Payment posting is crucial in medical billing because it guarantees accurate and timely reimbursement for healthcare providers. Healthcare providers may track the amount of money they have received from clients and insurance companies, spot any unpaid balances, and reconcile their financial records by correctly reporting payments. This blog post delves into the importance and steps in payment posting.

Understanding Payment Posting

Payment posting in medical billing refers to recording and updating payments received from patients, insurance companies, or any other third-party payer in the healthcare industry. It involves accurately identifying the payments received, matching them with the corresponding patient accounts, and updating the financial records accordingly. The payment posting process is crucial for maintaining accurate and up-to-date financial records and ensuring timely reimbursement for healthcare providers.

Why Accurate Payment Posting is Essential

Accurate payment posting ensures that payments are correctly recorded, and accounts receivable are correctly managed. This helps healthcare providers to:

Improve Cash Flow

Accurate payment posting ensures that healthcare providers receive timely and correct service payments. This, in turn, results in improved cash flow, as there is a reduced risk of delayed payments, rejected claims, or incorrect payment amounts. Healthcare providers can use accurate payment posting to identify issues and take preventive measures to reduce the risk of revenue leakage.

Reduce Denials and Rejections

Accurate payment posting reduces the risk of denials and rejections of claims. By ensuring that payments are posted accurately, healthcare providers can avoid errors and omissions that lead to claim rejections. This saves time and effort spent reworking rejected claims and reduces the time to receive payment.

Enhance Patient Satisfaction

Accurate payment posting leads to enhanced patient satisfaction. Patients are more likely to be satisfied when their bills are accurate and receive clear and timely payment information. This results in improved patient loyalty and helps generate positive reviews and referrals.

Increase Productivity

Accurate payment posting leads to increased productivity. Healthcare providers can save time and resources spent reworking claims by reducing the risk of denials and rejections. This increases productivity, as healthcare providers can focus on delivering quality care rather than dealing with payment-related issues.

Improve Revenue Management

Accurate payment posting helps healthcare practices avoid revenue loss due to payment errors or delays and better track financial performance. This can help improve cash flow and financial stability while ensuring patients are billed accurately and efficiently.

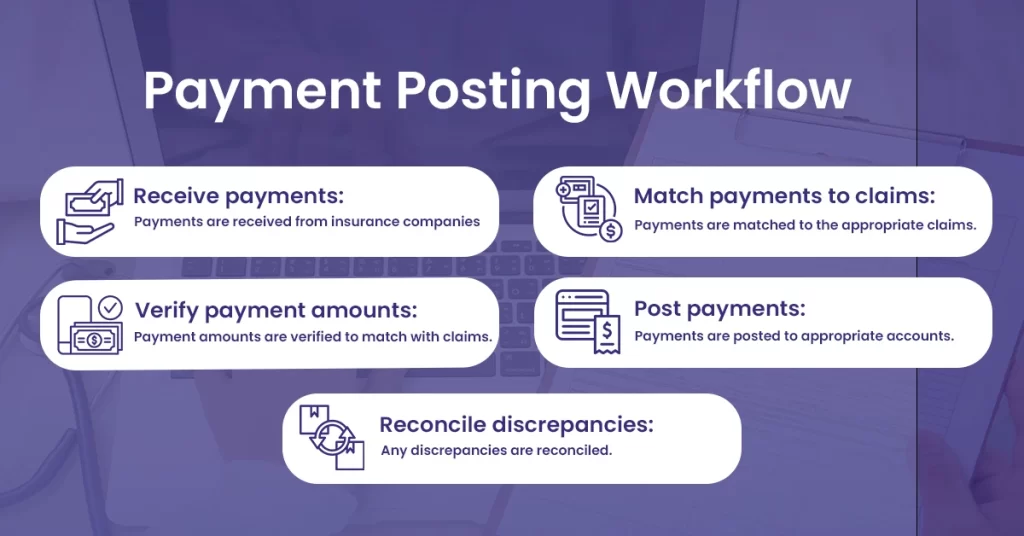

Steps in the Payment Posting Process

Receiving payments

Payments can come in many forms, including checks, credit/debit cards, electronic transfers, and cash. When a payment is received, it must be logged and recorded in the business’s accounting system.

Identifying payments

Once a payment has been received, it must be associated with the correct account or customer. This may involve matching up invoices or account numbers to ensure the payment is applied to the valid account.

Applying payments

Once a payment has been identified and associated with the correct account, it must be applied to any outstanding balances. This may involve allocating the payment to specific invoices or account balances.

Reconciliation and Updating Records

Reconciliation in payment posting refers to comparing the payments received from patients or insurance companies with the corresponding charges and ensuring they match. This involves cross-checking the payment amounts, dates, and other details against the related claims, invoices, or receipts to identify discrepancies. If any differences are found, the payment posting team must investigate and resolve them promptly to avoid potential billing and financial issues.

Reconciliation is an essential part of payment posting because it helps to ensure that the financial records are accurate and up-to-date, which is crucial for managing cash flow, complying with regulatory requirements, and maintaining the financial health of the healthcare provider.

