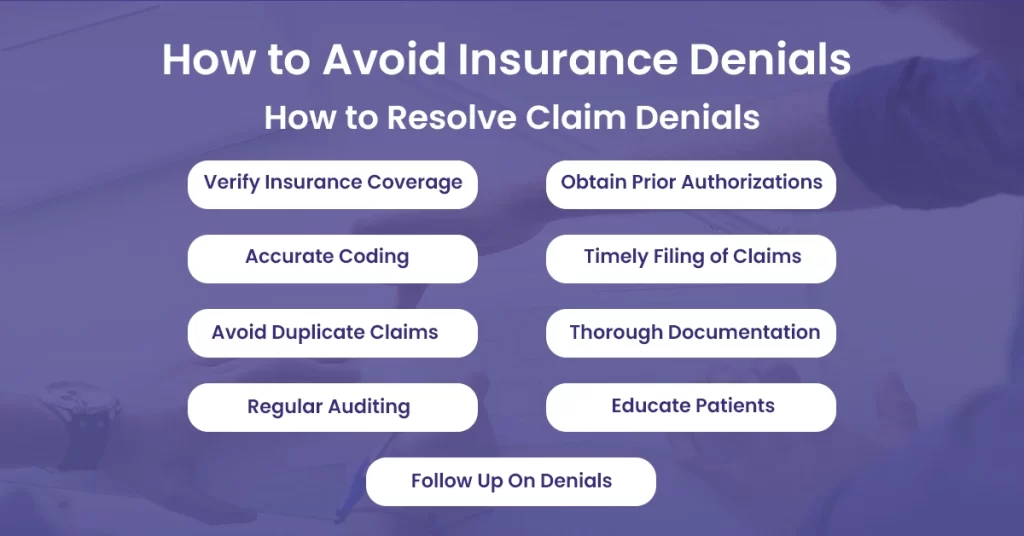

How to Avoid Insurance Denials

Avoiding insurance denials is essential for the smooth functioning of healthcare facilities and practices. Here are some practical tips to reduce the likelihood of insurance denials:

Verify Insurance Coverage

Always verify a patient’s insurance coverage before providing services. This process should confirm that the patient’s policy is active, the benefits are covered, and the provider is in-network.

Obtain Prior Authorizations

Obtain a procedure or service before delivering the care if it requires prior authorization. This process involves getting pre-approval from the insurance company verifying that the procedure is medically necessary and covered under the patient’s plan.

Accurate and Complete Coding

Use the correct and up-to-date procedure and diagnosis codes. Coding errors are a common cause of denials. Regularly train your staff on the latest coding standards, such as ICD-10, CPT, and HCPCS.

Timely Filing of Claims

Each insurance company has a filing deadline. Submit claims as soon as possible to avoid denials due to late filing.

Avoid Duplicate Claims

Be careful not to submit duplicate claims for the same service, as this is a common reason for denials. Implement a system to track claims and their status.

Thorough Documentation

Document all services thoroughly and accurately. Include details about the patient’s condition, the treatment provided, and any communications with the patient. This documentation can be crucial in case of an appeal.

Regular Auditing

Conduct regular audits of your billing process to identify and correct common errors. This can help you spot patterns and address problems proactively.

Educate Patients

Make sure patients understand their insurance coverage, including their responsibilities for copayments, deductibles, and non-covered services. This can help avoid confusion and disputes later on.

Follow Up On Denials

Not all denials are final. If a claim is denied, review the reason, correct any errors, and resubmit the claim. If the denial is due to a coverage issue or a dispute about medical necessity, you may need to submit an appeal.

Conclusion

Dealing with denied claims may be difficult for healthcare practices. These denials interrupt the revenue cycle and consume valuable time and resources that could be better spent on patient care. Understanding the common causes of denials and implementing effective preventive measures is essential for maintaining a healthy, efficient practice.

However, managing all this while providing top-quality patient care can be challenging. That’s where the expertise of a professional medical billing service like BellMedEx is.