Efficiency and Accuracy are crucial in today’s constantly evolving healthcare system. Verifying patient insurance eligibility is one area that frequently presents difficulties. This essential phase might be delayed or mismanaged to prevent claim denials, financial instability, and operational inefficiencies for healthcare providers. Automated insurance eligibility verification is a solution that has emerged with the development of modern technology. We’ll examine the nuances of this procedure in this blog, compare manual and automated verification, and discuss how BellMedEx automates the process to take your practice to the next level

Insurance Eligibility Verification

Patient insurance eligibility verification is a crucial step in the medical billing process; without it, the procedure cannot be completed properly.

The term “patient insurance eligibility verification” refers to checking if a patient has active health insurance when they seek medical care. It is also used to understand the specifics of their policy, such as the treatments covered, the coverage limitations, and any exclusions or conditions that must be met before the insurance company pays for a specific service.

Elements of Insurance Eligibility Verification

- Patient Information : This consists of the patient’s personal and insurance policy details.

- Insurance Coverage Specifics: The nuances of a patient’s insurance policy, including the scope of coverage, limitations, and exceptions.

- Verification Techniques and Tools: These systems and software are employed to confirm the patient’s insurance eligibility.

Manual vs. Automated Verification

| Feature | Manual Verification | Automated Verification |

| Method Description | Traditional approach where healthcare staff manually collect patient’s insurance information and contact the insurance company. | Modern, tech-driven method that uses software to verify a patient’s insurance coverage in real-time automatically. |

| Speed & Efficiency | Time-intensive and laborious. | Rapid real-time verifications, streamlining the process. |

| Accuracy & Error Rate | Prone to human errors, which can lead to claim rejections. | Minimizes human errors, leading to more accurate verifications and fewer claim rejections. |

| Administrative Overhead | Increases administrative overhead due to substantial time staff spend on verification. | Reduces administrative burden by automating the verification process. |

| Costs | Manual labor can increase costs, mainly if errors result in claim rejections or delays. | Initial investment in software and staff training, but long-term benefits like reduced claim rejections and faster payments often outweigh these costs. |

| Workflow & Productivity | Can be disruptive to workflow as staff are diverted from other crucial tasks. | Streamlines workflow, improving efficiency and productivity. |

| Patient Experience | Patients might experience longer waiting times and potential inconveniences due to delays or errors in verification. | Reduced waiting time and inconvenience for patients, leading to improved overall satisfaction. |

| Implementation & Training | Generally, it does not require new systems or training, but staff must be well-informed about insurance policies and procedures. | Requires an initial investment in software systems and staff training to utilize the automated platform effectively. |

| Financial Health Impact | Manual errors, delayed payments, and increased administrative costs can negatively impact the financial health of the healthcare provider. | Prompt and accurate verifications lead to fewer claim denials and quicker payments, bolstering the financial performance of the healthcare provider. |

| Future Viability | As the healthcare industry evolves and patient numbers grow, manual verification might become increasingly unsustainable due to the sheer volume of verifications. | Automated systems are scalable and can handle larger volumes of verifications, making them more viable for the future demands of the healthcare industry. |

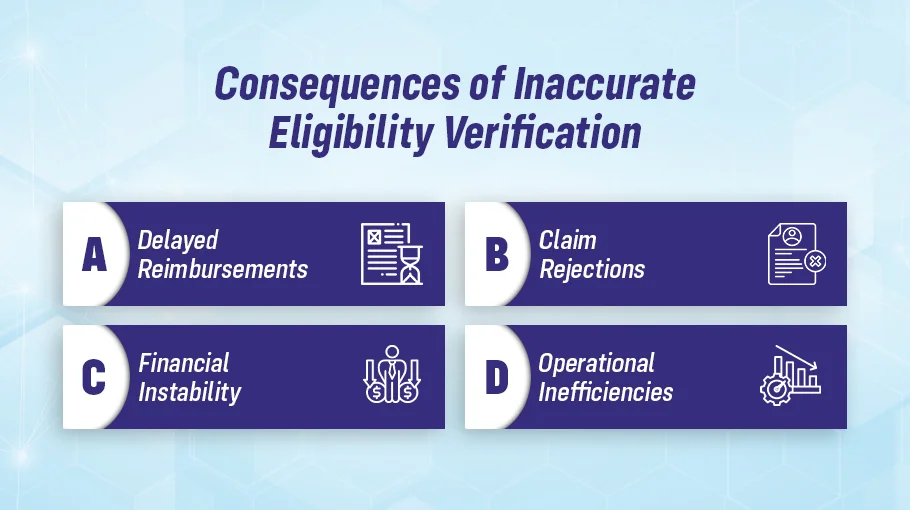

Consequences of Inaccurate Eligibility Verification

Failure to perform accurate and timely insurance eligibility verification can lead to several complications for healthcare providers.

Delayed Reimbursements

If a patient’s insurance coverage isn’t correctly verified promptly, it might turn out that their insurance policy doesn’t cover the services provided. In this case, the healthcare provider may only submit a claim to the insurance company to reject it. This would delay the provider’s reimbursement for the services rendered, as they would then need to seek payment directly from the patient or write off the costs.