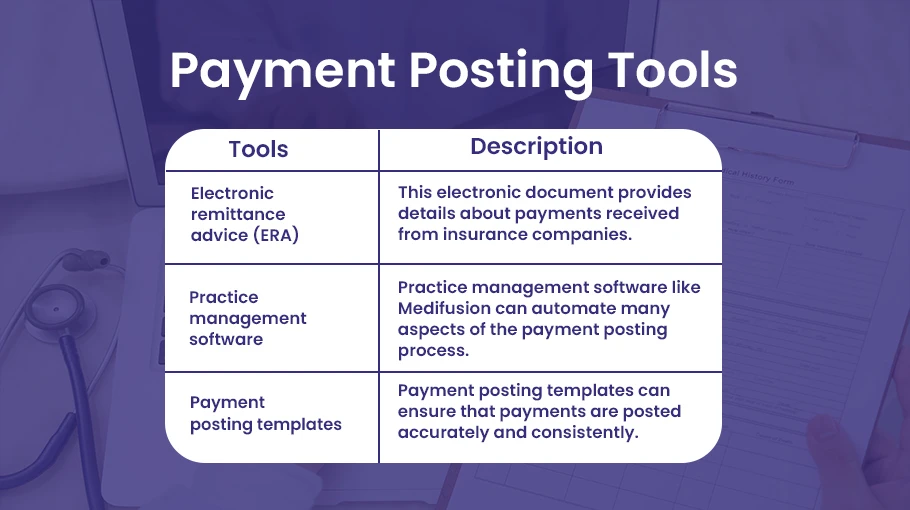

Payment Posting Tools

Electronic remittance advice (ERA)

This electronic document provides details about payments received from insurance companies.

Practice management software

Practice management software like Medifusion can automate many aspects of the payment posting process.

Payment posting templates

These templates can ensure that payments are posted accurately and consistently.

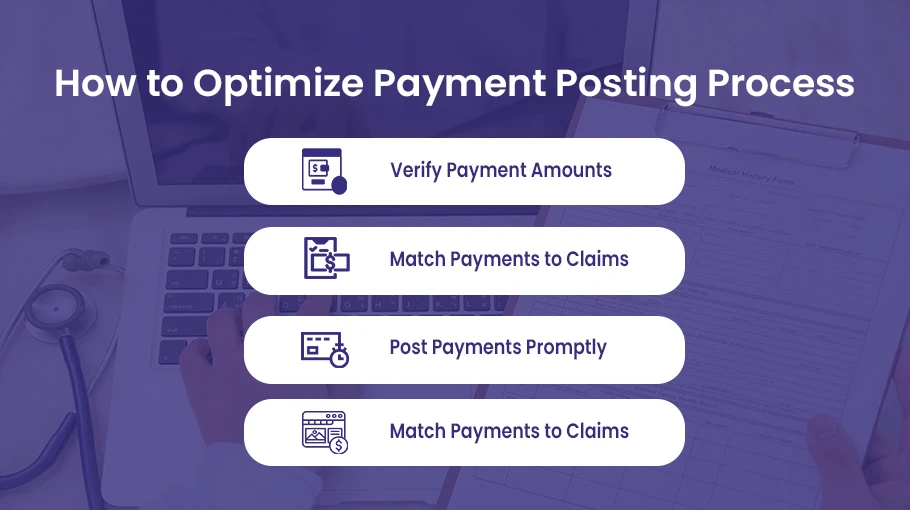

How to Optimize Payment Posting Process

Payment posting is crucial for healthcare providers to manage their accounts receivable and ensure timely and accurate payments. Best practices in payment posting can help providers avoid errors and reduce the risk of claim denials or delays. Let’s discuss some essential payment posting best practices to optimize the process.

Verify Payment Amounts

Verifying payment amounts involves checking that the payment matches the expected amount based on the submitted claim. Providers should check for any underpayments, overpayments, or other discrepancies that may affect the payment posting process. This verification process should be done before posting any payment to ensure accuracy and avoid potential issues later.

Match Payments to Claims

Matching payments to accurate claims ensures that payments are applied to the correct charges and reduces the risk of claim denials or delays. Providers should use unique identifiers such as claim or patient account numbers to match payments to the proper claims. In cases where a payment cannot be reached for a specific claim, it should be researched to identify the correct account to post the payment.

Post Payments Promptly

Prompt payment posting means that payments should be posted as soon as possible after receiving them. Delayed payment posting can lead to issues with account reconciliation and inaccurate reporting. Providers should establish a consistent payment posting schedule and ensure all payments are posted within a specified timeframe.

Use Payment Posting Templates

Payment posting templates provide a standardized format, ensuring that payments are posted accurately and consistently. Payment posting templates should include fields for payment amount, date, and other patient details.

Healthcare providers should implement strong internal controls to avoid these payment posting errors, such as double-checking payment amounts and matching payments to the appropriate claims. They should also ensure that payments are posted promptly and that regular reconciliations are performed to identify and resolve discrepancies. By avoiding these common payment posting errors, healthcare providers can improve their revenue cycle management processes and maximize their financial performance.

Conclusion

Accurate payment posting is critical for effective medical billing. By understanding the payment posting process, using appropriate tools and best practices, and auditing payment posting activities, healthcare providers can ensure that payments are correctly recorded and accounts receivable are appropriately managed. This can help to increase cash flow, reduce accounts receivable, improve revenue cycle management, and minimize claim denials and rejections.