Effective claims payment optimization is essential for healthcare providers to assure financial stability, simplify revenue cycle management, and improve operational efficiency. Effective solutions can help providers increase cash flow, reduce administrative work, and optimize reimbursements. This blog post will discuss the claims payment optimization process to ensure that patient services run without a hitch.

Why Claims Payment Optimization?

Automating healthcare claims management offers numerous benefits for providers, addressing one of their biggest challenges: maximizing reimbursements and minimizing denied claims.

Enhance Revenue Cycle Management

Claims payment optimization enhances the practice’s revenue cycle management. Effective revenue cycle management is essential for maintaining a healthy financial standing. Providers can improve cash flow and allocate resources more effectively by optimizing claims payment processes.

One of the primary benefits of claims payment optimization is improving cash flow. Timely reimbursement ensures providers have the funds to meet their financial obligations and invest in critical resources. Delays in claims processing and payment can hinder providers’ ability to invest in necessary infrastructure, such as medical equipment, technology upgrades, and staff training. Optimized payment processes ensure a positive cash flow cycle, reducing the need for borrowing or relying on credit.

Minimize Administrative Burden

Claims payment optimization also helps minimize administrative burdens for healthcare providers. Manual claims processing is time-consuming and prone to errors, resulting in delayed payments and increased administrative workload. By leveraging automation and electronic systems, providers can streamline the claims submission and adjudication process.

Automation plays a vital role in claims payment optimization. Electronic systems automate claims submission, track claim status, and generate alerts for discrepancies or missing information. This reduces the need for manual intervention, decreases the risk of errors, and enables providers to focus on patient care rather than tedious paperwork. Additionally, automation improves efficiency by reducing the time and effort spent on manual tasks, ultimately increasing productivity and allowing staff to dedicate their time to higher-value activities.

Accelerate Reimbursement

Timely reimbursement is essential for a provider’s financial stability. Optimizing claims payments ensures that providers receive payments promptly, enabling them to meet their financial obligations and maintain a stable cash flow. Faster reimbursement contributes to a more positive cash flow cycle, reducing the need for borrowing or relying on credit.

By streamlining claims payment processes, providers can significantly reduce payment delays. Efficient claims submission, accurate coding, and clean claims with all required documentation can speed up reimbursement. Leveraging technology, such as electronic claims submission and real-time claim tracking, allows providers to monitor their claims’ progress and promptly address any issues. Accelerated reimbursement improves financial outcomes, enhances the provider’s ability to invest in patient care, and helps build a strong foundation for long-term success.

Reduce Claim Denials

Claim denials can be a significant setback for healthcare providers. They result in delayed or reduced payments and increased administrative costs due to the need for resubmission and appeals. Claims payment optimization involves proactive measures to minimize claim denials and improve revenue cycle management. Analyzing denial patterns is crucial for preventing future denials. By identifying common reasons for claim denials, providers can implement strategies to address them. This includes ensuring accurate coding, proper documentation, and effective payer communication. Providers should have a robust denial management process to promptly address denials, track trends, and implement corrective actions. Proactive denial prevention reduces administrative burden, improves cash flow, and optimizes revenue cycle management.

How to do Claims Payment Optimization?

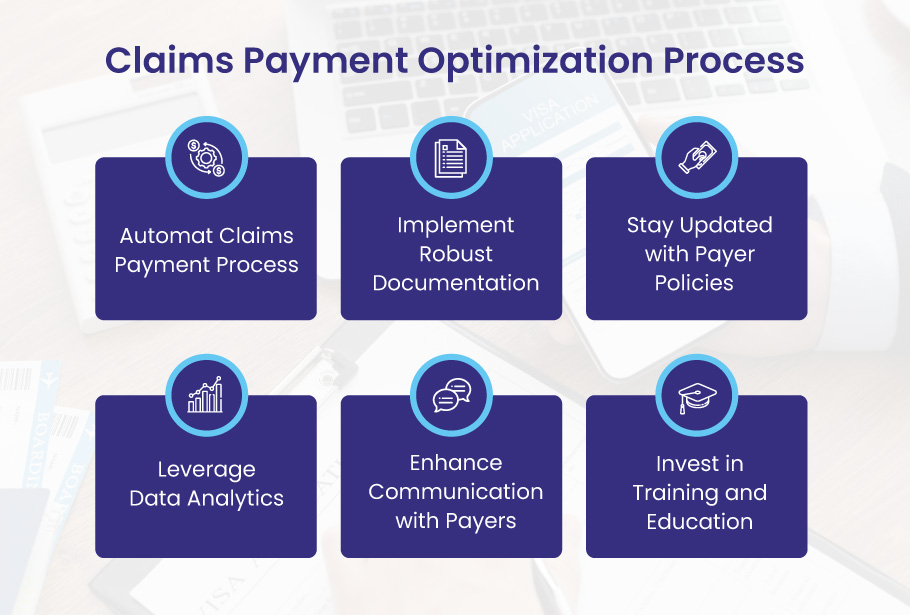

Here are the key steps for claims payment optimization, enabling providers to navigate the complex world of healthcare billing and coding more effectively.

Automate Claims Payment Process

Automating claims payment processes is crucial for optimizing revenue cycle management. By leveraging advanced technology solutions, providers can streamline claims submission, reduce errors, and accelerate payment processing. Automated systems can handle tasks such as electronic claims submission, real-time claim tracking, and automatic alerts for missing or incomplete information. This not only improves efficiency but also minimizes denials and decreases administrative overhead.

Implement Robust Documentation

Accurate and comprehensive documentation is essential for successful claims payment optimization. Providers must ensure that all medical records, procedures, and diagnoses are well-documented and coded correctly. Clear and detailed documentation helps substantiate claims, minimizes the risk of denials, and facilitates efficient claims processing. Regular staff training and ongoing quality assurance programs can help ensure consistent and accurate documentation practices.

Stay Updated with Payer Policies

Payer policies and regulations are constantly evolving, making it crucial for providers to stay current. Reviewing and understanding payer guidelines helps providers align their billing and coding practices accordingly. Compliance with payer policies reduces the likelihood of claim rejections or denials and promotes a smoother claims payment process. Establishing effective communication channels with payers is essential to address any policy-related questions or discrepancies promptly.

Leverage Data Analytics

Data analytics plays a significant role in claims payment optimization. Providers can leverage data to gain insights into trends, identify denials patterns, and uncover improvement opportunities. Analyzing claim data helps identify the root causes of denials, enabling providers to implement targeted strategies to minimize them. Additionally, data analytics can assist in identifying areas for process optimization and improving overall revenue cycle management.

Enhance Communication with Payers

Establishing solid lines of communication with payers is crucial for effective claims payment optimization. Providers should proactively engage with payers to understand their requirements, clarify any ambiguities, and resolve potential issues. Building positive relationships with payers facilitates smoother claims processing, quicker resolutions of discrepancies, and improved reimbursement rates.

Invest in Training and Education

Continuous training and education for staff members involved in the claims payment process are essential for optimal performance. Providers should invest in ongoing training programs to ensure that employees are equipped with the latest knowledge of billing and coding practices, payer policies, and industry regulations. A well-trained staff is likelier to submit clean claims, accurately code procedures, and effectively navigate the claims payment process.

Conclusion

Now is the opportune time to embrace electronic claims payment, not only for the potential savings but also due to the rising costs associated with processing paper checks. Providers must overcome the challenges of adopting electronic claims payment and leverage secure solutions to save money, reduce administrative burdens, and ultimately enhance the patient experience.