Claim Rejections

Similarly, if the insurance coverage isn’t adequately verified, the healthcare provider may provide services not covered by the patient’s insurance. The claim could be outright denied When the provider submits a claim to the insurance company for these services. This leaves the provider with no compensation for the services rendered.

Financial Instability

Over time, regular instances of delayed reimbursements or claim denials can lead to financial instability for the healthcare provider. The provider might consistently face a shortfall in expected revenue, impacting their ability to provide services or maintain operations.

Operational Inefficiencies

Each deny claim requires additional administrative effort to resolve, whether seeking payment from the patient or writing off the cost. This extra effort increases operational inefficiencies and costs.

These potential complications highlight the importance of accurate and timely patient insurance eligibility verification. It ensures that services are covered under the patient’s insurance policy, securing the provider’s revenue and maintaining operational efficiency.

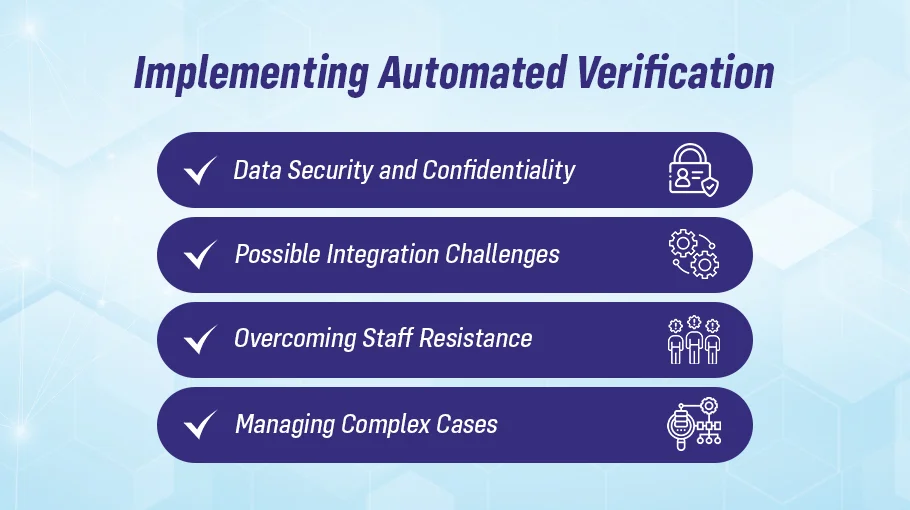

Implementing Automated Verification

Before integrating automation, it’s crucial to assess the current workflow and identify areas for improvement. Staff training and a well-planned change management strategy can facilitate a smooth transition. Establishing standard operating procedures for using the automated system will ensure consistent effectiveness. Moreover, regular monitoring and updates are necessary to maintain system efficiency.

Data Security and Confidentiality

In the era of digitization, data security is a paramount concern. Opting for a system that offers robust security features and adheres to privacy regulations is essential.

Possible Integration Challenges

The new system should flawlessly blend with existing systems to minimize disruptions.

Overcoming Staff Resistance

Some staff members may resist change. Addressing their concerns, providing comprehensive training, and articulating the new system’s benefits can help alleviate this resistance.

Managing Complex Cases

While automation can tackle most situations efficiently, exceptions or complex cases will inevitably arise. These instances should be handled meticulously to ensure precision and compliance.

Automate Eligibility Verification with BellMedEx

Are you looking to enhance your practice’s eligibility verification process? It’s time to step into the future with BellMedEx. Our advanced Automated Patient Insurance Eligibility Verification system is designed to streamline operations, improve efficiency, and elevate patient satisfaction. Don’t wait any longer to transform your healthcare delivery.

- Experience Rapid Real-Time Verifications.

- Minimize Human Errors and Boost Accuracy.

- Enhance Workflow and Productivity.

- Deliver an Improved Patient Experience.

Why Choose BellMedEx’s Automated Verification System?

Enhanced Security

With the rising concerns over data breaches and leaks, our system prioritizes robust security measures to ensure that your patient’s data remains confidential and protected.

Seamless Integration

We understand the challenges in introducing a new system. That’s why BellMedEx’s solution is designed to integrate seamlessly with your existing systems.

Dedicated Support

Transitioning can be challenging, but your team will find the switch smooth and beneficial with our comprehensive training and ongoing support.

Elevate the way you manage your medical billing. Say goodbye to claim rejections, delayed reimbursements, and unsatisfied patients.

Contact BellMedEx today and revolutionize your healthcare journey. Let us lead you toward a future where efficiency, Accuracy, and patient satisfaction are the norm, not the exception

Concluding Thoughts

Automating patient insurance eligibility verification can offer numerous benefits to healthcare providers, including enhanced Accuracy, improved efficiency, cost savings, and increased patient satisfaction. Despite potential challenges, adopting automated verification is a prudent strategy for any healthcare provider aiming to modernize their operations and boost their financial performance.